Adapting to the fast-paced digital world presents major challenges for traditional financial institutions. For some, it’s not only about future success but a question of survival. Some are making the shift and achieving extraordinary results with minimal resources. What’s their secret? They’ve all adopted a customer experience mindset.

In the old days, it was all about numbers. You focused on your budget, reach, conversions, and sales. This requires a heavy emphasis on advertising — placed wherever possible and repeated as often as possible — to seduce, persuade and convince consumers to use your service.

But the traditional approach no longer works. Today, you can reach almost anyone at no cost. So do you have something people actually need? Do you offer something that solves their problem and provides a delightful user experience? (If not, there will always be someone who can and will.)

Making the following five shifts will allow a bank or credit union to move in the shortest possible time from the old models that are broken to a new customer experience model. To adapt to today’s new reality, banking providers must imbue this new mindset throughout their culture.

Just remember: It’s not about the tools you use. It’s about your mindset.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

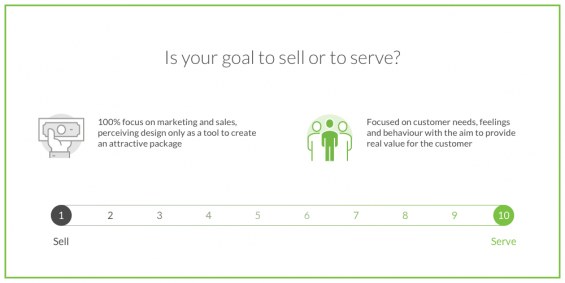

1. Switch from Selling to Serving

Companies rigidly focused on sales, perceiving users as objects of manipulation from whom to extract money in any way possible. We have all watched The Wolf of Wall Street, right? Therefore, such trends as Design Thinking, UX and User-Centricity become just marketing tools that allow the wolf to put on sheep’s clothing to lure the buyer closer and perform the win-lose model.

By contrast, companies that actively implement the work principles of the Experience Age aim to bring maximum value to the client, in exchange for which the client will gladly reward the company and support its development. This is a sincere win-win relationship that truly makes the world a better place.

The most efficient enterprises today place user experience metrics to the forefront, including Net Promoter Score, feedback monitoring, support request statistics, speed of key scenarios, retention rate, etc. This allows us to measure the quality of customer experience and make it a key value in the company.

During the Experience Age, sales efficiency increasingly depends on the service value to users. Thanks to the network effect, positive reviews become the best advertising. Therefore, the most successful companies of our time have already switched their focus from sales to service. They support their products and their culture through metrics, values and learning.

For example, traditional banks use their homepage on the internet to promote all services, turning it into an advertising platform. This causes the user to drown in a large number of offers and lose direction. Fintech companies, in an easy and accessible way, suggest starting with key scenarios, for example, opening an account and only then gradually making a contextual upsell. User experience and emotions are more important to them.

Unfortunately, some specialists believe that a knowledge of psychology is a good tool to increase conversion. But, instead of using human psychology to trick users into buying useless products, we should think about how human psychology can increase the value of our products and help to deliver an experience customers will appreciate.

Self-Assessment: Where would you place your business approach, culture and goals on this scale? “1” on the scale is a selfish company that is driven only by profit and selling, looking at people as numbers behind conversion. A score of “10” is a company focused on customer needs, feelings and behavior, and the main aim is to provide real value by changing people’s lives and world for the better. What is the main driver of your activity — to sell or to serve? How could your bank or credit union move closer to a “10”? What are the key actions that can take you closer to the “serve” principle?

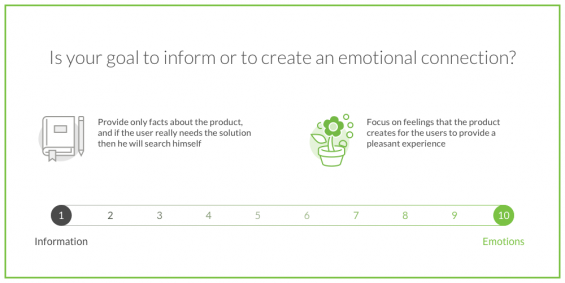

2. Shift from Information to Emotions

You might wonder, what’s the problem with information? Isn’t it a good practice to explain everything to your user? From a marketing perspective, it is. In the previous age, people read the description of products in magazines to find out how it could help them. Basically, advertising was about simple information about products. Even today, you can see a lot of attempts to promote products just by informing customers about product features.

