Over a decade ago, Target made headlines for its use of personalization — for all the wrong reasons. It sent coupons for baby products to a teenager before her parents knew she was pregnant. While Target’s predictive analytics aimed to anticipate customer needs, it crossed the fine line between helpful and creepy.

Now, banks face a similar conundrum with even higher stakes. With vast quantities of customer data at their fingertips, bank marketers have the power to deliver hyper-personalized experiences, from tailored product recommendations to proactive financial advice. However, personalization can backfire if it feels invasive or insensitive, destroying trust and pushing customers to switch banks. Finding the right approach is a delicate balance that needs to be maintained.

So, how can banks use personalization to enhance customer relationships and build customer trust and satisfaction without crossing the line?

Walking a Fine Line

Financial service industry experts increasingly recognize personalization’s crucial role in customer engagement, retention and conversion. It’s emerged as a key competitive differentiator in a crowded marketplace. That aligns with consumer demands; almost 70% want banks to offer personalized financial advice, according to recent data from Sopra Banking Software and 72% find products tailored to their individual needs more valuable, data from Dynamic Yield by MasterCard show.

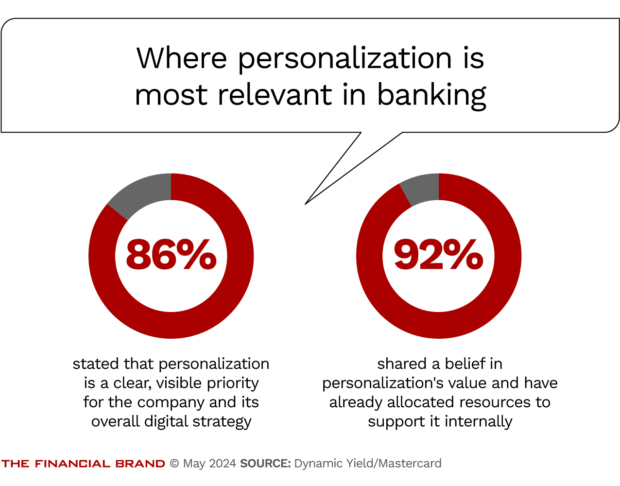

Banks and financial institutions understand the power of personalization. Over 85% of financial institutions cite having a personalization strategy as a priority and 92% plan to invest further resources, the Dynamic Yield study shows. There’s been a significant push towards more sophisticated, data-driven marketing personalization with investments in data analytics, generative AI and other technology to target customers more effectively. So, this trend toward more personalized banking experiences aims to meet customers at their point of need and moment of decision, providing relevant, timely interactions.

Modern Customer Journey Mapping

Customers navigate a multi-touch, multi-channel journey before interacting with your brand. Do you deliver successful and seamless experiences at every touchpoint? Download webinar.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

However, finding the balance is easier said than done, there are still challenges. Financial institutions hold incredibly sensitive personal information, including data on income levels, debt obligations and spending habits. This intimate knowledge of a customer’s financial life can be a double-edged sword. It is a powerful personalization tool but raises concerns when taken too far.

“Banks must walk a fine line between using financial data to create a personalized customer experience (CX) and avoid seeming intrusive.” John Nash, Chief Marketing Officer of Redpoint Global, a customer data platform and engagement strategy provider, told The Financial Brand. ”While spending habits and debt levels should be off-limits in a CX sense, there are all kinds of demographic, behavioral and life-event information that might be used to determine which products to market to the customer, when to market those products and how to message them — all in a personalized way.”

Dig deeper:

- How AI Generates Irresistible, Tailored Bank Marketing Messages

- From Mini-Millionaires to Overemployed: Five Emerging Demographic Cohorts for 2024

Avoiding the ‘Creep Factor’

When personalization crosses the line from helpful to invasive, often due to missteps in data use, communication, or timing, well-intentioned efforts can backfire. The consequences of mishandling sensitive data can be severe and the erosion of trust can inflict lasting damage to a bank’s reputation and bottom line.

