The quest for the perfect customer experience is driving digital transformation at top banks and new strategies that take advantage of generative AI and real-time data sets are creating real opportunities.

Financial institutions are increasingly focused on new ways to interact with consumers and are now leveraging large swaths of data to do it. Technologies like cloud computing and open banking are already helping banks improve digital experiences and connecting client data to all parts of their business lines. The challenge is quickly becoming how to best capture that data and utilize it in real time.

“Personalization is absolutely critical,” says Leslie Gillin, former JPMorgan Chase Global CMO and current Chief Growth Officer at the lending fintech Pagaya. “It’s the expectation in the world of Amazon – you need to be anticipating people’s needs.”

In a recent survey of 7,000 global participants by the financial consultancy Zendesk, more than seven in 10 customers (72%) said personalization is “highly important” to them and almost eight in 10 (77%) banking leaders said it leads to increased customer retention. While personalization is nothing new, there are trends emerging that create stickier engagements and turn casual users into life-long customers.

“Deepening existing relationships is priority number one with every bank,” Gillin says.

Offering personalized product recommendation in real time is one avenue and can be a highly effective way to cross sell products, she says. Customers with multiple accounts create a “halo effect” and generally have higher deposit rates, lower delinquencies and pay back debts earlier.

But to deliver these hyper-personalized experiences, banks will need to analyze and house large stores of client data, which could also bring privacy concerns. These customer profiles will have to be robust and use AI to collect and analyze the data.

“People think personalization and customization is only for sophisticated ultra-high worth customers,” says Olivia Eisinger, General Manager at the custodian Apex that lists top digital banks like M1 Finance and Stash as clients. “I would argue that everybody wants personalized interactions and firms should be considering how they can use tech to enable those personalized experiences.”

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Creating Real-time Interactions with Customers

The ability to use AI to leverage data in real-time is becoming a top priority for companies that are looking to offer personalized user experiences. One prominent example is point-of-sale lending options – like Apple’s Pay Later, Klarna and Afterpay – that offer lines of credit to pay off purchases right as the transaction is taking place.

These POS lending options (including BNPL) have quickly become the fastest growing asset class, according to Gillin, and are starting to take market share from the traditional credit card environment. “If you’re not talking about something relevant to your customer, you’re going to lose the opportunity and that impacts your bottom line,” Gillin says.

Seventy percent of the global companies in the Zendesk research said they are actively investing in technologies that automatically capture intent signals. The benefits are clear. Instantaneous interactions create better customer service, enhanced customer loyalty and satisfaction, and more revenue from highly individualized and relevant recommendations.

However, more than six in 10 global banking leaders said they feel their companies are behind the curve in providing those instant experiences to customers. “The question remains however, will [customer experience] leaders have the vision and commitment to take full advantage of these tantalizing opportunities?” according to the Zendesk survey.

Read more:

Personalization is Fostering Financial Inclusion

While personalization is helping banks boost their bottom lines, it’s also opening banking options to traditionally underserved communities. That means serving more customers.

It comes as no surprise that people of color face inequities in the financial services landscape that other Americans simply don’t. This includes lower access to financial institutions in their communities, lower approval rates and less availability and participation across a range of financial products and services, according to a recent report by McKinsey. Black Americans today constitute just about 1.5% of the nation’s wealth, and the median Black family has about 13% of the wealth of the median white family.

One of the major structural issues is that data has not been fully leveraged to be able to serve more Black and Latinx customers, Gillin says. “That’s really important from a financial inclusion perspective,” she says. “Especially bringing more people into the mainstream economy.”

Companies are now using broader data sets to go beyond traditional FICO credit scores to personalize financial products that help serve minority groups. By analyzing additional customer data points, like rent , phone and utility bill payment histories, fintech companies are offering more financial services to historically underserved segments than in past decades.

That’s a win-win for the industry and opens necessary avenues to better financial products for more Americans. “It’s the ability to leverage personalization to make sure that you’re front and center in your customer’s lives when and where they need you,” Gillin says.

Dig deeper:

- How A Chicago Credit Union Became a Personalization Powerhouse

- Why Should Banking Providers Offer Credit Builder Loans?

How to Harness AI Using Customer Data

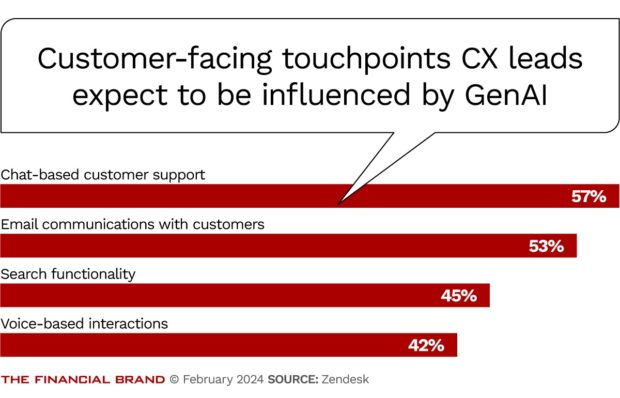

With all the potential and hype around generative AI, banking executives are still in the early innings when determining the most lucrative ways to incorporate the technology into their organizations.

Traditionally, AI has been used to create operational efficiencies, and has evolved into a tool to gather insights from large data sets. But as the amount of customer data being gathered today continues to grow, the technology will also help businesses offer more humanlike and personable interactions.

“Data really is the new oil,” says William Trout, director of securities and investment at the consultancy Datos Insights.

The technology can currently automate product offers to send to clients based on data, create wealth management recommendations about portfolios or investments, and is now recognizing customer intent. By looking at past behavior, however, AI is also beginning to piece together a more robust picture of the customer.

“It’s becoming more like a service concierge based on customer profiles and grouping customers as part of an affinity groups, like health enthusiasts or sports fans, and marketing to them appropriately,” Trout says. “It’s gotten really tactical.”

AI is now surfacing insights in real time that would otherwise have to be generated either by a human or manually on a one-off basis, creating a more human experience for customers, he said. The transactions could be linked to personal interests, like vacation spots or leisure offers.

“The secret sauce is to enable AI to have the capability to find the insights, and for that, you need robust data integrations,” Trout says.

Open Banking Still Faces Major Hurdles

With the rise of larger and more robust data sets, the open banking movement is continuing to pick up steam in the U.S., and may revolutionize how customer data is shared between financial institutions and market segments. The ability to source data from multiple places will make it easier for many Americans to access financial products.

However, this utopian vision of the future of banking data still has major hurdles to overcome before becoming the way mainstream America banks. “The fact of the matter is you need consent,” Gillin says.

She puts the percentage of Americans that have agreed to share their financial data at around 35% to 40%. As the trend continues, organizations will start to ask customers if they would like to opt into the data sharing, likely at the end of normal business transactions. Some top firms, like American Express, are already using similar tactics, she says.

“Having that additional information is a way for top companies to give healthier and better answers to customers,” Gillin says.

Sean Allocca is an award-winning journalist with more than 15 years of experience. Most recently, he was Editor-in-Chief of ETF.com, overseeing the company’s content strategy and long-term editorial goals. He was also deputy managing editor at InvestmentNews, an editor for the wealth management publication Financial Planning, and editor of CFO magazine. He has a M.A. in business communication from Fordham University and a B.A. in journalism from Loyola University, Maryland.