The mission of building one-to-one communication and engagement is not a new concept. Back in 1993, Don Peppers and Martha Rogers, Ph.D., proposed that organizations could use technology to gather information about, and to communicate directly with, individuals to form a personal bond. The book, The One to One Future: Building Relationships One Customer at a Time, stated that technology had made it possible and affordable to track individual consumers, to understand each person’s individual journey, and to provide contextual offers at the optimal time of need.

Six years later, internationally recognized best-selling author Seth Godin published Permission Marketing. He built a logical case for creating incentives for consumers to accept advertising voluntarily. He showed how reaching out only to those individuals who have signaled an interest in learning more about a product would enable companies to develop long-term relationships, create trust, build brand awareness — and greatly improve the chances of making a sale.

In other words, both books, from over 20 years ago, illustrated the logic of moving beyond mass marketing communication, using data, analytics and advanced marketing technology to build trusting relationships with a foundation of timely engagement and offers.

Just like two decades ago, the objective of effective marketing in banking (and any industry) is to improve the customer experience by using real-time insight to understand and improve every interaction a consumer has with an organization. Going beyond individual transactions – viewing the entire customer journey in context – allows organizations to understand the cumulative impact of customer engagement over time.

Read More:

- 15 Applications for AI and Machine Learning in Financial Marketing

- Artificial Intelligence: The Financial Marketer’s Secret Weapon

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Data Analytics Performance Gap

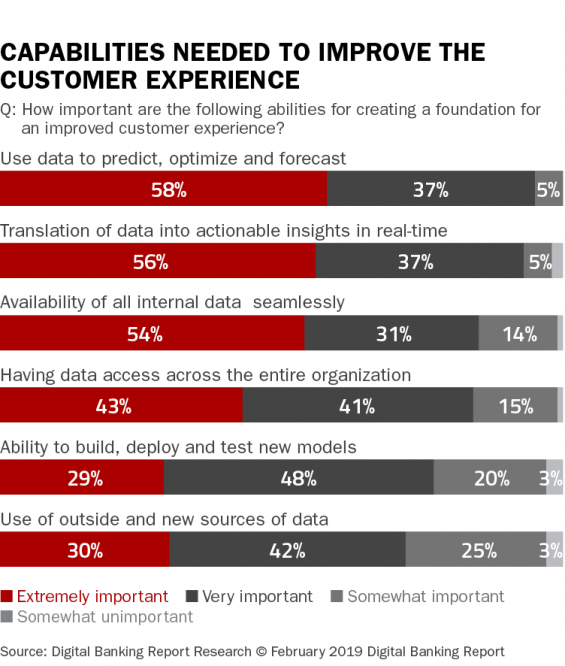

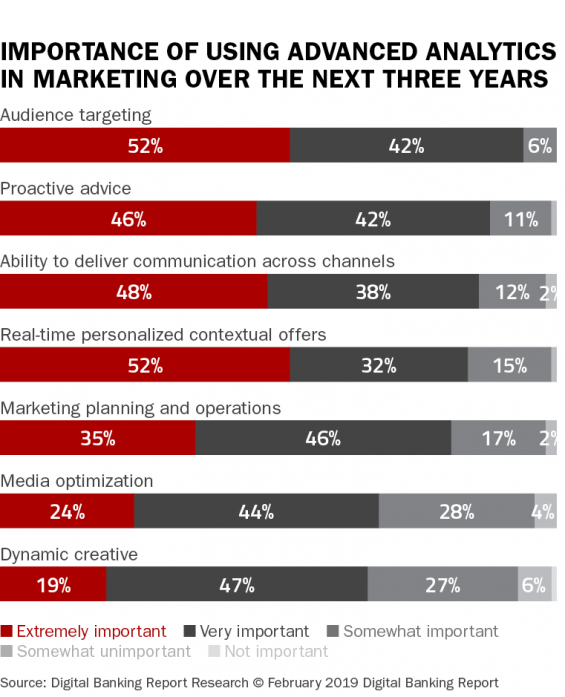

Research by the Digital Banking Report Intelligence Unit found that there is a significant “performance gap” when we view the stated importance of using advanced analytics and the actual use of AI in financial marketing. In fact, the level of stated importance of using AI for targeting, proactive advice, delivery of communication across channels, delivery of contextual offers, and for marketing planning were all either extremely or very important for more than 80% of the organizations we surveyed.

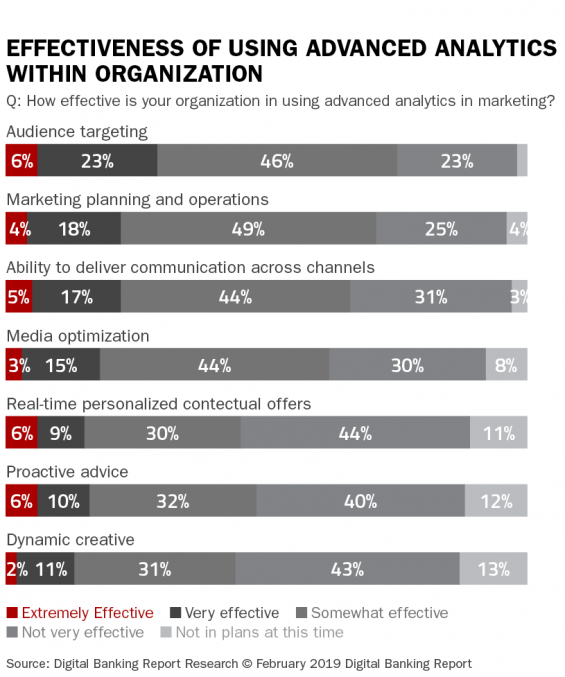

Unfortunately, the effectiveness of using AI in financial marketing did not reflect the level of importance stated. Overall, virtually no organizations believed their application of advance analytics was extremely effective. The vast majority of organizations believed their application across all of the desired uses was either “somewhat effective” or “not very effective.”

