Google accounts for more than 78% of all online searches, and nearly half of all those Google searches — 46% — pertain to local queries. This makes Google a leading source of organic traffic to many local businesses, such as restaurants, retail stores, and yes, banks.

It’s why search engine optimization, or SEO, is a common marketing practice among financial services companies. Optimizing one’s digital presence for organic search is an effective way to attract customers, both online and in person.

But how do the top 20 U.S. banks by assets measure up?

In this study, I set out to determine who is leading the charge on SEO and who is coming up short. The results may surprise you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

What Factors into ‘SEO Value’?

“SEO value” is difficult to define without tying it to quantifiable data. And “traffic” is only one of many indicators of organic reach. So, I decided to look at several metrics that SEO professionals commonly use to measure value.

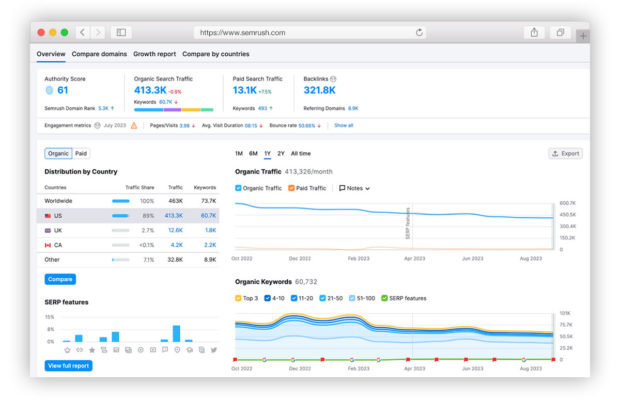

I used the search engine optimization tool Semrush to analyze the domains of the top 20 banks, based on the following metrics:

- Authority Score – Semrush’s proprietary score for measuring a site’s reputability, based on number and quality of backlinks from other sites, organic traffic, overall authenticity, and other factors.

- Organic Search Traffic (monthly) – Total number of organic visitors by month. For the sake of this study, we looked at U.S. traffic only.

- Branded vs. Non-Branded Traffic – The ratio of organic traffic driven to a domain via keywords that are branded (term contains brand or product name) or non-branded (term does not contain brand or product name).

- Organic Keywords – Total number of keywords the domain is ranking for.

- Traffic Cost – The estimated average monthly cost to rank for the current organic keywords using Google Ads.

These metrics provide a well-rounded view of a domain’s organic value, based not only on organic traffic but also on the monetary value of that traffic.

Bear in mind that the recommended ratio of branded to non-branded keywords varies by industry. However, a business having a more equal (i.e. “narrow”) branded to non-branded ratio is often indicative of the brand generating a more equal percentage of traffic from customers who are not yet aware of their brand and/or are encountering the brand through generic keywords (e.g. “credit cards” or “mortgage”). This is often preferred, as it demonstrates that the business’ traffic is not solely dependent on brand awareness or brand visibility.

Asset Size is No Guarantee of Reach and Authority

Overall, I was surprised to see that a bank’s SEO value did not always correspond with its asset size. Some of the megabanks fell low in terms of organic keywords, while some of the comparatively smaller regional banks knocked it out of the park with their site authority. For example:

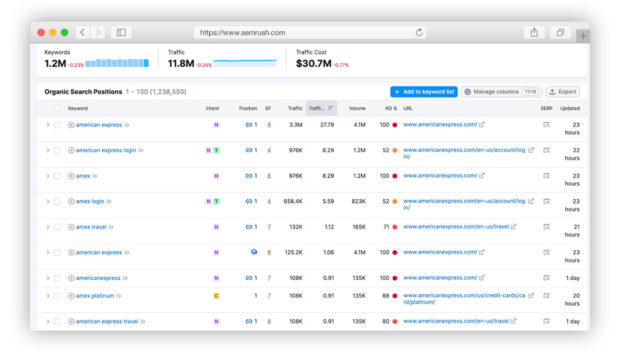

- American Express National Bank (#19 in asset size) scores a hefty 85 on authority, rivalling much larger institutions like JPMorgan Chase and BofA.

