Banking has historically been an industry founded by men, run by men, with products created for men. Recently, some progress has been made, but the gender bias in banking still runs deep. Surprisingly, this same bias exists in the modern world of fintech, where there are far too few women fintech founders and too few women overall working at these new financial start-ups.

What are the causes of this imbalance? More importantly, how do we address these imbalances that continue to impact the funding mechanism, the ability to get new ideas heard, and the potential for innovations geared to women? Finally, despite setbacks caused by the pandemic, is the outlook overall brighter as we enter 2021?

The good news is that greater attention to gender equality is being paid both inside and outside the banking industry. Numerous research studies are digging deeper into this ongoing phenomenon and the impact gender equity has on organizations and the solutions they provide.

To dig deeper into the challenges women face in getting an equal opportunity for funding, having a seat at the management table, working at start-ups, and the ability to create solutions geared to the female market, I interviewed Neha Mehta for the Banking Transformed podcast. Neha is the founder of Femtech Partners, a consulting company based in Singapore helping fintech start-ups get a foothold in Asia and promoting women in fintech.

Listen to the Podcast:

You can listen to this podcast interview with Neha Mehta here on The Financial Brand, or find the Banking Transformed episode, “Closing the Gender Gap in Banking and Fintech” on your favorite podcast app.

Gender Equity is Not a New Problem

While women and men are nearly equally reflected in the overall labor force of traditional financial institutions, the representation of women becomes far less the higher you go within the organizational ranks. According to research from Deloitte, women accounted for just under 22% of leadership roles in traditional banks and credit unions in 2019, with this number expected to increase to only 31% by 2030.

This lack of women in leadership positions is more based on tradition than on skill sets. In fact, in research by the Harvard Business Review, women scored at a statistically significant higher level than men on 17 of 19 (84%) leadership competencies measured. These competencies included taking initiative, acting with resilience, practicing self-development, driving for results, and displaying high integrity and honesty.

Two of the ongoing challenges is the lack of confidence many women have in their ability to move up the corporate ladder, and the unconscious bias that still exists within financial institutions around women belonging in senior level positions.

According to Neha Mehta from Femtech Partners, “Part of the challenge has to do with the fact that women are sometimes not taking enough risks, even if they have innovative ideas. Sometimes, they may not have the right skill sets, or lack the opportunities that their male counterparts have. And when you talk about the banking sector, women are also fighting legacy issues.”

Read More:

- Improved Focus on Women’s Needs a Must for Financial Institutions

- Building Better Banking Services for Women

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Gender Imbalance Extends to Fintech Founding and Funding

As fintech firms began to emerge, most would think that the disruption of legacy banking traditions would include a rethinking of the gender imbalance that had long existed within the banking industry. Unfortunately, the lack of women in financial services, and the scarcity of women in the tech sector created a lack of supply for many new fintech players.

But progress is being made … slowly.

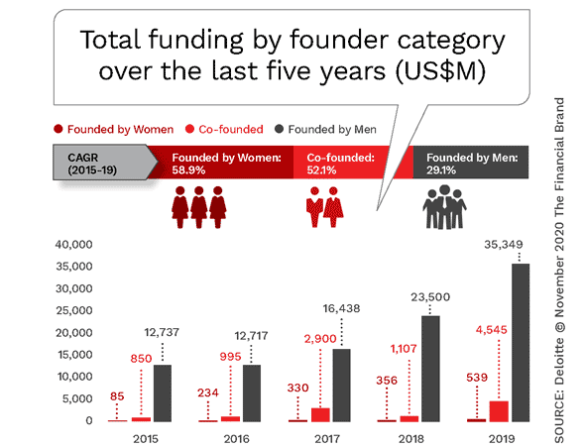

Women-founded and co-founded fintechs have grown at a slightly faster clip compared to startups founded only by men since the start of the decade, growing eight-fold, according to Deloitte, while startups founded by men grew seven-fold. Unfortunately, this only relates to 12.2% of the total startups being founded or co-founded by women vs. 10.9% a decade ago. Worse yet, those firms founded by women only represented just 3.1% of all fintech firms in 2019.

