The rising tide of credit card fraud is a growing concern for banks. As highlighted in a recent report from BackgroundChecks.org, major U.S. cities are seeing alarming increases in fraud incidents year after year. Banks that don’t take proactive measures against credit card fraud risk drowning in the swelling waves of financial and reputational damage. But with the right defenses in place, they can stay afloat — and protect their customers from harm.

In this article, we’ll dive below the surface to understand credit card fraud, equip banks with advanced security measures and empower consumers to swim safely in the turbulent waters ahead.

Understanding the Impact of Credit Card Fraud on Banks

Banks are on the front lines when credit card fraud strikes. Every incident causes direct financial losses and strains bank resources as they launch investigations and issue refunds. But indirect impacts can be equally devastating over time.

High fraud rates tarnish a bank’s reputation for security and erode customers’ trust. Some consumers may leave for competitors perceived as more resilient to fraud. Amid waves of attacks, banks can struggle to keep up, leading to customer service bottlenecks that further frustrate account holders.

For the industry at large, swelling fraud statistics could deter people from adopting digital banking solutions that promise convenience and efficiency. Innovation may stagnate if banks become too risk-averse, falling behind the digital transformation curve.

Banks clearly need to implement robust defenses. Otherwise, they risk losing far more than money. Customer loyalty, competitive edge and strategic progress into the digital future all hang in the balance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Developing Tactics and Techniques to Defend Against Fraudsters

To battle credit card fraud effectively, banks need to intimately understand how fraudsters operate. The more familiar they become with the tactics and techniques, the better prepared they’ll be to disrupt attack strategies.

Phishing remains among the most common initial vectors. Criminals send emails impersonating banks to trick customers into entering account credentials on fake sites. The harvested data then provides access to make fraudulent purchases and transfers.

Skimming continues to plague ATMs and point-of-sale systems. Fraudsters attach card readers to capture account data from unsuspecting customers. Even chip-enabled EMV cards are at risk from skimmers stealing the data and replicating the magnetic stripe.

Be Wary of Advanced Fraud Tech:

Chip-enabled debit and credit cards have grown popular amongst banking providers as an additional way to protect customer data. Don't get too comfortable though — EMV cards are at risk.

Synthetic identity fraud is also on the rise. Sophisticated fraud rings combine real and fake credentials to generate identities tied to nonexistent individuals. The manufactured identities allow criminals to open fraudulent accounts and make high-risk transactions.

By studying the latest fraud tactics as they emerge, banks can implement targeted safeguards that close security gaps and lock out criminals before the damage spreads.

Read more about fraud mitigation:

- Why an Identity-Based Solution is Critical to Mitigate Bank Fraud

- AI Arms Race: Banks and Fraudsters Battle for the Upper Hand

Identifying Top Geographical Hotspots for Credit Card Fraud

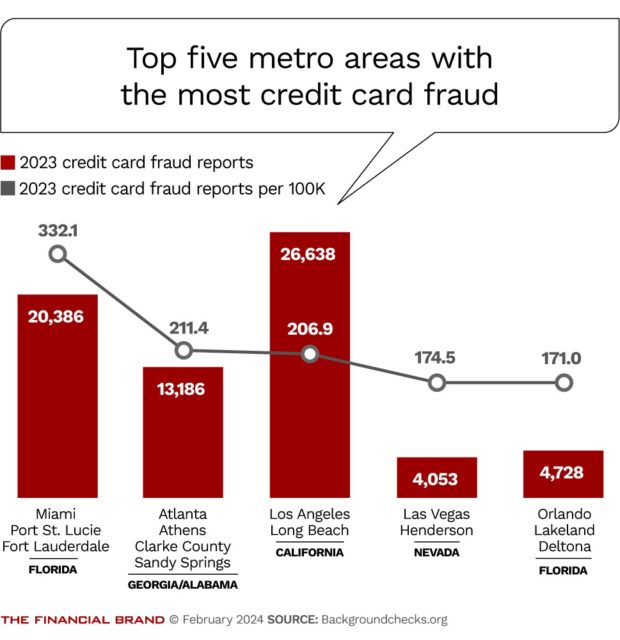

It’s also critical for banks to understand geographical fraud trends in the U.S. Awareness of higher-risk cities and states allows banks to allocate fraud-fighting resources more strategically.

