I sat in a client’s marketing war room recently, where all of the competitors’ offers were displayed by product type and relevant geography. The walls were covered with mail items, printed copies of webpages, and newspaper advertisements. It was a bit like playing “Where’s Waldo,” with banks and credit unions competing to find the optimal customer and match them up with the best offer and most compelling call-to-action in the market.

Amid these different brands and promotions, two things struck me about the scene before me:

- The differences between the best offer and the average were not dramatic

- The desired response from the consumer varied significantly by the size and type of bank – The larger banks had a greater emphasis on web and mobile, while the smaller banks tended to focus on channels (branch, call center), where human interaction and collaboration were important components of the offer fulfillment.

The basics of financial marketing have not changed. Product, price, promotion and place are still mandates of the marketing process – from CD’s to auto loans. But the idea of “place” is now amorphous and defined entirely by the consumer. Practically speaking, this means that financial marketers must compete not only on how they earn initial consideration from the in-market consumer but also on how they guide the consumer from their first interaction to their account opening.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Getting Attention From The Consumer

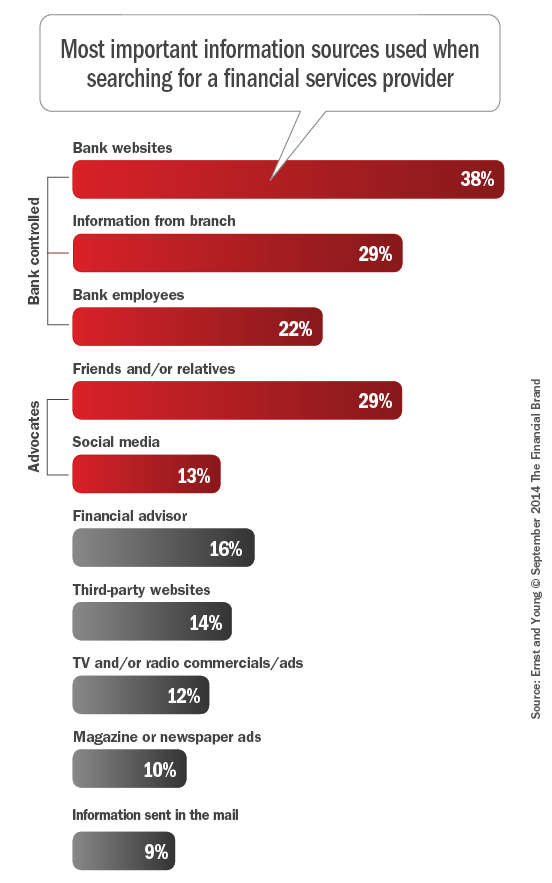

Today’s consumers demand omnichannel outreach from the organizations that solicit them, with digital interactions leading the way. According to a 2013 Price Waterhouse Coopers report, 3 out of 5 consumers desire a digital self-service research experience as they formulate which banks will be considered for a particular purchase. These findings are further echoed by an Ernst and Young 2014 global survey of consumer attitudes about banking.

As shown in the chart below, the interactive digital presence of a bank is critical to the consumer who is actively buying.

