First Cherokee State Bank, like many retail financial institutions, is worried about its future. The banking industry in Georgia, where First Cherokee is based, was hit hard by fallout from the financial meltdown, with 57 bank closures between 2008 and 2011 — more than any other state in the U.S.

As a modest community bank with only three branches, First Cherokee wondered how they could survive in a such highly commoditized industry, one where giants reign supreme. Is the traditional branch model outmoded? What will financial services look like 5-10 years down the road? How can the organization radically reposition its brand and change consumer perceptions, but without all the turmoil involved with renaming?

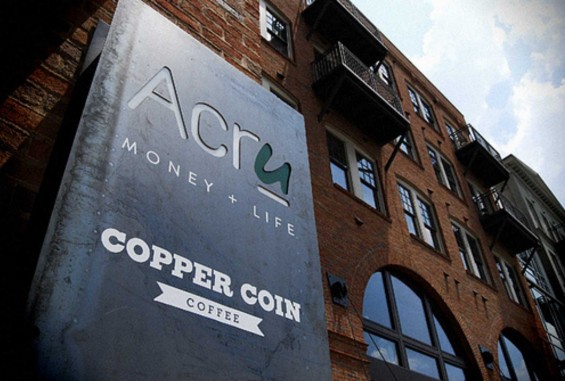

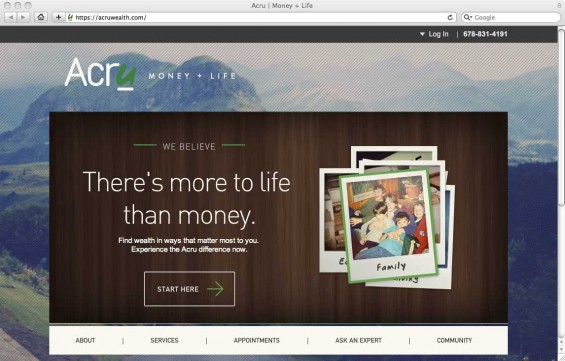

First Cherokee’s answer: Acru, the bank’s new sub-brand created around its wealth-management division, described as “a revolutionary new retail concept where wealth strategists give away financial wisdom at no charge.”

It’s not the café inside Acru’s prototype location that makes First Cherokee’s strategy so noteworthy. Nor the absence of tellers. There’s no cash, no transactions, and not customer service desks. Nay. What is interesting about First Cherokee’s approach is that the bank plans to grow into the Acru brand over time. They plan to patiently, methodically increase Acru’s visibility and expand its focus beyond its wealth-management beginnings. Meanwhile, the First Cherokee State brand will edge quietly towards retirement.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The interior of the initial Acru location looks and feels like a classy cigar and wine bar. Indeed the space is two bars. Situated in the front half of the store is the Wisdom Bar, home to Acru’s wealth management advisors. The second half of the location is a full-service retail coffee bar. The location boasts free WiFi, an open community meeting space and a conference room available to anyone who makes a reservation.

“The design evolved from a low-barrier interaction environment — similar to the Apple Genius Bar — to a more intimate setting akin to the comforts of home,” said Matt Hames, CEO/Acru.

“Our community space design is intended to be as comfortable as your own living room — great coffee included,” it says on the Acru website. “We want you to come in and stay for a while.”

The team at Cherokee State/Acru created their own Copper Coin Coffee brand for the Acru café experience. Ten percent of coffee operation’s gross revenues are put towards philanthropic community projects.

The coffee bar is open from 6:30 am to 11 pm, seven days a week. Wealth management advisors are available Monday through Friday, 9 am to 5 pm.

“Everything Acru does starts with a conversation,” bank spokesman Rob Kremer explained. “We believe coffee houses facilitate conversation.”

“The goal at Acru is to remove the transactional element from financial services and create a more interactive, relational environment,” added Hames.

Financial Quarterbacks & Switch Teams

Acru is staffed by five “Wealth Strategists” who use a CRM solution from Salesforce to manage customer relationships.

“Our job is to ask questions, shut up and listen,” Hames said. “Listening is the most important part.”

Each Acru representative serves as a single point of contact for clients, offering them a plan with a 360-degree holistic view. A Wealth Strategist will manage a client’s entire portfolio of financial needs, regardless of their socioeconomic status.

Hames likens the role to that of a “financial quarterback.”

“Acru helps people and businesses with anything related to their money, including banking, investments, insurance, tax and estate planning, regardless of their net worth, beginning with the area of greatest need as agreed upon by the client and Wealth Strategist,” Kremer explained.

“Acru’s front line employees — the Wealth Strategists — do not sell anything,” Kremer added.

“Our wealth strategists are free from having to sell products and push transactions,” Hames said. “Rather, their sole focus is to provide clarity and wisdom across multiple disciplines utilizing specialists that will best serve the client’s needs.”

Acru also has “Subject Matter Experts” who can provide detailed expertise in specific areas. Kremer said Subject Matter Experts are “brought to the table to deliver products when a need has been identified by the Wealth Strategist and/or consumer.”

Adding to the Acru difference are the services of the Switch Team, a team dedicated to handling the logistical and administrative nightmare associated with switching banks. They handle all the details, including moving online banking and bill pay relationships. This is offered as a free service.

“Our Switch Team takes the pain out of moving checking accounts,” Hames promised.

First Cherokee knew it wanted a radical new retail concept to reinvent itself, but couldn’t see how remodeling its existing three locations would have much impact. Everyone in the community knew First Cherokee was a bank, and management didn’t feel a new coat of paint would change that.

“We believe it’s impossible to create something truly new and different by redecorating something old,” Kremer said. “The bank’s brand is one that is known for offering a commodity like all other banks with locations designed for transactions.”

“To expect the Acru brand promise to be effectively delivered through the banks physical locations and current brand position in the marketplace did not seem reasonable to us,” Hames said.

They also didn’t think people weren’t likely to come into a coffee-style retail environment simply to have a conversation about checking accounts. Investments, insurance, trusts…? Yes, perhaps. But basic banking? Probably not. So they looked outward for inspiration.

In creating a new experience, First Cherokee studied the latest ideas within the industry, as well as service leaders in venues such as boutique coffee shops, the Apple Store and the Ritz-Carlton.

The Acru prototype incorporates shades and flavors of things seen previously in the financial industry, including Umpqua’s community branch locations, ING DIRECT’s cafes and UNCB’s failed attempt at creating a coffeehouse brand. In fact, First Cherokee executives including CEO Hames spent a couple days visiting with Umpqua Bank’s team in Portland, Oregon.

To assist with the design and development of Acru, First Cherokee partnered with the branding experts at Leader Enterprises, and ai3, an architectural firm based in Atlanta.

“We looked at it like a hospitality project,” a spokesperson with ai3 said. “There is nothing in there that says ‘bank.’”

First Cherokee feels its Acru retail space is the model for the future of financial services. “Acru provides product-agnostic wisdom at no charge from a trusted, single advisor and team of experts to clarify your financial life today and help you prepare for tomorrow,” Hames explained.

“Acru is how we believe the next generation of community based financial services should look and feel to the local community,” he continued. “A trusted advisor that, in addition to First Cherokee State’s banking products and services, also offers single source access to Investment, insurance, tax and estate planning.

“This is what community banking needs to be,” Hames added. “We have to do this to not only survive, but thrive.”