The coronavirus pandemic has forced the closure of an increasing number of schools, restaurants and major retailers globally, while sending workers home either because of sickness or to care for family members. It is only a matter of time before government calls for people to stay at home negatively impacts financial institution branch visits. There is also the possibility that banks and credit unions will need to reduce branch hours or completely close branches due to staffing challenges or for the health of their customers and members.

But the need for banking services will not cease. In fact, there will be an increased demand for credit availability, new savings and investment accounts, new or replacement debit and credit cards, as well as general financial advice. Unlike any time in the past, the ability for consumers to conduct all banking business digitally may be a matter of life and death.

Research by the Digital Banking Report, Fiserv and other organizations indicate that the majority of consumers and financial institutions are ill equipped for an instant migration to digital channels. For those organizations that have focused on building completely digital solutions, this period of digital transformation could provide a strong competitive advantage. Likewise, those organizations that have created tools for educating consumers on digital banking alternatives also are in a position of strength.

The fear and anxiety brought on by the rapid spread of COVID-19 is resulting in a change in overall consumer psychology. Social distancing and the awareness of disease vulnerability could change the way consumers who previously visited branches regularly conduct business forever.

For those financial institutions that invested in creating seamless, easy-to-use digital products and services, these investments will finally pay off. As consumers seek out digital options, this may also result in greater awareness and usage of fintech alternatives.

Read More:

- Banking Must Provide Financial Relief In Times Of Economic Stress

- The Top 7 Digital Transformation Trends in Banking

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Reliance on Branch Banking Remains

Despite a significant move to digital channels, most consumers use multiple channels to manage their finances. According to Fiserv’s Expectations and Experiences research, 58% of consumers prefer to interact with their primary financial institution via digital channels (online or mobile). This is significantly higher than those who prefer branch interactions (32%).

As expected, the channel of preference is highly related to age, with seniors having the highest preference for branch visits. All other segments prefer to interact with their primary financial organization through online and mobile, with Gen Z having the strongest preference for online and mobile channels (77%). In other words, the segment of the population most at risk for coronavirus are also the most likely to visit branches.

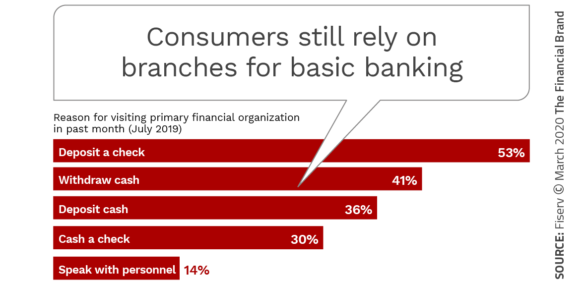

More important than the generational differences that drive branch usage are the transactional differences. Surprisingly, 50% of consumers overall visited a branch in the previous month. This frequency has remained relatively constant over time. The most common reason for visiting a branch was to deposit a check (53%) or withdraw cash (41%). Both of these transactions can be done digitally using remote deposit capture or by having payments made with a digital wallet.

Mobile Payments Begin to Meet Expectations

For several years, analysts have predicted exponential growth in digital payments and mobile wallet use. While not reaching expectations, recent growth is emerging due to a continued migration away from cash, increases in delivery of contactless cards, the presence of more advanced POS devices and the increased reliance on mobile devices by all generations.

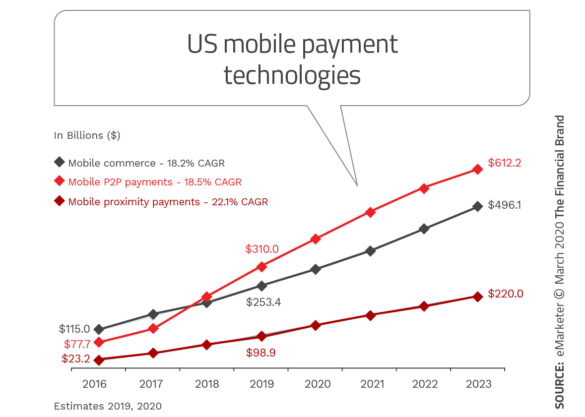

According to eMarketer, US mobile payment volume was set to rise from an estimated $662.3 billion in 2019 to an estimated $1.33 trillion in 2023. This estimate was done before the impact of the recent coronavirus pandemic. The research found that while mobile proximity payments were set to grow the fastest, mobile P2P payments would become the largest segment, hitting over $600 billion annually in 2023.

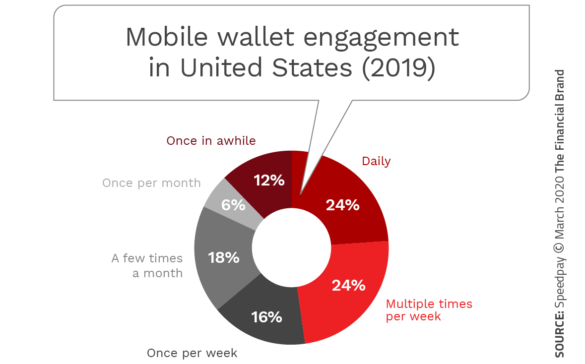

As part of the mobile payment evolution, mobile wallets are beginning to be used more frequently, with Apple Pay leading the charge. Beyond Apple Pay, many other wallet options are available including Android Pay, Samsung Pay, Venmo, Zelle, Starbucks, Square Cash and even Amazon. According to the Speedpay Pulse report, a quarter of US adults between 18 and 80 have adopted at least one mobile payment method, with 48% of those adopters using a mobile wallet more than once a week.

