Most financial services marketers would love to develop a well-respected, differentiated brand for the financial institution (FI) they work for. While some marketers rely strictly on advertising to do this, others deploy brand management practices — developing brand standards, design guidelines, brand manuals, brand orientation/training, etc. — to support their branding efforts.

Do these brand management practices pay off? Research from The Financial Brand and Aite Group suggest the answer is definitely “yes.”

The State of Brand Management Practices

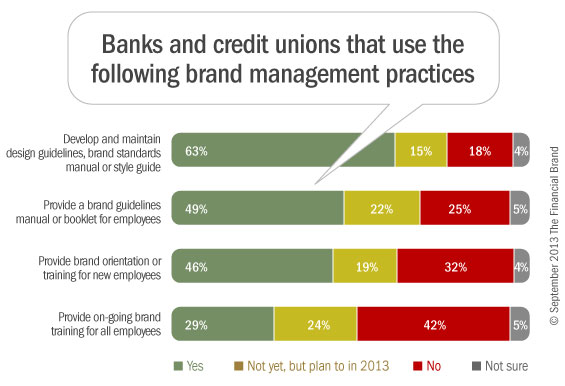

In February 2013, The Financial Brand and Aite Group surveyed 171 marketing executives from banks and credit unions. Nearly two-thirds of respondents have developed, and maintain, brand design guidelines, and a brand standards manual or style guide. Roughly half, however, provide a brand guidelines manual to employees or provide brand training to new employees. And just three in 10 FIs provide on-going brand training for all employees (Figure 1).

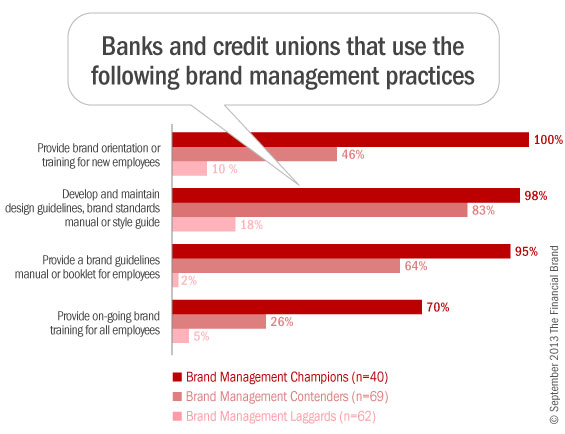

To better understand the differences between FIs that deploy brand management practices and other institutions, we segmented respondents into one of three segments (Figure 2):

1. Brand Management Champions. Accounting for 23% of the sample, practically all FIs in this segment provide brand training to new employees, and supply them with a brand guidelines manual. Seven in 10 Brand Management Champions provide on-going brand training to all employees. Sixty-two percent of these FIs believe that their organization’s brand is well-defined and differentiated in the market.

2. Brand Management Contenders. The four in 10 FIs who comprise this segment are inconsistent in their brand management practices. More than 80% of them have developed a brand standards manual, and about two-thirds provide employees with a brand guidelines manual. But only half train new employee on branding practices, and only a quarter deliver on-going brand training to all employees. Almost half (47%) consider their organization’s brand well-defined and differentiated.

3. Brand Management Laggards. Few of the 36% of FIs in this segment have implemented or deployed any of the four brand management practices. Just 29% of the FIs in this category consider their organization’s brand to be well-defined and differentiated in the market.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Brand Management Champions Differ

Our analysis of the three segments revealed that Brand Management Champions differ from other FIs in a number of ways, most importantly in terms of: 1) Market growth; 2) Marketing budget increase; 3) Organizational support for branding efforts; and 4) Analytical capabilities.

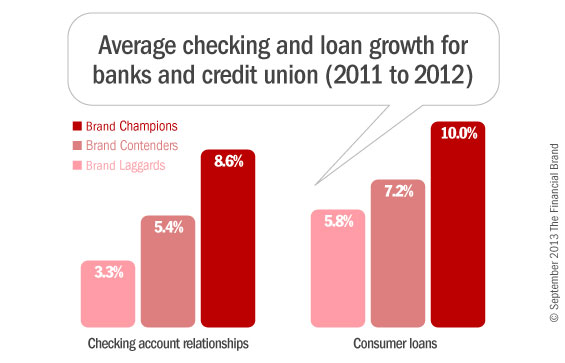

In terms of year over year growth in checking account relationships and number of consumer loans issued from 2011 to 2012, Brand Management Champions outperformed their peers. On average, they grew checking relationships by 8.6% and consumer loans issued by 10%, far surpassing the growth rates of FIs in the other two segments (Figure 3).

