According to a major study by Market Force Information, consumer satisfaction with banking providers rose across the board. Consumer satisfaction with their primary banking provider for the industry overall jumped eight percentage points in one year from 49% to 57%, and one point ahead of the previous high of 56% in 2016. Likewise, consumers are generally more inclined now to recommend their bank or credit union to a friend or colleague (60% very likely to recommend, compared with 54% in 2017 and 59% in 2016).

“Overall consumers feel pretty good economically, and that’s having a positive impact on their assessment of their financial institution,” observes Chuck Rogers, Financial Service Practice Leader for Market Force Information.

Rogers believes banks and credit unions are doing many things right. In particular Rogers notes how many financial institutions have stopped fighting the fintech crowd and have instead actively partnered with- or even acquired them. As a result, they are now leveraging fintech expertise to deliver an improved customer experience.

Looking at these results, it might all sound like good news for an industry besieged with bad press and negative sentiment. But if financial marketers aren’t careful, they could lull themselves into a false sense of confidence. Just because things are looking up and the data appears to be going in the right direction, it’s no time to celebrate.

Consumers continue to get choosier about banking providers, and expectations are on the rise. The digital arms race is intensifying. And new competitors are breathing down their necks. This is no time to get complacent. Banks and credit unions still need to pick up the pace.

As the Market Force report observes: “It’s not okay to just be okay” anymore.

“Even though satisfaction recovered eight points over 2017’s losses,” note the authors of the Market Force report, “brands are still vulnerable to losing market share.”

In its annual analysis, Market Force says there is ample room for improvement, particularly in areas relating to consumers’ financial well being and understanding their needs.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Consumers May Still Switch, Even If They’re ‘Satisfied’

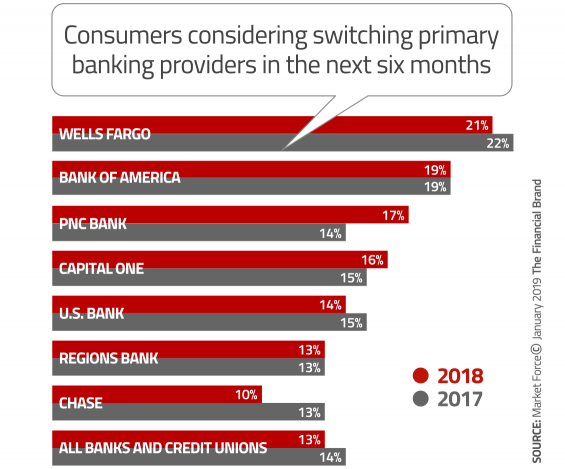

Overall 13% of all banking consumers are considering switching banks in the next six months, with some individual banking brands ranging from 10% like Chase to as high as 21% at Wells Fargo.

The top two reasons given for considering switching are familiar: Seeking lower fees (42%) and general unhappiness with service (39%). Another perennial reason is to get a better return on deposits (34%). Note, however, that 37% of consumers cited lack of help “Improving my financial well being” as a reason to switch providers.

Rogers observes that the switching rate has hovered within a point or two of 13% for the past two years. Two reasons the number isn’t higher, he says, are inertia and the perception that switching banks is difficult. In reality, however, the process for a consumer to change banking providers is much easier now.

As digital account opening and onboarding tools become used more widely (and more effective), there will be less inertia and opposition to switching banks will decline.

What Drives People’s Satisfaction With Their Primary Financial Institution?

In its study, Market Force examined a total of 19 different factors influencing the satisfaction scores consumers give their banking providers. Among the full list of attributes, banks and credit unions scored well in a few areas. For instance, they tend to have decent retail delivery models, providing people with multiple options to access services. They score well in categories like “Security” and “Financial Stability”, but you could argue that financial institutions would go out of business if they couldn’t check off antes like those.

Of the 19 parameters studied, Market Force identified six attributes in particular that correlated most strongly with high satisfaction scores:

- Making it easy for people to handle their most frequent transactions

- Resolving issues efficiently (more on that in the next section)

- Having an excellent reputation

- Fostering a complete trust in the relationship

- Charging fair rates and fees for services provided

- Understanding people’s unique situation and needs

While these are all components of solid satisfaction scores, Rogers points out that consumers — especially younger ones — increasingly expect more from their primary financial institution. In short, to create true loyalty, banks and credit unions need to make it easy to do business with them and build a sense of trust. Most notably they want help to better manage their financial lives.

According to the Market Force study, there are some areas where banks and credit unions aren’t doing so well overall. Generally speaking, the lowest ranked attributes suggest consumers see financial institutions as selfish and self-serving. For instance, few respondents felt that their banking provider invested in their well-being or that of the community. And only two in five consumers feel that their institution provides them with personal financial tools that help them save, invest, and spend money wisely.

David vs. Goliath: Hope for Smaller Institutions

About a third of the survey respondents said their primary financial institution was either a credit union or community bank. Market Force says those banking with these smaller institutions gave them a significantly higher satisfaction ratings than customers of global, national or regional banks. This gives these smaller institutions a strong footing from which to build.

Rogers believes that some of the shortcomings revealed by the survey present the best opportunities for small, local, and community-based institutions. Their nimble size makes it easier for them to understand people’s unique financial situation and needs. They are also best positioned to demonstrate how they invest in communities and consumers’ financial well being. They tend to have closer connections with those they serve, and a model for both community involvement and customer intimacy that’s easier to scale in a smaller network.