As highlighted in the BackgroundChecks.org , the Miami metro area experiences the highest levels of fraud, with over 300 cases per 100,000 residents reported in 2023. The city’s allure for criminals lies in its cosmopolitan makeup, popularity with tourists who may be less cautious with cards and role as an immigration hub.

Other hotspots like Los Angeles, Las Vegas and Atlanta also attract transient populations and tourists while featuring urban density that enables anonymity for fraudsters. Analyzing the metro level data arms banks with intelligence to fine-tune detection platforms, increase monitoring for the riskiest regions and ramp up customer education efforts in fraud-prone areas.

Advanced Security Measures: The First Line of Defense

Banks have an arsenal of advanced security measures at their disposal to wage war against fraud. The right combination of technology and vigilance acts as the first bulwark against attacks.

Multifactor authentication adds an extra layer of protection beyond passwords. Requiring an additional step for login or transactions using one-time codes sent to a verified device helps validate legitimate users.

AI-powered fraud detection platforms can analyze transactions for suspicious patterns in real time. By identifying high-risk activity as it occurs, banks can attempt to halt fraud mid-attack and limit losses.

Ongoing security awareness training is also critical. Educating customers and employees to recognize phishing attempts, questionable transactions and other red flags empowers the first line of defense across the organization.

Banks that implement strategies combining capable technology and informed people significantly improve their odds against determined fraudsters. They become harder targets, forcing criminals to search for weaker prey.

Dig deeper:

- 4 Ways to Ensure Your Financial Wellness Marketing Pays Off

- Trends 2024: Banks Must Ramp Up Protections as Mobile Fraud Grows

Customer Education: Empowering Consumers Against Fraud

While advanced security measures provide vital protection on the bank side, customer education is essential for closing security gaps on the consumer end. Banks that actively empower account holders to outsmart scammers and avoid compromising behaviors do more than boost first-line defenses. They also build trust and instill confidence in their fraud prevention capabilities.

Educational content should focus on making customers savvier. Banks can provide tips for securely managing account credentials, recognizing fraudulent emails and calls, monitoring transaction histories and reporting suspicious activities. Guidance around safely using ATMs and point-of-sale systems also reduces skimming risk.

Banks can further educate consumers about avoiding oversharing sensitive information on social media platforms, securing Wi-Fi connections and enabling the strongest authentication options for online accounts.

Ongoing education through multiple formats gives customers the knowledge to both contribute to fraud prevention efforts and feel more secure in their banking relationships. Banks that arm consumers with fraud-fighting skills ultimately enhance protection for everyone.

The Future of Fraud Prevention: Leveraging Technology and Data

While banks have made strides battling fraud, the future promises innovations that will shift advantage even further in their favor. Both existing and emerging technologies — combined with the power of data — are poised to add predictive capabilities that will allow banks to literally stay one step ahead of threats.

AI and machine learning will continue maturing, analyzing patterns across millions of transactions to instantly determine activities diverging from normal baselines. Algorithms will become so attuned to customers’ spending habits that they trigger alerts for the slightest anomalies, shutting down unseen attacks early on.

“Banks that arm consumers with fraud-fighting skills ultimately enhance protection for everyone.”

Expanded biometric authentication through fingerprints, facial recognition, voice verification and even heartbeat scans will help confirm legitimate users. Matching biometrics against fraudster spoofing attempts provides another layer of defense.

And blockchain’s distributed ledger technology offers banks transparency into every transaction within a secure, incorruptible network. With an immutable record of all activity, fraudulent transactions become easier to detect and investigate.

The more data banks can harness through advancing technology, the better prepared they’ll be to not only face current fraud schemes but predict and neutralize emerging threats before they ever land a punch.

Learn more: The Security Imperative of Banking Transformation

Conclusion: Navigating the Surge and Ensuring Security

As credit card fraud continues rising across major cities, the banking industry must take decisive action. Implementing advanced security measures, educating customers and leveraging emerging technologies will help banks stay afloat.

Companies that fail to respond adequately risk sinking fast with damaging financial losses and eroded consumer trust. Those plotting the right course can navigate the stormy seas ahead to safe harbors. With vigilance and proactive defenses, banks can withstand the swelling waves of fraud and continue providing secure, reliable services well into the digital future.