Beyond the imbalance in the number of fintech firms being created by women, the gender bias extends into the area of start-up funding. While significantly more money is being directed to fintech firms founded and co-founded by women than in 2015, much of this funding was directed to two major players (Starling Bank and Tala), and the growth is misleading given the almost non-existent funding for women-led organizations 5 years ago.

Bottom line, only 1.3% of the $40 billion raised in 2019 went to firms founded only by women with fintech firms with women co-founders generating 11.2% of all funding.

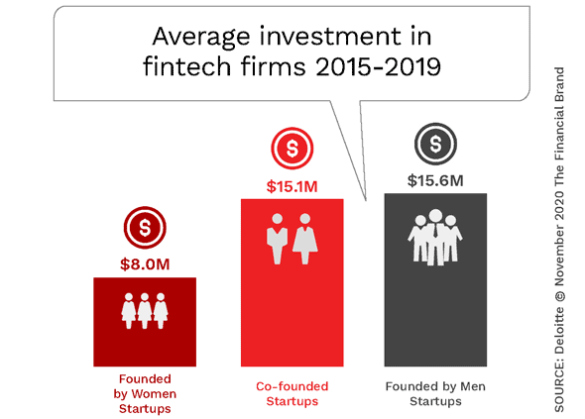

Beyond the number of women-led firms being funded, the average investment level for women-founded start-ups lagged those co-founded by women and those founded by men. Based on Deloitte’s research, the average women-founded fintech start-up raised 50% less capital than start-ups by men, with co-founded start-ups falling 3% less than the men-founded firms.

Impact on Fintech Solutions for Women

Having more women within the leadership ranks of fintech firms and having more women-founded fintech firms would provide a stronger springboard for solutions geared to women. Women-founded or co-founded teams are more likely to understand the needs of women – especially in a pandemic-impacted period when women have seen the largest disruption to their daily routine.

According to research on the impact of the pandemic on women, nearly 82% of women surveyed said their lives have been negatively disrupted by the pandemic, and nearly 70% of women who have experienced these disruptions are concerned about their ability to progress in their careers.

These unique challenges faced by women must be addressed by financial institutions – with most of these efforts having a better chance of success if spearheaded by women in positions of power within traditional banking or fintech organizations.

“We need to keep in mind that women have special needs, so if we can have gender-specific financial products, that’s a good start,” stated Mehta. “For us to do that, we need to understand how a women’s psyche works. We need to have senior managers within the banking and fintech ecosystem who are women who can relay it back to the financial products team and ask them to create such products.”

Potential Solutions to Gender Bias within Financial Services

Gender balance within organizations makes good business sense, according to research from Catalyst. Those organizations with greater gender equality achieved 300% greater profits, 19% greater innovation revenue and were 25% more likely to have above-average profitability.

Some ways to increase the participation of women in financial services includes:

- Removal of unintentional gender blindness. Are past biases impacting current funding decisions?

- Leadership commitment. Top leaders within an organization and in the investment community must commit to expanding opportunities for women and women founders.

- Create opportunities for advancement. While some progress has been made at the C-level of financial organizations regarding female opportunities, the progress has been less prevalent at senior level positions.

- Develop mentorship programs. Expand networking, peer-to-peer interactions and mentorship programs within organizations and between investors and founders.

- Embrace work-at-home opportunities. The pandemic has created significant challenges for women who must balance work and family, but it has also created opportunity for innovation and creativity.

But the pandemic may not be the gender equity catalyst some had hoped for. “I think when the pandemic started, most of us were very hopeful that it’s going to be a brilliant opportunity for women because now they can do everything by sitting at home, aiming for more and exploring more, but it has turned out the other way.” states Mehta. “I have seen a lot of women dropping out of their careers and they are not feeling motivated enough to go out and pitch for the business. They have broader responsibilities with their family and that has impacted the potential to expand horizons.”