- On the “traffic cost” metric, Wells Fargo was the highest — not exactly a bragging point. It suggests that competitors are pursuing its customers heavily, bidding up the cost of Wells Fargo-branded keywords.

Read on for a more detailed analysis of the relative SEO strengths of the websites for the 20 largest U.S. banks., ranked by asset size as of midyear 2023.

Some questions to consider as you review the metrics: How does your bank or credit union size up to these big competitors? And do you see an opportunity to outperform some of them on SEO in your local area?

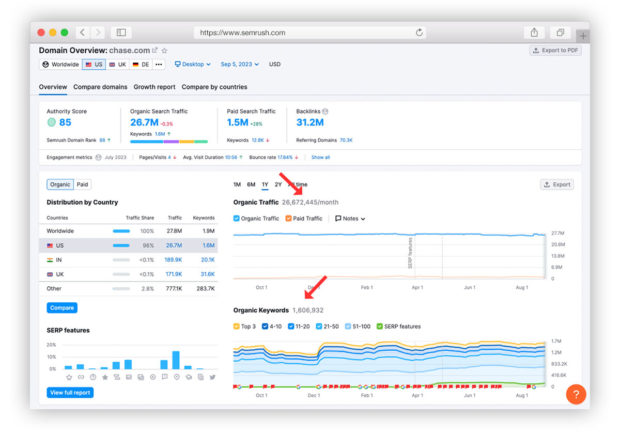

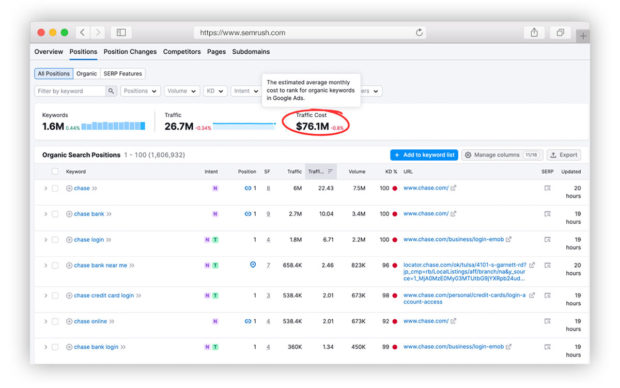

1. JPMorgan Chase

Authority Score for chase.com: 85

Organic Search Traffic (monthly): 26,672,445

Branded vs. Non-Branded Traffic: 93.1% branded; 6.9% non-branded

Organic Keywords: 1,606,932

Traffic Cost: $76.1M

Chase is the largest bank in the country, with $3.4 trillion in assets and 4,883 branches, per Federal Reserve data as of June 30. So I wasn’t surprised to see that chase.com receives well over 26 million organic visitors every month.

What was surprising is that over 93% of their total organic traffic is branded, meaning that users are primarily searching for the bank by name. This means Chase may be missing out on opportunities to drive non-branded traffic on terms such as “best credit card,” “open checking account,” “small business banking,” and others. People searching on these terms could be potential future customers.

JPMorgan’s Jamie Dimon on What It Takes to Be an Effective Leader

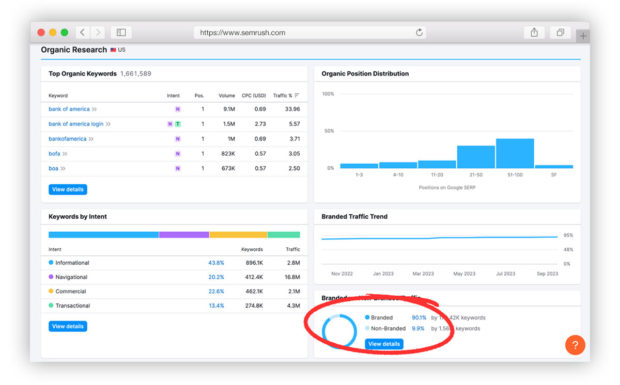

2. Bank of America

Authority Score for bankofamerica.com: 83

Organic Search Traffic (monthly): 23,245,043

Branded vs. Non-Branded Traffic: 90.1% branded; 9.9% non-branded

Organic Keywords: 2,303,676

Traffic Cost: $43.8M

The second-largest bank by assets is Bank of America, but it’s interesting how much lower its domain is in terms of organic traffic. With only around 23 million organic visitors per month, its estimated traffic cost is much lower than that of Chase as well.