“Historically community banks and credit unions have had to rely primarily on close relationships and knowledge of personal situations,” says Rogers. “They’re still obviously at a disadvantage in terms of having the scope necessary to compete with the largest institutions, but there is much more in the way of technology available now that smaller institutions can use, so the disadvantage is smaller.”

Rogers recommends community-based institutions continue building their data analytics capabilities using new tools now available. This together with fintech partnerships will make it more likely that they can hold their own against banking’s behemoths.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Problems Are Resolved Ripples Through Satisfaction Scores and Impacts Attrition

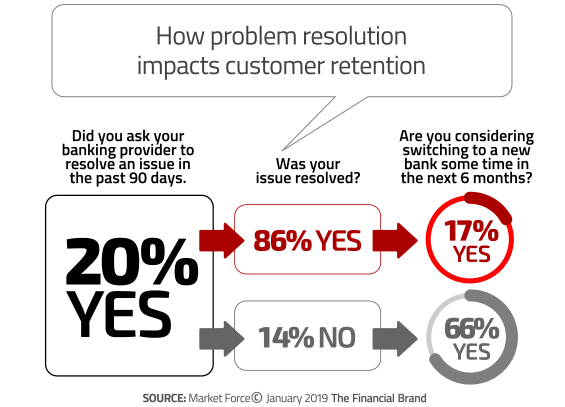

Unresolved problems lead to decreased recommendation rates, Market Force found. Overall satisfaction for those consumers who had a problem resolved to their satisfaction averaged 54% compared with just 15% for those who said their problem had not been resolved.

In addition, they lead to increased propensity to switch. This presents both competitive opportunities and some potential weaknesses you may want to address. Defensively, you want to “plug any leaks” and minimize attrition by making sure your problem-resolution process works the right way. Offensively, you want to identify any competitors who have a poor track record when it comes to resolving problems (hint: check social media channels). Then marketing can target people who bank with these institution(s). You can also train your staff how to approach these customers — e.g., questions to ask, points to stress, etc.

Big Jump in Digital Wallet Usage

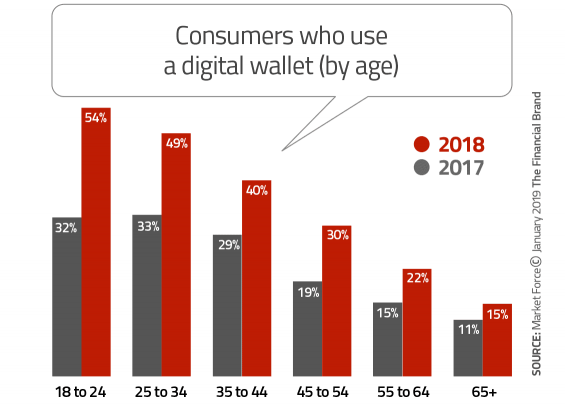

Based on the Market Force survey results, consumer use of digital wallets (aka e-wallets, mobile wallets) looks like it might have finally turned the corner.

Rogers says adoption rates for digital wallets has really accelerated over the past three years. While usage of digital wallets clearly skews more heavily toward younger consumers, Rogers says that usage was up in every age bracket.

The top three uses for digital-wallets include making payments (59%), sending money (48%), and receiving money (46%).

Unsurprisingly, the top three digital wallet providers listed in the survey were PayPal (69%), Apple Pay (42%), and Venmo (28%).

Rogers acknowledges that there is the potential for consumer confusion as to what constitutes a digital wallet and what doesn’t. PayPal, for example, represents a broader range of services than Apple Pay or Venmo (owned by PayPal). Zelle is noticeably absent in the Market Force study, something Rogers attributes to the fact that it hasn’t been around that long, although it is being aggressively marketed now.

Among those not using a digital wallet, the number one reason is simply that people don’t know what they are. Half of non-users (48%) say they lack a basic understanding. Roughly a third don’t see any benefits to using a digital wallet. One in four non-users have security concerns, while an equal number are worried about privacy issues.

Frequent Use of Mobile Banking Apps Up Big

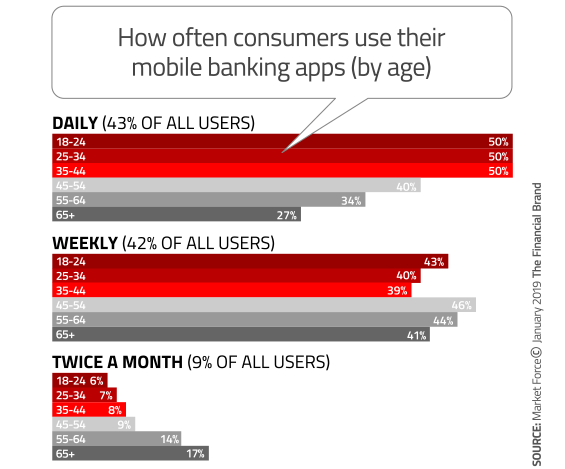

Consumer use of their primary providers’ mobile banking app continues to climb. 83% have downloaded their provider’s app and a sizeable 94% report having used it in the past 90 days, the survey found.

Millennials and Generation Z are frequent — often daily — users of banking apps, but the percentage of people saying they are weekly app users is almost the same across all age categories.

Among the top banking-app tasks, nearly everyone (96%) checks their balance. Two thirds will use their bank’s mobile app to check on their monthly statement or the status of a payment. 64% of users say they make mobile deposits, which — if true — is a big move upwards in adoption rates for this feature, and great news for banking providers. Nearly two out of five users transfer funds between accounts, and half are using mobile bill pay.