Financial institutions face a myriad of challenges as they head into 2024. From greater earnings pressure to trouble training staff on AI, leaders are already feeling the squeeze.

Even so, banks and credit unions need to add another priority to their list. Leaders need to invest in strategies that can help better support their workforces as the labor market tightens. Attrition is expensive, and financial institutions are struggling to recruit and retain frontline staff, says Alex Kostecki, founder and chief revenue officer at fintech Clair.

“People making under $80,000 are relatively difficult to find right now,” Kostecki says. “You’ve got HR managers in a lot of industries trying to find a way to retain employees.”

Leaders can better retain their workforce, and attract the best talent, by investing in better employee benefits. Roughly 74% of American workers are concerned about their workplace well-being, a survey from the Employee Benefits Research Institute, or EBRI, found. More than half of workers say that mental health and financial wellness benefits have become more important to them over the last year, the EBRI survey found.

Offering benefits that better help workers deal with the realities of their jobs should be a top priority for community banks and credit unions. The market is changing, Kostecki says, and companies who don’t invest in better supporting their workforce will struggle.

“The entire economic package is being considered far more than it used to be,” he says.

Benchmark Employee Satisfaction – And Pain Points

The first step to better understanding complex problems among employees is to ask them. Leaders should survey employees regularly about the challenges they face, says Ashley Hardcastle, chief executive and co-founder of Zesa Wellness, a corporate wellness program vendor.

It’s important to ask employees different types of questions. Hardcastle says. Managers should include a mix of big-picture questions about the company culture alongside smaller asks, such as how they’re feeling at their job right now, to gauge where pain points are. “Send those out randomly so that you can kind of hit them right in the middle of their day,” she says.

Leadership should also look at data provided by the HR team to understand where issues are emerging, says Christie Lindor, the founder of Tessi Consulting, a diversity, equity and inclusion consultancy, and a lecturer at Bentley University. Information about attrition rates or the number of employee relations inquiries, combined with data from worker surveys, will usually create a clear picture of the problems, she says.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

“Leaders should take the time to create and normalize a culture of feedback where employees can feel safe and supported, bringing risks up long before they become issues,” Lindor says.

Once you’ve reviewed the data, executives should spend time considering what internal programs or benefits might help solve those problems, says Paola Accettola, chief executive and principal consultant at True North HR.

“If you take the time to understand your employees, and take the time to understand what they need and what’s missing, typically patterns will be exposed,” she says. Once you feel confident that you understand the data, slowly begin to make changes. Continue to regularly survey your staff to understand if they’re seeing any benefit.

Read more:

- Higher Pay Isn’t Enough to Stem Bank Employee Turnover

- How Engaged Employees Improve Banking’s Customer Experience

Get Comfortable with Remote Work

Where possible, banks should try to provide location flexibility. It’s not realistic to expect employees to come into the office five days a week anymore, Accettola says. Policies that require a full-time, in-person presence “cause issues from a recruiting and retention perspective,” she says. “If employees don’t enjoy the idea of being in the office five days a week, they will resign.”

Many employers have moved toward hybrid work schedules, which require employees to be in the office two or three days. At least 41% of employees with jobs that could be done from home are working a hybrid schedule, according to a survey from Pew Research Center. But even that may not be enough: About a third of workers who are working hybrid schedules would prefer to work from home more often, Pew found.

Where the Preferences Lie:

A third of hybrid employees say they prefer to work from home more often than not.

For frontline staff, and those with jobs that cannot be done from home, provide flexibility where possible, and ensure that you have other perks and incentives to make their jobs easier. “Focus on supporting them with tools that help them cope with customers, cope with their mental health, cope with work life balance, including financial stresses,” Accettola says.

Money Matters, But It’s Not the Whole Picture

In general, U.S. worker salaries did not kept pace with the rising cost of living in 2023, although the gap is narrowing. On average, companies are expected to raise their compensation budgets by 3.5% in 2024, according to data from the Society for Human Resource Management.

In 2024, raises for frontline staff members may be especially vital. Data shows that frontline employees feel the least supported by their companies, particularly if they are paid by the hour. In a survey from Qualtrics, frontline employees reported significantly lower confidence in leadership and felt they were paid less fairly than non-frontline colleagues. “Hourly staff are impacted significantly with inflation and are seeking other jobs because those jobs aren’t quite competitive from a pay perspective” Accettola says.

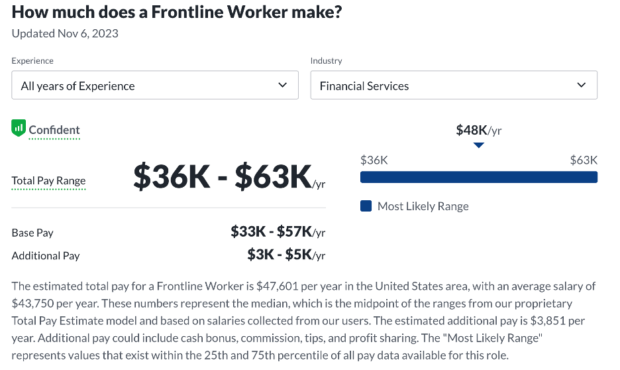

On average, a frontline worker in financial services earns about $43,750 per year, according to data from Glassdoor — significantly below the national average of about $58,563, or $28 per hour, for all workers, according to ZipRecruiter.

Offer Benefits that Make Sense for the Workforce

Raising salaries can be a good first start, but employees, particularly younger workers, also value other perks like mental health support, financial wellness benefits, education reimbursement, and sabbaticals.

Large banks are already investing in these programs, while many community banks and credit unions are falling behind. Bank of America, for example, added a sabbatical program in 2022, which allows employees to take an additional four to six weeks of time off after 15 years of service. The bank had more than 15,000 employees participating in the program in 2023.

The megabank also offers a specialized life event service, which provides personalized support around domestic violence, terminal illness, retirement, natural and man-made disasters, transition related to military service, and other major life events. The team provides resources, benefits, counseling and more, by tapping experts inside and outside the company.

Even if adding expensive perks like education reimbursement isn’t in the budget, community banks and credit unions can look for small ways to boost their benefits. If you don’t know where to start, consider partnering with a vendor or a benefits broker.

“In today’s market there are a number of high-quality virtual programs, apps, and platforms that could provide your employees with the support they need to be holistically well,” Lindor says.

Whatever vehicle leaders choose to pursue to improve the worker experience, experts agree that it should be a top priority in the new year. “There is value in working for a smaller bank,” Accettola says. “You can certainly articulate that to employees when you’re trying to recruit or retain them.”

Caroline Hroncich is a freelance business journalist based in New York. She writes about workplace trends, HR, personal finance, banking, and more. Her work has appeared in MarketWatch, Business Insider, Employee Benefit News, the Society for Human Resource Management, and Cannabis Wire.