With all of the recent news around fraud and data breaches, consumers are more focused on the safety of making purchases. This awareness has manifested itself in shifts in payments choices as well as expectations related to mobile payments.

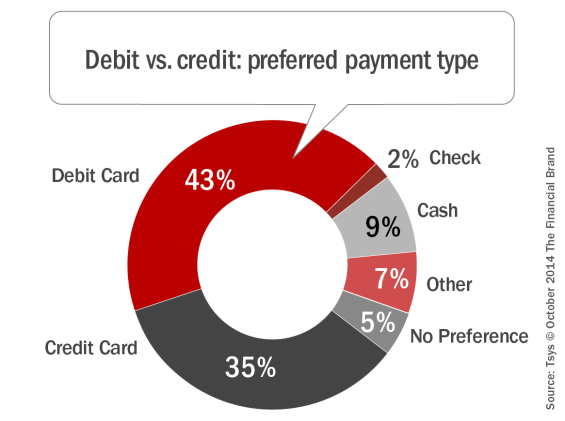

For instance, while debit cards continue to be the most popular form of payment in the U.S., the popularity dropped more than 12 percent from 2013, according to a new report from TSYS. Forty-three percent of respondents preferred debit as their overall payment type in 2014 compared to 49 percent in 2013.

During the same period, respondents preferring to use credit cards remained unchanged at 35 percent. “Credit card preference is likely attributable to the fraud and risk concerns of consumers,” the report said. “Eighty-nine percent of respondents felt that it was safe to use their credit card, while that number dropped to 83 percent for debit cards.”

In addition to the shift away from debit cards, key findings include:

- Many consumers use various cards to manage their finances and can be influenced by convenience and value added features such as rewards.

- Consumers are concerned about the security of their payment cards and are increasingly demanding new security tools.

- Online payment choices differ from POS choices, with credit cards being the preferred way to pay in-store.

- Interest in mobile payment options are increasing slowly, with fraud prevention and risk reduction being primary inhibitors to growth.

- Rewards and offers continue to be the biggest controllable factor to influence payment choice.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Consumer Payment Preferences

The TSYS study asked respondents to indicate which features they most value in their preferred payment type. As could be expected, having a purchase deducted directly from a checking account and the ability to get cash from an ATM were the leading drivers of the consumers’ preference for using a debit card (66% and 55% respectively).

For credit card users, rewards were the highest ranking feature (52%) by a large margin, with the card brand (33%) and payment options/flexibility their card (24%) being the next most desired features. The significant reduction in debit card rewards programs contributed to the low ranking of rewards for debit (24%) compared to credit.

Value-added features like text alerts and mobile access were rated higher than in last year’s survey. These value-added features reflect the importance of being able to control risk and the movement to mobile channels for payments.

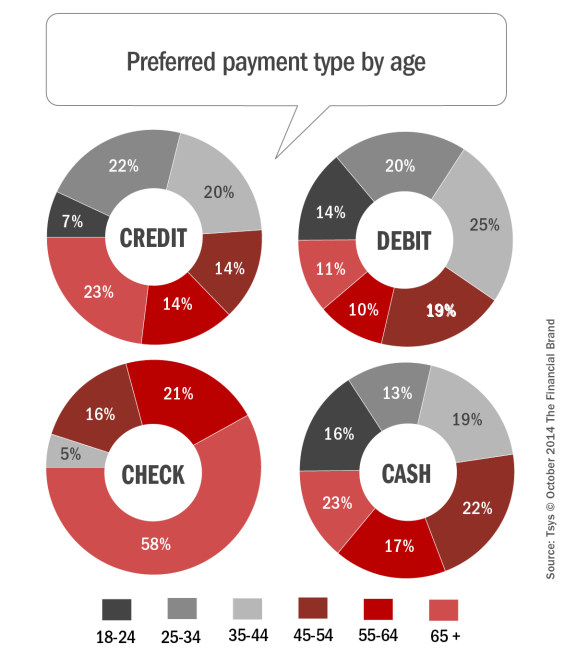

There were distinctive differences in payment choice based on both age and income. “The most over-represented age range of those who preferred to pay using a credit card was 65 and older, while respondents age 18-24 were the most under-represented in choosing credit as a preferred method of payment,” the TSYS report said. “Of respondents who preferred to pay using their debit card, the 35-44 age range was the most over-represented. Respondents age 18-24 and 45-54 were also over-represented in preferring debit as their payment method.”

