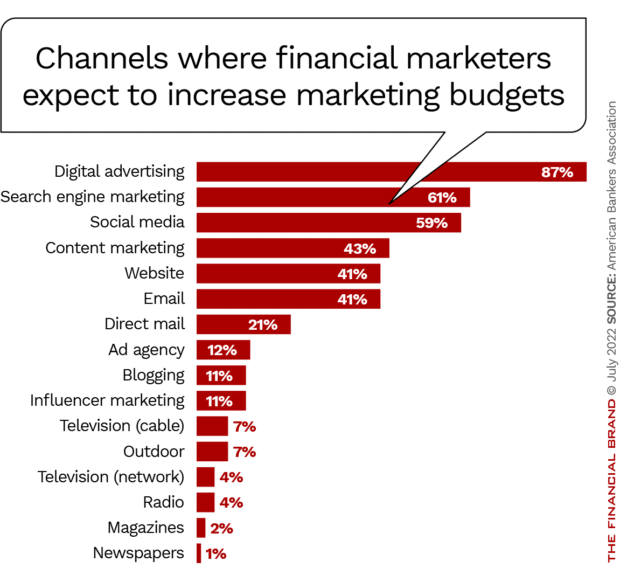

The profusion of marketing channels and advertising vehicles financial marketers must consider these days is overwhelming. It ranges from Google searches, email, SMS, push notifications and mobile ads, to multiple social media platforms including Instagram, Facebook, LinkedIn, YouTube and TikTok.

Add to that the complex array of marketing technology platforms and tools and bank and credit union marketers need all the help they can get.

The Financial Brand assembled this essential collection of key digital marketing statistics and trends for bank marketers to use in their internal presentations and when building their strategic marketing campaigns.

Digital Marketing Strategy

Worldwide digital advertising spending amounted to $521.02 billion in 2021. That number is projected to reach $876 billion by 2026, an increase of 68%.1

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

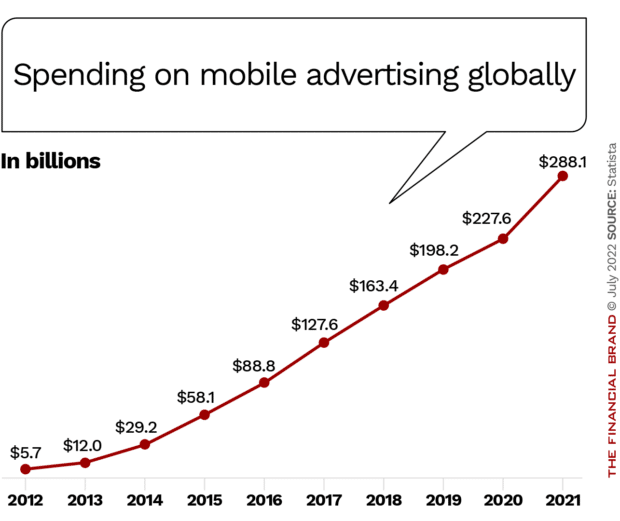

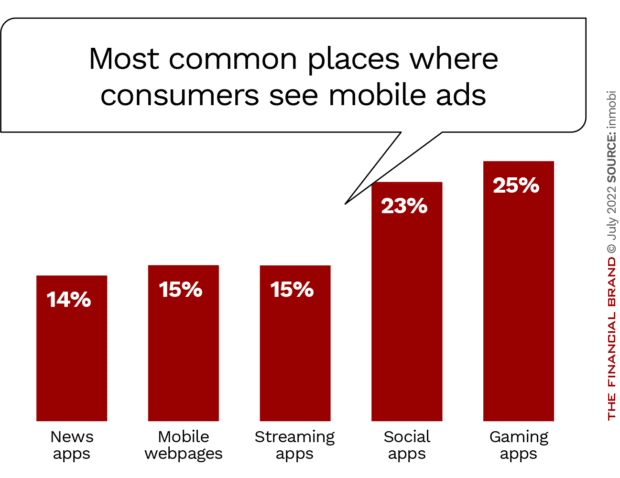

Mobile Advertising Trends

Five industries — including financial services — say they plan to allocate more than seven out of ten digital ad dollars to mobile.2

