Every year, FIS fields a study examining how well banking providers are meeting consumers’ needs. Researchers ask people to rank the importance of nine key attributes like “trust” and “security”, then score their primary banking provider’s performance in those areas.

The findings, which FIS packages into its annual “Performance Against Customer Expectations” (PACE) report, shed light on a number of key trends that reflect just how quickly the banking industry is changing. Here are five big themes that emerged from this year’s report.

1. Your Main Branch is Now The Mobile Device in Consumers’ Back Pocket

“72% of all bank interactions are digital, with Millennials leading the way.”

— FIS Consumer Banking Report

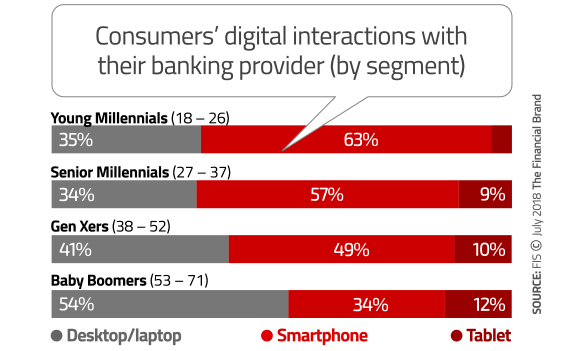

The results of the PACE study show that digital self-service is a high priority for consumers under the age of 53. All generations except Baby Boomers — from young Millennials through Generation X — now prefer the mobile channel. People are banking on their mobile devices more than they use any other retail delivery channel, including desktop PCs, ATMs or physical branches.

FIS says these findings “highlight a needed shift in strategic thinking among banking providers — especially smaller ones.” As their mobile interfaces — not their physical locations or even their personnel — are now “the face of the bank.” A lacking or poorly performing mobile application is now enough to turn off potential new customers, something no bank or credit union can afford.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

2. David vs. Goliath: Smaller Institutions Finally Catching Up With Megabanks’ Digital Capabilities

In its PACE report, FIS says that “feature parity is here.” According to FIS, community banks and credit unions that roll out features like P2P payments are seeing rapid adoption of such digital banking solutions.

“It has never been cheaper or easier to add ‘big bank’ digital capabilities,” FIS wrote in its report. “Smaller banking providers can no longer delay digital transformation.”

Which is great news for consumers and financial institutions alike, because people now expect the same digital tools — e.g., mobile deposits, transfers, account opening, digital payments, mobile wallets, etc. — from their banking provider, regardless of size or scale. Consumers want their credit unions and community banks to deliver the same range of products and services they could find if they used larger institutions.

“Given how affordably and quickly financial institutions can roll out such features, these are reasonable expectations,” FIS says.

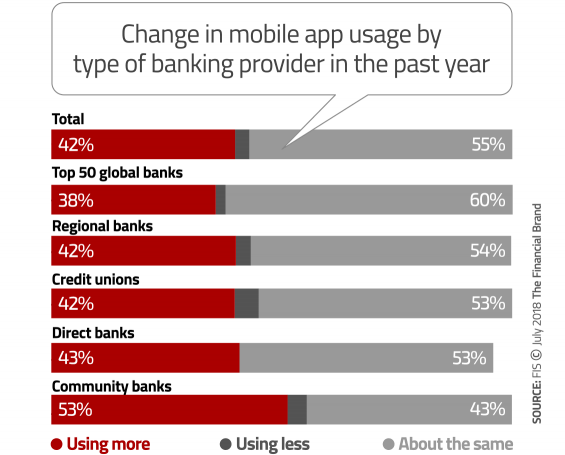

In general, 42% of consumers report that they now using their banking provider’s mobile app more now than they did 12 months ago. Notably, community bank customers use mobile apps more aggressively than customers from other types of banks, with more than half (53%) claiming to use apps more than ever before, something FIS says is “a likely result of recent rollouts of new mobile features” among smaller institutions.

Read More:

- Top 7 Customer Experience Trends in Banking

- Best Customer Experience in Banking Blends Digital with Human Touch

- Retooling CX Strategies in Banking for the Post-COVID Reality

3. Welcome to the Age of ‘Helicopter Banking’

“In the age of ‘helicopter banking,’ consumers expect banks to be always-on, to remain distant but accessible, to be a long-term advisor and to be there in the moment of need.”

— FIS Consumer Banking Report

As this year’s PACE findings show, banks face the daunting challenge of meeting their customers’ expectations to be always-on, to remain distant but always be accessible, to be a trusted long-term advisor and to be there in the exact moment of need. These expectations mirror in many ways the “helicopter parenting” that played a part in raising millennials. What younger consumers expect from parents and employers, they now also expect from their banks: helicopter banking.

Banks that can pull off this great balancing act – with the right mix of technology, products, service, education and outreach – are poised to see outsized growth as the great wealth transfer gets underway. Obviously, many banks are not today outfitted for such a task. But with industrywide digital transformation underway and the arrival of feature parity (and, soon, open banking), it has never been easier or more affordable for banks to rapidly upgrade their systems and add capabilities.

4. People Want Their Very Own Financial Yoda

The PACE findings revealed a gap between where consumers are financially and where they want to be. The good news? With trust most important to consumers, FIS says banks and credit unions are well positioned to expand their advisory role and services.

“Banking providers are well-positioned to serve as the trusted sage to consumers eager to learn about- or hand-off the management of their finances — the Yoda to young Skywalker (or old Skywalker to young Rey, as the case may be, depending on your generation),” FIS explained.

Nurture must become second nature for banks to grow, and deploying trusted financial advice across channels, assets levels, and price points (including free) is essential to success.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

5. When Customers Get Burned, Their Banking Provider is Toast

” Internally, big data and machine learning present opportunities for improving internal security controls and identifying security risks as they emerge, not well after the fact.”

— FIS Consumer Banking Report

According to the PACE survey, consumers say they “feel safe and secure banking with their primary financial institutions.” Generally speaking, they believe that their banking provider “ensures their transactions are safe and secure” and “protects the privacy of their personal information.”

However, their faith and trust can quickly vanish. If a security lapse happens — for instance, if a data breach occurs, even if it’s not necessarily the institution’s fault — consumers are far more likely to switch. In fact, one in four U.S. consumers in the PACE study said they switch banking providers if/when they experience fraud.

“Banking providers not only need to institute multilayered security protocols from the core out to protect their institutions from malicious threats, they must also give their customers the tools to protect themselves and their accounts,” FIS wrote in their PACE report. “This includes education about how to keep accounts private and secure as well as adding tools like two-factor authentication, fraud monitoring, push notifications, card controls and other protection features.”