1. Email Is The Most Effective Digital Marketing Channel Out There

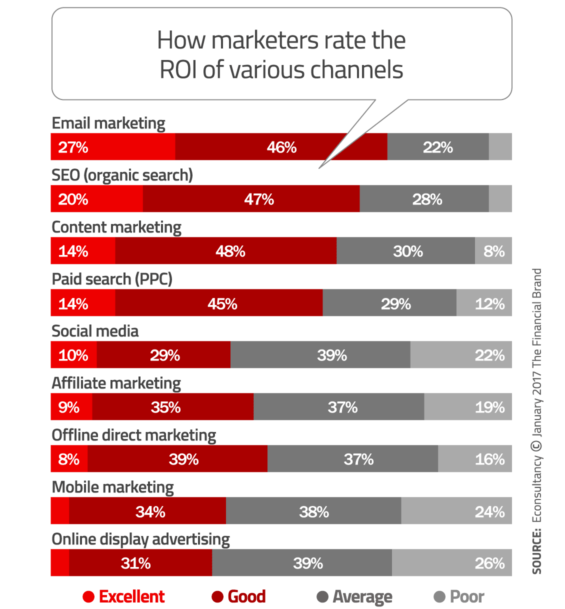

It’s hard to believe that some financial institutions still refuse to use email as a marketing channel. There are some that tell consumers that “they will never send an email, so if you see anything purportedly from our institution you can be sure it’s spam.” This is the marketing equivalent of thinking the world is flat and that you can sail off the edge. The reality is that email performs very well. In research conducted by Econsultancy, almost three-quarters (73%) of companies rate email marketing as ‘excellent’ or ‘good’ when it comes to ROI. In fact, US marketing executives believe email alone drives the same amount of revenue as their social media, website, and display ad efforts combined, according to The Relevancy Group.

While new marketing memes may be drawing all the attention these days — from retargeting and personalization to data analytics and automation platforms — don’t forget about trusty old email. It may be one of the oldest digital marketing methods around, but it still works… and works better than many of the methods-du-jour. While it’s not “email vs. other channels,” when it comes to budgets, most financial brands underfund this top performer.

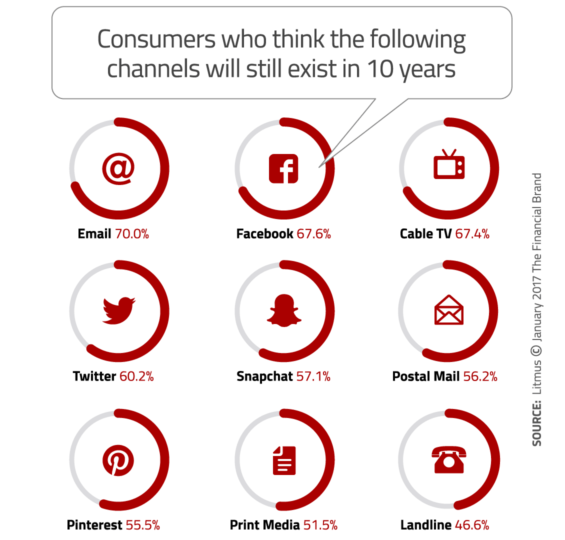

2. Email Is the Most Future-Proof Channel

Consumers believe email is more likely to be around in 10 years than cable TV, Twitter and Pinterest. And support for email is particularly strong among two key demographics. First, older Millennials, a group thought to be hostile toward email, are the most optimistic about email’s longevity; 72.1% believe it will still be around ten years from now — more so than any other demographic group. And second, consumers with above average household incomes are also bullish on email. Such optimism among younger, well-off consumers is a sign that email marketing will be strong in 2020 and beyond.

3. Net Clicks Might Be More Important Than Click-Through Rate

Do lower open and click rates mean you should pull back on frequency? Not necessarily. During heavy volume time frames, the higher cadence of emails typically produces fewer opens and clicks per message sent but more opens and clicks in total. Think of it like this: Suppose you double your frequency, but see open or click rates going down by 15 to 20 percent from one message to the next. But that’s no reason to panic because during the entire sending period you should have a marked increase in total opens and clicks. Similarly, you can also expect to see hard bounces, spam complaints and unsubscribe rates decline when you raise frequency.

