For financial marketers, AI is no longer something out of science fiction. It’s reality. And here to stay, driving significant changes in how financial institutions interact with customers.

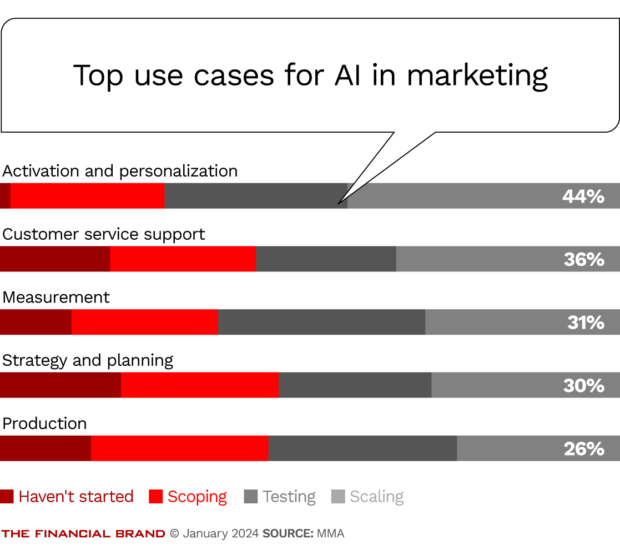

According to the MMA Global report, personalization is the predominant use case for AI, with 44% of organizations scaling it to tailor customer experiences and anticipate needs, bolstering loyalty and engagement.

AI for customer experience is a focal point for organizations shifting to a customer-first approach with more sophisticated, data-driven strategies. The primary goals for marketers using AI are improving the customer experience and personalizing the customer journey, driving marketing effectiveness, customer lifetime value and retention.

“AI and generative AI are rapidly transforming how we view personalized banking experiences. It’s enabled our ability to analyze vast amounts of data and generate tailored content, recommendations and interactions. It’s really going to be transformational across industries like marketing, eCommerce and banking,” Ashvin Parmar, global head of Insights and Data for Financial Services at Capgemini, told The Financial Brand.

However, while the surge in generative AI adoption presents opportunities — personalized creation at scale, hyper-personalized recommendations and dynamic interactions among them — there are challenges. Outdated legacy systems, data silos and privacy can impact AI integration and slow down successful marketing campaigns.

Dig deeper:

- 4 Ways Personalization Is Evolving at Top Banks

- How Banks Can Unlock the Complete Value of Automation

Banking Use Cases for AI Personalization

Financial institutions seeing success with AI adoption go beyond conventional applications or a focus on cost-cutting and instead focus on creating a relationship-first approach. Erin Pryor, Chief Marketing Officer at First Horizon Bank, has integrated personalized AI outreach into marketing efforts with promising results.

“AI’s ability to analyze internal data produces predictive insights, which marketing can use to understand our clients’ needs better. This information allows us to personalize messages based on the client’s preferences,” Pryor told The Financial Brand.

In Shaping the AI-Enabled Customer Experience, Parmar and colleagues found that using AI to derive insights from data and leveraging them for customer experience delivered double-digit boosts in revenue, customer satisfaction and campaign conversions.

This shift towards AI-driven personalization also emphasizes the need for continuous learning and adaptation. As customer preferences evolve, so “can AI systems, ensuring they consistently deliver relevant, meaningful experiences that resonate with ever-changing financial journeys.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Here are a few use cases:

1. Personalized content creation at scale: Data, behavioral insights and predictive analytics can enhance customer experience and loyalty through personalized messaging targeted to the specific persona you want to reach. This isn’t about mass-producing generic messages but using data to create content that speaks to each customer’s unique financial journey.

It also helps ensure relevancy. AI algorithms can analyze vast amounts of data to generate articles, financial advice and product recommendations for customers at the moment they need it.

2. Hyper-personalization in service offerings: AI enables banks to tailor products and services to individual customer needs, meeting customers where they are. That can improve responses and return on investment (ROI) of campaigns.

“Using AI-powered algorithms, we can observe individual behaviors, interests and demographics to identify those actively seeking financial products or services. This helps us reach users at the best times, resulting in more efficient ad spend,” says Pryor. “Our bankers can use this information to enhance their conversations and provide better solutions for clients.”