One out of five people (21%) said they enjoy seeing ads in mobile apps.3

Three out of five mobile users (59%) say they are as comfortable with mobile advertising as they are with other marketing channels, such as TV.4

Shorter mobile ad videos are just as good as longer videos.4

55% agree or strongly agree with the following statement: “I prefer that mobile apps have ads, rather than having to pay to download apps.”3

Nearly three-quarters (74%) of iOS device users would rather opt in to targeted ads than pay for features or content that is currently free.3

Google Marketing & Advertising Trends

Search engines drive nearly all (93%) of website traffic.5

96% of brands say they spend money on Google ads.6

The average click-through rate (CTR) for ads is 0.50% and 3.58% for search ads in the financial sector — one of the lowest across all industries.7

The banking industry pays the highest cost-per-click (CPC). On average, financial institutions pay $0.81 per click for a display network ad and $3.56 per click for search ads.7

70% to 80% of users say they ignore sponsored search results and paid ads.8

More than three out of five people (63%) have clicked on a Google ad.9

Google drives 95% of all paid search ad clicks on mobile.10

According to Google, its ads deliver an 8:1 return on investment.11

Financial Marketing In The Metaverse

By 2026, a quarter of all people are predicted to spend at least one hour a day in the metaverse for work, shopping, education, social and/or entertainment.12

The metaverse represents a $1 trillion market opportunity.13

In 2021, people spent $501 million on metaverse “real estate.”14

The average price of virtual land doubled from $6,000 to $12,000 over six months in 2021.13

Decentraland, a primary metaverse environment where JPMorgan sets up shop, has a monthly active user base of about 300,000 people and 18,000 daily users.15

“While a seamless metaverse experience may be years away, financial institutions can’t ignore the massive resources being spent by tech giants on immersive technology and experiences.”

Most financial institutions are not likely to jump into the metaverse until 2027.16

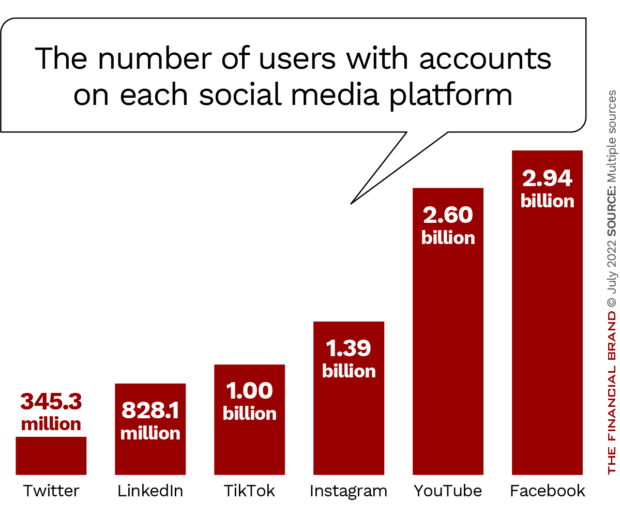

Social Media Marketing Trends

There are 3.96 billion total social media users across all platforms as of January 2022, which is roughly half the world’s population.17

More than four out of five (81%) financial marketers say they’ve picked up new leads through social media marketing.18

Social media will account for a third of all digital advertising spending in 2022.18

Ad spending on social media is projected to reach over $173 billion in 2022.18

Social media video ad spending will grow by 20.1% to $24.35 billion in 2022.18

Brand advertisers expect to spend over $50 billion on Facebook ads in 2022.2

The cost to run an ad on Facebook jumped by 24% year-over-year in 2021.19

LinkedIn ad revenue surpassed $1 billion in 2021, growing by 37%, while organic engagement grew by a record 22%.17

Almost four out of five content marketers say LinkedIn ads produced the best results over all other social media platforms.20

Promoted tweets cost $0.50 to $2 per action (a retweet, follow or like) and promoted accounts cost $2 to $4 per follow.10

Over 40% of Gen Z spends more than three hours a day on TikTok.2

“TikTok may not be where your older customers are today, but it’s definitely where next generation customers are hanging out, and ads there are insanely cheap.”