Unfortunately, that approach does not work well for digital products. Today, we have too much information around us and too many competitive solutions. Thankfully, only 20% of our brains think rationally. We perceive and act through emotions and instincts – so-called “subconsciousness.” This protects us from information overload.

If you open a website in search of a solution, would you read a paragraph about the company? Or would you form a first impression and quickly scan the page in seconds? Let’s take a look at how this works in practice. Imagine you want to take out a mortgage and choose to look at the bank’s website. You look around, and there’s lots of information, some parts even duplicating themselves. It provides information, but does it create a connection for you?

Users forget information but remember experiences —and experiences are created from emotions. This means that information should be integrated into a context of usage. It should become an organic part of the user experience. To achieve this, we must focus on emotions our product delivers, using intuitive information architecture and a delightful design to manage it. Explore your users to connect with them emotionally.

Do not make your user read. Show them the right path using visual accents with simple and clear tags. Landing pages of fintech services create this vital connection by delivering a clear message of who they are and why we should trust them. They usually use emotionally engaging visuals to show that they offer something revolutionary. They want to create the emotional connection through simple messaging and a clear interface.

Of course, there are “smart” marketing guys who misuse the principles of Experience Mindset in a malicious manner. They manipulate with human irrationality and emotions just to increase sales. And here it’s very important to understand the difference. In the Marketing Mindset emotions are used to trick people. By contrast, in the Experience Mindset emotions are the language to communicate with the customer, understand his needs and expectations, in order to deliver the best possible experience.

Self Assessment: Ask yourself, where would you place your institution’s business approach, culture and goals on this scale? What is the main drive of your activity — to inform or to create an emotional connection?

“Information” is about providing some facts about your product or service, like the do-it-yourself approach. If a potential user really needs your solution, then they will search for it as long as it’s needed by carefully reading all the information on your website. “1” on the scale is about a company that absolutely has no idea how the user feels and does not let them get too close.

“Emotions” means to focus on the feeling that our product or service creates. Such a company is interested in understanding its users well, their thoughts, emotions and behaviors. Why do they need your product, how will they use it and how can you better help them? What could be a pleasant experience in our case? “10” on a scale could be given to a company that tries to perceive the world through its customer eyes and creates a close connection through its service. Apple is a good example of such approach.

If you wish to improve your result and get closer to a “10,” you could simplify your website by reducing some content, making the design more emotional, or establishing a closer connection by asking your customers for feedback. Maybe you already have other great ideas of adding emotions to your financial product? Write them down!

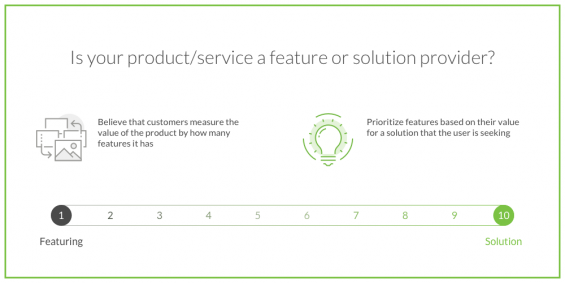

3. Focus on Solutions Instead of Features

Another misconception of using UX is to generate killer features that will help to sell a product. For some companies, featuring is an obsession. The company believes that consumers measure the value of the product by how many features it has.

A common way of thinking is to assume that the more features you deliver, the more likely customers will buy your product. This worked perfectly during the Marketing Age. If you came to a shop and compared two similar gadgets, and one had twice as many functions at the same price, then the choice was obvious. And it was not so important that only 20% of functions were ever used.

We use this example in banking. At some banks, if you want to do an online payment, you have to click on “Payments, cards, accounts,” and it opens a huge list of 23 payment options. Then, after opening domestic payments, you’re offered a huge list of inputs to fill.

