Did you know that, on average, people stay with their financial institution for 17 years? Even more surprising, people are more likely to stay with their bank or credit union longer than they will stay with their partner.

For financial institutions, this means that winning a new client ranks highest because each onboarded customer is likely to become a loyal account holder for years to come.

But what happens when the banking onboarding experience is long and complicated? It makes it difficult to estimate how many customers are lost in the process — but you know they are leaking out of the system.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

A One-Man Test of a Dozen Onboarding Routines

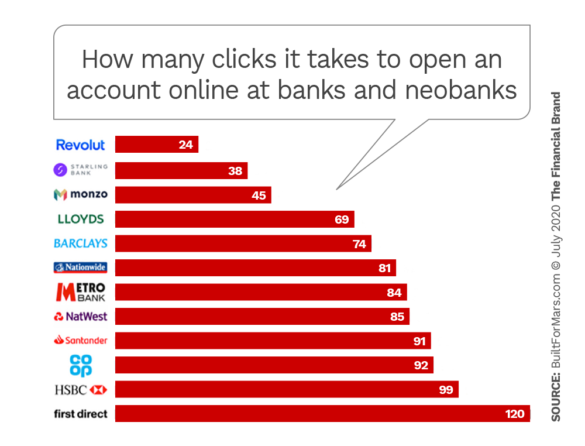

A long and complicated onboarding process costs a lot in the long run. Peter Ramsey, founder of the UX site Built for Mars, conducted a test where he opened 12 real bank accounts and logged everything involved in applying for an account online. The results showed that traditional banks’ onboarding process is significantly longer and more complicated than the newer challenger banks.

“The challenger banks not only required the fewest clicks but needed significantly fewer than even the best-scoring traditional bank. It took five times as many clicks to open an account with First Direct than it did with Revolut,” Ramsey wrote in a blog.

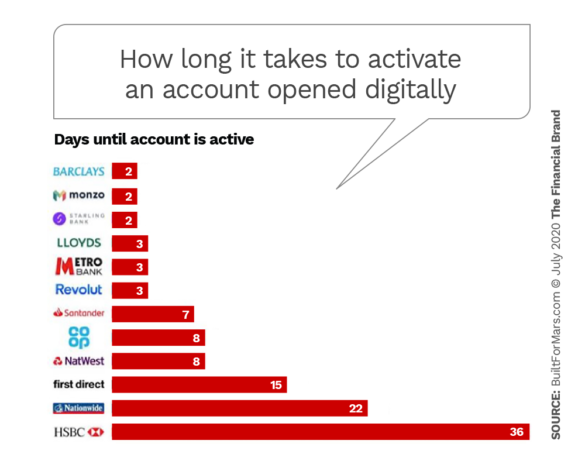

Another astonishing statistic is how long it actually takes from onboarding to actually having an active account at some institutions. While this anecdotal evidence shows the experience of a single person, 36 days seems unreal for any type of account, leave alone a retail banking account.

This is even more amazing when the bar has been changed so drastically by the likes of the Apple Card, offered by Apple and Goldman Sachs. On an iPhone one can apply, receive approval and commence using the “card” digitally in minutes. Consumers’ patience with laggards is growing thin.

Read More:

- It’s Time for Banking Providers to Stop Faking Digital

- Are Today’s Banks Prepared To Deploy Tomorrow’s Technologies?

- Most Financial Institutions Still Make Banking Too Difficult

For Many Financial Brands Better CX Remains the Impossible Dream

For customers, onboarding often remains a challenging and time-consuming process. Traditional processes, as well as some so-called digital efforts, are often heavy with friction, which seriously impacts conversion rates and the cost of acquisition. Manual processes, paper and PDF documents, needing to visit bank branches to complete processes started online, awaiting approval, and passing information through a series of systems all contribute to delays and inconvenience.

Instead of using the onboarding experience as an opportunity to demonstrate a superior customer journey, many financial institutions squander that opportunity. They often overwhelm potential customers with boatloads of data requests and lengthy waits.

Often this behavior is blamed on regulation. But that’s no excuse for a bad experience.

Yes, banking is a highly regulated industry, and a complex documentation trail is required. Banks and credit unions must put their customers through a Know Your Customer process, These rules are strict and often require that documents be signed in person or sent via mail. Each step of the process requires waiting for approval before moving on. However, eSignature adoption is skyrocketing as regulators across the world are shifting rules to accommodate new digital realities.

Traditional onboarding means consumers must re-enter information multiple times, and employees have to manually input the data into other systems. In the end, human resources and a new customer’s time are wasted on unnecessarily repetitive data entry and tedious paper-pushing.

Read More:

- 5 Tips to Improve Customer Onboarding for the ‘Next Normal’

- Accelerating Your Financial Institution’s Onboarding Success

Five Steps to Frictionless Onboarding in Banking

None of this makes sense and there are huge opportunity costs. But institutions can take measures to fix the situation.

1. Transform paperwork into opportunities for digital engagement.

For years, financial institutions have settled for making their paperwork as painless as possible. However, paperwork can be transformed into responsive digital journeys that are built to improve engagement and boost revenue growth.

2. Embrace “no-code” for agile development.

To ensure a user-friendly process, the process must continuously adapt to changes in customer behavior and preferences. But when it takes months to develop a single process, adapting quickly to customer behavior is impossible. The very first step to improving the banking onboarding experience is to slash the time it takes to revamp a digital journey.

No-code development may help here. Coded solutions are great for one-off projects that require a lot of customized features, making formal programming time worthwhile. However, a no-code platform is an ideal tool to improving the onboarding experience. No-code means enabling both programmers and non-programmers to create application software by manipulating graphical user interfaces — like building blocks —instead of doing traditional computer programming.

3. Treat transformation of digital customer experiences as priority #1.

It’s clear that digital and remote is becoming a primary channel of communication with customers. To capitalize on this shift, it’s imperative that banks and credit unions change the way they look at digital and prioritize customer experience over other considerations.

4. Use data to differentiate and personalize experiences.

Transforming the customer experience depends on seamless multi-channel experiences. As far as customers are concerned, their data flows freely between devices and processes. There is no need to ask irrelevant questions, or questions they know your institution already knows the answers to. Ensuring two-way integration between front-end experiences and backend systems can help the bank achieve a high level of personalization for the process.

5. Be customer-led, not technology-led.

Consumers don’t care about elegant technological solutions being implemented in back-office systems. Customers want a great user experience and the ability to easily and quickly apply for banking products.