An ad on TikTok starts at $10/CPM (cost per 1,000 views). The minimum campaign ad spend is also $500.22

Email Marketing Trends

Over a third of marketers (35%) send customers three to five emails per week.9

Nearly a third of businesses use Mailchimp to send marketing emails.9

Over half of emails are now opened on mobile devices.23

More than a third of emails are opened on iPhones.24

Email marketing performance in banking compared to other industries

| Rates | ||||

|---|---|---|---|---|

| Industry | Open | Click-through | Click-to-open | Unsubscribe |

| Financial services | 27.1% | 2.4% | 10.1% | 0.2% |

| Media/Entertainment | 23.9% | 2.9% | 12.4% | 0.1% |

| Real estate | 21.7% | 3.6% | 17.2% | 0.2% |

| Retail | 17.1% | 0.7% | 5.8% | 0.1% |

| IT/Tech | 22.7% | 2.0% | 9.8% | 0.2% |

| Restaurant/Food | 18.5% | 2.0% | 10.5% | 0.1% |

| Travel/Hospitality | 20.2% | 1.4% | 8.7% | 0.2% |

| Average totals* | 21.5% | 2.3% | 10.5% | 0.1% |

* Averages represent 18 industries, not all shown above

Source: Campaign Group

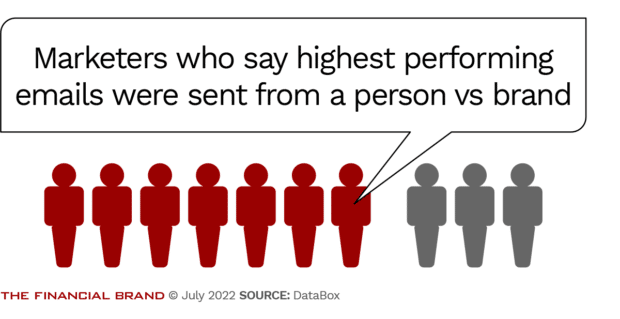

Tuesdays, Wednesdays and Thursdays are the best days for email marketing campaigns.26

Streaming Media Trends: Video, Webinars & Podcasts

Almost nine out of ten video marketers (87%) say video has increased traffic to their website.27

94% of marketers say video has helped them increase customer understanding of products or services.27

37% of companies exclusively create video content in-house, 14% rely on an agency, and half share a mix of both in-house and agency-created video content.9

Of marketers who use videos to market their products and services, roughly three-fourths (74%) create explainer videos.27

18% of people prefer video ads while the same share prefer banner ads. But when asked about which ads they notice, one out of three (36%) said they notice videos while only a quarter notice banners.3

Over half of marketers (53%) planned to use webinars in their video strategy in 2021.9

20% to 40% of webinar attendees become marketing leads.28

60-minute webinars attract more viewers than 30-minute ones.29

Connected TV ad spending grew 57% in 2021 to $15.2 billion and will grow another 39% in 2022 to $21.2 billion.30

Financial Marketing Trends

Four in five consumers want ads customized to their location.31

Over a quarter (27)% of American internet users now use ad blockers.32

The average American’s online data is shared with advertisers and ad tech companies 747 times every day, double the EU figure of 376 times per day.33

96% of U.S. consumers still say more should be done to protect their privacy.2

Three quarters of financial services marketers are concerned that new data privacy shifts will make marketing efforts less effective.2

Sources: 1 Statista, 2 eMarketer, 3 inmobi, 4 Digital Examiner, 5 Omnicore Agency, 6 State of PPC, 7 Instapage, 8 SearchEngineLand, 9 Hubspot, 10 WebFX, 11 Google, 12 Gartner, 13 JPMorgan, 14 CNBC, 15 Yahoo Finance, 16 Accenture, 17 SproutSocial, 18 Hootsuite, 19 Meta, 20 Content Marketing Institute, 22 Influencer Marketing Hub, 23 Litmus, 24 Smart Insights, 25 Smart Insights, 26Local IQ, 27WyzOwl, 28OptinMonster, 29WorkCast, 30Interactive Advertising Bureau, 31Social Media Today, 32Social Media Today, 33 Irish Council for Civil Liberties,