It’s safe to say the last two years in the world of banking haven’t been typical, and that’s the case for marketers in the industry too. This year we surveyed over 590 financial marketers across the globe. They’ve given us insights into the state of marketing in the banking industry. There was a lot to cover, so the following insights are broken down into three categories to help define the findings:

Know: It is crucial to understand the value of creating a single source of truth for consumers.

Data is everywhere — siloed departments, multiple platforms. We all know the story of institutions trying to bring together data to get that single view, no matter where you sit in the company. But in an industry with many products and services, regulations, and multiple departments, what data are marketers prioritizing to create a single view?

Humanize: Once you have a single source of truth, you can segment and activate your data (with the help of artificial intelligence) to humanize moments, at scale, across any channel.

Personalization is king. But how do bank and credit union marketers make automated marketing feel human? This was the primary focus of most marketers surveyed. Getting a single identity of a customer or member and being able to orchestrate a connected experience. We look at the priorities here.

Optimize: Measure marketing performance and optimize the impact of your investments with unified analytics and real-time, AI insights.

The days of manually pulling data and trying to upload to a presentation slide are gone. Well, they should be gone. We asked about automated insights and particularly what kind of metrics do marketers prioritize in financial services. We’re at an age where marketing strategies can be optimized using intelligent insights, in real-time.

Before we dive into the details, it’s worth calling out that marketers were asked to put themselves in a category of either a high, moderate or under-performing marketer. Here’s the split of respondents:

- High performing marketers, 12%

- Moderate performing marketers, 71%

- Underperforming marketers, 17%

1. Know — Seeking that Single Source of Truth

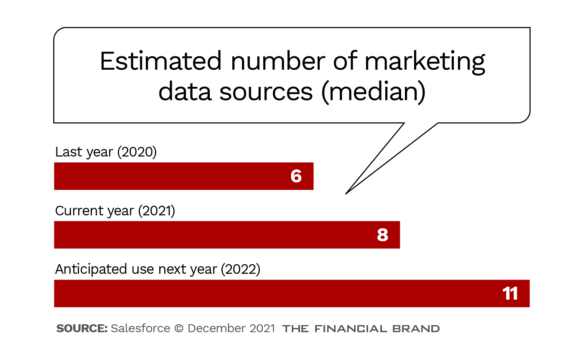

Let’s start with all that data. The number of data sources that financial institution marketers deal with continues to increase year over year with 11 data sources projected by 2022, up from eight in 2021, as shown in the chart below. At an industry level, this isn’t really the peak: For instance, marketers in the media industry averaged 35 data sources by 2022. So 11, while still a lot, is a good place to start for unifying that data now.

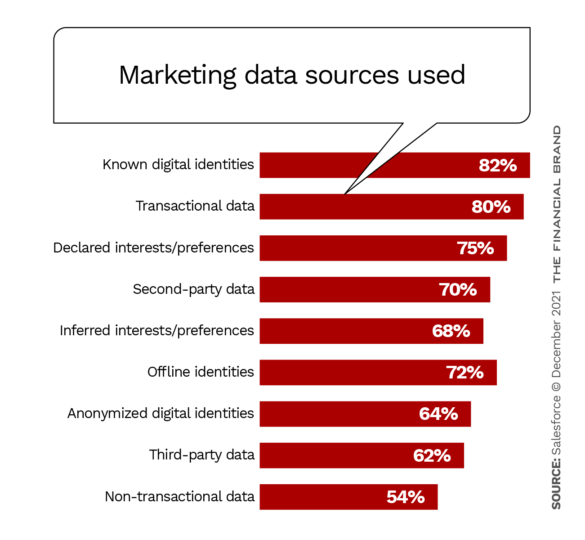

The survey asked about nine data sources in particular. The most popular focus is on “known digital identities,” with 82% of respondents identifying that as a source used. Known digital identities are anything the organization owns like the company’s website data, transactional data or customer relationship management (CRM) data. This isn’t a surprise for this industry with customers and members usually consuming more than one product or service. The marketer needs to bring that data together to figure out what to communicate next.

