Plenty of financial institutions think they offer “digital account opening” when they really don’t. It’s basically in-branch or not at all.

Other banks and credit unions, however, are actively working to use biometrics to permit consumers to open an account in seconds by unlocking and sharing personal data in their smartphones.

The majority of financial institutions fall somewhere in the middle. Some allow consumers to open accounts partially online but require people to come into a branch to finish the process.

As of 2017, 48% of institutions surveyed worldwide said they could open a checking account completely online, according to Digital Banking Report’s Account Opening and Onboarding Benchmarking Study. But that really depends on how you define “account opening” — just starting the application started? Or finishing it entirely in digital channels, and funding the account?

How many financial institutions offer true, end-to-end mobile account opening? Just 24%.

Reality Check: These days, if someone can’t open an account today without stepping foot inside a branch, then you don’t really offer digital account opening.

Right now, digital capabilities among banking providers “varies wildly,” says Derek Corcoran, Chief Experience Officer at Avoka. Just because a bank is huge doesn’t mean they are on the forefront of online account opening.

“Some really big banks — those with over $20 billion in assets — have zero capability to acquire customers digitally,” he explains. ”

And then there are institutions like First Tech Federal Credit Union ($12 billion in assets), where 31 out of 32 retail products have a mobile-friendly application experience. According to Corcoran, the only institution with a higher percentage of products supporting digital applications is Capital One.

Read More: Is Your Online Account Opening Process Driving People Crazy?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Abandoned and Forgotten

According to the Digital Banking Report, the abandonment rate for online account opening is 19%. Abandonment rates increase significantly as the time required to complete an application increases. In 2017, research revealed that one in five financial institutions have an online account opening process that exceeds ten minutes.

Another big cause of abandonment is the absence of a “save and resume” function. Corcoran says such a function allows consumers to partially complete and application in one channel and come back to it later on the same or different device, or pick up the process in a branch.

Customers who abandon, save an application, or complete an inquiry form are the best source of leads for an institution (Amazon does this constantly). This is one area where larger institutions have a clear advantage. Corcoran says big banks are much more adept at identifying consumers who abandoned an application for an account or a loan, then reconnecting with them. Smaller institutions — particularly community banks and credit unions — forget to nurture those leads.

Marketing automation tools — ranging from powerful enterprise-grade platforms like Salesforce, Marketo, and Eloqua to solutions like Pardot and MailChimp — can help ensure appropriate follow-up with these prospective customers.

According to Corcoran, the impact of recapturing abandoned online applications is huge. One large bank emailed applicants who had saved a checking account application without completing it, and converted 9% of them in just 12 hours — with a single email reminder. Another large bank in Australia telephoned those who abandoned an application for a personal loan, and converted 40% of them to borrowers within three calls.

Read More: Improving New Account Opening Process Increases Sales for Santander

Phone, Laptop or Tablet?

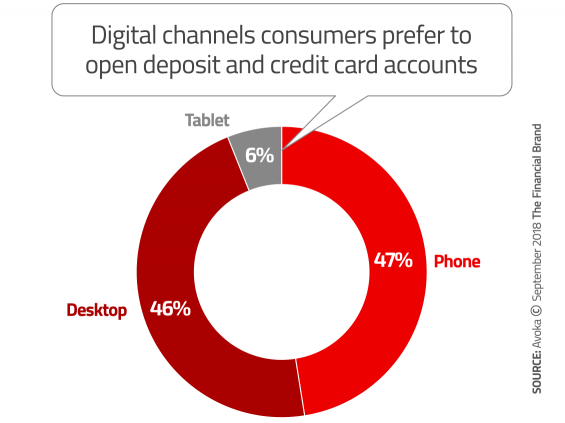

Avoka’s Digital Sales Report, which tracks the progress of large banks in delivering mobile-friendly experiences for account opening, loan origination, and card applications, shows that smartphones have edged past desktop computers as the preferred device for consumers to apply for products like checking accounts. That means a mobile-first experience is crucial to effectively acquire new customers.

Avoka’s research found that large national banks are seeing more than 60% of their total digital applications coming from phones. For institutions using mobile-first design, completion rates can be higher on phones than desktop computers.