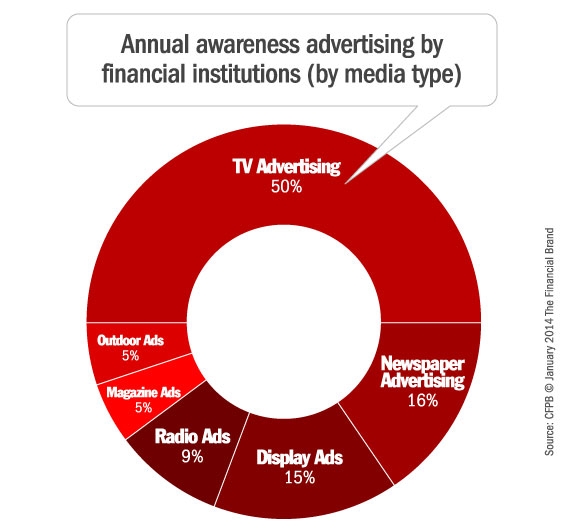

While this would suggest that savvy financial marketers concentrate budgets on digital channels (search, banner, social), conventional media (TV, print, direct mail) still have a prominent role in overall marketing spend. When it comes to direct marketing efforts, a recent Consumer Financial Protection Bureau (CFPB) study indicates that allocation is evenly split between digital and conventional channels, with a category breakdown as follows:

Digital

- 44% internet display and search

- 4% social networking

- 2% marketing emails

Conventional

- 22% direct mail

- 16% direct response TV advertising

- 8% direct response print ads

- 2% direct response radio ads

- 2% other methods

According to the same CFPB study, traditional media carries even more weight with awareness marketing spend – with 85% of advertising dollars going to traditional media outlets.

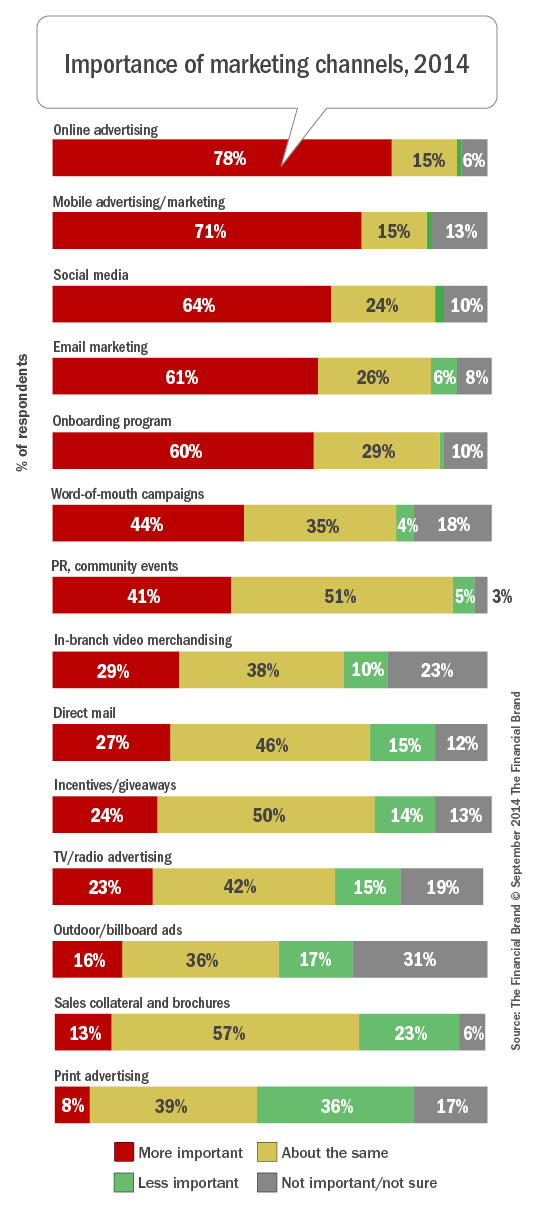

Other indications suggest that banks and the financial services industry has realized the significance of digital media and its direct response impact. As noted by a the 2014 State of Bank & Credit Union Marketing survey from The Financial Brand, banks indicate that while some of the most traditional media types (e.g. direct mail, public relations, advertising) will hold the same or slightly greater weight in their budgeting decisions, digital marketing spend is becoming significantly more important across the board.