In the Experience Age, it works differently. Users are not interested in buying the functions of your drill. They simply need to hang a picture on the wall. Businesses can provide this in many ways, especially in banking. To make a payment in e-wallet, you only need choose your friend from a contact list and enter the amount. That’s it.

Actually, we see that people do not like over-featurized services because they’re difficult to use. That’s why simple solutions provided by fintech are in great demand. They are easy to understand and simple to use. If you think in terms of solutions for the user, you will see that some features have no value at all, while others play a key role. Prioritize features based on their value for a solution that the user is seeking.

A product with one feature that is simple and over-delivers an expected solution achieves greater success then a complex service with dozens of confusing features.

Here we can see a trap for some rocketed startups that tried to add a lot of new features after successfully launching MVP. This must be done carefully to preserve usability of the basic solution and simple architecture.

Self Assessment: How would you rate your product — a feature provider or a solution provider? What is more important — to create new advantages or to fit your solution to user’s needs to the greatest extent possible? What can be done to immediately start improving your business right after reading this article? You could begin with the evaluation of your service features from a solution perspective or maybe even reduce the complexity of the existing product.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

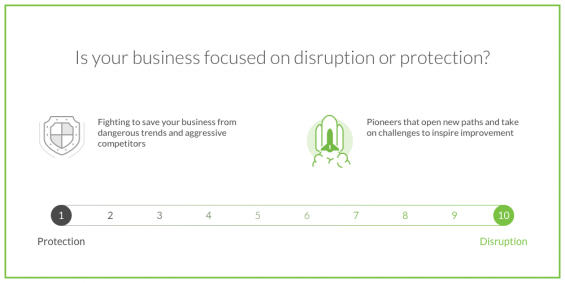

4. Emphasize Disruption Over Protection

A Marketing Mindset would perceive the world as a battlefield. You have to conquer your market share and then protect it. Marketing people are sure that everyone wants to compete with them, steal their secrets, and copy their successes. So, for them, the world is actually a threat.

In FMCG (fast moving consumer goods), a market where marketing was born, this mindset became the only way to survive. It was too easy to copy one other’s products. So, for thousands of non-unique products, the only difference was brand name and marketing presentation.

The worst part is that protection applies not only to competitors but to consumers as well. The mindset: “Protect” the product from customers getting to know the real features or side effects and don’t embarrass the buyer and ruin a sale. As we well know, these kinds of actions have caused serious health issues to thousands of loyal customers. As the marketing age money sign says, “If the cash is there, we don’t care.”

We can see the same in the banking world. For example, does the transfer payment form show how much sending 1,000 euros to other countries will cost you? Based on the rate that money will be converted, is it good? This information is hidden, so as to not confuse the user and divert their attention.

The Experience Age, in this case, should be a better place to live because such an attitude will be exposed instantly on the internet. It is hard to keep it secret for very long. And we’ve heard a lot of similar revelations recently. We should not fear the world or be aggressive towards it because the world is full of opportunities. Everyone can find their unique place in it and deliver value to the people around them.

So, why would you protect your business from market disruption if you could lead it? Instead of protection, gain inspiration from others!

In 2007, Nokia reached 1 billion customers and $100 billion in capitalization. The same year, the first iPhone was released. Ten years later, the Nokia Devices Unit was sold for $350 million. They failed to protect themselves from disruption. At the same time, Samsung sold even more phones than Apple because they nailed it.

We still see a lot of protection cases. Recently, some of my friends could not add funds to their fintech e-wallet account with top-up using the card function. Their bank just didn’t allow those transfers. That raises the question of who’s blocking — and why.

Instead of thinking about how to protect their product and stop customers from leaving, banks have to change their mindset to figure out how to disrupt themselves and their competitors. In the Experience Age, disruption is the only way to provide more meaningful and pleasant experiences for users. Let’s challenge the outdated legacy and find an innovative solution that matches user needs more effectively.

For example, Transferwise offered wire transfers with low transparent fees and fair currency rates using peer-to-peer technology. On average, Transferwise is 83% less expensive than the big four UK banks on major currency “routes” and moves over £2 billion every month globally. You can easily calculate your transfer costs right at the main page with no registration. They are not hiding anything.

