Affinity Plus Federal Credit Union needed a way to grow its membership after reducing overdraft fees and doing away with nonsufficient funds fees in July 2022.

“That’s sort of a bold move,” says Joel Swanson, vice president of marketing at the $4 billion-asset credit union in St. Paul, Minn. “A lot of financial institutions rely on that income.”

For Affinity Plus, the changes meant forgoing $5 million in revenue for the second half of 2022, leaving it short of its original net income goal. It set out to make up the difference by attracting more members and recruited the Minneapolis marketing firm Haberman to help.

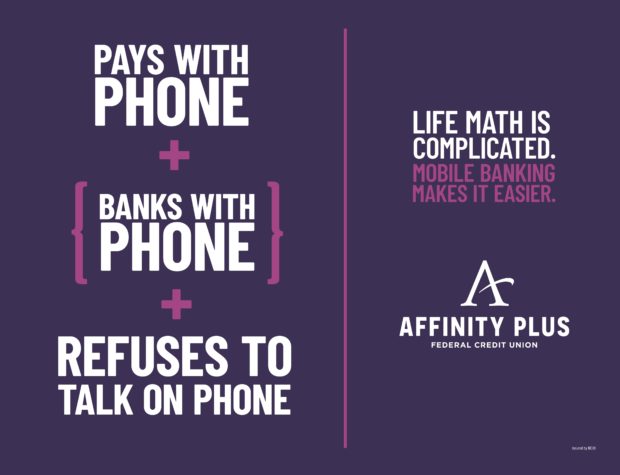

The multiyear campaign developed for Affinity Plus — called “Life Math” — plays off its financial literacy efforts, which is fitting in a few ways.

The reason the credit union had cut its fees in the first place was to help alleviate stress for its members. The move was intended as a doubling down on its financial wellness commitment.

“We have this mantra that if we ‘do good,’ business results will follow,” Swanson says.

As Affinity Plus sees it, the fee changes and the marketing campaign offer another proof point for that philosophy. Its membership grew more in 2022 than in any of the previous 10 years.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

How the Fee Changes at Affinity Plus Jibe with Its Overall Strategy

Affinity Plus has a “low income” designation, which means more than half of its members fit this criteria, and it is looking to expand into additional underserved communities.

The fees that it cut tend to have a disproportionate impact on this segment. The credit union announced in April that, in the initial six months after the changes, half of the savings from the elimination of the nonsufficient funds fee — often referred to as an NSF fee for short — went to its “most vulnerable” members, meaning those with credit scores below 620 who are in the low or low-middle income range. It used to charge a $35 fee for returned checks.

Changes to Amplify Plus fees:

- Eliminated $35 returned item fee.

- Reduced overdraft fee from $35 to $15.

- No overdraft fee if negative balance is less than $100.

The credit union also stopped charging overdraft fees in cases where the negative balance is less than $100. It slashed the fee by more than half — from $35 to $15 — for overdrafts exceeding $100.

Affinity Plus says its analysis shows those who benefited most from the $100 overdraft allowance were lower income, lower credit tier, minority and younger members.

“We believe we’re the only credit union in Minnesota so far to take this approach designed around the most vulnerable members, and it’s our hope that sharing our success spurs others to follow suit,” Dave Larson, the chief executive of Affinity Plus, said in the press release.

Overall, 30,000 individuals benefited from the changes in the initial six months — with some of them saving on fees multiple times and a few of them as often as 14 times, the credit union said.

To be sure, other financial institutions across the country also have reduced or eliminated such fees, including the $2 billion-asset Amplify Credit Union in Austin, Texas.

The trend is fueled in part by the Consumer Financial Protection Bureau. It has been highly critical of the banking industry for NSF and overdraft fees, referring to them as “junk fees.”

What the CFPB Says:

These fees not only make it more difficult for many people to get by, but affect their overall perceptions of whether the banking system is fair and transparent.

An NSF fee is levied when someone overdraws an account via a check or automated payment, and the financial institution declines the transaction. An overdraft fee applies when the account is overdrawn, but the financial institution covers the amount despite the shortfall.

According to the CFPB, banks with assets of more than $1 billion collected a total of $7.7 billion from these two fees in 2022, with the amount shrinking consistently every quarter. The 2022 total is down 35% from 2019.

Affinity Plus Ad Campaign Targets Millennials & Gen Z

Affinity Plus is dealing with a few common industry challenges — specifically, a lack of awareness about what a “credit union” is and a membership base that skews older. In developing the “Life Math” campaign, it aimed to tackle both of those issues.

Brian Wachtler, Haberman’s president, says the campaign does this by taking a “storytelling” approach that emphasizes how Affinity Plus is focused on helping people with their financial challenges.

One of the three, 30-second television spots tells the story of two young people moving in together and trying to merge their belongings and their finances. “One new place for two people. Plus two distinct styles. Plus two of everything,” says a female voiceover. “Plus one budget, divided by two. Life Math is complicated.”

