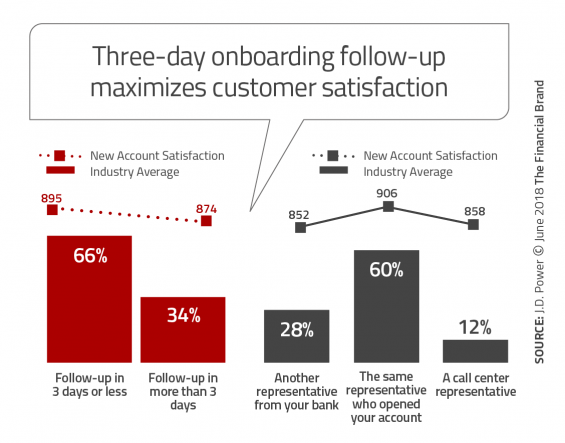

While the concept of reaching out to consumers after they have opened a new banking relationship is definitely not a new strategy, there isn’t a clear industry standard for how banks and credit unions onboard and cross-sell new customers or members. In the most basic programs, organizations may do a three-step program including a phone call, an email and a direct-mail letter in the first 30-90 days after an account is opened. Other organizations have a multichannel strategy that extends several months.

Because some institutions believe there is only a minimal incremental cost of each contact, a rather extensive use of email is used to help set up new accounts and promote virtually all ‘sticky’ products and services. Other organizations have internal policies that only allow one (or fewer) communications to a new customer a month. It is our belief that both strategies miss the mark because of the lack of using insights and engagement behavior to determine the ‘next best action’ for the building of a genuine win-win relationship. Onboarding and customer engagement strategies should create a relationship with a foundation of trust and advice as opposed to being a way to bombard a new customer with sales messages.

As an example of an insight-driven strategy, Capital One revamped its entire onboarding experience, working to provide a personalized, dashboard-style onboarding web-page from which new customers set up and manage their own account. Consumers build their own relationship based on their individual needs. This engagement process helps Capital One to capture valuable insight into consumer needs very early in the relationship.

Wells Fargo & Bank of America have landing pages dedicated to onboarding new customers, but unlike Capital One, these take more of an informational role and aren’t specifically tied to visitor accounts. Other financial institutions simply include onboarding steps in email communications, linking to various online and mobile log-in portals.

The examples of direct mail, email and web communications in this direct-communication showcase were provided compliments of Mintel Comperemedia. Their searchable competitive database tracks direct mail, email, print advertising, mobile advertising and online banner advertising and is a valuable go-to resource for The Financial Brand. We again thank them for their partnership in this effort to show some best-in-class bank and credit union marketing examples.

Read More: Multichannel Onboarding Trends in Banking

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The Foundation of Best-in-Class Onboarding

Despite differences in onboarding tactics, there are still some very clear similarities in the objectives and strategies for new customer engagement after account opening. The first step for almost all new customer communications begins with an email or direct mail that encourages the new customer or member to set up online and/or mobile banking accounts. The sooner this is done, the better. The benefit presented is for the customer to have 24/7/365 access to their account which improves account management capabilities.

New account holders are subsequently encouraged to build balances (and active engagement) by depositing money by mobile deposit, in-branch, or through an ATM. As part of this communication, most financial firms also provide account holders with a method of determining their account’s routing number in order to set up direct deposit.

Once the basics are communicated (often through multiple channels and ‘touches’), new account holders are then contacted through various channels to add additional components to their relationship. These range from educational communication around mobile deposit capture, to setting up bill payments, overdraft protection, P2P capabilities, SMS alerts, etc. These ‘sticky’ services not only make the relationship more valuable for the new customer, but improve loyalty and reduce the potential for attrition.