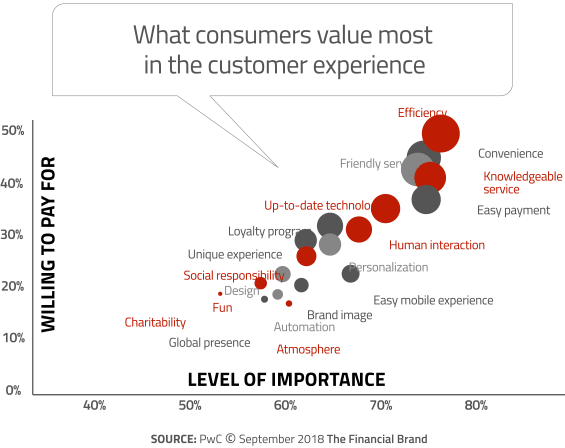

Efficiency and convenience are the critical aspects of customer experience, according to research from PwC. These characteristics power digital transformation, says Corcoran, and therefore, a smartphone experience that can be completed as quickly as possible (with minimal fields, etc.) is the ideal design.

“Customers expect technology to always work,” says the PwC research report. “They want the design of websites and mobile apps to be elegant and user-friendly.

Read More: Six Ways to Improve the Online Account Opening Experience

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Start With Digital Channels First

Ultimately, banks and credit unions should have an omnichannel approach to account opening, allowing consumers to bounce between channels — online and branch, branch and call center, etc. — as they complete their application. The truth is that few institutions can wrap their arms around an initiative with goals this grand.

Corcoran says most financial institutions should just start with just the digital channel first. The digital channel allows for rapid A/B testing to help identify issues and best practices. Once the experience has been ironed out, lessons can then be extrapolated and applied to other channels like branches and the call center.

“Banking providers are leveraging lessons from their onboarding experience in self-service digital channels in their assisted channels like branches,” Corcoran observes. “This paves the way for omnichannel cross-over — i.e. allowing someone to start in a digital self-service channel, then pick up in the branch, or vice versa.”

Corcoran says you don’t need separate systems for each channel. “In fact, it’s better if you don’t,” Corcoran explains, “because it would make channel cross-over and consistency of experience harder to achieve.”

Corcoran adds that from a tech perspective, there’s no real difference in applying a simplified account-opening solution in different channels. What is different is the training required for branch and call center staff. That takes time.

Read More: Digital Account Opening Expectation Gaps Remain

What About Complying With ‘Know-Your-Customer’?

Corcoran finds many banks and credit unions asking, “How do some institutions get away with asking for so little information in their digital account opening?

In Avoka’s experience, the requirements associated with anti-money laundering, Bank Secrecy Act, and Know Your Customer regulations are open to interpretation. The larger institutions, says Corcoran, use a combination of internal compliance experts along with consulting firms that have specialized practices in these areas to determine what’s absolutely required.

One suggestion Corcoran offers can help institutions of any size successfully navigate the compliance minefield: Include the risk, compliance and legal teams in the design of a streamlined account experience.

“When these teams are involved in the design and are exposed to data such as the correlation between ‘time to complete’ and ‘abandonment’,” he says, “they are more collaborative in the design of a frictionless experience.”

But if they are excluded from design conversations and then given something to approve, they don’t have the right context to ensure a great customer experience.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Four Steps You Must Take Now

Based on his interactions with institutions of all sizes, and research data, Corcoran offers the following four suggestions to assist banks and credit unions get up to speed on digital account opening and onboarding.

1. Design from “the customer in,” not from “the bank out.” Many banking providers build a digital version of their core-system-based account opening process. But those systems were designed for bankers by bankers, not customers. And many are decades old. Financial institutions should think about digital processes from the consumer’s perspective, and design around their needs and what’s easy for them. Focus on convenience and efficiency in account-opening and onboarding experiences.

2. Generate and nurture leads. Banks and credit unions should collect first name, last name, email and phone number as the first four fields in an application. Then, if the customer abandons the application process, nurture them as leads using that data. If someone abandons their application, it doesn’t necessarily mean they’re not interested. Perhaps they ran out of time, got distracted, were missing information, lost their internet connection, or ran out of juice on their device.

3. Reiterate the offer. If the customer is looking for a high-interest savings account, a $200 bonus for opening a checking account, a low-rate mortgage, etc., be sure to reiterate that offer/key benefit when they begin the application for that product. Remind them why they’re applying and reassure them that this is the correct application for that product.

4. Be Omni-Channel. It’s important to support channel cross-over, especially branch to digital. A customer might begin an application for a product in the branch – but might not have the time or information to complete it. Allow them to begin in a branch and then finish at home or in their office if that’s what they need to do. Don’t ask them to come back to the branch again. That’s inconvenient.