The TV spot cuts from the befuddled couple standing in their living room amid all the stuff they need to unpack and organize to a smiling Affinity Plus employee sitting at his desk and waving, “Hi.” The final scene shows the couple relaxing on their couch, their belongings all squared away. “Financial experts make it easier,” the voiceover says. “Affinity Plus.”

Another spot, titled “Sanity,” is about a woman who is having a baby and trying to fix up the nursery in time, while another, titled “Giving Back,” highlights the fact that Affinity Plus customers can donate their reward points.

The messages are intended to resonate with Millennials and Generation Z — segments that are experiencing major life stage changes. “They were the biggest opportunity we identified and developed the creative idea around showing our humanity in helping relieve the stress around finances and banking,” Swanson says.

Wachtler says these segments are also likely to appreciate how credit unions are mission-driven nonprofits. “The younger generation has the same value set related to giving back to the community and doing good in the world,” he says. “And that story really hasn’t been told to the extent that it could for credit unions.”

The campaign took roughly six months from the brainstorming to execution phases. Affinity Plus defines its target audience as tech-savvy, upwardly mobile deal-seekers, and it aims to reach them using television and billboards.

A new addition to that mix — YouTube advertising — is planned for this year. Swanson says he believes YouTube is a more effective option than other social media platforms because it’s used as a search engine.

Read more:

- How Financial Institutions Can Tell Their Stories More Effectively

- One Credit Union Axes All Fees: Bold Strategy or Big Mistake?

Expanding into More Low-Income Communities

“Life Math” has been a draw for Affinity Plus.

Growth accelerated in the second half of 2022, with membership climbing to a total of 246,446 people by yearend, up 7% from the year earlier. The credit union added another 11,000 members in the first quarter of 2023, a 4.5% increase from Dec. 31.

That’s already more than halfway towards the marketing team’s goal of 20,000 new members for this year.

Much of the credit union’s focus is on serving low-income communities.

Affinity Plus has roughly 30 branches, including one gained when it absorbed the struggling White Earth Reservation Federal Credit Union in February 2022. White Earth, based in Mahnomen, Minn., had 1,400 members, mostly from Native Americans tribes.

The National Credit Union Administration “has dubbed it one of the most underserved areas in the country,” Swanson says. “The regulators were desperate trying to find somebody who could take it over that had the resources to keep it afloat.”

He says there were few opportunities for people living on the reservation to get access to a mortgage, for example. And now, it’s one of the fastest-growing branches that Affinity Plus has.

The credit union is also branching into other low-income communities. This year it added a branch in St. Paul’s Midway neighborhood, which previously lacked any traditional banking options. All the staff members at the branch speak either Spanish or Tagalog in addition to English. Three more new branches in other communities are expected to open by mid-2024.

Swanson says one new product the credit union is hoping to offer is an immigration or citizenship loan “to help people who are going through the citizenship process afford the many, many fees that come along with it.” It is pursuing a partnership with the cities of Minneapolis and St. Paul to help make that happen.

Affinity Plus membership is open to all Minnesota residents. People from other states also can qualify to become members by making a one-time $25 donation to the Affinity Plus Foundation. The foundation makes grants to nonprofits involved in financial education, affordable housing and food security in the state, and awards some college scholarships through an application process. It plans to give $4,000 scholarships to 15 Affinity Plus members going to Minnesota colleges in the upcoming school year.

Read about other marketing campaigns:

- Storytelling with a Twist Helps This Bank Connect with Small Businesses

- Rally Credit Union’s Rebranding Effort Plays on Its New Name

The Results of the ‘Life Math’ Ad Campaign So Far

The Affinity Plus marketing team initially set out to grow membership by 10% in 2022, but ended up hitting pause on the “Life Math” campaign in the fourth quarter because of the economic environment.

So Swanson says he was very happy with the 7% growth that the credit union experienced, especially since this amounted to the highest level of new members it had seen in more than a decade.

In June 2022, the month the campaign started, daily new member growth increased 24%. Swanson says roughly a third of that activity can be directly correlated with the campaign.

The overall product engagement rate also increased significantly from 2021 to 2022, he adds. And to top it all off, its “priority markets” — designated low-income areas where Affinity Plus is trying to grow — reported between 42% and 75% higher penetration rates than previous years.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Power of Storytelling

Smaller institutions are finding it increasingly difficult to compete with the offerings of megabanks. But Swanson and Wachlter say storytelling can be a differentiator.

All financial institutions should think analytically about how they communicate with Gen Z, Millennials or any other core audience, Wachlter advises.

“Ask the question, ‘Are we really harnessing and telling our unique authentic story in a compelling way that is going to attract this younger generation?'” he says. “We believe it’s just a matter of diving in and uncovering that unique story.”