Why BofA Is Covering the Country with Branches

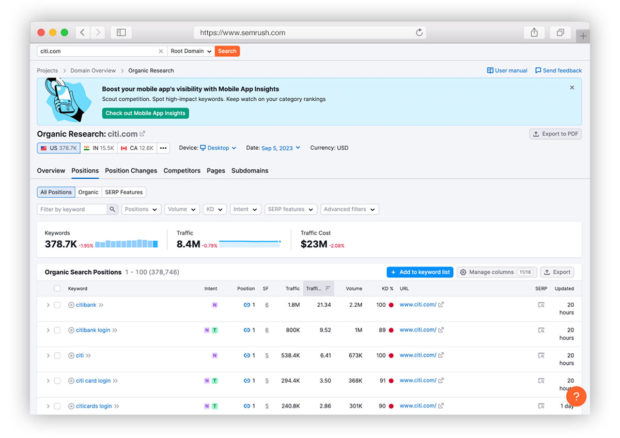

3. Citibank

Authority Score for citi.com: 75

Organic Search Traffic (monthly): 8,965,257

Branded vs. Non-Branded Traffic: 95.2% branded; 4.8% non-branded

Organic Keywords: 518,763

Traffic Cost: $23M

Once we get to Citibank, we see a dramatic decrease in authority score, organic search traffic, and organic keywords. Considering that Citibank has far fewer U.S. branches than its larger rivals (660 branches vs. 3,000+), this seems to correspond with the brand’s retail banking presence. As noted earlier, a large share of Google searches is local.

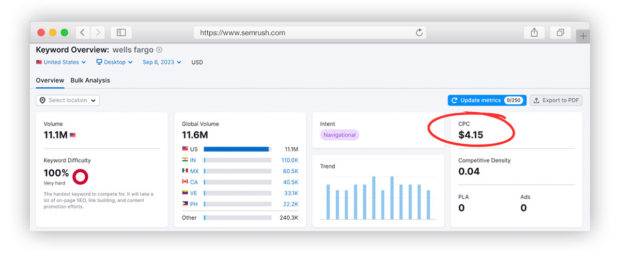

4. Wells Fargo

Authority Score for wellsfargo.com: 82

Organic Search Traffic (monthly): 22,432,714

Branded vs. Non-Branded Traffic: 93.5% branded; 6.5% non-branded

Organic Keywords: 1,923,074

Traffic Cost: $91.1M

Wells Fargo follows close behind Bank of America in terms of organic search traffic and organic keywords, but its traffic cost is through the roof.

This is due in part to the cost per click, or CPC, on Wells Fargo’s branded keywords being significantly higher than that of BofA and Chase (e.g. 80 cents for “chase.com” vs. $4.15 for “wells fargo”). Wells Fargo’s branded keywords are more competitive than those of BofA or Chase because other brands are bidding on them, driving the cost of those keywords higher. It suggests that other brands are targeting Wells Fargo customers. Perhaps they consider the bank vulnerable to poaching, given its tarnished reputation.

Did CFPB Hit Wells Harder in Its Reputation Than Its Wallet?

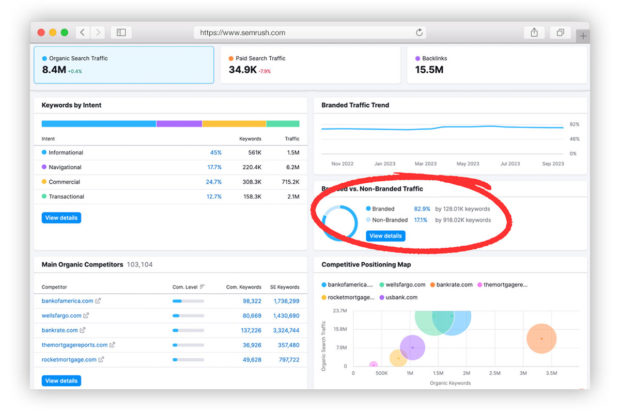

5. U.S. Bank

Authority Score for usbank.com: 74

Organic Search Traffic (monthly): 8,352,936

Branded vs. Non-Branded Traffic: 82.9% branded; 17.1% non-branded

Organic Keywords: 1,230,855

Traffic Cost: $16.5M

U.S. Bank appears to be a close contender with Citibank when it comes to SEO value, with a comparable level of organic search traffic and similar authority score. However, U.S. Bank has a “healthier” split in branded vs. non-branded traffic, with more than 17% of users visiting the website via non-branded keywords.

