Fintech providers have signed up millions of customers for mobile tools simplifying a whole range of financial applications that promise a simpler, frictionless experience. And for years now, banks and credit unions have been racing to catch up.

Consumers have been increasingly using third-party financial apps on their mobile devices, assuming fintechs are limiting how users’ personal financial data is being leveraged. In reality, fintechs are exploiting data in ways that would make most consumers cringe if they found out.

This puts banks and credit unions in a good position to provide both education and solutions that give consumers greater control over their personal data. Traditional banking providers maintain some advantages that have helped keep them in the fintech game. Their status as trusted stewards of consumers’ assets — both money and data — is one of their most potent branding weapons.

Research from The Clearing House suggests that the data protection issue is bigger than many expected. And when consumers are presented with the full picture, it causes many of them to have second thoughts about using nonbank fintech apps.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Consumers Love Fintech Convenience, But Fret Over Privacy

The research sought to identify where the balance lies between ease-of-use and data privacy — how much privacy are consumers willing to sacrifice in exchange for greater convenience and a better experience?

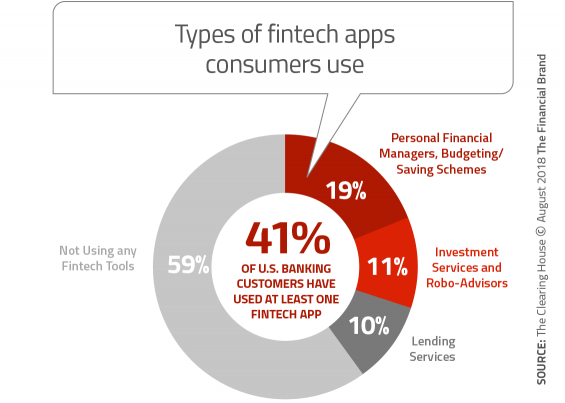

The report found that nearly two out of five (41%) U.S. banking consumers already use at least one fintech app. The most commonly used apps relate to budgeting and saving, investment advice, and lending.

Having established that benchmark, researchers then focused most of the rest of its questions on users of nonbank financial apps. About 1,500 of the survey participants fell into that category. Specifically it sought to determine how important data privacy is to these app users, as well as how aware they are of how their personal data is collected, used, and shared.

Read More: Consumers Crave More Mobile Banking Features Despite Security Concerns

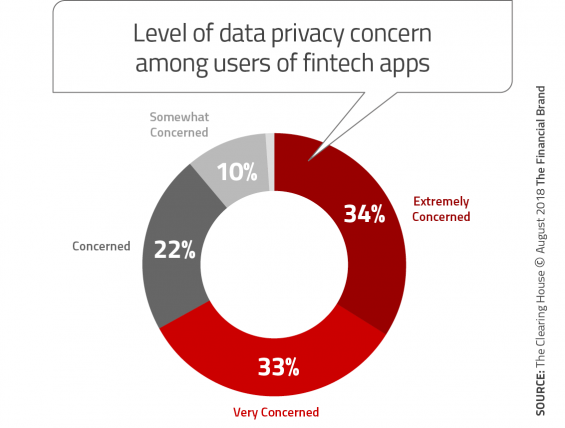

Consumers’ love affair with fintech apps has a dark side. When asked if they worry about the privacy of the data they share when using financial apps online or on mobile devices, more than two thirds of consumers say they are “very” or “extremely concerned.”

“Nearly nine in ten fintech users say they worry about data privacy and data sharing.”

Fintech users have the greatest privacy concerns about sharing their bank account user name and password. Two-thirds of them report being “Uncomfortable” or “Very Uncomfortable” sharing that particular information. Yet many (if not most) fintech providers requires that consumers share their log-in credentials for their accounts with them and/or a data aggregating intermediary.

While the survey found that fintech users are quite comfortable sharing their email address, home address, and date of birth, there are other types of data consumers that make consumers very nervous: Social Security numbers, bank account numbers, and credit/debit card numbers are the most troubling.

