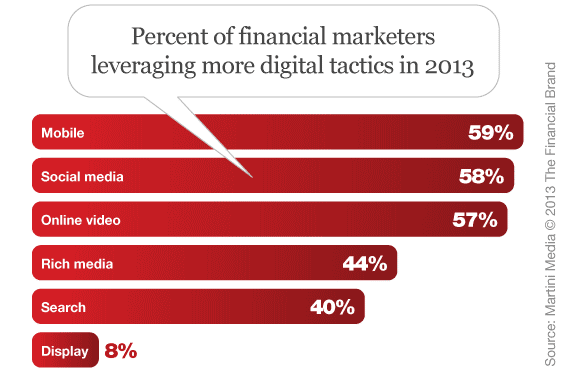

40% of financial marketers’ budgets will be allocated to digital in 2013. But which digital channels will see the biggest gains? Here’s the breakdown.

According to research by Martini Media, the majority of financial brands plan to increase marketing investments in one or more of the digital marketing channels they currently employ.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

( Read More: The 5 Biggest Digital Marketing Mistakes Banks Make )

When asked about budget decreases, regular online display ads showed the largest decline. In fact, only 8% of financial marketers say they will increase their budget for standard online advertising, while a quarter plan to decrease spending. Martini Media says this reflects a wider shift in digital spending towards richer, more engaging digital media formats.

“The results of our research clearly show that financial brands understand how their customers consume media,” asserts Martini Media President and CRO Tom O’Regan.

Perhaps. But some of the numbers in the study might suggest otherwise. For instance, 59% of financial marketers say they intend to increase spending in the mobile channel this year.

Key Question: How, precisely, do they plan to do that?

Enthusiasm in the financial industry for mobile solutions is high — both from marketers and consumers alike. That much is clear. Less clear, however, is how financial marketers can leverage the mobile channel. With its cramped screen size and limited marketing opportunities, banks and credit unions could find themselves struggling to exploit mobile in significant ways. In other words, they may plan to spend more, but where are they going to spend it? Who is supposedly going to get this (bigger) pile of dough?

The same could be said about “rich media.” Do financial marketers really understand what “rich media” entails? There are probably many who equate rich media with YouTube videos.

Reality Check: Survey options like “mobile marketing” and “rich media” may sound very important to participants, so perhaps financial marketers are just checking those boxes despite having a fuzzy understanding of what’s involved.

( Read More: 2013 State of Bank & Credit Union Marketing )

Martini Media says financial marketers are pivoting to digital because they are seeing diminishing returns and poor audience engagement in traditional advertising channels. 77% of participants believe high impact ads can breakthrough as much as TV/Print ads. 67% say digital is more efficient, believing that it costs less to reach targeted consumers online than off.

These numbers align with results research conducted earlier this year by The Financial Brand, where 72% said that online/digital channels would be “more important” in 2013 than in 2012. Conversely, The Financial Brand’s study revealed that 47% of bank and credit union marketers felt print advertising would be “less important” this year, and 28% felt the same way towards TV/radio advertising.

Financial marketers also think digital represents a smarter, more effective way for financial brands to reach their ideal customers. 91% of those surveyed believe they can hit their target audience via data and targeting, and 87% agree it’s worth paying premium CPMs on some specific sites to ensure they reach their target audience. The brands also overwhelmingly (88%) feel they can reach these consumers by aggregating niche sites that speak to their target audience.

58% of financial institutions believe video is vital to marketing financial services online. Not surprisingly then, 53% will be experimenting with some form of video advertising and an additional 32% will be shifting TV dollars to online video.

According to the study, 91% currently leverage some form of content in their digital ads. 68% exclusively use their own original content and 23% also integrate third party content.

Martini Media’s survey was conducted with Grammercy Institute in March 2013. Martini Media will present the findings as well as discuss financial marketers’ expectations from the digital channel around the country this Spring.