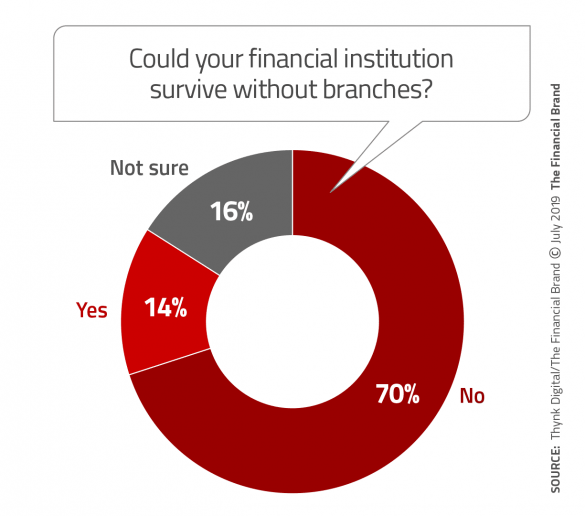

Branches aren’t just important to banks and credit unions. They’re viewed as essential to institutional existence by a significant majority in the industry.

Seven out of ten bank and credit union executives consider branches to be so important that their institution’s very survival depends on them. Considering the rapid migration of everyday banking transactions to digital channels and the corresponding sharp falloff in branch traffic, that is a startling conclusion. Why do so many retail banking executives feel this way? Are they clinging desperately to tradition or do sound reasons support their belief in the much-debated branch?

Many of the statistics from “The World Branch Report 2019” address those questions. The 62-page report, a collaboration between Thynk Digital and The Financial Brand, is based on surveys of nearly 500 executives from banks and credit unions worldwide and about 9,400 consumer users of financial institutions worldwide.

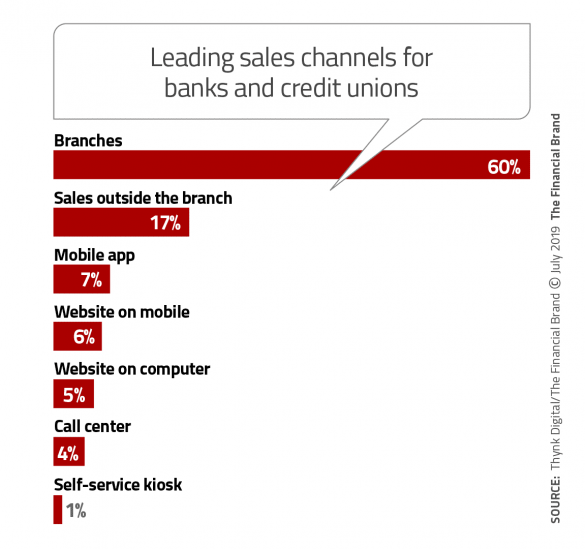

Support for the branch is found among both banks and credit unions, as well as large and small institutions, says the report’s lead author David Horton, Global Head of Innovation for Thynk Digital. Yet, any financial institution would be unwise not to have “becoming digital” their highest priority, Horton states in the report’s introduction. But equally foolish, he says, is to think that the branch is not an important component to being a digital bank. The branch still represents a critical means of establishing brand and identity, helping to create deeper customer engagement and competitive differentiation, according to the report. Furthermore, branches continue to be the dominant sales channel for banks and credit unions.

“A large element of the disruption pitch from the fintech world is that branches represent old-fashioned banking, and that people only want a mobile app as their financial services provider,” Horton tells The Financial Brand. “This is just not true. Mobile apps are a significant factor in customer retention and attraction, but then so are other services that branches provide best like mortgage and investment advice.”

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Branches Dying? No. But They’re Less Important

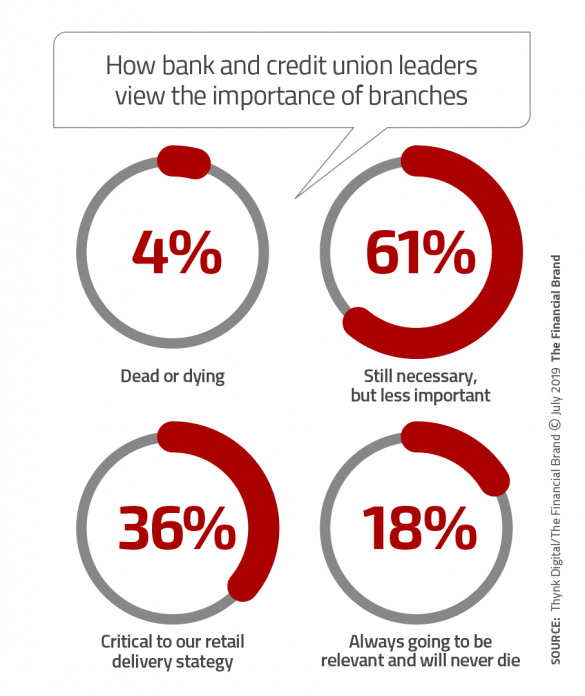

The overwhelming view of bankers is that branches are not going away anytime soon. A bit more than half (54%) believe physical facilities are either critical to the institution’s retail strategy or “will always be elevant.” Just 4% labelled the branch “dead or dying.”

