1. Ally Bank – Lucky Pennies

The idea was simple. If Ally Bank could get people to care about pennies, they could get them to care about interest rates, investing products, cash-back credit cards, etc.

Ally placed ten Lucky Pennies worth $1,000 in 10 different major metropolitan markets around the country. The custom-minted coins were “hidden” in plain sight — everywhere from busy hiking trails, city sidewalks and near landmarks, to fishing piers and parks.

Each “penny” was specially marked with an Ally logo on one side, and a call-to-action on the other: Visit AllyLuckyPenny.com and you could win $1,000.

Throughout the campaign, clues to Ally Lucky Penny locations and updates on those already found were shared on the microsite and via social media. A mix of PR, social media, influencers like Jimmy Kimmel Live and ESPN’s Kenny Mayne, and paid media was used to help spread the word.

To emphasize the point that people don’t care about pennies, Ally produced a short documentary film for YouTube showing just how many people would walk by a penny on the busiest street in New York City. The lowly penny sat unclaimed on the street for hours. The video went viral on Facebook, Snapchat and YouTube.

The campaign generated 350 million impressions and helped drive a 57% increase in brand awareness.

Umpqua Bank pulled a similar stunt with pennies, placing stickers on the coins with a simple message for those that found them: “Bring this into any Umpqua store and get a dollar.”

Another alternative spin to this type of promotion would be to put a special code on the penny that users have to plug into a website (perhaps along with their email address) to see if they win a prize — from $100 up to $5,000 cash.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

2. First Bank – Where’s Mark?

Once a week, the folks at First Bank Financial Centre would put a bobblehead figure of their CEO Mark Mohr in a photo — somewhere that only true locals in their markets would recognize.

They would publish the “Where’s Mark?” photos on Wednesdays through their Facebook page. The first person to guess the correct location would win a gift card.

As a result of the on-going campaign, CEO Mohr has become something of a local celebrity while helping to humanize the bank in a fun way that’s resonated with locals.

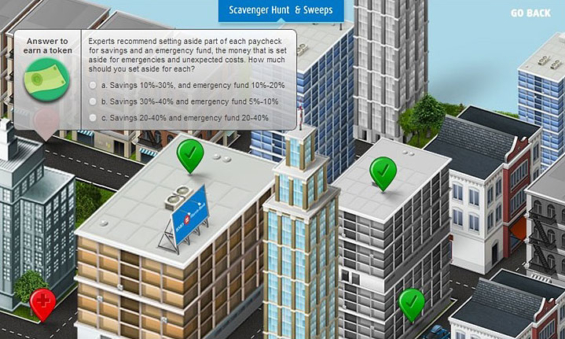

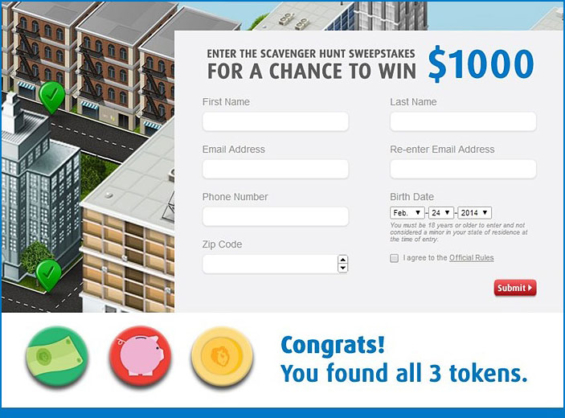

3. BMO – Virtual Hunt

From taxes to retirement savings, consumers consistently felt like they lacked basic financial knowledge, a skill they wished they learned in college. The BMO Scavenger Hunt Sweepstakes was created to offer real financial advice that went beyond “brown-bag your lunch” and “brew coffee at home.”

The digital campaign was created to tie into a series of five television spots focused on banking at varying stages of life. They created an isometric town for people to explore, and learn financial education and money saving tips tied to a person’s first job, planning for retirement, growing your family, or heading to college.

Different parts of the map in their virtual world focused on a different life stage moments, where users could discover relevant financial information. Users clicked on red markers in the world for a multiple choice question, financial tip or a short video from BMO Harris, then were rewarded with tokens. Those who collected all the tokens were entered into weekly drawings to win anywhere from $500 to $2,000.

BMO’s approach shows that you can create engaging scavenger hunts entirely online.