How U.S. Bank Balances ‘Human Connections’ with Digital Innovation

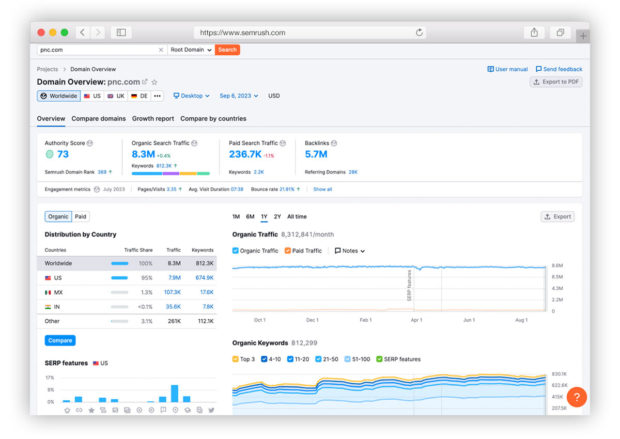

6. PNC Bank

Authority Score for pnc.com: 73

Organic Search Traffic (monthly): 8,312,841

Branded vs. Non-Branded Traffic: 95.5% branded; 4.5% non-branded

Organic Keywords: 812,297

Traffic Cost: $22.8M

PNC is doing well on search engine optimization, comparatively speaking. It is smaller than U.S. Bank by about $100 billion of assets, yet the websites of these two large regional banks have similar SEO authority. PNC.com’s authority score is 73, just slightly below U.S. Bank’s 74. The organic search traffic for the two websites is also similar. But U.S. Bank has about 2.5 times more backlinks than PNC does. Notably, PNC’s traffic cost exceeds U.S. Bank’s by about 38%, too.

Meanwhile, PNC and Truist are nearly neck and neck when it comes to size, with the difference between the two being less than $10 billion of assets. However, PNC is a few extra steps ahead of Truist when it comes to SEO value, ranking for about 200,000 more keywords and earning an authority score of 73 (vs. Truist’s 69).

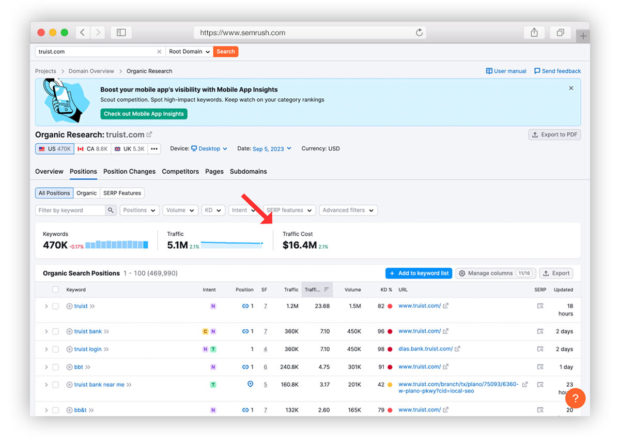

7. Truist

Authority Score for truist,com: 69

Organic Search Traffic (monthly): 5,216,325

Branded vs. Non-Branded Traffic: 98% branded; 2% non-branded

Organic Keywords: 536,577

Traffic Cost: $16.4M

So, what’s behind the dip in Truist’s authority score compared with U.S. Bank and PNC? Its smaller backlinks profile is the likely cause. U.S. Bank has 15.5 million backlinks and PNC has 5.7 million, while Truist has 3.7 million. Truist’s traffic cost is roughly on par with that of U.S. Bank, though it is ranking for far fewer organic keywords.