Control Over Access is Key Consumer Need

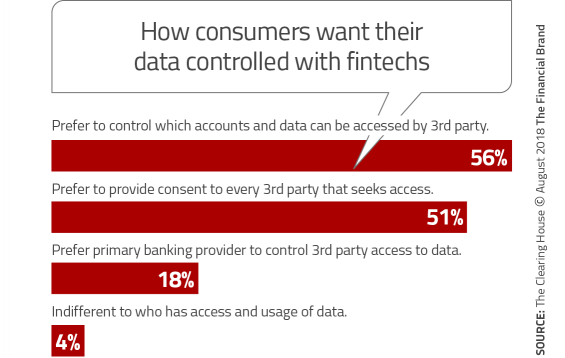

Most fintech users want to control who can access their information. More than half (56%) say they would like to determine which of their accounts can be accessed by a third party.

Probing further, The Clearing House asked fintech users how they would like to exercise that control. Exactly half say they would like their primary banking provider to provide a dashboard that gives them the ability to determine who has permission to access their financial data. Another 18% say they want their primary financial institution to manage how their data is used by third parties. Roughly half (47%) say they would like to have a dashboard within each fintech app. More than a quarter (29%) would look to a customer service representative at their primary banking provider to be the mechanism by which they exercise control over access to their financial data.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

People Know Less About Data Sharing Than They Think

Some consumers exhibit some seriously wishful thinking when it comes to controlling their personal financial data. In the survey, fintech app users were asked how aware they are of how these apps access, collect, and use their personal and financial data. More than half say they know how the apps use their data and almost two thirds feel confident in their ability to control the flow of their data to these apps.

Despite that show of confidence, the research revealed a significant gap between how people think these services interact with their data and how the apps really work.

“Less than half of fintech users believe these apps can access their personally identifiable information or financial information, even though they often can (and do),” The Clearing House report says.

Key Question: What would happen if consumers knew the truth?

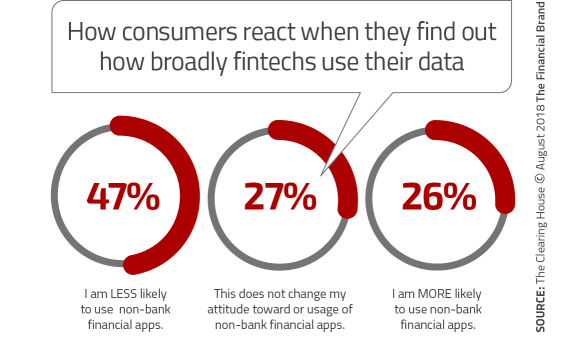

Researchers at The Clearing House wondered the same thing. During online panels, researchers told consumers that the terms and conditions for many fintech apps (which no one reads before clicking “I agree”) give them permission to use consumers’ data for purposes other than the functioning of the app.

Once fintech users become aware of this fact, nearly half (47%) of them say they would be less likely to use these services going forward. One in five (22%) said that now they will no longer let nonbank financial apps access their bank account, even if it meant they couldn’t use the application.

Reality Check: Knowledge is power — a big opportunity for banks and credit unions to steal back some business from fintechs.

Banks and Credit Unions Expected to Safeguard Data

In a separate survey cited in the report, A.T. Kearney sought to find which financial services providers consumers feel can best keep their personal information safe. The results show that banking providers are most trusted with data security. Banks and credit unions lead the next closest option by a whopping 13 percentage points.

Given how much concern consumers have about the privacy of their personal data, the edge in trust should be a significant advantage for banks and credit unions. More than that, however, consumers expect their primary banking provider to keep their data safe. The report from The Clearing House says that 56% of all the banking users surveyed and 59% of the fintech users say they hold these institutions accountable for the security of their data.

Similarly, six out of ten consumers look to banks and credit unions to help educate them about how financial applications access and use personal data. Again, this was higher than any other choice including fintechs, the government, or consumer groups, and represents another avenue by which to regain ground lost to fintechs.