| Click-Through Rates by Industry/Sector |

Unique CTR |

Median | Top Quartile |

Bottom Quartile |

|---|---|---|---|---|

| Banks and financial services |

3.2% | 1.4% | 9.4% | 0.1% |

| Insurance | 3.6% | 1.4% | 10.9% | 0.1% |

| Auto industry | 3.7% | 1.9% | 10.4% | 0.1% |

| Consumer products | 3.4% | 1.8% | 9.2% | 0.6% |

| Food, sports and entertainment |

3.6% | 1.3% | 11.0% | 0.3% |

| Healthcare | 3.5% | 1.6% | 10.2% | 0.2% |

| Travel | 2.4% | 1.3% | 6.4% | 0.4% |

| Media and publishing | 2.7% | 2.7% | 7.3% | 0.3% |

| Retail/eCommerce | 3.5% | 2.0% | 9.2% | 0.5% |

| Schools/education | 4.3% | 1.8% | 13.1% | 0.2% |

| Marketing agencies and services |

2.4% | 1.0% | 7.4% | 0.2% |

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

4. Engagement Rates Really Matter

Financial marketers will need to start monitoring — and increasing — the engagement of individual subscribers in addition to the overall engagement of their list. According to Return Path, all mailbox providers will eventually incorporate individual level engagement when deciding what’s spam and what’s not. Some mailbox providers are already incorporating individual engagement into their filtering decisions with great success. Going forward, Return Path says both the number of mailbox providers using individual level engagement and the weight they place on it will increase. To help boost their engagement, financial marketers need to use email and consumer data across various sources to personalize every aspect of their email campaigns, including send time, campaign cadence, and email content.

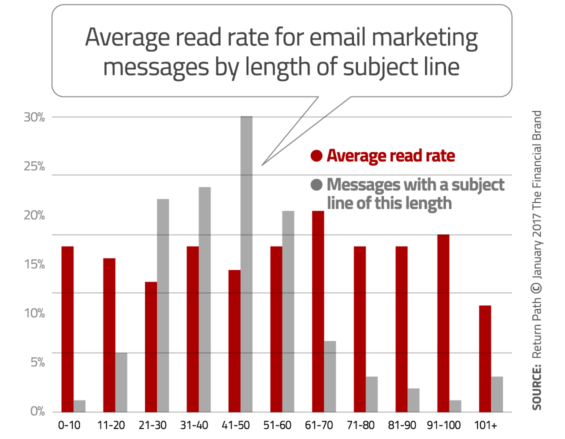

5. Longer Subject Lines Outperform Short Ones

According to research from Return Path, 65 characters seems to be a sweet spot for email subject lines, which is about 15 characters more than the average subject line. When subject lines are 61-70 characters long, they tend to get read. However, most email subject lines are between 41 and 50 characters.

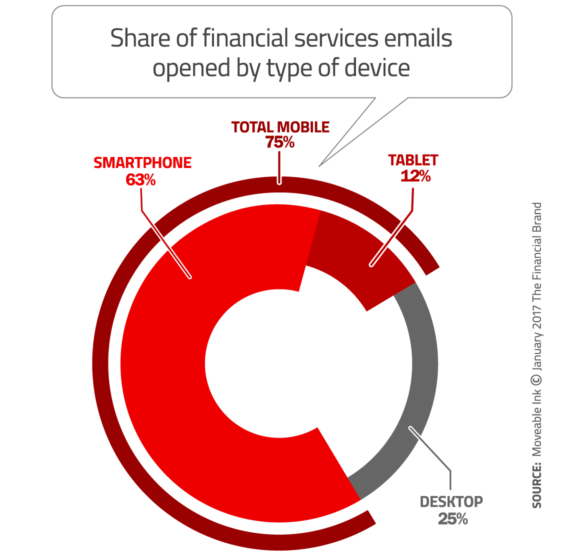

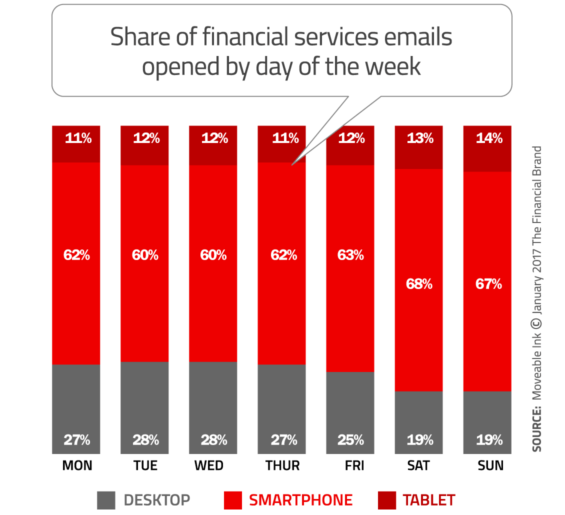

Different devices have different display capabilities, so it’s important to keep this in mind as you write your subject lines. A typical desktop inbox displays about 60 characters of an email’s subject line, while mobile devices show just 25-30 characters. If your audience is primarily reading your emails on smartphones, place the offer or call to action at the beginning of the subject line where it’s more likely to be seen.

6. Email List Hygiene is Critical

Many marketers will throw any email address they come across into their database without ever removing anyone from the list — they believe that “more” is “better.” Plenty of financial institutions make this mistake.

Higher-than-average hard-bounce rates can indicate you don’t practice good, ongoing list hygiene. You need to regularly prune your email list to keep it healthy. So make sure you remove email addresses from your list if they generate hard bounces.

Also consider sending your “deadwood” a reengagement email. Start by segmenting your list into two basic groups: those who have opened or clicked an email recently, and those who haven’t. Send an email to those who haven’t engaged with any of your recent campaigns a simple message asking if they would like to continue receiving emails from you. Some will opt-out on their own, or you can remove those who don’t respond.

