Banks and credit unions have been bumping up starting salaries in an effort to lure talent during a time of record-low unemployment. But if financial institutions don’t offer programs that help employees advance their careers, staff turnover may continue to be a problem.

That’s one takeaway from the Crowe bank compensation and benefits survey, which identifies lack of opportunities for career advancement as the chief reason for leaving a financial services job. Pay is second.

“If financial institutions could start to focus on career-development plans for their employees, maybe it would help with turnover, especially since that’s the No. 1 reason employees are leaving,” says Stephanie White, a financial services consulting senior manager at Crowe and a contributor to its fall 2023 report on compensation.

The survey, which Crowe has done annually for 42 years, is based on responses from 388 banking organizations nationwide, about half of them with between $500 million and $5 billion of assets. The accounting and consulting firm tracks salaries and raises for many officer and nonofficer positions as a benchmark for the market, and a table farther below displays those median figures for nearly two dozen job titles.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Recruitment and Retention Challenges Persist

Recruitment and retention have been challenging for banks and credit unions for at least the last two years. The U.S. unemployment rate has hovered near historic lows since the waning of the Covid-19 pandemic and employers across many industries have been struggling with finding enough workers to fill jobs.

While the crunch eased during the first half of 2023, progress appears to be reversing. In September, there were 512,000 job openings nationwide in finance and insurance, compared with 417,000 in August and 321,000 in July, according to data from the U.S. Bureau of Labor Statistics. The federal agency counts job openings as of the last day of each month.

Banks and credit unions already have been increasing pay among frontline retail staff as they moved away from transactional tellers toward universal bankers trained to focus more on product sales, says Jamie Eads, director of retail staffing for Bancography, a consulting firm based in Birmingham, Ala.

Salaries also have been rising to combat turnover, particularly with frontline roles, she says. “That’s the first line of defense with your customers, or, for credit unions, your members.”

Who Got the Biggest Pay Raises?

Among the roles with highest percentage pay increases in 2023 were hourly positions, such as tellers (ranging up to 9%, depending on level) and teller operations supervisors (14%). Employees in these roles have career options outside of banking that pay comparable salaries, but come with less responsibility and more flexibility, Crowe says.

But opportunities for career advancement are not evenly distributed, Eads says. “The larger an institution, the more opportunities there are.”

Still, it’s possible to carve pathways for career growth even within job categories, Eads says. A financial institution can start a loan specialist on installment loans, for example, and then gradually promote them into mortgages or home equity loans, where they can earn more pay.

“There are opportunities to create that without it being, ‘Hey here’s a whole other layer of middle management,’” she says, noting that banks have flattened their corporate hierarchies over the years.

More Banks Are Relenting on Remote Work

This is the first year Crowe asked survey respondents about the reasons employees gave when leaving for new jobs.

Nearly half of the banks, or 44.6%, cited “lack of career development,” as one of the reasons people left.

“Inadequate total compensation” was second at 42%, followed by childcare issues, which were cited by about a quarter of the respondents, likely reflecting the challenge of finding quality, affordable care. This issue became more prevalent nationwide in the wake of the pandemic, as many daycare centers closed down.

Lack of workplace flexibility was fourth, at just over 20%, but this is an area where financial institutions have been improving, according to the Crowe report.

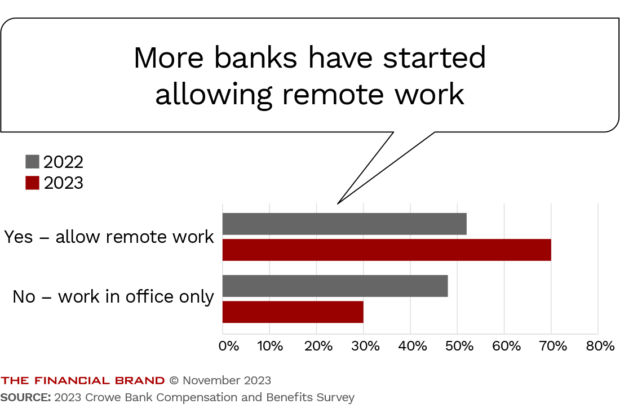

Indeed, while debate has swirled about a return to the office, more banks are allowing remote work. This year, seven in 10 banks said they allow one or more days of remote work, compared to 53% last year.