This is definitely a red flag at a time when consumers are expecting more.

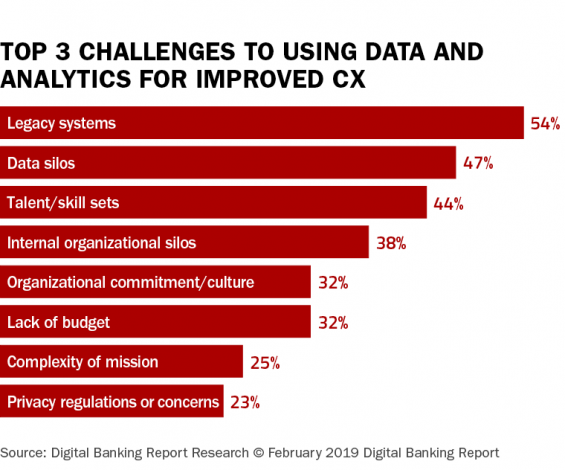

Despite the potential for AI and machine learning, there are a number of obstacles to successful utilization of these advanced technologies in marketing. Beyond budgets, data integration, analytics and other internal issues, probably the most significant obstacle over the next five years will be in skills required.

The skills needed for successful use of AI and machine learning are in high demand and short supply … especially in the banking industry. From skills related to AI, to advanced marketing and data privacy, financial services organizations will be challenged to find skilled people internally and will be forced to enlist the support of partner organizations that are built around advanced technologies.

The beauty of this concept, compared to 20 years ago, is that the capabilities to deliver this level of engagement is not just for the largest organizations any more. In fact, access to highly detailed consumer data, and advanced decisioning engines that can deliver actionable insights “at scale,” is both available and affordable to financial institutions of any size.

Making this insight significantly more powerful than two decades ago is the pervasive use of connected mobile devices, which allows for the immediate collection of data and delivery of contextual communication in an instant. Now more than ever, we can respond to consumers’ “moments of truth” with highly personalized messages that change the marketing function by taking advantage of the widest array of channels and devices.

Leveraging ‘Moments of Truth’

The concept of delivering contextual communication as a consumer’s “moment of truth” can be a win for the consumer and the financial institution. Instead of being product-focused, leveraging mass or broadly segmented communication, timely and personalized communication allows a prospect or customer to feel more connected to their financial institution that is cognizant of the customer’s desire to “know me”, “look out for me” and “reward me” – where the reward is an offer that makes sense. This obviously improves the potential for the offer to be accepted. By having access to device data makes it possible to deliver the offer in real-time.

But how much more powerful could this experience be if the bank was able to understand and react to the context behind mobile logins of each customer every day? Or, where the customer shops, travels do and activities that they use their mobile device for?

Real-Time Data Impact on Privacy

Banks and credit unions that are not yet leveraging data and AI need to begin harnessing the power of advanced analytics and new marketing technologies today to ensure competitiveness in an increasingly digital marketplace. This was the perspective advanced by the Predictive Analytics Working Group at Mobey Forum, in its report entitled “Predictive Analytics in the Financial Industry – The Art of What, How and Why.”

“Banks have great data but if they want to compete in the digital age they need to get more strategic and more professional about how they use it,” comments Amir Tabakovic from BigML and Co-Chair of the Predictive Analytics Working Group at Mobey Forum. “The huge influx of new, specialist, data-centric players in digital financial services also means that (advanced analytics) is already becoming commonplace among the ‘new breed’; new services underpinned by predictive analytics are enabling the next generation service providers to extend their lead.”

The reason why financial institutions must “up their game” in the context of data and advanced analytics includes:

- Consumer Expectations are growing exponentially based on the digital experiences they have with non-financial big tech organizations. They expect the organizations they interact with to have accurate data and to be able to provide proactive, personalized insights and recommendations that will save them money, make them money and improve their daily life. Real-time advanced analytics provide the foundation for these interactions.

- Mobile Technology. The smartphone is the perfect digital device for the collection of insight and the distribution of real-time insights and solutions. Mobile transactions and geolocation insights are tremendous data sources for AI and predictive analytics. Wearables and the Internet of Things (IoT) will only enhance the accuracy of insights.

- Increasing Datapoints. The advanced data storage and analytic capabilities that were viable for only the largest of financial firms just a few short years ago now lie within the financial and intellectual reach of the smallest organizations. The costs of storing data have fallen below the costs of deciding which data to keep and which to delete. The cost of machine learning now comes within the range of almost all organizations.

- Non-Traditional Competition. As the ability to collect, process and apply data becomes easier and less expensive, non-bank and challenger fintech firms are in a better position to “catch up” to legacy banking organizations in the ability to deliver a personalized digital solution. The current window of opportunity is closing for legacy banking organizations.

There is a huge opportunity for financial institutions that move forward early in the collection and application of data and advanced analytics for improved customer experiences. For every major trend in banking, it’s all about the data. With advanced analytics and AI, banks and credit unions can generate a 360 degree view of each customer’s financial behavior, anticipating needs and creating highly personalized engagement that creates trust and loyalty.

By using contextual insights, banks and credit unions can establish greater relevance and appeal, increase trust and ultimately create a more stable commercial and operational footing for the digital age. Those organizations that successfully grasp technology identities will achieve a living, individualized view of each consumer — one that’s needed to deliver rich, continuous, experience-based relationships in the post-digital age.