Data can be complex and marketers can have issues with data that might be out of date. Below is how respondents viewed the quality of the customer data. Only 38% of bank and credit union marketers were fully satisfied with the completeness of their customer data, but most were somewhat satisfied at 81%. Similarly only 38% of marketers were completely satisfied with the quality and hygiene of their customer data with 85% being somewhat satisfied. Overall, that’s a good position for marketers in the industry but there is room for improvement to get that true single view that humanizes communication — based on where the customer is in the life cycle.

How about activation of all the data then? After integrating that data, financial marketers prioritize these five use cases to activate it:

- Consumer insights

- Personalization

- Identity reconciliation across systems

- Consent management

- Audience segmentation

There’s a theme here of understanding what the consumer is engaging with across the organization, then using that for personalization to build on the next best action.

2. Using Data to Humanize Marketing

The top two priorities of financial institution marketers involve engaging with customers and members, so humanizing these engagements is critical.

The number No. 1 priority is engaging with consumers in real-time. That’s why clean and current data is so important and ties in with marketers focusing on known digital identities and transactional data. The next two priorities are creating a cohesive customer journey across channels and devices and measuring marketing ROI and attribution.

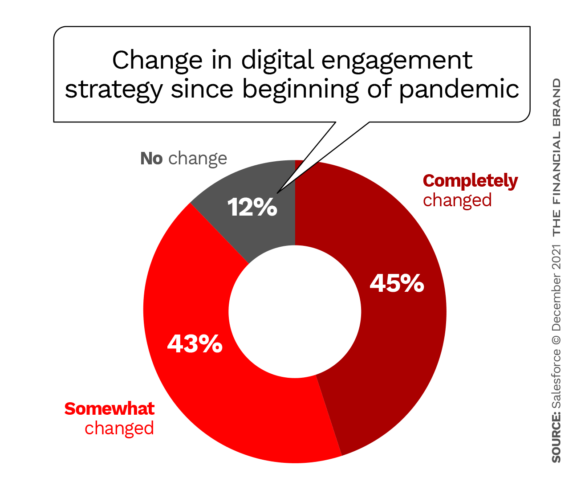

The pandemic has influenced how financial marketers think about customer engagement, with 45% of them claiming their digital engagement strategy has changed since the beginning of the pandemic, and 43% saying it has somewhat changed.

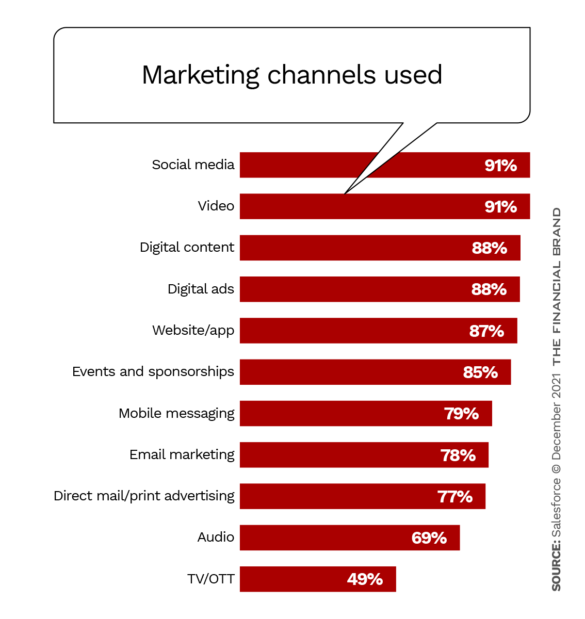

There’s diversity in the channels marketers are using to engage with consumers. Financial institutions are trying to reach consumers on the platforms they want to receive communication from, a great step towards personalization. As shown below, over 77% use nine different channels. It’s important to identify what channel consumers prefer, especially with so many different ways to engage.