3 Strategies for Enterprise AI Success That Are Tried and Truist

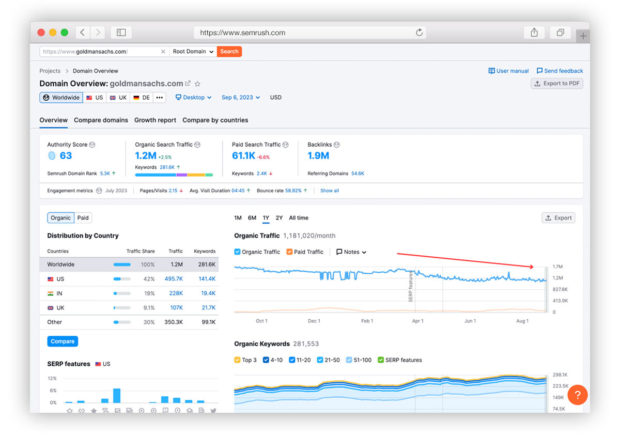

8. Goldman Sachs

Authority Score for goldmansachs.com: 63

Organic Search Traffic (monthly): 1,181,020

Branded vs. Non-Branded Traffic: 86.3% branded; 13.7% non-branded

Organic Keywords: 281,553

Traffic Cost: $521.2K

Goldman Sachs’ authority score, at 63, is still considered to be in the “high” range and it’s ranking for a decent number of organic keywords. However, its organic search traffic appears to be on a downward trend.

This might be a reflection of the fact that the Wall Street giant, which once aspired to become a major Main Street player, is winding down its consumer banking business. In February 2023, Goldman Sachs said it was exploring “strategic alternatives” for its Marcus digital bank, which has lost billions since its launch. It has also been widely reported that Apple is looking to move its credit card and savings accounts elsewhere, ending a high-profile partnership that generated a lot of publicity for Goldman Sachs over the past few years.

Read more:

- Goldman Sachs Finds That Building a Retail Bank Is Tough

- Apple’s Banking Strategy: Memojis, Marketing and Next Moves

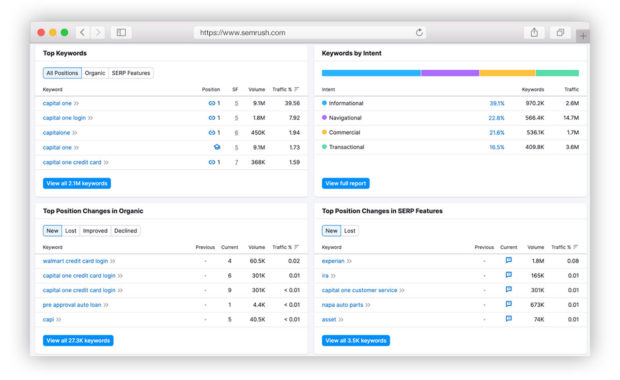

9. Capital One

Authority Score for capitalone.com: 83

Organic Search Traffic (monthly): 19,289,154

Branded vs. Non-Branded Traffic: 88.3% branded; 11.7%

Organic Keywords: 2,502,523

Traffic Cost: $39.2M

Capital One has made a concerted effort to post content that will boost its SEO footprint. The intent is to draw key targets, like people who are doing research ahead of buying a vehicle or applying for a new credit card. For example, it has a lot of articles and tools on its website geared to shoppers trying to figure out things like what type of vehicle they want and how much they want to spend.

This may be why Capital One’s authority score is on par with the likes of Bank of America, one of the largest banks in the country, and higher than competitors that, based on asset size, are in positions three through eight on this list. It’s clear from the data that Capital One has a strong domain, with a high volume of organic search traffic and a slew of ranking organic keywords.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