The younger respondents age 18-24 and respondents in both the 45-54 and 55-64 age ranges were overrepresented in the group who prefer to pay with cash.

In 2014, higher earning consumers continued to be over-represented in the credit category and under-represented in the debit category. Consumers earning more than $150,000 were equally represented in the cash and credit categories, indicative of consumers who use credit to get rewards, pay off their balances monthly, and use cash for smaller transactions.

Lower earning respondents were over-represented in the debit category, with cash being the preferred payment type for the lowest earning consumers. This finding is similar to what was seen in 2013.

![Preferred_payment_type_by_income[2]](https://thefinancialbrand.com/wp-content/uploads/2014/10/Preferred_payment_type_by_income2-565x684.png)

Influencers of Payment Choice

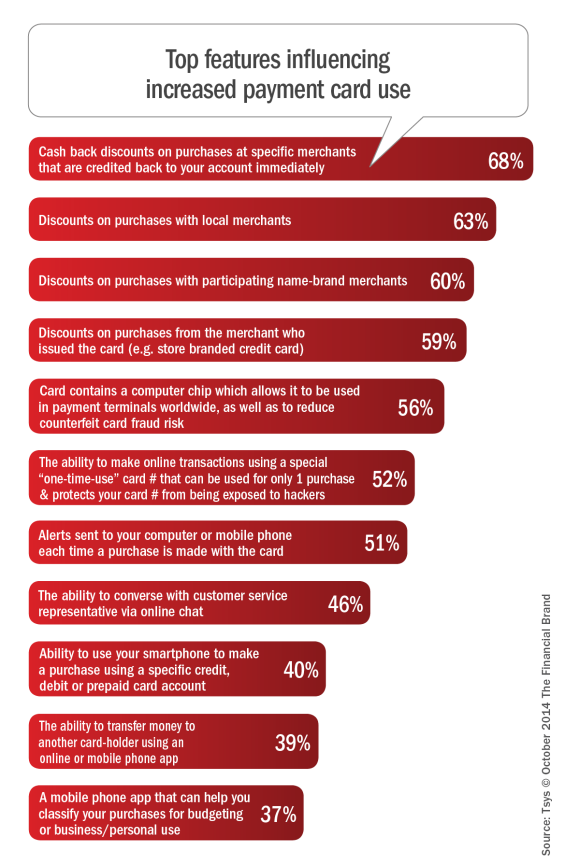

Issuers try to find the ‘sweet spot’ of features and benefits is an effort to increase payment enrollment, engagement and retention. When survey respondents were asked to indicate, on a scale of one to five (with five being the most effective), what features would lead them to use one payment card over another, rewards and discounts were the most desired followed by security features.

Monetary inducements like discounts and rewards took the top four spots, with around 60 percent of all respondents indicating fours or fives when given specific examples. Features which help prevent/control fraud received high marks from over half of the consumers surveyed.

The largest increases in scores came from those related to security. Consumers showed an increased desire for chip and pin cards and digital/email alerts.

When asked how offers were received by their bank, traditional mail and email were the most mentioned channels (63% and 49% respectively). Following direct mail and email, offers by text message (15%), advertising (11%) and mobile alerts (10%) were also mentioned. Seventeen percent of consumers said that they did not receive any offers from their financial institution in the past year.

Importance of Security Features

As mentioned, enhanced security with regard to payments is important to customers and to issuers wanting to increase utilization. Forty-eight percent of respondents said that they had heard of EMV/Chip cards, with 84 percent of those who received a chip card indicating they had no trouble using the card.

After watching a short video about how chip cards work, 66 percent of respondents said that the process seemed no more difficult than using their current card – and that it would make them feel safer. Sixteen percent indicated that it seemed more difficult to use, but that they would feel safer when using their card.

