An air of uncertainty and potential doom looms whenever two financial institutions merge. It makes everyone nervous. Customers fret and may defect. Key employees may jump ship. Competitors will probably go for your jugular. Stakeholders freak out about the potential of lost productivity and unrealized ROI.

The only way to effectively mitigate all these issues is through effective, proactive and frequent communications with all key constituencies.

How Many Customers Will Leave Over a Merger?

The risks facing institutions planning a merger is very real, and if mishandled can completely undermine the ultimate value of the deal.

Customer attrition can be significant after an acquisition. J.D. Power and Associates says the likelihood for customers to switch banks increases by up to three times after their bank merges with- or is acquired by another financial institution.

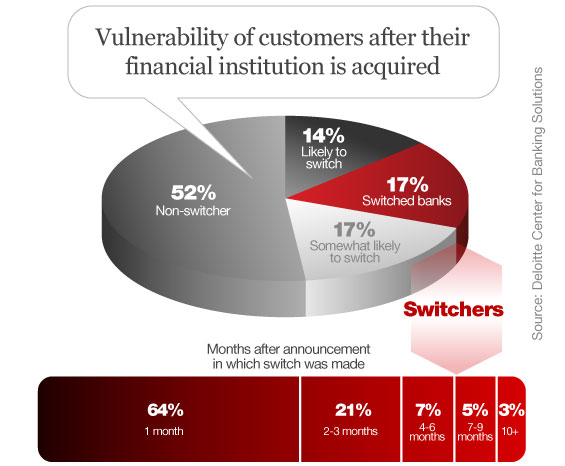

A study by the Deloitte Center for Banking Solutions found that 17% of bank customers that had been acquired switched at least one of their accounts to another institution. Almost two-thirds of the survey respondents who had switched an account to another bank did so within the first month after the deal was announced.

An additional 31% of respondents remained at risk, saying they were at least somewhat likely to switch one or more of their accounts to another bank over the next 12 months. Respondents who remain at risk of switching appear to have adopted a wait-and-see attitude. They want to see if their new bank will provide similar customer service, products, and fees to those provided by their old bank, and many are shopping around to see what other banks can offer.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

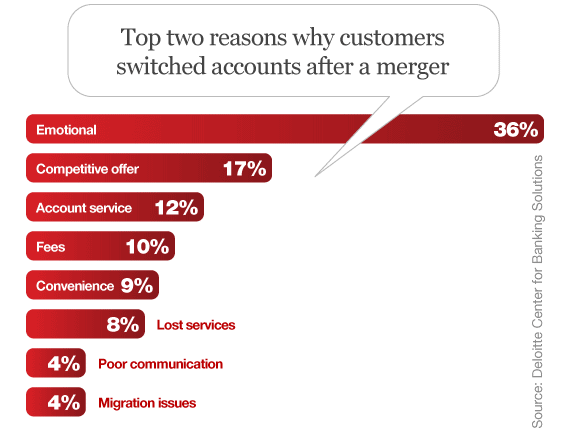

Deloitte’s survey asked respondents whether they had experienced any of up to 46 negative events to assess which types of experiences led respondents to switch accounts after an acquisition. These events included problems with the level of service, access to services, competitive offers from other institutions, increased fees, and poor communications, among others.

According to Deloitte, in most cases switchers had not experienced simply a single negative event, but instead reported several negative changes in their banking relationship. This suggests that the decision to switch usually results from the cumulative, compounding impact of a series of negative experiences.

J.D. Power and Associates says fewer than one-half of customers at banks that are being acquired report that they received a sufficient amount of information from their financial institution about the merger. Furthermore, when a customer finds out about the merger from a source other than their financial institution — such as the media or a friend or family member — they are twice as likely switch banks compared with customers who reported receiving merger or acquisition communications directly from their bank. Approximately 75% of customers of these merging banks state that they received information about the mergers from a third party, rather than their bank.

“Customer retention or attrition after a merger will be a direct function of how well communication is handled through the merger integration process,” says Casey Boggs, president of LT Public Relations. “Merger confusion is a root cause of customer attrition and a key reason mergers fail to meet expectations.”