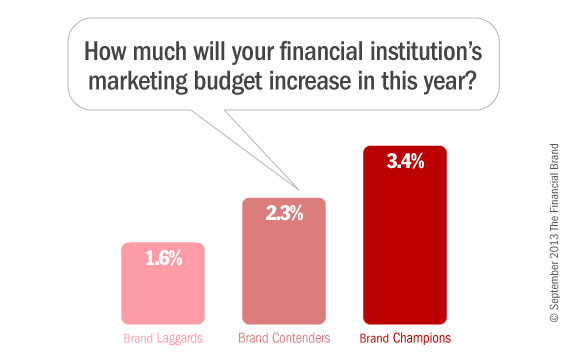

Brand Management Champions were also expecting a more generous increase in marketing budgets than their peers were anticipating in 2013. The 3.4% increase that Brand Management Champions were expecting is more than double the 1,6% increase anticipated by Brand Management Laggards (Figure 4).

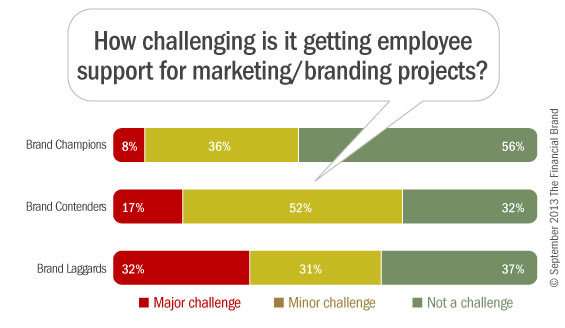

Brand Management Champions also enjoy broader support for marketing and branding initiatives from the rest of their organization than other FIs do. Just 8% of them said that employee support for branding initiatives was a major challenge, in contrast to 17% of Brand Management Contenders, and 32% of Brand Management Laggards (Figure 5).

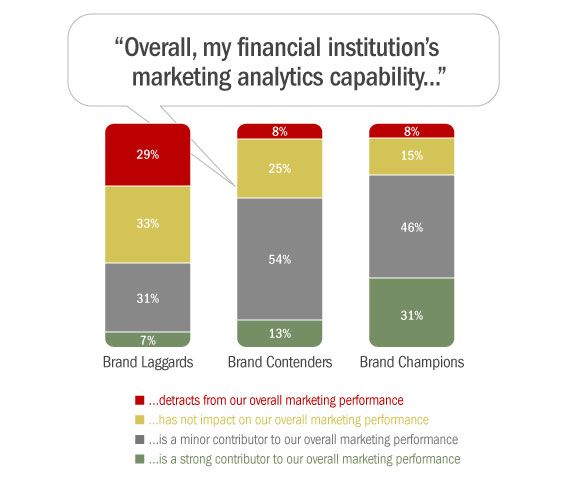

The marketing analytics superiority of Brand Management Champions also stands out. Three of 10 FIs in this segment believe that their organization’s marketing analytics capability is a strong contributor to their overall marketing performance, in contrast to 13% of Brand Management Contenders, and just 6% of Brand Management Laggards (Figure 6).

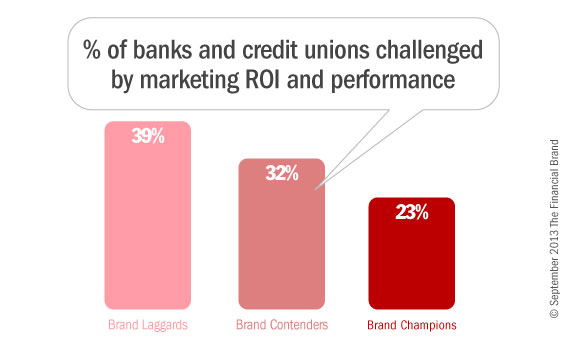

In addition, nearly four in 10 Laggards admit that measuring marketing performance and ROI is a major challenge. Less than a quarter Champions cited this as a major challenge (Figure 7).

Conclusion

Do brand management practices guarantee superior market performance? No. But Brand Management Champions — banks and credit unions that develop brand guidelines and providing employees with brand training — out perform their peers in terms of customer growth.

The Financial Brand and Aite Group’s research suggests more broadly, however, that strong brand management practices are part of a strong overall marketing management capability. Brand Management Champions aren’t just stronger brand managers—they demonstrate stronger marketing analytics and measurement capabilities, as well.