The Illusion of Digital Transformation in Banking

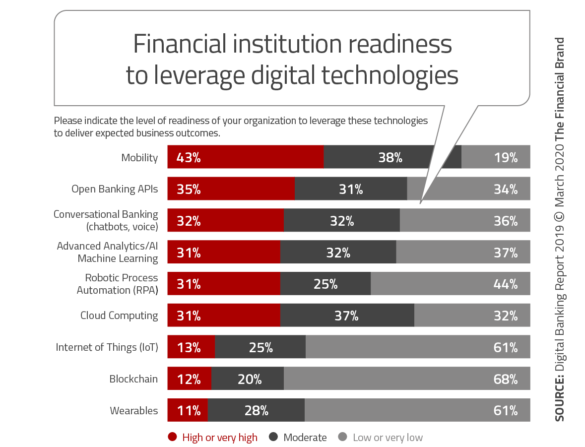

While more and more consumers are using digital channels and embracing digital payments, the banking industry is still frighteningly unprepared to react to an immediate shift to digital products and services that may be required by the recent coronavirus outbreak. According to the Innovation in Retail Banking 2019 report, published by the Digital Banking Report, only 43% of banks and credit unions thought they had high or very high readiness in the category of mobile technologies, with 19% stating they had a low or very low level of readiness.

Part of the reason for this lack of readiness is because few organizations have managed digital transformation from the ‘inside-out’ as opposed to simply focusing on a prettier app. Without building a mobile platform that significantly modifies how transactions and products are delivered, consumers will be stuck with a disjointed and hard to use application.

In a world that may be sequestered in their homes for an extended period of time, a requirement that a consumer must visit a branch at some stage of a ‘digital’ account opening or loan application process is unacceptable (or impossible).

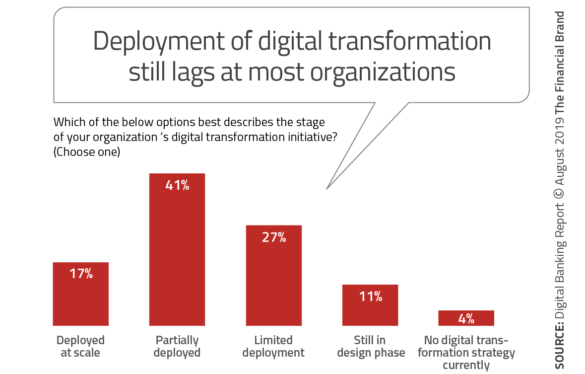

The level of readiness to leverage other, more advanced, digital technologies such as open banking APIs, advanced analytics, robotic process automation, cloud computing and the Internet of Things is even more alarming. In fact, when asked about the progress of digital transformation efforts, only 17% of organizations surveyed by the Digital Banking Report indicated that the transformation was ‘deployed at scale’, with 41% stating that digital transformation was ‘partially deployed’. An additional 38% indicated that their efforts were either in the design phase (11%) or had ‘limited deployment’.

Free Innovation in Retail Banking Report Download

Immediate Action Required

Based on a series of research studies done by the Digital Banking Report, there is no lack of understanding of what is needed to digitally transform an organization. In addition, research shows that most organizations know the challenges as well as many of the solutions that are available. Until recently, the reason for inaction was a complacent culture and leadership that was lulled into a false sense of security because of strong financial results.

Financial results at organizations that are not digitally prepared will suffer.

If consumers cannot deposit a check from their home, make digital payments, open a new account or apply for a new home remotely, market share will be lost. In addition, for those organizations that claim to be focused on a strong consumer experience – satisfaction and loyalty will be negatively impacted as well.

Three strategies will be needed immediately to respond to the needs of a remote consumer.

- Eliminate the Need for a Branch. When the health concerns around the coronavirus subside, many consumers may return to previous behaviors of visiting the branch for depositing checks, getting cash, depositing cash or getting advice. Or not. Banks and credit unions need to eliminate the need to visit a branch for any reason. It can be done. It has been done by many organizations.

- Improve Consumer Education. At a time of a health crisis, consumers are looking for options to stay safe. Most financial institutions have done a terrible job of ongoing education around the benefits and process of remote deposit capture, digital account opening, digital P2p and online bill payments, etc. In many cases, the consumer has not had the desire to be informed. That time has come and gone. It is imperative for banks and credit unions to reach out to any customer or member who has done a branch transaction and inform them of digital options.

- Increase Security Protocol. With the possibility of a major influx of new digital consumers and transactions, it has never been more important to ensure that the security around transactions remains strong. Communication around how digital transactions remain safe also needs to be communicated to a new segment of consumers who may be completely unfamiliar with digital privacy and security.

Focusing all available resources on the two strategies above will go a long way towards serving the consumer at a time of international crisis. It is incumbent on financial institutions to simplify digital engagement and to keep consumers out of harms way. This can be done if organizations eliminate the need for a branch interaction by fixing back office processes and delivering consumer safety messages around how to bank from home and conduct all basic banking using their phone and computer.