Like most banks and credit unions, Traditions Bank has been looking for ways to drum up deposits.

But the $808 million-asset bank in York, Pa., also had another goal: It wanted to boost its scholarship fund for girls graduating high school.

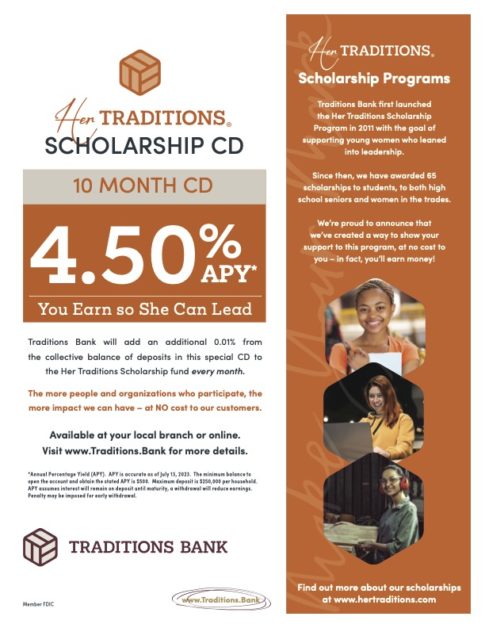

So, Traditions launched what it calls the Her Traditions Scholarship CD, a 10-month savings product that earns an annual percentage yield above 4%. The bank makes a monthly donation to the scholarship fund in an amount equal to 0.01% of what’s deposited.

Within the first month, the bank had generated enough deposits to add more than $1,000 to its scholarship fund, which continues to grow.

Nicole Shaffer, Traditions Bank

“This is a win-win,” says Nicole Shaffer, director of Her Traditions, a bank initiative focused on female customers. “The motivation is to do the right thing for women. But it has to make business sense, too. What’s our need right now? Our need is to generate deposits.”

Many banks and credit unions have unveiled initiatives for female customers over the years, driven primarily by insights into the different ways men and women tend to think about their finances.

These include KeyBank, which rolled out its Key4Women program in 2005, and CNB Bank, which just this spring created a separately branded banking division it says is “designed for women by women.”

Even so, financial institutions in general still appear to be struggling when it comes to reaching women. According to a survey that BMO Financial Group published in March, nearly four-fifths of women — or 79% — would like more help in improving their financial literacy. However, only 12% of women rely on financial tools or resources from their banks, compared with 20% of men.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Gaps in Confidence and Funding Spark Women’s Initiatives in Banking

Women generally feel less confident than men about managing their money, research shows. So the banking initiatives targeting them often focus on providing education and guidance.

Rachael Sampson, KeyBank

“Lack of confidence is one of the main pillars that we look to address,” says Rachael Sampson, a senior vice president at the $198 billion-asset KeyBank and director of its Key4Women initiative.

Key4Women relies on a mix of national and local programs to foster financial confidence, primarily for female business owners and entrepreneurs. This segment is often risk averse, for example, and tends to refrain from debt, which can hold back business growth, Sampson says.

As part of the Key4Women initiative, the Cleveland-based bank also certifies staff members who complete training on how to engage more effectively with female customers, Sampson says. The majority of those certified are client-facing staff, all of whom undertake the training voluntarily.

Like KeyBank, CNB Bank in Mansfield, Pa., is focusing on female business owners with the Impressia Bank division it launched in mid-May.

Mary Kate Loftus, Impressia Bank, a division of CNB

“The reality is banks are not yet fully supporting the fast-growing ‘sheconomy,'” says Mary Kay Loftus, who is leading the CNB initiative as president of Impressia. “We have the opportunity to shake things up a bit.”

Impressia intends to work on fresh approaches to credit access to help close the gender gap in funding. It also aims to offer help with financial literacy, leadership skills, and business and career development.

CNB has 47 branches that operate under different bank names across New York, Ohio, Pennsylvania and Virginia. Impressia, CNB’s sixth division, is based in Buffalo, N.Y., where its BankOnBuffalo division is also based.

Loftus, a Buffalo native, is a former M&T Bank and HSBC Bank executive who has deep experience in digital banking. Impressia is concentrating its efforts within CNB’s physical footprint initially, but the intent is to have a broader reach online, which will be augmented by regional relationship managers.

Some of the banking industry’s other recent entrants with a female focus include First Women’s Bank, which opened in 2021 and counts tennis legend Billie Jean King among its investors, and For Members Only Federal Credit Union, which was chartered in February 2023 to serve members of the Black sorority Alpha Kappa Alpha, their families and the organization’s employees. Both institutions are based in Chicago.