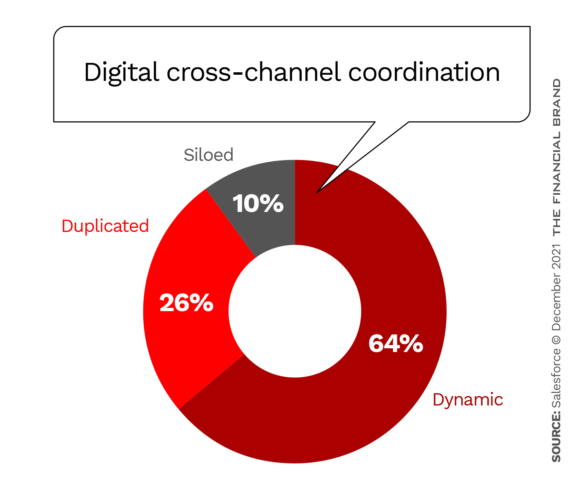

As bank and credit union marketers work towards personalization, only 64% say their channels are dynamic. That means marketers are figuring out how to orchestrate channels together.

Artificial intelligence has been one way marketers have achieved personalization in their marketing communications, but 45% of financial marketers are unclear on the role of AI in their organization. Of those that do use it, from the survey, we see that the main use of AI is personalization and real-time communications. Here are the top five use cases in which financial services marketers are using AI:

- Drive best actions in real-time

- Automate customer interactions

- Resolve customer identity

- Personalize the overall customer journey

- Process automation

Personalization is at the heart of consumer communications. To do this well, financial services marketers know they need to gather insights and optimize. Next, we look at the priorities for optimization, including the use of intelligent analytics.

3. Optimize Using Analytics and AI

Now it’s time to take a look at marketing performance and how financial marketers measure and optimize the impact of their investments.

81% say they are using marketing attribution tools — pivotal for being able to optimize marketing strategies with accurate, real action-based insights (and to avoid having to prepare those manual presentation slides each week).

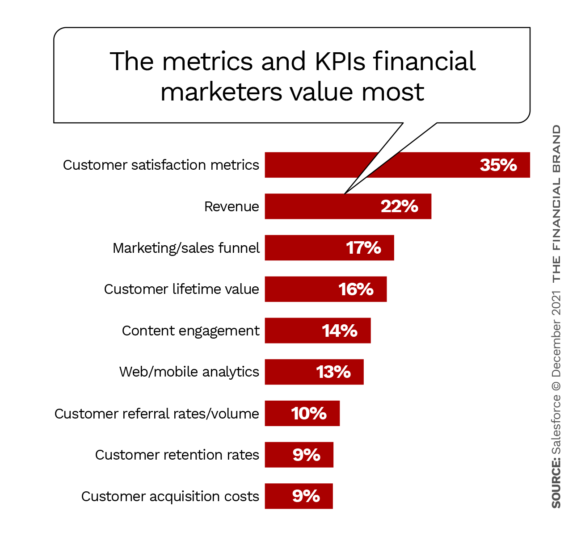

Customer satisfaction metrics is the key focus for financial marketers, with 35% voting it the most important metric — significantly more important than any other KPI.

There are multiple marketing KPIs tracked by financial institutions, with over 70% tracking six of the nine metrics identified in the survey.

One last insight is that more than three quarters (78%) of financial marketers say they align their KPIs with those of their CEOs. So, it makes sense that customer satisfaction metrics and customer retention rates sit in the measurement for marketing in banking.

The CMO is now at the heart of the customer lifecycle and this is shown by the results of this survey as financial marketers work towards a strategy of “Know, Humanize and Optimize.”

If you’re interested in the results of a survey with marketers from any industry, view the 7th State of Marketing report, where you can uncover the trends and insights from over 8,200+ leading marketers worldwide.