Map Out Your Audience

“One in five financial institutions plan to notify customers about a merger or acquisition sometime in the next 12 months.”

— Mosaic Marketing

The first step in any merger communications plan is to map out all your audiences, and there are many of them. You have to worry about internal constituencies: front line staff, back office/support staff, middle management, the board of directors. Then there are the external audiences: customers of the acquired bank, customers of the acquiring bank, shareholders at both banks, regulators, the news media, the trade press, vendors and suppliers, any charities and civic groups either bank supports, and banking review sites like Bankrate.com and MyBankTracker.

Build a spreadsheet matrix with all your core communications constituencies down the left column. Then for each group, define their issues and concerns, your primary communications objective, what your main takeaway message will be, and what media/channels you’ll use to reach them. You should consider adding multiple rows for each group in your audience; if some groups have multiple issues and/or messages, map them all out. And remember, every unique constituency may have different concerns at different stages of the merger.

Below is the basic framework for how to construct an audience matrix for your merger communications plan. The contents of the grid are purely for illustrative purposes — avoid using this as a cut-and-paste template for your plan.

| Audience | Their Issue(s) |

Communications Objective |

Message | Channels |

|---|---|---|---|---|

| Shareholders | Stock price |

Communicate long-term value of merger |

The merger is safe and the value of the combined company will be enhanced, giving us the scale to compete | Press releases, website, direct mail |

| Customers at bank being acquired |

Service, pricing | Retain customer relationships |

We will be even more competitive with more branches, better access, wider range of services, lower costs and greater efficiencies mean better rates/fless fees | Direct mail, email, website, newsletter, in-branch materials |

| Customers at acquiring bank |

Changes, feelings of lesser importance | Grow customer relationships |

Stress commitment to customers and emphasize increase access and availability of services | Direct mail, email, website, newsletter, in-branch materials |

| Staff | Job security, career outlook | Retain the best talent |

Better opportunities in a larger, diversified organization | Intranet, webcasts, email, meetings and events |

| Regulators | Transparency, blueprint | Compliance | Everything is being handled professionally, responsibliy, legally | Formal documents, meetings |

Once you’ve created an audience matrix for your merger communications plan, your next step is to turn it into a schedule and figure out who will receive what and when. Create a comprehensive, itemized list of deliverables, and add key dates for when first drafts need to be completed, when materials need to be shipped to printers, when press releases should be sent, etc.

Take a Customer-Centric View

“Customers left

in the dark

assume the worst.”

— Bain & Company

“If the value of the merger is based on cutting costs that affect the customer experience, you can’t be surprised by customer flight,” says Boggs with LT Public Relations. “However, early and frequent communication about the benefits of the merger can mitigate some customer defection, especially with loyal customers.”

According to Bain & Company, financial institutions that do the best job of retaining customers (and attracting new ones) will adopt the customer’s view of the merger as they make important integration decisions. Successful merger communications maintain an open two-way dialog with customers, seeking their input and listening to it.

One effective way to do this is to create a closed-loop system for learning why customers are promoters, passives or detractors, and deliver the feedback directly to employees who can learn from and act on that feedback. It’s also important to follow up directly with customers when appropriate.

One communications lesson companies successful with mergers have learned is to bundle good news with bad. For example, on the first day that two airlines joined their customer operations, they announced combined priority airport services and integrated self-service capacity, but explained that a single reservation system would take more than six months to be introduced.

“For credit unions, their members must vote on mergers,” points out Glenn Christensen, President of CEO Advisory Group. “Credit unions use a variety of methods to understand and address the members including surveys, town hall meetings, fireside chats, lions club and chamber meetings. I even had one client set up a booth at a local farmers market to connect with the community prior to the merger vote.”

“During the integration phase, people will be concerned with how the merger will impact them in their daily lives,” adds Christensen. “Account conversion guides are helpful tools to assist in this process. After a merger, some financial institutions have used special promotions and new product introductions to demonstrate the benefits of the merger.”