Capital One Introduces Personalized Video Onboarding

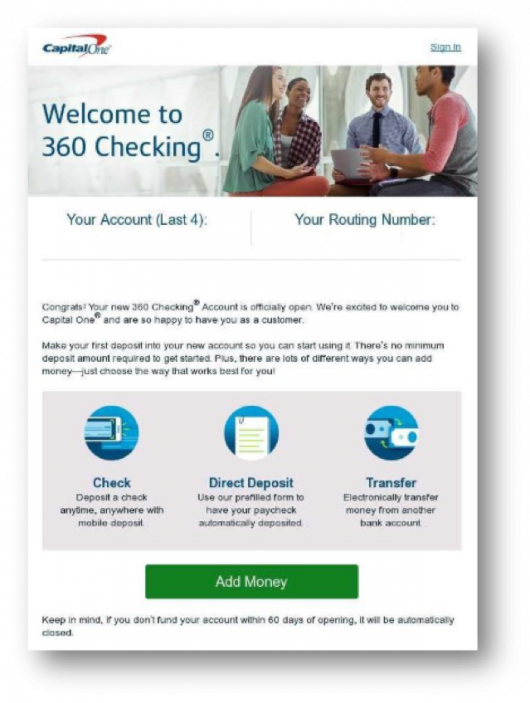

More and more organizations begin the onboarding process with email communication. Compared to direct mail, email communication can be sent within minutes of the new customer or member opening a new account. In fact, some organizations set a goal of having a completely personalized email welcome kit in the customer’s inbox before they return home from the branch or instantly if the account has been opened digitally. As you will see below, Capital One is also one of the first organizations to introduce completely personalized video onboarding from SundaySky. We expect more organizations to follow this trend in the future.

According to the Mintel Comperemedia research, Capital One immediately emails welcome kits to new checking customers encouraging them to deposit money “within 60 days or face automatic closure.” We have not seen many organizations mention automatic closure if deposits are not made, but this makes sense in order to avoid dormant accounts. If an account is dormant for 60 days, it is unlikely that the relationship will ever grow.

According to the Mintel Comperemedia research, Capital One immediately emails welcome kits to new checking customers encouraging them to deposit money “within 60 days or face automatic closure.” We have not seen many organizations mention automatic closure if deposits are not made, but this makes sense in order to avoid dormant accounts. If an account is dormant for 60 days, it is unlikely that the relationship will ever grow.

Capital One gives the option to deposit checks, use direct deposit or transfer funds as outlined in the email, with a call to action (CTA) to “Add Money.” According to Comperemedia, customers who set up core account features upon opening were “significantly more likely to become active, long-term customers.”

Before the revamp, a rather static, three-bullet point message was provided (below). Unfortunately not as many customers engaged as were desired, even though many consumers bookmarked the onboarding portal, according to Capital One.

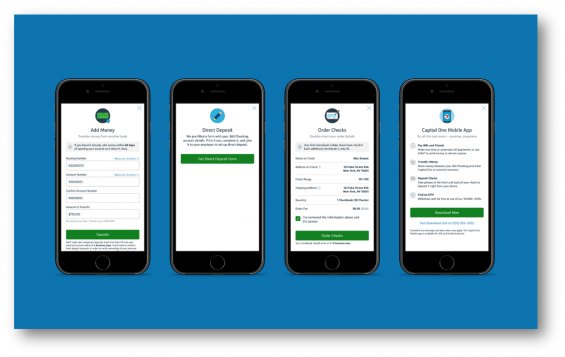

After the revamp of both its onboarding online hub and mobile app, Capital One included options for customers to quickly and conveniently add money, set up direct deposit, order checks, and download the app. This revised process reinforced the ease of mobile and online account opening, using cleanly designed steps that avoided friction and uneeded steps.

After the revamp of both its onboarding online hub and mobile app, Capital One included options for customers to quickly and conveniently add money, set up direct deposit, order checks, and download the app. This revised process reinforced the ease of mobile and online account opening, using cleanly designed steps that avoided friction and uneeded steps.

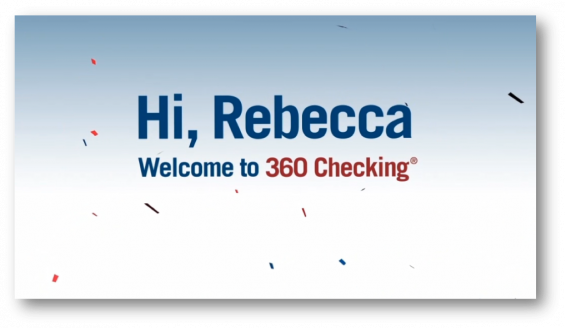

Capital One is one of the first financial institutions to use the services of SundaySky, to greet new 360 Checking account holders with a completely personalized video that explains the benefits of the account and ensures clarity, comprehension, and engagement. The dynamic video builds engagement by mentioning the customer’s name, location, and app usage.

When looking at the complete flow of email onboarding communications for the Capital One teen checking account, you can see that there is communication to both the teenager and her parent, providing informational material and various alerts, including the initial transfer of funds to the teen’s account via Zelle.

Bank of America Uses Custom Onboarding Landing Page

Bank of America has been testing many onboarding strategies over the years, leveraging a series of multiple emails delivered over time based on engagement activity of the new account holder. Bank of America is one of several organizations that have extended their onboarding email communication well beyond 90 days if the consumer needs to expand their use of ancillary services.

