For the average consumer, banking is a chore akin to scrubbing the toilet. It’s something that has to be done whether one likes it or not, and most people don’t. There are a million things we’d rather be doing.

People detest banking because it’s rife with complex nastiness like math, numbers, fractions percentages, forms, queuing, waiting and bureaucracy. Consumers are concerned more with how they spend their time than their money, so they think about banking as little as possible. “It’s boring. I’m busy.”

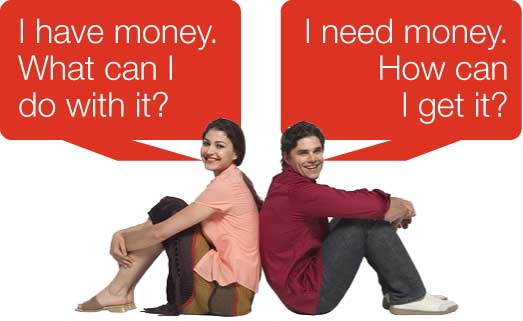

The consumer view of money is actually very straightforward. People either have money or need some.

HOW CONSUMERS VIEW BANKING

It seems pretty simple and obvious, but have you ever looked at banking this way?

Most bankers are incapable of translating financial services from this consumer perspective. They typically only see the industry through the lens of ROI, risk analyses, legal disclosures, regulatory issues and compliance concerns. Some bankers like the fact that it’s confusing, while a few deliberately exploit banking’s complexities for profit.

Marketers sensitive to these realities see an opportunity — quite literally a “simple” solution. They know that making banking easier is something that would really resonate with the vast majority of consumers who would rather be doing something (anything!) else. It’s an intuitive conclusion, and one that doesn’t require a deep data dive or tons of market research to validate.

Reality Check: Making banking easy ain’t easy.

If making banking easy was an easy thing to do, someone would have done it already. Yet surprisingly few financial firms have even attempted this direction. National City had been on a “simple” kick for a few years before being swallowed up by PNC. More recently we’ve seen Ally Bank, with its focus on transparency and its “Straightforward” slogan. And certainly PFM providers like Mint and Geezeo are doing what they can to improve one part of the overall banking experience. But no full-service financial institution has stepped up and dedicated itself 100% to the concept of making banking easy.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

There’s been much buzz among thought leaders in the financial industry over BankSimple, a startup venture with plans to pursue the “easy banking” strategy. Albeit BankSimple will only handle transaction accounts, so the strategy should more aptly be called “easy checking.” What about loans, credit cards and other financial products?

The nascent company claims to have the solution that will conquer consumer apathy towards banking. The BankSimple motto: “Don’t suck.”

“By not sucking, we will win,” says Joshua Reich, a BankSimple founder, on the company’s blog.

Reality Check: There’s a lot more to making banking easy than simply “not sucking.”

Despite being somewhat vague about their offering, the guys at BankSimple are right about one thing: the financial marketplace is ripe for startup brands that challenge the status quo. It’s part of the anti-incumbent attitude running rampant in America.

Despite BankSimple’s optimism and idealistic ambitions, they will likely find that change — especially from within the industry — doesn’t come easy. Truly implementing an “easy banking” strategy is one of the hardest things a financial institution can attempt. For starters, when you make anything easier for someone else, that usually means you are making things more difficult for yourself. It’s a zero-sum equation where you shift the workload off their shoulders by taking on more of the burden yourself. This is a huge mental leap from the philosophical position financial institutions are operating from today: “We make more money when we do less. We want consumers to handle more for themselves, on their own.”

Reality Check: There’s an important difference between “easy” and “easier.” Many banks and credit unions that have ventured down the “easy” path turn back when they realize how many barriers, roadblocks and other SNAFUs are in the way. What they often choose to do instead is cherry-pick a select few items that can be simplified here and there, then sell the world on how they are “making banking easier.” It’s a cop out. Just because you chop some steps out of a couple of processes does not mean it’s easy to bank at your institution.

Financial marketers fantasize about creating simpler solutions while frequently underestimating the energy and effort it takes to achieve this dream. Reducing banking’s complexities consumes a lot of internal energy and resources, and innovating new processes takes time. For example, how long would it take your organization to completely overhaul all its forms? How can forms be shortened? What forms can be eliminated or combined with others? What forms should be online? Five committee meetings and six months later…

And that’s just the beginning. If you want to make banking easy, you have to look at the complete relationship. When viewed in aggregate, how much are you asking people to do — e.g., get a debit card, a credit card, enroll in online banking, mobile banking, sign up for e-statements, etc.? How much time does all that take? How many different employees, forms and touchpoints are involved?

But wait, there’s more:

- Processes – How hard is it to get a loan? Or open an account? Or enroll in online banking? How many steps does it take? Are there unnecessary policies or complex procedures interfering with efficiency? How long does it take? Where are consumers frustrated by bureaucratic baloney? What hoops do you make people jump through?

- Locations – Are your branches easy to find? Or are they in awkward locations, buried far from beaten paths? How accessible are your ATMs? Is it easy to get in and out of your parking lots? Once inside, do people intuitively know where to go and what to do?

- Online – How hard is it for consumers to find what they are looking for on your website? How far do they have to dig? How many clicks does it take? Is your site map counterintuitive? Is the interface confusing? Do you overwhelm visitors with links? Can people open accounts and apply for loans online? Can people ask you questions live online?

- Service Delivery – What could people do online that they can presently only do by making a trip to a branch? How many times is someone handed off before they get the information they need? If someone talks to three different people, will they get three different answers? What’s your automated phone system like?

- Products – Do you make it easy for consumers to compare products? Are your products easy to apply for and use? How much paperwork is involved? Can people easily access current account information via various channels?

- Choices – Do you offer too many? Are the differences clear? How do you make it easier for people to make the right decisions?

- Transparency – Are you upfront about how are your products structured? Are you honest, candid and straightforward? Are you clear about what the costs will be to each consumer? How complex are your disclosures? Do you bury conditions, or cloak them in confusing legalese?

- Image & Identity – What does your brand identity say about you? Does your logo, slogan, colors, etc., convey and reflect a “simple” way of doing business? Do you have multi-page brochures? Do you send new customers away with a folder full of printed materials?

These are merely cursory items on a partial list.

Bottom Line: Simple, easy banking is one of the financial industry’s Holy Grails. Just don’t be naïve about what engineering an “easy banking” experience entails. There is more to making banking easy than just making checking accounts marginally easier. If you really want to simplify banking, you must be prepared to retool everything. That means revamping your entire product lineup, your marketing, staff training, and probably even your core data processing system.