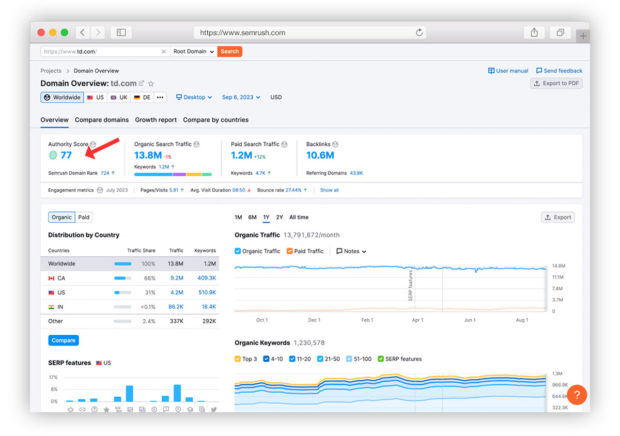

10. TD Bank

Authority Score for td.com: 77

Organic Search Traffic (monthly): 13,791,672

Branded vs. Non-Branded Traffic: 88% branded; 12% non-branded

Organic Keywords: 1,230,578

Traffic Cost: $22.4M

For its asset size, TD Bank has a relatively high authority score and a solid amount of organic search traffic. In fact, it’s outdoing the significantly larger Citibank and U.S. Bank in SEO authority. It’s also ranking for just as many keywords as U.S. Bank. While TD Bank may not have the same level of brand recognition as some of the others, it’s in step when it comes to SEO value.

Below I’ve included the SEO metrics and Semrush reports for banks No. 11 through No. 20, excluding additional commentary.