From Pictures to Products: The Evolution of Marketing to Women

When financial services companies initially began thinking of women as a discrete customer segment, they often started out with a simple recognition that their ads should at least include women, says Anna Forbes, an account supervisor at The Cyphers Agency, a marketing firm in Crofton, Md., whose clients include banks.

However, those ads often failed to move the needle, because they did not change women’s perceptions of financial services, Forbes says.

The banks that are doing well went further: They worked to gain a better understanding of female customers, she says. Then they used those insights to develop services to target this segment. This often included help with managing finances, such as tools to analyze spending and aggregate separate accounts into a single view.

The Confidence Gap Between Men and Women:

The BMO survey found that 53% of women feel financially confident about retiring at their target age, compared with 66% of men.

Typically, the goal of women’s initiatives is to create a wider sales funnel for existing products, such as mortgages, checking accounts and business loans, Forbes says.

In other words, “how does this analysis of your mortgage spend and some of the calculators that we put together funnel into a mortgage product?” she asks. “How does starting a local community program that really focuses on women and minority entrepreneurs funnel into our commercial line of business?”

The Her Traditions Scholarship CD is a unique approach, Forbes says. But she notes that it is rooted in the traditional bank menu. “It’s not a new product. It’s not a new service,” she says. It does, however, put a new spin on savings and gives women a new reason to park money in a CD, Forbes says.

Read more about CDs:

- Deposit Competition Is On, But Should CDs Still Be the Go-To?

- See all our latest coverage of checking accounts

Using Language that Resonates, Instead of Alienates, at Traditions Bank

Traditions Bank unveiled the CD in early February. It initially had an annual percentage yield of 4.1%, which has since been bumped up to 4.5%. The accounts are not limited to new money.

It’s the first product specifically to come out of the Her Traditions initiative, which got underway soon after the bank was formed in 2002.

It also addresses what has been something of a conundrum for financial institutions in general: How to translate a focus on female customers into discrete products that make a splash.

The services offered through Her Traditions include what the bank calls a financial personality indicator, which is loosely based on the Myers-Briggs Type Indicator. “It really is just a guide to better conversations,” says Shaffer, noting that the bank makes the tool available to both men and women.

Question to consider:

Would offering customers a financial personality test make sense for your institution?

This approach allows the bank to engage with people more productively from an education and communication standpoint, she says.

For example, the results from the personality indicator could help Her Traditions guide a discussion of retirement options for a woman with children nearing college age. The standard advice is parents should save first for their own needs, with the underlying message being that you can borrow money to fund a child’s education but not to fund your retirement.

That can sound cold to a woman who may prioritize protecting relationships, as determined by the personality indicator, Shaffer says.

Say something like that, and “you’ve lost them,” Shaffer says. “But if you tell them the best thing you can do for your child is make sure they don’t have to take care of you when they’re starting their own family, now you’re speaking their language.”

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why This CD Is a Good Fit for a Female Target Audience

Shaffer described the CD as a form of cause-based marketing, which often appeals to women and also gets people talking.

A local lawyer, for example, opened a Her Traditions Scholarship CD, grabbed a handful of flyers and took them back to her office, Shaffer says. “That’s not something you normally do for a CD.”

Shaffer hopes the extra donations can boost the dollar amount for the scholarship awards and increase the number awarded. In 2022, the bank handed out 11 scholarships of $500 each to high school seniors in York and Lancaster counties.

As of July, the bank had funneled $10,000 into the scholarship fund, an amount based on how much the new CD has attracted in deposits. Shaffer says that $10,000 is the goal that the bank had hoped to raise.

Bank executives say introducing additional products is possible. However, they continue to see Her Traditions more as an on-ramp into the bank than a product launcher.

“Although we will continue to explore different products, it’s how we deliver it. It’s the support. It’s the add-ons, the extras,” says Teresa Gregory, president of Traditions Bank’s York region and its mortgage business.

Read more about CDs:

- This Fintech’s Pitch: Cheap Deposits for Banks, Big Returns for Savers

- ‘It’s Like a Spigot:’ How SaveBetter Helps Bring in Deposits

Key4Women Wants Female Entrepreneurs to Feel Supported

The sentiment expressed by Gregory — that initiatives like these are about creating an experience that appeals to women — is one bankers generally share. They say the focus is likely to remain on this idea.

“We don’t need specific product lines or businesses,” says Sampson who also is director of Key@Work, a workplace financial wellness program offered by KeyBank. “We just need to be there to support them and provide the tools and resources so that they make the right decisions for their business.”

The Key4Women target audience includes entrepreneurs who will be making decisions to exit their companies in the years ahead, as well as those who stand to inherit assets as part of the transfer of wealth from Baby Boomers, Sampson says.

“Thinking about how we can really serve these individuals to ensure that they are set up for success is what keeps me up at night,” she says.