Only 8 percent of respondents said they had heard of tokenization. “It will be interesting to compare results next year once payment offerings that utilize tokenization features, such as Apple Pay and other mobile payment options, have become more widely offered,” mentioned the report.

Mobile Payments Still in Formative Stage

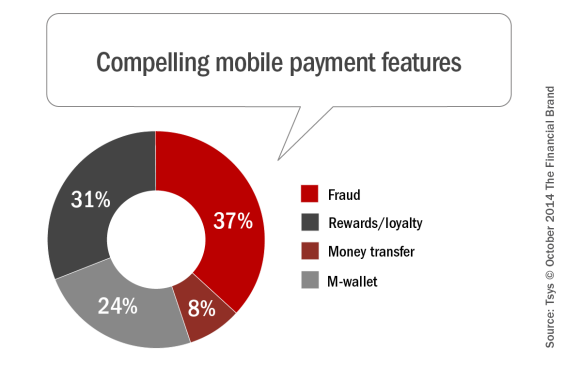

While consumers are becoming more and more attached to their mobile phones, the same can’t be said for their affinity to make payments using a mobile device. When asked about features that integrated payments and mobile, respondents to the TSYS research found fraud prevention and risk reduction tools the most important.

The only other features that scored a ‘net positive’ sentiment were discount and loyalty related features. “When asked about the use of smartphones in conducting different types of payment transactions, we saw that consumers were very interested in taking part in protecting their accounts by using mobile tools to monitor and track payments. We did not see quite as much interest from the respondents in actually using their smartphones to make payments,” the report found.

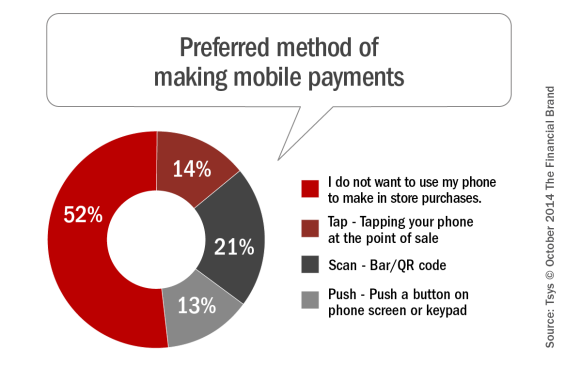

In fact, when asked about making making payments using a mobile device, 52 percent did not have an interest in this capability. For those who did have a mobile payment preference, the most-preferred method of paying was through scanning a bar code or QR code (21%), with 14 percent preferring a top-and-go option and 13 percent wanting to push a button on the phone to pay.

Implications

Based on the results of the TSYS study, it is clear that consumer selection of payment option is driven by security, ease of use and the ability to integrate with their normal financial lifestyle decisions. Rewards and special offers can also alter the use of different payment options. To succeed, banks and credit unions will need to enhance their offerings to reflect changes in consumer sentiment.

In another TSYS study, ‘Opportunity Knocks: How Card Issuers Can Address Consumer Concerns Around Payment Security,’ 63 percent of consumers indicated they would likely switch accounts in order to obtain more robust security features. Based on the lack of awareness around both EMV cards and tokenization, if security enhancements are offered, consumer education programs should be considered.

Finally, as financial institutions try to increase awareness and utilization of mobile wallets, rewards and incentives will most likely be needed in addition to security features to move the needle on mobile payment acceptance and use. To replace the familiar and easy-to-use plastic card, an enhanced value proposition will need to be presented that improves the consumer’s daily life.

Download the Study

TSYS surveyed more than 1,000 consumers who owned a debit card and a credit card. Thirty-nine percent of respondents were men and 61 percent were women. Survey demographics were geographically proportionate by region. Primary credit card relationships were mainly with banks (76 percent) followed by credit unions (14 percent). Consumers also had primary credit card relationships with retailers (3 percent) and airlines (2 percent). Five percent of consumers indicated their primary card relationship as “other.” The majority of other responses indicated relationships with American Express or Discover. You can download a PDF of study after completing a short form on the TSYS website.