“It demonstrates that the banking industry — which might adopt changes more cautiously — is aware that staying competitive means nontraditional accommodations are necessary,” the Crowe report says.

Along with the increase in remote work, banks are increasingly likely to hire people outside their geographic footprint, Crowe found. Nearly 11% are willing to hire people for fully remote work, with credit analysts among those deemed most adaptable to a work-from-home environment.

Expanding remote work opportunities is an option to help contend with the ongoing challenges in recruiting new talent and retaining existing talent, Crowe advises.

Read more:

- What Inspires Your Employees? That’s the Key to Retention

- 8 Tips for Building Effective Employee Incentive Programs

Pay at Banks Still Climbing, But Raises Are Smaller

Pay raises at banks continue to make headlines. The latest volley came from Bank of America. In September, the Charlotte, North Carolina-based megabank hiked its U.S. minimum wage to $23 an hour and announced plans to raise it to $25 an hour in 2025.

Such moves are likely to put pressure on smaller institutions, White says. However, they have already been lifting salaries, making their frontline jobs a more attractive proposition.

Even six months ago, banks’ lowest wages were not that far above the fast-food industry, White says. Now, “they’re starting to pull away a little bit, which is good.”

Overall, salaries rose less quickly in 2023, following double-digit increases between 2021 and 2022. And, in a few isolated cases, salaries declined.

Trends in base salaries at banks

Entry-level tellers, for example, notched a 17% median increase in pay in 2022. The increase was roughly half that, or 8.6%, this year.

The top gainers this year are teller operations supervisors. They enjoyed a 13.8% median raise, although it is down from 19% a year ago. The second-highest gains went to data-entry clerks, who had a median raise of 9.3%. This is one position that runs counter to the trend of the shrinking raises, as the 9.3% is a big improvement over the median raise of 2.9% that data-entry clerks received in 2022.

On the other hand, median pay declined by 1.2% for those starting as credit analysts and by 0.5% for customer service representatives.

Despite receiving significant base wage increases in 2021 and 2022, the teller position remains the most difficult to fill and to keep filled, according to Crowe, which suggests that financial institutions get creative to stand out from other industries competing for people in this salary range.

Read more:

- The 0% Loan: How This Unique Employee Benefit Works

- Jamie Dimon on What It Takes to Be an Effective Banking Leader

Is the Higher Pay Helping Banks Reduce Turnover?

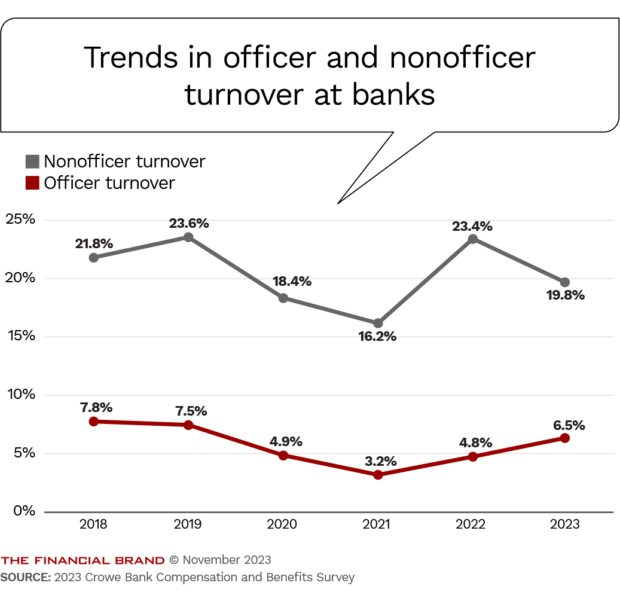

After a year of quiet and not-so-quiet quitting, turnover rates are generally down at financial institutions, at least on the frontlines.

The nonofficer turnover rate dropped to 19.8% in 2023, the lowest it has been in years. It is now below even pre-pandemic levels, which were north of 20%, according to Crowe.

However, officer turnover inched up for the third year in a row. It hit 6.5% in 2023, up from 4.8% the previous year and a trough of 3.2% in 2021.

People who can fill certain roles — like chief compliance officer — are in high demand. But even so, the forces driving the increase in officer turnover are unclear, White says.

“I know there’s a high demand for talent, especially knowledgeable, experienced employees,” she says. “So once you get some experience, what I suspect is that they’re being lured away from their current position by promises of more money or better benefits or maybe the ability to work from home.”