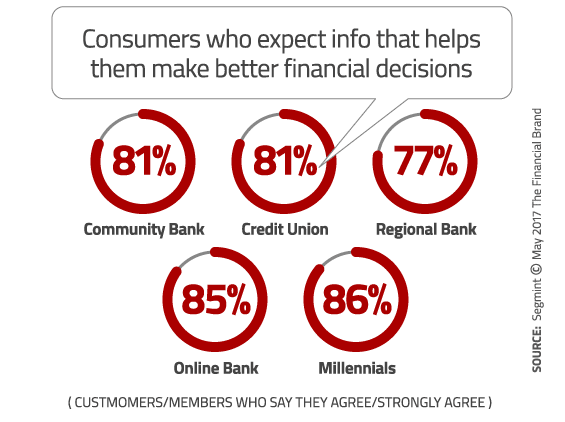

Out of 2,000 U.S. adults who participated in the 2017 Segmint Consumer Bank Marketing Study, 80% of those surveyed think their bank should be providing them with information tailored to their needs and circumstances that will help make better financial decisions.

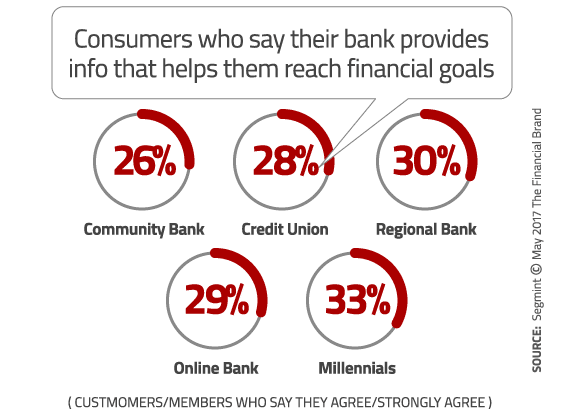

However, barely a quarter (28%) feel their banking provider actually delivers information that helps them reach their personal financial goals and life events such as paying for college or saving for a down payment on a home.

That’s a big gap.

More than half of consumers (52%) said they would rather have their bank proactively share information and offers relevant to their needs than research products on their own. That number jumps way up to 62% among Millennials.

The findings suggest that financial marketers need to radically accelerate their content marketing efforts. People are saying they are hungry for more insights and information from their primary financial institution, so banks and credit unions should feel obligated to respond with a broad range of content — from money-management tips shared in social channels and blog posts exploring more complex financial matters, to educational seminars and webinars.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Personalize and Contextualize Your Marketing Messages

You don’t worry about over-sharing. Only one in ten consumers feel they receive too much communication from their bank or credit union trying to cross-sell them different products and services. Nevertheless, there are some insights to be gleaned from those who complain about the material financial marketers are sending them.

Among the 11% of consumers who say they receive too much marketing, the table below breaks down the reasons they aren’t responding positively to cross-sell communications.

| Millennials | Community Bank |

Credit Union |

Online Bank |

|

|---|---|---|---|---|

| It is annoying | 59% | 44% | 52% | 71% |

| I don’t want what they are offering me |

41% | 32% | 73% | 63% |

| It doesn’t match what I need in my current situation |

42% | 52% | 47% | 7% |

| I already have what they are offering me |

21% | 31% | 19% | 53% |

The good news is that banks and credit unions can overcome many of these objections. There are a multitude of ways financial marketers can figure out what products a consumer does and doesn’t likely need — data analytics, life stage mapping, predictive analytics/AI, behavioral analysis, and simply by asking them. That’s the first step. After all, you need to know what someone needs (or doesn’t need) before you can sell them anything.

The goal is to contextualize and personalize your marketing messages as much as possible to create maximum relevance. This requires that you (1) know as much as possible about the audience, so you can (2) segment the audience and target your communications accordingly.

Marketing Must Become More Sophisticated in the Digital Age

More than a quarter of consumers (28%) say they never see online advertisements from their bank or credit union beyond the institution’s website or mobile app. This is a problem that is ridiculously easy for financial marketers to solve. With mainstream retargeting solutions from the likes of Google and AdRoll readily available today, there is no excuse — cross-selling via digital channels should be a major component in every financial institution’s marketing plan.

According to Segmint, the marketing models used by many financial institutions today are outmoded, something that their research seems to support. Segmint says it takes too much time for marketers to collect data, analyze it, build a strategy and then ultimately launch their campaigns. Instead banks and credit unions must find ways to individually tailor mass communications at scale, and compresses the timeline down from months to a matter of minutes.

“Broad marketing and loose demographic assumptions are not enough to win customers or build loyalty in today’s environment,” said Rob Heiser, President and CEO of Segmint. “Customers expect more than a one-size-fits-all approach to banking. Banks and credit unions have all the data they need to provide a highly personalized experience.”