“Financial data is undoubtedly personal, but I believe there shouldn’t be a strict line banks shouldn’t cross when using it for personalization. The key is relevance, Leo Goriev, Co-Founder at Alty, an IT company specializing in crafting digital products for banks, fintech, crypto, and large enterprises, told The Financial Brand. “If the bank sends irrelevant propositions or uses misleading communication, it cannot be considered a sign of personalized care, but vice versa. The goal is to provide tailored messages and services that align with client’s needs and preferences.”

“Banks must walk a fine line between using financial data to create a personalized customer experience (CX) and avoid seeming intrusive.”

— John Nash, Redpoint Global

There are plenty of places where personalization can go wrong in marketing communication, from feeling overly intrusive to misusing personal data, inaccurate personalization and a lack of contextual awareness. Banks may leverage data analytics to predict significant life events and offer relevant financial products, but consumers expect financial institutions to guard their data for tailored needs, not exploit it.

One path forward is to focus on customer journeys over the long term, throughout their financial lives, rather than relying solely on product recommendations. McKinsey found across business units, product lines and customer interactions, a typical regional bank has over 1,500 customer journeys. Using personalization throughout each journey to reduce friction and streamline shopping, onboarding and customer service can directly translate to better customer satisfaction, leading to more loyalty, faster growth and higher returns.

“Retail digital banking strategies should embrace these financial life stages by offering products and services to support each,” Joan Clark, Director, Product Management and John Redmond, Product Manager at Alkami, a digital banking solution for regional banks and credit unions, told The Financial Brand. “Financial institutions that look beyond simply offering products and focus on helping account holders achieve their goals form lifelong relationships with their customers.”

Clark and Redmond suggest using data analytics to support customers’ potential financial wellness needs by offering stress-reducing products, distributing educational resources to increase financial literacy and offering strategic investment options. Nash recommends providing a consistent experience across channels, combining digital and physical touchpoints and removing silos between departments and product lines for a more unified view of each customer throughout the bank, making personalization easier.

Learn more:

- 4 Ways Personalization Is Evolving at Top Banks

- AI Personalization as a Catalyst for Customer Loyalty

The Role of Data

Every click, transaction and interaction generate a wealth of information banks can leverage to gain deeper customer insights. Data is critical to effective personalization, enabling bank and financial services marketers to tailor services, anticipate needs and deliver timely solutions. But to get the most out of it, that data must be clean and managed.

Undoubtedly, AI will continue to play a significant role in enhancing data-driven personalization. AI allows banks to leverage vast amounts of customer data to deliver personalized experiences crucial for customer retention and satisfaction and improve marketing segmentation. It’s also leveling the playing field, making advanced analytics and personalized customer experiences accessible to all financial institutions.

“Banks that don’t personalize their marketing will lose customers to competitors using GenAI technology to improve engagement via tailored communications,” Chris McGee, Managing Director of AArete, a technology and management consulting firm, told The Financial Brand. “While integrating and scaling GenAI will be a top priority for banks, areas such as cloud analytics, customer data management, data quality and volume and systems evolution and monitoring will all need to be addressed.”

AI opens a world of personalization to banks and consumers are hungry for it. However, the challenge for banks is finding the balance between leveraging sensitive data for valuable insights while not taking it too far. Marketers can’t use set-it-and-forget-it approaches, so consistent monitoring, testing and tweaking AI output is crucial. This requires a thoughtful strategy for data governance, security measures and transparency about data practices.

Striking the Balance

Personalization in banking has the potential to improve customer satisfaction, long-term customer value and a bank’s bottom line. However, it requires maintaining a balance between information and privacy, relying on responsible data governance and best practices.

Banks can build trust and increase engagement by prioritizing customer well-being and focusing on relevant and timely interactions throughout their financial journey. A customer-centric approach, underpinned by responsible data practices, can ensure personalization provides a better banking experience without crossing over to the ‘creep’ factor.

Liz Froment is a financial services writer based in Boston. She specializes in banking, lending and wealth management with an interest in technology. Her work has appeared in Business Insider and The Motley Fool, among others.