Since the financial crisis, banks and credit unions have closed over 10,000 branches, an average of three per day. According to JLL Research, the number of U.S. bank branches will soon fall to 71,500.

Then there are the provocative headlines that trigger much hand-wringing in the banking industry, causing banks and credit unions to wonder if branches are old-school relics — e.g., “Retailpocalypse: Bank Branches are Closing in Droves.”

It can be easy to get lost in statistics and headlines like these that lend credibility to the hype surrounding the demise of branches. It can be downright frightening.

While there is no doubt that digital is disrupting the industry, it isn’t plausible that digital has killed the branch. At least not yet.

Everyone Still Loves Branches

The vast majority of Americans love branches, and don’t want their local branch to close. According to a survey by the American Bankers Association, 87% of consumers say that it’s important to have a local bank branch easily accessible from their home.

That’s why people like Julian Vermaas of MSR Group have come to the defense of branches. Vermas pointedly says that closing bank branches is a mistake.

“While banks may prefer moving customers to automated channels as a more cost-effective way of meeting their needs, eliminating branches is a risky decision,” Vermaas explains.

He bases his conclusions on research showing that consumers who use a combination of branches, online and mobile banking have a higher Net Advocacy Rating.

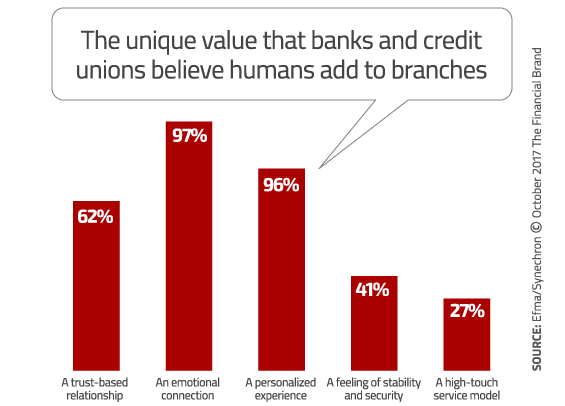

Banks and credit unions are defending brick and mortar as well. According to a report from Efma and Synechron, nearly nine in ten executives in the banking industry believe that brick-and-mortar branches add value to consumers, and will continue play a role in the future of banking.

“The branch still represents something tangible, something real,” says David Horton, Head of Innovation at Synechron. “When you are talking about an industry that sells trust, people want a place where they know their money is safe.”

Banking providers generally believe that branches give their brand legitimacy, and therefore want their branches to exude security. In the Efma study, banks and credit unions overwhelming said they expect their branches to project that they are traditional, trusted, and secure.

Key Fact: When asked what they want their branch to communicate, not one said they were shooting for the “cool hang-out” vibe.

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

Are You Ready for a Digital Transformation?

What Should Retail Financial Institutions Do With Branches?

According Efma and Synechron, banks and credit unions should transform branches into advisory service hubs. In this role, a branch becomes less about transactions and more about a positive consumer experience that leans on well-trained employees and “engaging self-service.”

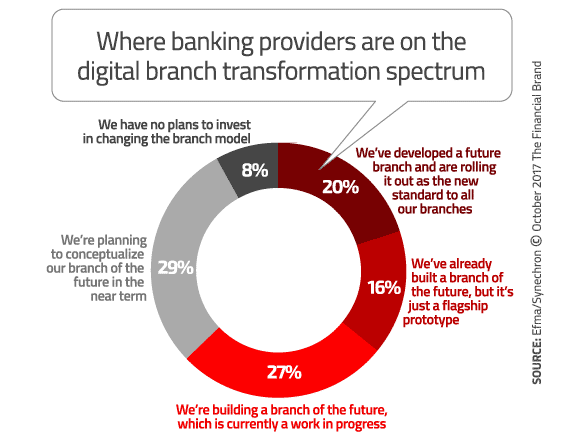

In the Efma study, one in five financial institutions say they have already embarked on their digital branch transformation journey, and are in the process of rolling out their future branch model.

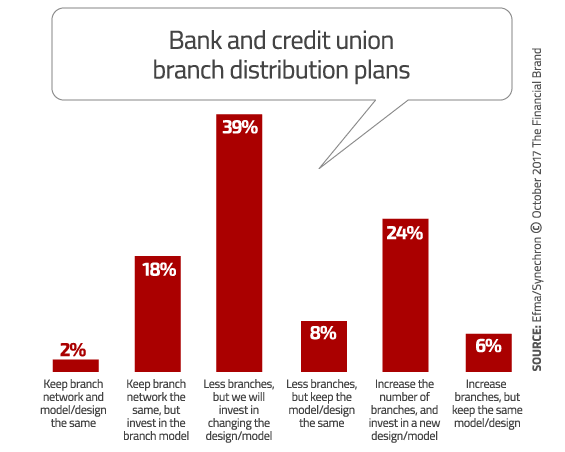

Most banks and credit unions agree that the branch model has to change and are working on new models, they have different opinions about the best approach. One in four think the answer is to both increase the size of their branch network while also investing in changing the model. Two out of five are electing to close some branches as they focus on changing the model.

Key Facts:

- Only 8% of banks and credit using say have no plans the change their branch design/model.

- Only one in 50 say they’re happy with their branch distribution network as is and are making no changes.

- Not a single banking executive says they would consider shutting all their branches and go digital-only.