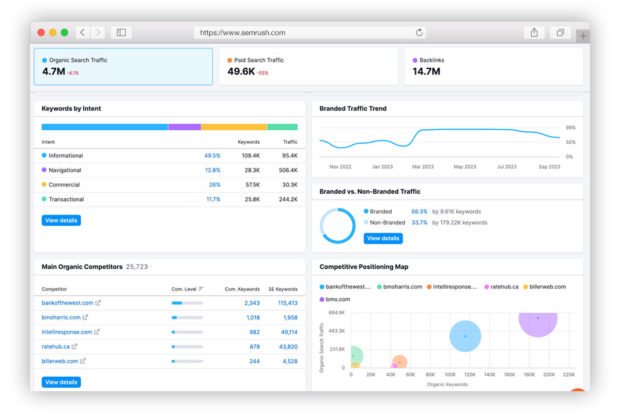

11. BMO

Authority Score for bmo.com: 69

Organic Search Traffic (monthly): 4,663,513

Branded vs. Non-Branded Traffic: 66.3% branded; 33.7% non-branded

Organic Keywords: 561,486

Traffic Cost: $1.3M

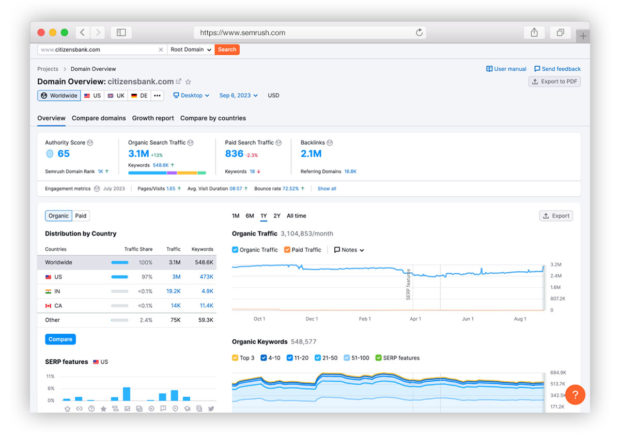

12. Citizens Bank

Authority Score for citizensbank.com: 65

Organic Search Traffic (monthly): 3,104,853

Branded vs. Non-Branded Traffic: 88.4% branded; 11.6% non-branded

Organic Keywords: 548,577

Traffic Cost: $7.7M

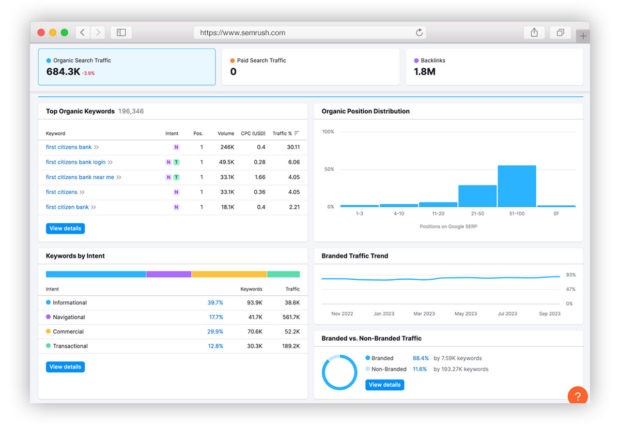

13. First Citizens Bank

Authority Score for firstcitizens.com: 54

Organic Search Traffic (monthly): 684,294

Branded vs. Non-Branded Traffic: 88.4% branded; 11.6% non-branded

Organic Keywords: 225,735

Traffic Cost: $1.1M

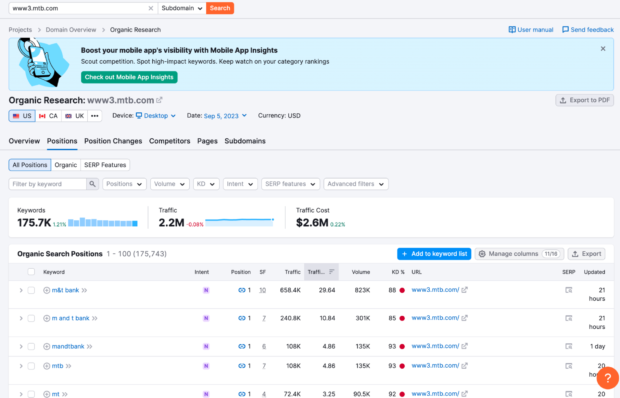

14. M&T Bank

Authority Score for www3.mtb.com: 64

Organic Search Traffic (monthly): 2,284,218

Branded vs. Non-Branded Traffic: 97.5% branded; 2.5% non-branded

Organic Keywords: 206,883

Traffic Cost: $2.6M

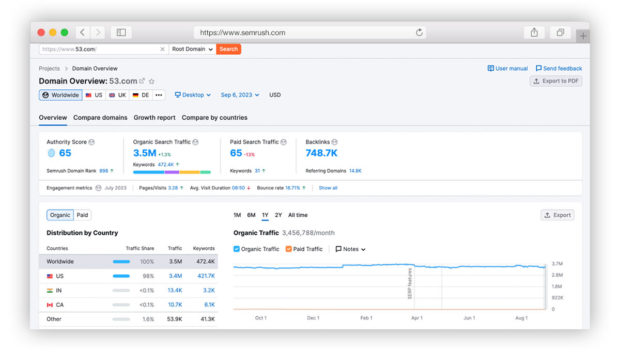

15. Fifth Third Bank

Authority Score for 53.com: 65

Organic Search Traffic (monthly): 3,456,788

Branded vs. Non-Branded Traffic: 95.5% branded; 4.5% non-branded

Organic Keywords: 472,374

Traffic Cost: $4.1M

Dentists & Vets Provide ‘Recession-Proof’ Loan Growth for Fifth Third

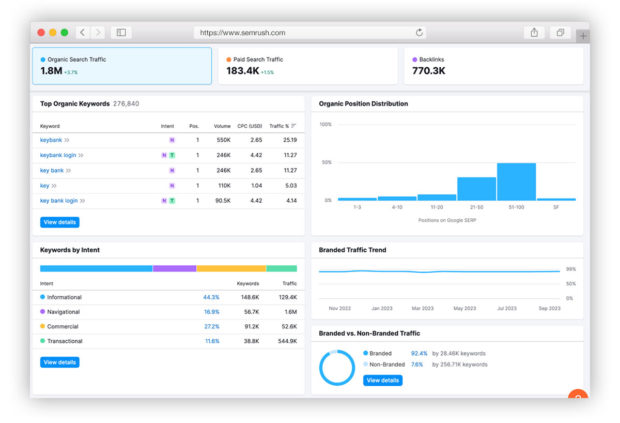

16. KeyBank

Authority Score for key.com: 62

Organic Search Traffic (monthly): 1,788,002

Branded vs. Non-Branded Traffic: 92.4% branded; 7.6% non-branded

Organic Keywords: 331,049

Traffic Cost: $4.6M

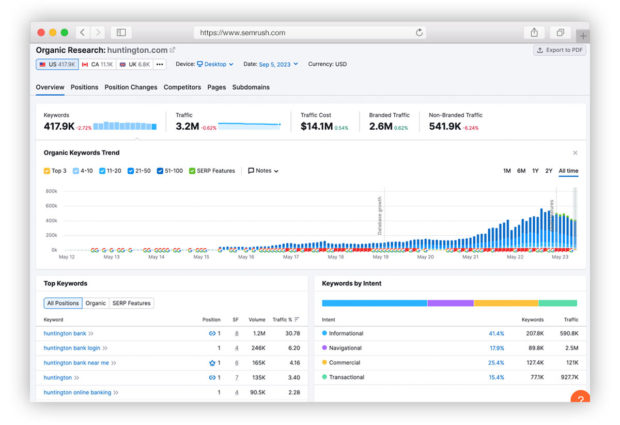

17. Huntington National Bank

Authority Score for huntington.com: 65

Organic Search Traffic (monthly): 3,361,972

Branded vs. Non-Branded Traffic: 82.9% branded; 17.1% non-branded

Organic Keywords: 493,436

Traffic Cost: $14.1M

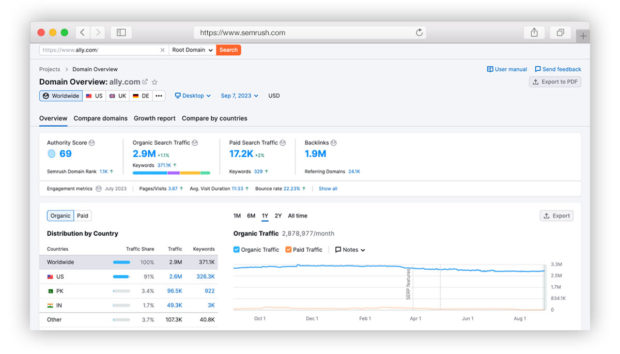

18. Ally Bank

Authority Score of ally.com: 69

Organic Search Traffic (monthly): 2,878,977

Branded vs. Non-Branded Traffic: 94.8% branded; 5.2% non-branded

Organic Keywords: 371,095

Traffic Cost: $5M

19. American Express National Bank

Authority Score for amex.com: 85