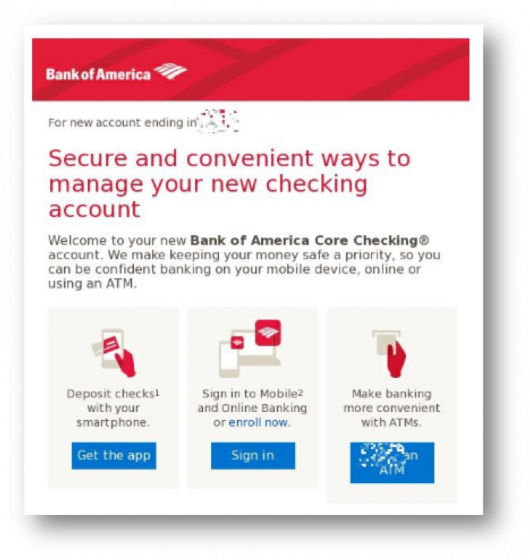

Onboarding emails to new Core Checking customers at Bank of America invite recipients to get the remote deposit capture app, sign into online or mobile banking, and to learn more about their checking account and the location of ATMs.

After new customers click the “Get Started” icon in the welcome emails, they are redirected to the Bank of America Core Checking account landing page where they can learn more about their account. Below the drop-downs on the landing page, Bank of America lists personalized protection, savings, and education options.

After new customers click the “Get Started” icon in the welcome emails, they are redirected to the Bank of America Core Checking account landing page where they can learn more about their account. Below the drop-downs on the landing page, Bank of America lists personalized protection, savings, and education options.

Following the welcome email, Bank of America keeps the communication process very active, with frequent informational emails regarding account features and account management tips.

Following the welcome email, Bank of America keeps the communication process very active, with frequent informational emails regarding account features and account management tips.

Read More: Multichannel Onboarding Trends in Banking

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Huntington Bank 3-Step Early Engagement

Huntington Bank has been testing various onboarding communication strategies and tactics extensively for years. They are one of the most aggressive mass-media marketers for new accounts, using TV and print to generate new accounts regionally.

Once a new account is opened, Huntington welcomes new customers with email communications outlining the first three steps to start managing their account. The emails focus on enrolling in online banking and downloading the mobile app. The campaign also encourages new account holders to build an account balance while providing tips and information on how to set up direct deposit.

As an aggressive marketer for new customers, the ability to turn dormant prospects into engaged customers is very important for Huntington. The Digital Banking Report has found that the cost of a new account that never becomes an engaged customer is over $400, which includes the cost of acquisition and the net present value of lost revenue on the relationship. For organizations that do not aggressively communicate to new account holders, attrition of new relationships can exceed 30%. By converting as little as 5% of dormant accounts, banks and credit unions can more than pay for the most extensive onboarding program.

Huntington bank thanks customers for choosing their bank multiple times over the course of the first six months, and then guides the new account holder through the process of setting up and managing their accounts.