During this changing of the branch model, financial institutions are focusing on consumer engagement and evolving how branch staff interact with consumers at the same they are introducing interactive digital experiences and self-service automated technologies.

Efma says the branch shouldn’t replicate what can be done online or on a mobile app. Instead, the branch should offer a connection with consumers that they can’t get from digital. We’re talking about value-added advice on complex products and services.

Many banking providers are experimenting with a “hybrid branch” model, one that combines digitalization with a relationship experience. It may sound like an oxymoron, but it can actually work — keep the personal and emotional connection with consumers, while providing digital alternatives and self-service options within the branch.

Read More: 10 Branches Designed To Wow The Digital Banking Consumer

The Most Coveted Branch Technologies

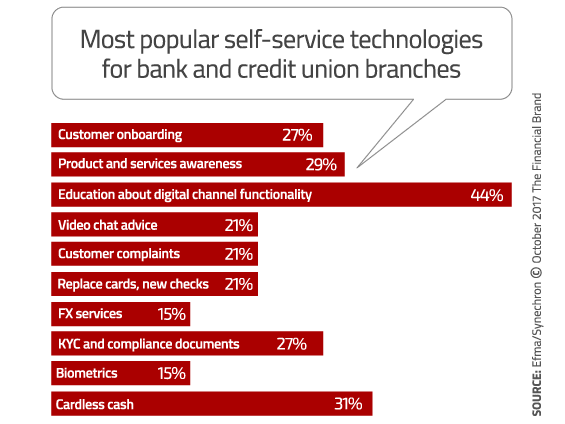

In the Efma research, banking executives said their top strategic branch priority was to increase self-service options. Nearly nine out of ten financial institutions (88%) want branch visitors to be able to deposit and withdraw both cash and checks on their own, without the assistance of a branch employees.

Somewhat ironically, 44% of bankers say they want to use branches to educate consumers about the functionality of their digital channels. In other words, banks and credit unions intend to use branches to train people how to avoid branches in the future.

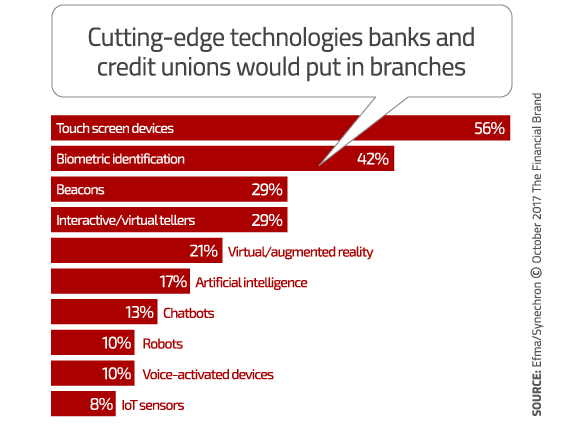

Asked to name the technologies that would make their branches appear to be more advanced, more than half (56%) named touch screen devices — including walls, tables, and tablets — as having the most impact, followed by biometric identification (facial, finger, voice). Beacons and interactive teller machines (a.k.a., virtual teller machines) were tied for third as the most cutting-edge technologies.

Financial institutions can leverage such technologies to create a more engaging and memorable branch experience. But it’s not enough to just install things like intelligent ATMs or touch-enabled devices like kiosks and iPads. Many banks and credit unions like to load their branches with the latest bells and whistles, but Efma and Synechron strongly encourage them to think more strategically about how consumers will actually use such technologies.

Can Humanless Branches Work?

What about a fully-automated humanless branch — no employees at all? A physical location that is less expensive to operate without employees sounds tempting, but banking executives are mixed in their opinions about the viability branches without any staff. One-third (35%) of banks and credit unions say that a humanless branch won’t work. The rest think that it might make sense, if not today, then sometime in the future when both technologies and the consumers using them become more sophisticated.

Bank of America is experimenting with branches without people. The jury is still out on these branches, and the bank has yet to announce any additional pilots. The Financial Brand has previously described these video-conference enabled branches as simply a stopgap until financial institutions figure out how to offer consumers secure video conversations with bankers using smartphones and tablets — regardless of where either the customer or the banker are in the physical world.

Almost all bankers believe that to establish an emotional connection with consumers, you need a living, breathing human being, at least for more complex transactions. Even account opening — a pretty pedestrian transaction — can benefit from a branch.

“Even in this day and age of digital channels, the vast majority of new accounts are opened — and in most cases, complex problems are still solved in the branch, face-to-face,” says Raja Bose, VP of Global Advisory Services at Diebold Nixdorf

More than half the respondents in the Efma survey said they expect digital branch transformation projects to reduce the headcount in branches. 62% of those surveyed said they plan to reduce overall digital headcount across bank branches, 32% said they might, 11% said they had no plans to reduce headcount, and 14% of respondents didn’t yet know if they’d reduce their headcount.

Key Fact: Not one banker believes that technology can replace people when it comes to relationships. Yet at the same time, banks and credit unions are also looking to reduce headcount wherever possible.

So, what to do with branches? Don’t panic, nor succumb to the hype. But Efma says you should start experimenting and prototyping their own digitally-enabled “branch of the future” that combines the humanness of the branch with self-service and digital.

“It’s about people,” says Horton with Synechron. “It’s about relationships, local knowledge, body language, smiling, being polite and generally trying to help customers that makes all the difference. No amount of technology transformation and digital alternatives can compete with empowered and motivated branch staff.”