Key Takeaway: Think like your customers. Put yourself in their shoes.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Sharks Will Smell Blood and the Piranhas Will Circle

Deloitte says another common reason customers switched was that the received a compelling, competitive offer from another institution. Specific examples include offers with more appealing products, improved savings rates, loans with lower interest rates or more flexible lending terms, or services that promised to make banking more convenient.

Consumers’ receptivity to competitive offerings speaks clearly to an absence of compelling reasons for them to stay. Banks acquiring another can go on the offensive and proactively communicate their strengths and the benefits of the acquisition for customers — on both sides of the merger. Deloitte says these communications can go beyond simply reassuring customers that changes will be minimal and service will not be disrupted. The acquiring bank has a real opportunity to emphasize its brand promise and illustrate how customers will benefit. These communications can be even more effective when they are customized to each unique, specific customer segment.

Key Takeaway: Your competitors will go on the attack, but you can beat them to the punch.

Involving Staff is Vital

The role of employees in building strong customer relationships cannot be overstated: Those who live the acquiring institution’s values and interact effectively with customers are essential to increasing retention.

Any communication gaps are going to cause problems. CCG Catalyst Consulting Group says you absolutely cannot afford to leave an information vacuum. Bad news, rumors and gossip will fill the communication void. If you get lazy or careless about communication, employees will lose their bearings and employees may start to drift off course.

Boggs at LT Public Relations says staff meetings should be held immediately to bring the core benefits of the merger or acquisition to light. It’s also very important that executive leadership present messaging to staff in a clear, unified voice. Talking points will keep the desired message consistent. Staff should be instructed to relay these talking points to customers.

CCG Catalyst Consulting Group says cultural differences are bound to appear, and when they do, leadership teams need to tackle them head-on. Openly work to resolve the conflicts – the hotter the issue, the greater the need to quickly handle it. Granted, harmony is nice, but not at the expense of effectiveness.

Analysts at Deloitte say proactively communicating the benefits of an acquisition can help to ensure that fees, while always important, do not become the exclusive issue for customers. Training employees is important in this area as well. Employees need to have the information and skills to answer every conceivable question on fees that customers might ask. It is helpful when staff are equipped with the training and skills required to move discussions off fees and onto the value and benefits of services provided.

According to experts at ROI Communications, giving employees the opportunity to ask any merger question, any time, and receive a speedy response builds valuable goodwill and credibility. For instance, one company introduced an “Ask a Merger Question” and an “Ask an Integration Question” section on its intranet. Employee questions were funneled to the appropriate executive for responses which were then posted. In addition, weekly reports outlining the break-down of questions by category gave the communications team keen insight into where they should focus their energy.

Successful merger communication also involves sharing issues, when they surface, to the very top, says the team at ROI Communications. This ensures quick action before they take on a life of their own. A process for quickly responding to these issues and making decisions about follow-up steps needs to be built into the strategy.

Key Takeaway: It takes a tremendous amount of communication to affect and sustain culture changes. If you do not regularly and proactively update your staff, they will fill in the blanks with rumors that spread along the grapevine. In times like these, even no news is news.

Unusual Experiment Proves Value of Internal Communication in Bank Mergers

Emirates NBD conducted a fascinating experiment to test the value of internal communications. The study compared two separate bank facilities: a “control group” that received no communication until the formal announcement of organizational changes, and the “test group” that received early and frequent communications throughout the planning process. It could very well be the only study of its kind in the financial industry. The experiment revealed that employees who were updated about the merger early and often were 9% less stressed, 6% more likely to remain with the company post-merger, 14% more satisfied with their jobs, and felt 22% less uncertainty about the future.

Sanjay Uppal, the erstwhile CFO for Emirates NBD, says what worked well for them during a major merger in 2007 was centralizing all communications. Uppal stresses the importance of planning, and allowing for constant feedback — you need to be able to process it, because you’re going to get it whether you ask for it (as you should) or not. He says one of his main takeaways is that they should have done more internal communications — particularly with key stakeholders — and finding ways to articulate the “offer” or value proposition of the merger. Uppal says you should always ere on the side of over-communicating.