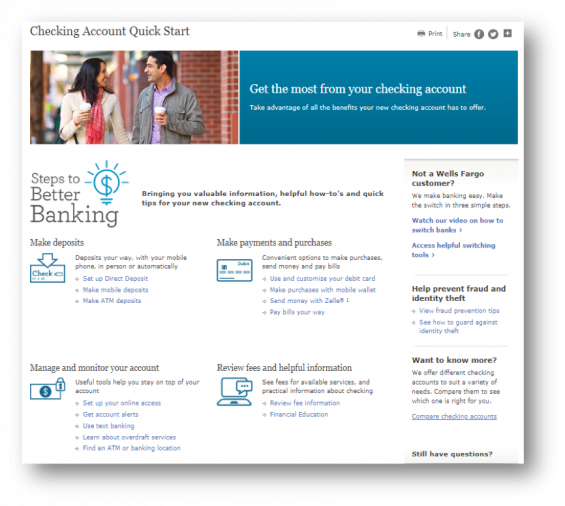

Wells Fargo Focuses on Consumer Needs vs. Cross-Selling

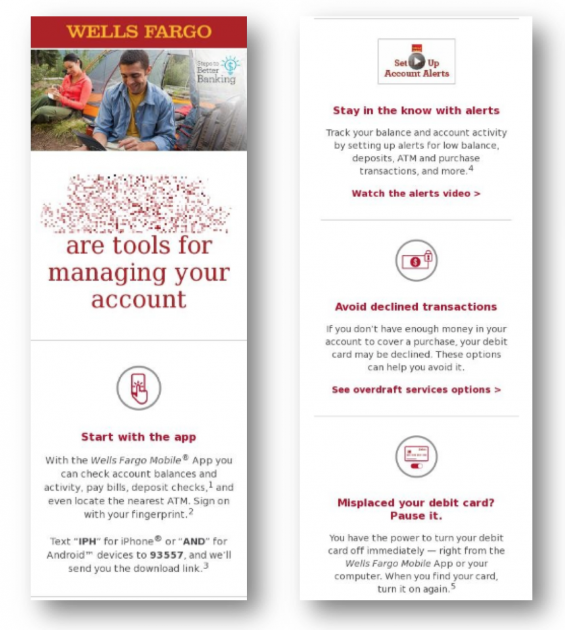

One of the concrete examples of a change in sales culture at Wells Fargo is their revised new customer onboarding process. Once one of the more sales-focused onboarding programs in the industry — including communication channels ranging from email to direct mail to SMS texts and direct phone calls — Wells Fargo noticeably focuses on consumer needs in its current onboarding communications.

Wells Fargo sends email communications to new account holders with tips on how to better manage their accounts, inviting them to download the mobile banking app, set up alerts, set up overdraft protection, and pause misplaced cards. Each of these tools are strong digital engagement services that will help retention without the impression of “selling” new services. All of the messaging is on consumer benefits. It is not until later in the onboarding process that Wells Fargo introduces additional products, such as savings options.

Within the Wells Fargo welcome emails, there is a link to their “Quick Start Guide,” which includes even more tips for checking account management. Again, noticeably absent are any references to adding new accounts to the newly established relationship. Instead, all of the copy is designed to assist the new customer through the early stages of new account management.

Wells Fargo also provides links to tutorials on how to switch financial institutions, links to fraud prevention and even links to a checking-account comparison tool. Finally, Wells Fargo includes a link to videos with tips like how to better manage money and maximize banking relationships with the option to call a live representative.

Onboarding As a Personalized Engagement Journey

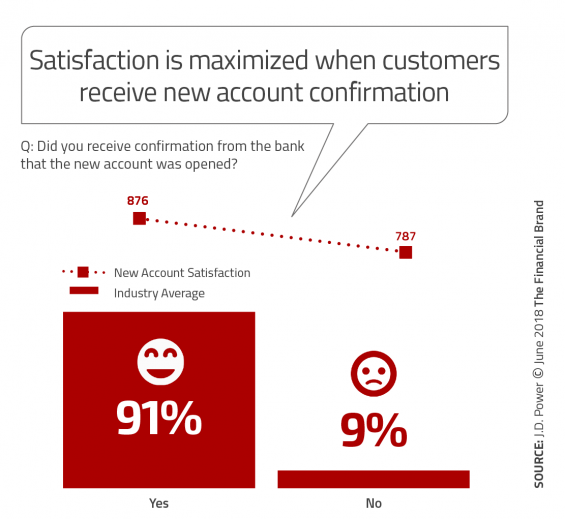

Bank and credit union customers want you to “Know them, understand them and reward them.” There is no better time to let the consumer know that you will exceed their expectations than during the time immediately during and after account opening. And with the majority of consumers hardly ever visiting the branch office after account opening, the need to digitally engage with the new account holder has never been greater. Not doing so can be very costly, both in terms of zero return on account-acquisition costs and lost future revenues on the new relationship.

Focusing only on the cross-sell of additional services misses the bigger, and potentially more important, component of satisfaction — the customer’s end-to-end experience. It is important to look at customers’ experience through their eyes — during every step of the customer journey. With this perspective, value can be optimized and satisfaction maximized. Wells Fargo has done the best job of shifting its sales mindset into a more consumer-focused onboarding strategy.

As mentioned, the onboarding communications process is not a one- or two-step thank you. The digital engagement customer journey can be long, across multiple channels and touchpoints, often lasting months. Welcoming a new customer and building engagement through an onboarding process is a perfect example of how to improve the customer experience beyond the use of the service. It is also a highly personalized journey that builds in different ways for different customers.

The challenge for many financial institutions will be to move from product silos to customer silos. The individual product and service owners that manage the communication touchpoints within a bank or credit union can lose sight of what the customer sees (and wants). This is why we recommend that financial services organizations use a single centralized team to coordinate early communications that are built using multiple channels and delivered with the customer experience front and center.