Many credit unions refer to themselves internally in acronym form. Using acronyms is common industry shorthand. Everyone does in our industry, right?

And when credit unions first start looking at a name change, one option is always first to make it on the table: Simply switch to an acronym. Easy.

Take a name with six words and a mountain of syllables – Something Employees Community Federal Credit Union – and turn it into an acronym, like SECFCU.

That’s sort of what Deere Harvester Credit Union did when they became ‘DHCU Community Credit Union’ (‘DHCUCCU’) after giving ‘DFCU Financial’ a whirl.

But what do all these acronyms look like from the consumer’s perspective.

They look a lot alike.

And they look cold and corporate.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Common ancestry, common surname

Credit unions all share a common last name – the last two names, actually: “credit” and “union.” When you turn your name into an acronym, you only leave yourself a couple of letters to differentiate your credit union from all the other CUs and FCUs out there – not to mention the vast sea of other 3-5 letter acronyms ending in “CU” (or even just “U”).

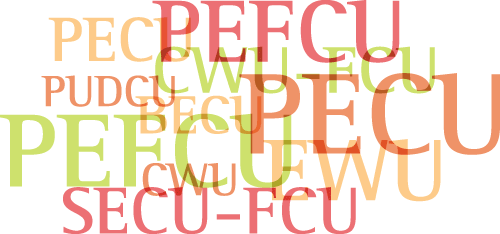

In Washington State, there’s credit unions whose official names are BECU, HPECU, PUDCU and SECU-FCU. There’s universities with acronyms like EWU and CWU. There’s even a CWU-FCU.

It’s dizzying. What the heck are are those letters supposed to mean?

Reality Check: Acronyms made out of credit union names are visually stiff and phonetically awkward. A combination like “PUDCU” sounds weird when read aloud as “pud kyoo” or “pud coo.” And you can’t enunciate SECU-FCU, which looks like a word jumble. “Seck-you fick-you?”

Acronyms lead to problems with domain names too. These four credit unions all use the ‘PECU’ acronym. But none of them own the über-desireable “www.pecu.com” URL, which actually belongs to the Professional Education Corporation University (aka “PECU“).

- PECU (Postal Employees Credit Union)

www.pecu.org - PECU (Postal Employees Credit Union)

www.pecu24.org - PECU (Public Employees Credit Union)

www.pecutx.org - PECU (Public Employees Credit Union)

www.publicemployeescu.com

There’s also the PECU known as Patriot Equity Credit Union. As well as PEFCU (Purdue Employees Credit Union), PEFCU (Panhandle Educators Federal Credit Union), and PEFCU (Publix Employees Federal Credit Union) with its wholly owned insurance subsidiary, PECU.

It’s not that these credit unions need to change names. Not at all. But if you’re using an acronym and you don’t have to, you might want to reconsider your policy.

Also, if your credit union changes names, avoid acronyms. The acronym you want is already taken by someone, somewhere, if not lots of folks everywhere. Pick a new name and use it with pride.

Bottom Line: The whole point of branding is to differentiate – in every way possible. That means your name – even your URL – should be as different from others as possible, especially your peers and competitors.

Exception: It’s okay to simplify “Federal Credit Union” down to “FCU” in certain applications. This reduction is not a strategic decision. It’s a practical one. You can turn seven syllables into three, and you’re often cutting the visual length of the name in half. It makes a name easier to say, easier to see, easier to write.

If you do use ‘FCU,’ you should still spell the whole name out in your logo and in signage. The fact that you’re a credit union is, in itself, a competitive difference worth spelling out.