3. AI engineering for individualism: Beyond marketing and customer service, AI can engineer individualizing the entire banking experience — from personalized dashboards in banking apps to customized financial advice.

“You can go beyond personalization and towards more individualism,” says Parmar. “Generative AI not only personalizes existing content but helps you create entirely new and unique experiences tailored to individual preferences.”

Parmar highlights embedding AI, like a chatbot, into personal collateral and reports to answer questions as one example of creating more stickiness through tailored approaches that can deepen relationships and build loyalty.

Highlighting Areas of Growth

According to MMA Global’s report, nearly half of organizations using AI for personalization have found a measurable positive impact in improving revenue, productivity, or margins. And 26% have seen evidence of very strong and consistent positive effects from AI implementation. It underscores AI’s role in enhancing customer experiences, improving operational efficiency and driving revenue growth in the financial sector.

While the initial impacts are encouraging, there is a clear need for further development. AI technologies rapidly evolve and banks must keep pace to leverage their potential fully, including investing in advanced AI capabilities, training staff and continuously improving AI models to ensure they remain effective and relevant.

It’s also critical to build an AI-ready organization — from the top down. MMA Global found the companies leading the way in AI adoption and scaling have buy-in from leadership.

Read more: How Two Financial Institutions Won With E-Signature

Navigating the Challenges Posed By AI

There is a fine line between personalization and intrusion. So, balancing it with respect for privacy is critical. “With the financial sector being highly regulated, we make sure to intentionally use and test AI to understand our clients better while simultaneously respecting their boundaries,” says Pryor.

When using AI, financial institutions must adhere to data privacy and security and meet compliance and regulations for customer data. However, according to the MMA Global report, only about half of marketers have complete awareness and are preparing for potential AI-related risks. Just 1 in 8 have a strategy in place to address future risks.

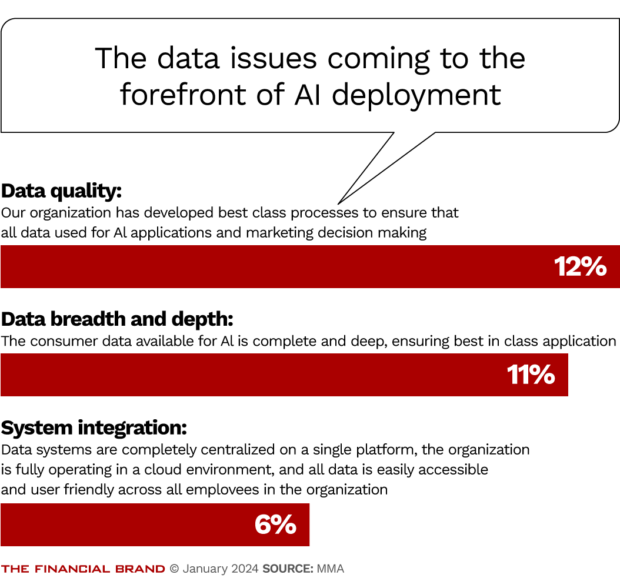

But this shift isn’t without roadblocks; only 6% of brands have fully centralized data systems. And 21% struggle with data silos reducing accessibility and integration, which is a significant hurdle for leveraging generative AI effectively.

Silos and fragmented ownership are key barriers to creating customer databases, which helps AI tools better analyze customer interests, intent and context during interactions, reshaping them as more data becomes available. Only 12% of organizations surveyed cited best-in-class data quality for AI applications.

The Road Ahead

“Organizations spent a good part of last year identifying different use cases for AI. Some focused on how to improve productivity and cut costs,” says Parmar. “But very quickly, others looked beyond that and said, ‘How do I use this pivotal technology to transform my business and create a better customer experience?'”

AI’s impact in personalizing customer experiences, enhancing operational efficiency and driving strategic marketing initiatives is undeniable. With nearly half of the businesses reporting positive impacts, the potential for AI in banking remains largely untapped.

Looking ahead, financial institutions face the challenge of strategically navigating this landscape, aligning AI implementation with customer needs and privacy concerns to deliver on expectations.

Liz Froment is a financial services writer based in Boston. She specializes in banking, lending and wealth management with an interest in technology. Her work has appeared in Business Insider and The Motley Fool, among others.