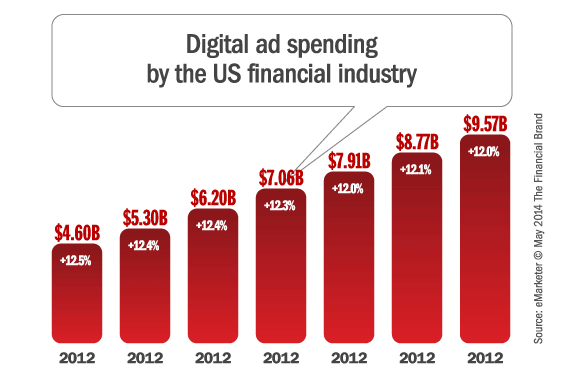

Other analyses suggest we can expect a growing alignment between consumer digital preferences and financial institution investment. According to Emarketer’s 2014 Digital Ad Spending and Forecast Trends, the growth rate in digital media eclipses all other forms of media used by banks. The chart below provides a recap and forecast of overall spend levels for digital media in financial services.

Read More: Digital Ad Spending Forecast & Trends for the Financial Industry

The research offered a few additional takeaways. First of all, overall digital ad spend is significant for financial services. Its historic and forecast growth rate indicates that it is growing faster than the spend of other media types in financial services. Yet, despite the growing importance of digital media to financial services, other industries are forecast to increase investment in digital advertising at even higher levels.

In fact, the percentage of digital ad spend attributable to financial services is forecast to decline from 2014 levels relative to cross-industry aggregate spending. So, while the financial industry is adapting to the digital preferences of our customer base, other industries are competing for the same screens and devices.

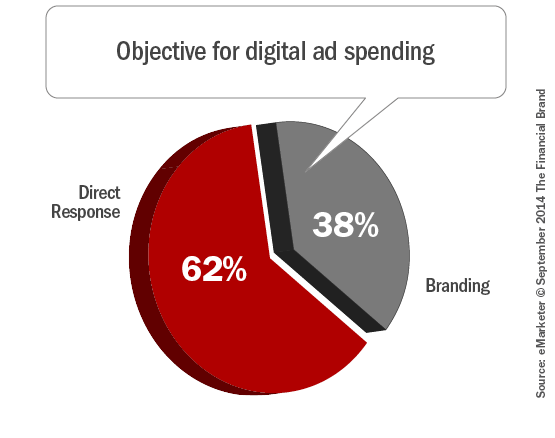

Perhaps even more significant than the overall increase in spending is the way in which financial institutions are allocating their digital media budgets. Emarketer’s research concludes that nearly 2/3 of financial services advertising budgets are directed to campaigns designed to generate a direct response.

Clearly, digital media is a rapidly maturing alternative to other advertising and direct response media. And, while traditional, non-interactive media may remain the majority component of overall advertising spend in our industry, consumer preferences and devices will continue to evolve at ever increasing rates.

Competition for the consumer’s attention is going to increase as this evolution continues. And all of this signals a significant shift in how our industry must address the buying journey once a consumer lands on a digital asset.

Leading the Way in Lead Generation

With the growing significance of digital and interactive research by in-market consumers, what are the logical opportunities for financial providers to exploit this trend? The online “research-first” shopping experience is distinctly different than the traditional, human-to-human collaboration upon which the retail banking sales and distribution platforms have largely been built.

Online research is mostly anonymous and unknown. Until the consumer elects to apply or approach another channel, the only thing bankers know is their digital footprint. A financial provider has no way of seeing a customer’s puzzled expression of confusion, or of hearing a prospect’s hesitation to commit due to incomplete product knowledge.

There are a number of ways to increase the visibility of digital in-market consumers while enhancing their shopping experience. Certainly, web analytics can play an important role in identifying where and how the consumer uses website content. By analyzing metrics such as scrolling, mouse movements, page/field abandonment, and end-to-end response time, marketers can begin to understand where a website is succeeding and failing in the consumer research experience.

Beyond the analytic framework, financial institutions can leverage content to learn more about the shoppers on their public-facing website. Offering a meaningful quid-pro-quo can encourage in-market consumers to opt-in for further interaction with the brand. Product buying guide, financial calculator results, and electronic rate alerts are all helpful customer resources with proven lead capture functionality.