The World Branch Report, however, does not portray a branch love-fest, by any means. Three out of five bank and credit union executives acknowledge that branches are less important than they once were.

Transactional activities have largely migrated to mobile and online solutions, lowering branch traffic consistently, the report states. Seven in ten retail banking professionals report branch traffic has declined over the past ten years with more than a third (37%) reporting a decline of between 10-25%, and just over a quarter saying traffic is down by 25-50%.

Despite that, nearly nine in ten (88%) either agreed or strongly agreed that branches add value for their institution’s customers. Much of this relates to complex, high-value services such as mortgage origination, retirement planning, and wealth management.

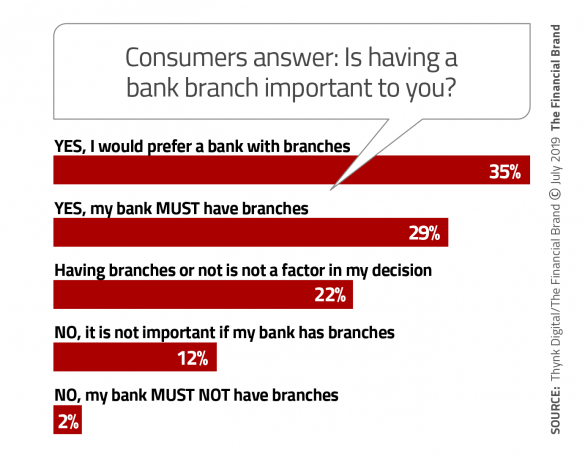

What do consumers think? Just about two-thirds of them say that having a convenient branch nearby is important to them in choosing a new banking provider, with just under a quarter saying it doesn’t matter either way.

Consumers were also asked, “Would you consider switching from your existing traditional bank to a digital-only bank?” The results reflect the changing dynamics of banking in a nutshell: 29% say they would switch to digital only and 20% say no, they wouldn’t. But the biggest segment, 41%, say they want to have both. (8% say they already have a digital-only account.)

“As the branch focus moves from transactions to product value and choice, customer experiences will separate the winners from the losers.”

— David Horton, Thynk Digital

The fact that 37% of people favor digital-only banking is impressive given that such providers are only a few years old, Horton states. “What I would say, however, is that a number of large, incumbent banks have already done well in matching the digital proposition of the startup challenger banks and as this normalizes across the industry it will be less of a factor in choosing what bank consumers want. As the branch focus over the next few years moves from transaction capability to product value and choice, customer experiences will separate the winners from the losers.”

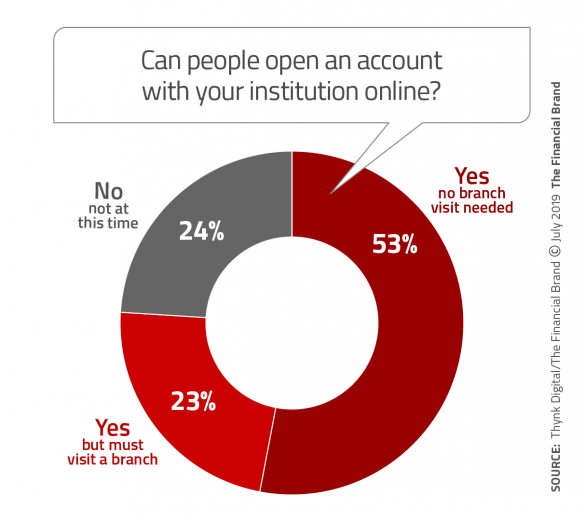

But digital transactions, and how easily they can be handled, matter right now. Just over half (53%) of financial institution leaders say consumers are able to open new accounts completely online with their institution. (Other studies have found a higher percentage, although that was among predominantly larger institutions.) As the chart below shows, more than one out of five banks and credit unions still require a consumer to come into the branch to complete an account-opening process begun online.

Compare that response, however, to what consumers told Thynk Digital: Just 10% say they opened their banking account completely online, while barely any (2%) had done it on a mobile app. 14% applied online and then completed the process in the branch. To be fair, these accounts may have been opened before their institution had upgraded its capabilities.

Key Takeaway: Consumer intent going forward is clear: More than two out of five (43%) would only consider opening an account online or on an app without having to come into a branch.

Read More: Don’t Abandon Branches to Favor Digital Banking Channels

Sales Remains the Secret to Branch Longevity

Despite sharply lower branch traffic, the physical channel still dominates in sales by a significant margin, Thynk Digital finds. Three out of five retail banking execs say the branch is the highest-performing sales channel, with everything else in single digits. Notably, however, online sales and mobile app-driven sales came in as high or higher than branches as the number two- and number three-ranking sales channels, so branches’ dominance is being challenged.