Transferwise disrupts the industry by reducing the fee instead of hiding it, which had been common practice. Should banks protect themselves from the likes of this firm? Or emulate it, and bring more transparency and fair rates? It depends on your business priorities – to make profit or deliver value. Fidor Bank found the answer and implemented Transferwise into its services.

Companies that are tended to protecting themselves usually are confident they can tackle the challenges of the digital age on their own. But they are most often mistaken and end up disappointed with the result compared to the disruptive outcome achieved by businesses that are open minded and dare to go out of their comfort zone. Because such businesses are seeking advice and inspiration from specialists experienced in the field.

Self-Assessment: Are you still trying to save your business from dangerous trends and aggressive competitors? Or, are you like pioneers who open new paths and challenge things around you? Evaluate your strategy, values, employees and products and mark your position at the scale.

5. Create Flow and Avoid Fragmentation

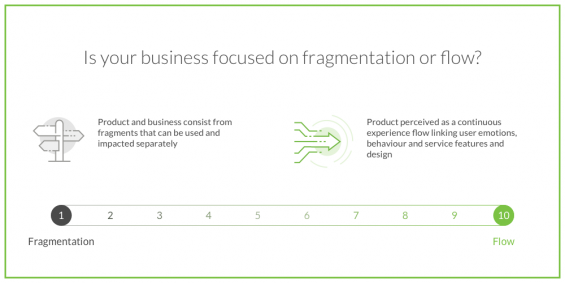

It is common to overlook business or products as separate parts. Do we have some problems with sales? Ok, let’s upgrade our marketing department. We have too many claims; just change the script for the support team and get «fresh blood». Is UX design trending? Add it to our marketing activity list into the section with different digital channels.

Does it look familiar? It is a traditional approach in marketing-oriented companies. Even in the organizational structure, they have different departments that compete with one another for budget and power.

They perceive reality and business as fragments that can be changed or upgraded separately. That’s why their products usually look like Frankenstein’s monster, different pieces that don’t fit one other. And, of course, they take a lot of time to develop because everyone has their own opinion. As a result, best business intentions can look very frustrating from the user perspective.

Imagine an attractive shiny restaurant with a messy, dirty kitchen. Would you like to have dinner in such a venue? For example, one bank decided to switch their authorization process to a fully digital flow. To make it secure enough, they provided it through another app. To log in, users have to switch between two apps several times. Such a fragmented flow causes frustration to the majority of users.

Obviously, this has been done with the best of intentions to ensure payment security. But does it really matter if the user has to quickly send money to a friend and is confused by the complexity of such fragmentation?

In another example, consider a form in which the button “next” is placed on the right but then, before confirming the purchase, it appears on the left. It looks like those screens were designed by two different people without using the same design system. If we look at a larger perspective, then starting an online application for a bank account and then confirming the account in the bank branch creates frustration for users who are aware of digital-only alternatives.

As user-centered architects, we know that the human brain perceives experiences as a continuous flow and usually connects different contexts with one other as a whole entity. For example, customers don’t care that sellers don’t manage claims and it is necessary to contact the support team. They simply want a solution from the same person who sold the product. If we look deeper at this particular struggle, we can even find that those claims are not a job for the support team but a result of the sales team’s over-promises and production team’s weakness.

It works the same way for the user experience. If you map your service as a user journey, you can easily detect fragmentation and reunite the flow. Think about the user who has insufficient funds to make a payment. Why does he need to learn that after he has already spent time entering the data and tapping the sending money button? Instead, show the balance before or during the payment flow.

The Experience Mindset does not perceive products as separate parts; instead, it sees the product as a continuous experience flow, even lasting for years. Such thinking allows one to detect links between user needs, emotions, behavior and service features, designs and strategy.

Self-Assessment: Where are you on this scale? Does your brain generate fragmented solutions in the majority of situations and perceive words as unconnected parts? Or, maybe you have already created a holistic journey for your product from a customer perspective? Try to find at least one solution that can take you closer to the flow product mindset. Maybe you can reduce friction in your onboarding process, make customers engaged with a fully digital experience or create a user journey map. Find the first step and write it down.