There are good reasons to weed deadwood from your database. First, you should ask yourself, “Why send emails to people who don’t seem want them?” Some people are too busy, too lazy or too polite to unsubscribe, so do them a favor and do it for them. After all, you’re paying to send them your campaigns, so why maintain a list that’s larger than necessary? And most importantly, you need to think about email delivery — low-engagement emails and high hard bounce rates mean fewer of your campaigns will ultimately land in people’s inboxes.

Ultimately, having an unclean list — one that’s full of spam traps, unknown users, and unengaged subscribers — is viewed by mailbox providers as characteristic of spammers, and messages from such senders will likely be flagged as spam.

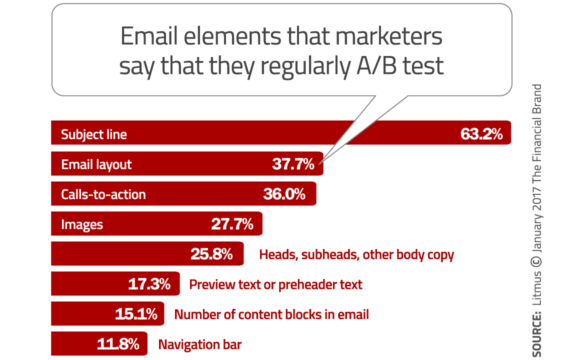

7. A/B Testing

Whether doing 50/50 splits, 10/10/80 splits, or multivariate, A/B testing is an important part of not only optimizing your emails, but listening to and understanding your subscribers. While subscribers’ responses to two different headlines, images, or calls-to-action are often the same, sometimes they’re very different — and finding those big differences makes A/B testing worthwhile.

Thanks to improvements at email service providers, A/B testing is much easier than it’s been in the past. However, research from Litmus reveals that only subject lines are being tested by the majority of marketers. That means there are still big opportunities for financial brands to increase clicks and conversions through testing.

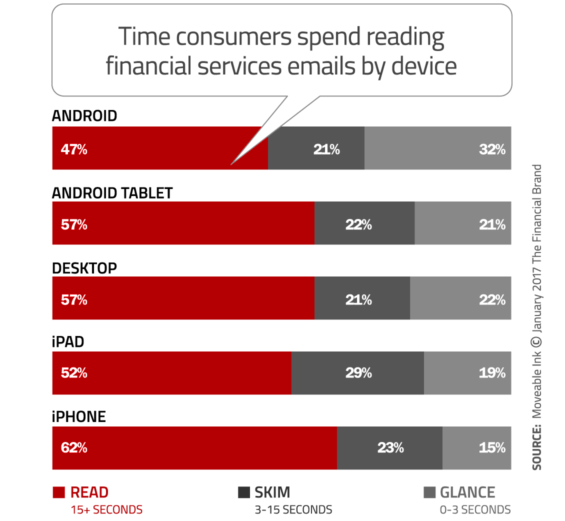

8. More Emails Are Opened on Smartphone Devices Than Desktop Computers

Financial marketers need to make sure their email content is mobile-friendly. The industry has one of the highest mobile open rates of those analyzed by Moveable Ink, second only to retail apparel. And busy on-the-go consumers still check their inboxes on the weekend.

9. All Unauthenticated Emails Will Be Blocked

According to Return Path, the future will see only legitimate emails making it to consumers’ inboxes. Financial institutions that have not implemented the strongest level of email authentication will see their legitimate email programs affected by this change — brand awareness and ROI will be negatively impacted. If you don’t know what things like DKIM, SPF records and DMARC are, you need to become familiar with them… fast.

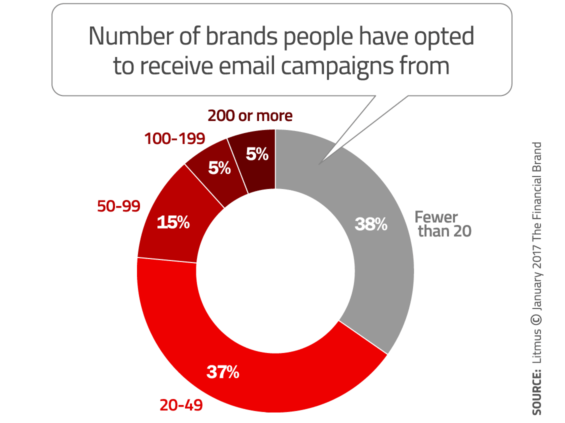

10. Remember You Are Not the Center of The Universe

Americans most commonly check their email while watching TV (70%), from bed (52%), on vacation (50%), while on the phone (43%), from the bathroom (42%) and even while driving (18%), according to Adobe. As much as we might like to think of subscribers dedicating their full attention to our carefully crafted emails, this research reinforces the fact that they are often dedicating much less than their full attention.

Unfortunately, many marketers often think their emails are of critical importance and relevancy to everyone on their list. But according to Litmus, the majority of folks (51.9%) are subscribed to more than 20 different companies’ email distribution lists. One in six receive emails from over 50 senders. Think about this: If each sender sent an average of three emails a month, that means that most people would see anywhere between 60 and 300 different campaigns in a 30-day period. That’s a lot of email — plenty of it will be disregarded as spam.