Organic Search Traffic (monthly): 20,105,140

Branded vs. Non-Branded Traffic: 94.9% branded; 5.1% non-branded

Organic Keywords: 2,759,342

Traffic Cost: $30.7M

20. HSBC Bank USA

Authority Score for us.hsbc.com: 61

Organic Search Traffic (monthly): 462,952

Branded vs. Non-Branded Traffic: 97.3% branded; 2.7% non-branded

Organic Keywords: 73,685

Traffic Cost: $2.4M

SEO Best Practices, Common Mistakes and Easy Wins

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Takeaways from Our Study of SEO Value in Banking

Search engine optimization is all about making businesses more accessible and available to users. It helps local businesses get discovered and websites generate organic traffic. This study made clear that even the largest of banks could learn a thing or two about SEO in order to increase their authority, visibility and traffic.

Based on my analysis of the SEO value of the top 20 U.S. banks, I came away with the following findings:

- The “household name” banks (i.e. Wells Fargo, Bank of America, etc.) had the largest disparity between branded vs. non-branded traffic, indicating that brand awareness plays a significant role in organic traffic.

- A brand’s total traffic cost is greatly influenced by the cost per click on its ranking keywords, less so by the total traffic value.

- Authority score appears to be strongly correlated with a bank’s asset size, even though the factors that are driving the score vary from bank to bank.

- The asset size of a bank is not the best indicator of its overall SEO value. Many factors play a role in a bank’s digital footprint.

- Even the biggest, most well-known banks are missing opportunities to rank for high-volume, non-branded keywords.

- A bank can rank for a lower number of keywords but still generate a high amount of traffic if the search volume (number of monthly searches) on those keywords is high.

Large and small banks alike can benefit from search engine optimization — whether that means optimizing for non-branded keywords, earning backlinks or creating user-focused content.

About the author:

Jason Hennessey is an SEO consultant and the author of “Honest SEO.” For more on this topic, see his website, Hennessey.com.