4. TCB – Hidden Hundreds

The Cooperative Bank (TCB) partnered with local social media personality Tom O’Keefe (aka @BostonTweet), who reaches some 250,000 Bostonians via Twitter, Instagram and Snapchat.

For the TCB’s Boston Scavenger Hunt, O’Keefe sent tweets out to followers challenging them to use their knowledge of Boston to find one of 30 TCB envelopes hidden around the city containing $100 cash. The envelopes were hidden inside local businesses, which helped shine a spotlight on TCB’s focus on local small businesses.

Also as part of the campaign, anyone opening a TCB checking account could automatically be entered in a drawing for $1,000.

The campaign resulted in more than four million impressions and doubled traffic to the bank’s website.

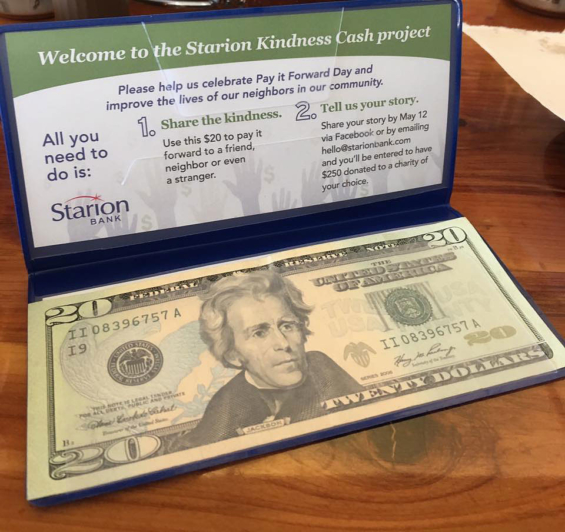

5. Starion Bank – Kindness Cash

For the past three years, Starion Bank has been reminding people that little things can make a big difference with its Kindness Cash project. On International Pay it Forward Day, Starion Bank staffers across North Dakota had fun hiding more than 600 Kindness Cash wallets at businesses, parks, schools and other public locations.

The wallets each contained $20 cash and instructions to share the money with a stranger, friend or local organization. Wallet finders were also asked to submit their stories of how they paid it forward via social media or email. Those who did so were entered into a random drawing to have $250 donated to the charity of the winner’s choice.

In addition, the Kindness Cash non-profit organization recipients’ stories with the most likes and shares on Facebook were entered in a second $250 drawing. Public votes determined which lucky organization would get the donation.

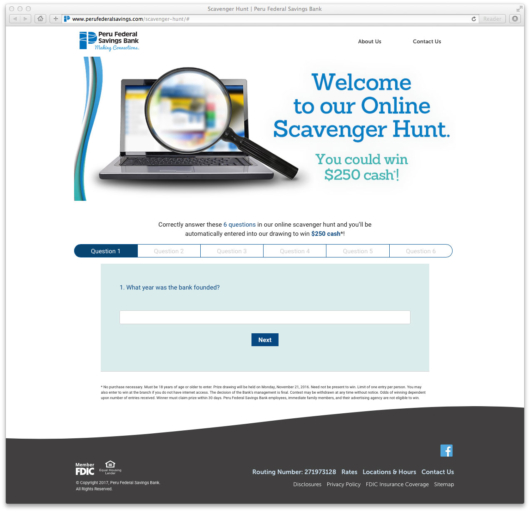

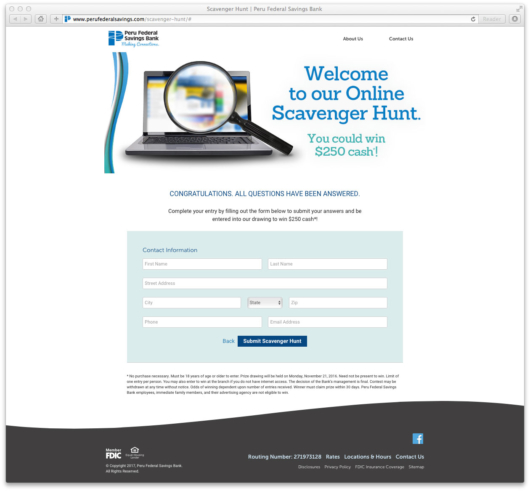

6. Peru Federal Savings – Website Scavenger Hunt

The bank posed six simple questions to site visitors (e.g., What year was the bank founded?). Those who answered all six questions are entered to win a $250 gift card.