Additionally, digital interactions that issue compelling calls-to-action can help anonymous consumers become known entities. In-market digital shoppers should never be abandoned without clear next steps for maintaining engagement with the financial institution, regardless of channel.

Finally, developing a strategic roadmap for the customer’s qualitative journey allows the financial institution to offer a research and shopping experience that stands out from competition. Financial executives need to understand the consumers’ multi-moment, multi-channel, multi-device interactions and establish a seamless sales process that extends across all paths.

When looking at the financial product shopping experience through the eyes of an in-market consumer, executives should answer these questions about the nature of the journey:

Early Consideration/Research

- Can I initiate interactive research into my financial goals across digital and mobile channels?

- Can I easily locate early stage research tools, like calculators and educational content without getting lost in a labyrinth of web pages and search results?

- Do the digital researching resources present me with relevant next steps to maintain engagement across channels?

- How much repetitive data entry must a consumer tolerate in my omnichannel research experience?

- Can I follow a logical path to move on from my initial investigation to compare products when ready?

Product Evaluation/Conversion

- Is it easy to use digital channels to find and compare product information?

- Do I see real-time pricing for my geographic area, not generic bank pricing?

- If I have questions, can I seamlessly transition from self-service research to in-person collaboration via branch or call center?

- Once I am ready to convert, do I have options for completing the application process in my preferred channel?

- If I switch channels during my buying journey, is the experience consistent and non-repetitive?

Examining the above questions will help financial providers better understand the journey customers take to travel from initial engagement to ultimate conversion. By identifying and removing any speed bumps along the way, an institution can ensure customers are able to move across channels and devices with the engaging educational resources, product information and sales guidance they need to make financial decisions.

Winning with Customer Experience

With the regulatory “shock” diminishing and the possibility of rising interest rates, financial institutions should reasonably expect increasing competitive pressures across their product sets. Banks and credit unions will continue to fight to find “Waldo” – the killer combination of an attractive offer making its way to an accurately targeted in-market consumer.

Winning institutions will be those that best align marketing outreach activities with consumers’ preferred media outlets. Best-in-class providers will go beyond compelling promotions, inviting in-market consumers to engage in meaningful digital research and product evaluation. It is there, in the early stages of engagement, that financial providers can leverage the full power of the omnichannel promise.

But “finding Waldo” s is only the beginning of the battle. Today’s empowered consumers expect their financial institutions to provide seamless, integrated research and shopping experiences. Banks and credit unions can take the next step to win Waldo’s business by eliminating barriers and authentically responding to the customer’s natural decision-making process.

With heightened focus on customer experience, successful institutions will break down channel and screen boundaries to deliver the tools customers need to make financial choices – where and when they want them. By making buying easy and frictionless for the omnichannel consumer, financial institutions can build and sustain competitive advantage for the long term.

Bill Secrest is the Regional Executive at Leadfusion, the industry leading provider of Financial Experience Management (FEM) solutions. Leadfusion’s CUSTOMERfirst™ platform drives revenue by engaging consumers across channels and devices in the critical stages leading up to conversion. Since 1995, Leadfusion solutions have engaged more than 1 billion consumers with the tools and information they need to confidently make financial decisions. Over 300 financial institutions, including 8 of the Top 10 banks and more than 75 credit unions have trusted Leadfusion to educate and empower their customers.

is the Regional Executive at Leadfusion, the industry leading provider of Financial Experience Management (FEM) solutions. Leadfusion’s CUSTOMERfirst™ platform drives revenue by engaging consumers across channels and devices in the critical stages leading up to conversion. Since 1995, Leadfusion solutions have engaged more than 1 billion consumers with the tools and information they need to confidently make financial decisions. Over 300 financial institutions, including 8 of the Top 10 banks and more than 75 credit unions have trusted Leadfusion to educate and empower their customers.