Branches still require people who can handle sales and service tasks, Horton states, although fewer people are needed. “When it comes to financial institution branches, the rule of thumb is that if a transaction or task can be done in less than five minutes, then use self-service. Otherwise ‘Robots need not apply’ — leave it to the humans!”

Banks and credit unions continue to invest in their branch networks with a variety of technologies, many of which support a shift away from handling simple transactions.

New branch tools and concepts already in use or being considered

| Considering | Planning to Deploy | Already Deployed | No Plans to Deploy | Not Sure | |

|---|---|---|---|---|---|

| Appointment setting tools/solutions | 31% | 18% | 22% | 17% | 12% |

| Two-way video conferencing/consultations or remote advisory services | 29% | 18% | 14% | 26% | 13% |

| Interactive video tellers (ITMs, VTMs) | 28% | 13% | 16% | 31% | 12% |

| Content management system for in-branch video marketing | 16% | 13% | 39% | 20% | 12% |

| Tablets for branch staff | 25% | 21% | 39% | 9% | 6% |

| Touchscreens | 26% | 13% | 25% | 22% | 14% |

| Cash recyclers | 9% | 6% | 57% | 14% | 14% |

| Universal bankers | 15% | 15% | 50% | 10% | 10% |

Source: Thynk Digital/The Financial Brand

As branch staffs become smaller, it’s no surprise that cash recyclers are used most often among respondents. That particularly makes sense because half of banks and credit unions are now using universal tellers. For the same reason, tablet computers have been deployed or will be by almost 60% of the institutions. Two-way video is still relatively uncommon in branches with a quarter having no plans to deploy it. That has implications for the ability to provide expert advice.

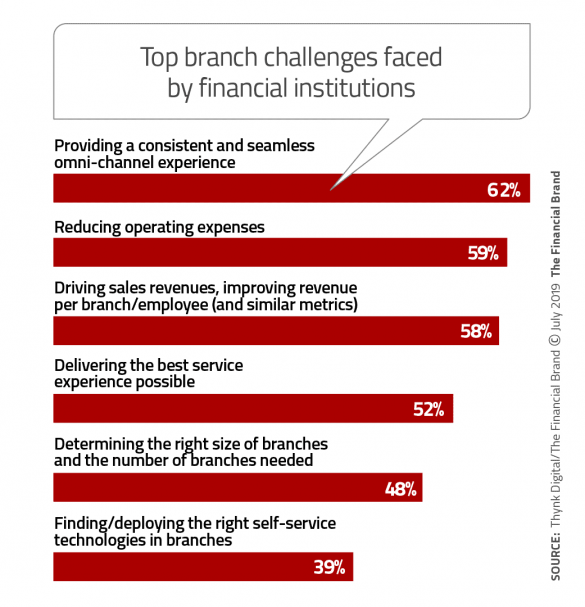

However, banks and credit unions have their hands full with other branch-related challenges, notably ensuring a seamless omnichannel experience, while at the same time reducing expenses.

Read More: Busting The Three Biggest Myths About Retail Branches in Banking

The Future is Advisory, But How Many Are Ready?

More than four out of five bank and credit union executives say that meeting with advisors in branches regarding mortgages, investments and other complex financial products is a service consumers want and value. Consumers clearly do value human input, but their preference for how to get it is more nuanced:

- Just over a third (31%) state that their preference would be to meet a financial advisor in a branch.

- One out of five (20%) would prefer to go online to speak via live video with an expert.

- More than a quarter (27%) say they would prefer to schedule a time to have the expert come to their home or workplace.

By comparison, just 12% of consumers say they prefer to do everything themselves online, and only 8% prefer to discuss options by phone.

Horton acknowledges that some advice is well suited to digital platforms, as demonstrated by the many robo-advisor applications. But advice based on “the type of information where it is not black and white is not yet suited to algorithms,” he says.

Horton notes that everything the experts can tell you at Apple Stores’ Genius Bars can be found online or by watching a YouTube video, yet these in-store help desks have been a big hit with consumers. Similarly, when people are not feeling well they will look for insights on WebMD. But when they have a serious medical problem, they go to a doctor.

Employees are the key to the evolving branch experience, Horton states. But he stresses that banks and credit unions must overhaul their 50-year-old branch-staff job descriptions, train people in hospitality skills and empower them with artificial intelligence tools and customer data.

The most likely trend Thynk Digital foresees is that branch staff will be retrained and reskilled to provide a “Level 1” or “Level 2” advisory service, much as what is done with IT support. “Offering expert in-branch assistance via video chat is a good solution that most consumers will buy into,” Horton believes.

In addition, the physical facility in which advisory service is accomplished must be reimagined. The report explores the “cafe branch” approach as well as other design considerations to make the branch a place consumers actually want to come to.

“Today it is experience and choice, not just location or channel, that represents banking’s greatest threat and opportunity,” Horton believes. “That’s why the future belongs neither to old-school banks nor challenger/fintech startups, but to those who deliver an experience that is unique and valued.”