In a white paper from the CUNA Marketing & Business Development Council, authors Kelley Parks and Lisa Taylor Phelps explore the application of psychographics as an alternative segmentation system bank and credit union marketers can to replace traditional data models.

“Consider how much diversity exists in any demographic data point,” Parks and Phelps point out. “Do all 25-54 women with incomes between $25,000 and $50,000 really share the same values? Do all families within a five-mile radius of a branch have the same needs and wants? Of course not.”

The duo’s 18-page report looks at what psychographics are, ways to gather significant data, how financial institutions are using it, and how they can leverage psychographics to improve overall marketing effectiveness.

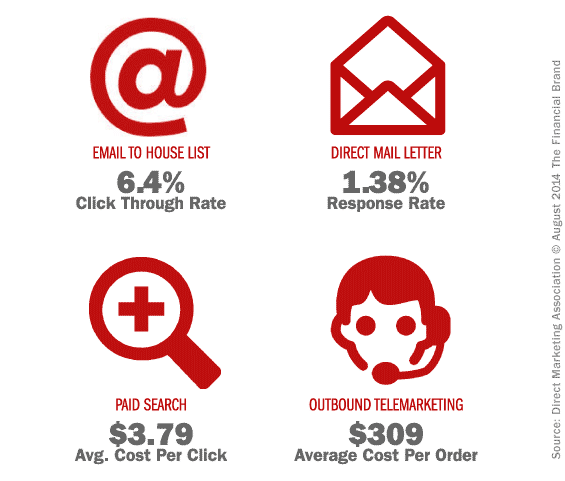

According to the authors, the general lack of consumer insight may be why response rates and engagement — based on demographic information alone — are exceedingly low.

“Marketers have more potential when attempting to connect in meaningful ways, rather than using sweeping judgments and over-generalized demographic data points in their marketing efforts.”

“The aim of marketing is to know and understand the customer so well, the product or service fits him and sells itself.”

— Peter Drucker

What if you knew someone was environmentally conscious? First-adopters of cutting edge technology? Do they value high touch or convenience? Are they open to new experiences, or do they cling to the status quo? What if you could define specific segments around these groups? Would that be useful to bank and credit union marketers?

Absolutely, the authors say, and this is what the study of psychographics is all about.

“Psychographics attempts to understand the choices people make based on lifestyle and attitudes. It helps marketers understand what will grab them and more importantly, what may turn them off.”

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Psychographics: The Basics

So what are “psychographics?” The field of psychographics classifies people based on psychological traits such as attitudes, habits, interests and opinions. Geodemographic data describes your audience and where they are located, while psychographics aim to explain why they buy.

Sources for psychographic intel include transactional data, MCIF and CRM info, web data and by fielding proprietary surveys.

Using psychographics isn’t as easy as demographics because you need to combine these various data points in order to create profiles, and that, unfortunately, isn’t something most financial institutions are very good at… yet. In a study from CU Grow, only 13% said they used psychographic data to define their market segments. But that number is likely to grow in coming years.

Sample Psychographic Segments

One model utilized by international ad agency Young & Rubicam categorizes consumers by psychographic segments according to their needs and values. They use the model to yield telling insights about what buttons marketing should hit when targeting certain consumers. Here are quick snapshots of the seven segments they’ve defined:

- The Explorer – Often the first to try out new ideas and experiences. They want to be seen as different or unique. The core need in life is for discovery.

- The Aspirer – Materialistic and acquisitive people who are driven by others’ perceptions of them rather. The core need in life is for status — image, appearance and fashion.

- The Succeeder – Has strong goals, knows where they want to be, and has a plan on how to get there. They seek reward and prestige. The core need in life is for control.

- The Reformer – Socially aware and prides himself on tolerance. They are often perceived as intellectual people. The core need in life is for enlightenment.

- The Mainstream – These people live in a domestic and everyday world full of daily routines. They respond to big, established brands because the core need in life is for security.

- The Struggler – Tend to live for today and have few plans for tomorrow. They are often seen as people with few aims and few resources. The core need in life is for escape.

- The Resigned – Predominantly older people with unchanging values and gravitate towards nostalgia. They respect organizations that conduct themselves in more traditional fashion since they are driven by a need for safety and economy.

Practical Applications for Psychographics

How are psychographics used in real-life marketing? Where has it been used most successfully? Facebook, with more than a billion users4, is probably one of the most well-known examples of a company that thrives on the use of psychographics. The company displays highly-targeted ads on their site based on your very-public likes, desires, relationships, activities, and all the other highly personal information you share with other Facebook users.

Leaders Credit Union is starting to follow in their footsteps. They leverage the data provided their plastics providers (MasterCard for debit and Visa for credit) to examine members’ spending habits.

“When prospecting for new accounts in our external markets, we use Fiserv Bank Intelligence to narrow our focus,” explains Josh McAfee, VP/Marketing at Leaders Credit Union. “Bank Intelligence uses P$YCLE segmentation presented by Nielsen, along with census data, to paint as accurate a psychographic picture of the target consumer as possible.”

By integrating psychographic data, McAfee says he’s learned the call-to-action he puts in each of the credit union’s marketing pieces is highly dependent on the member’s ability to hear it. While rate might interest a member who is in the “payoff stage” of life, pricing may be more appealing to someone in the “acquisition phase.” Using psychographic data allows him to sharpen his call-to-action in ways that make it more specific to each target segment’s core psychological drivers.