Millennials keep financial institutions on their toes, often sending marketers back to the proverbial drawing board to find new ways to attract them as customers. Navy Federal FCU commissioned a survey to learn more about Millennials and their financial situations and goals. Here are some of the key findings.

Millennials are the most educated generation in history, with more than 66% obtaining a four-year degree or higher. But that comes at a cost. The Millennials in the survey said they pay more for their student loans each month than for utilities, transportation or childcare.

They also reported a combined average of nearly $8,000 in credit card and personal loan debt, so it’s not surprising that more than three-quarters of those surveyed said they are unsatisfied with their current financial situation. The same number of Millennials don’t see their situation improving within the next five years.

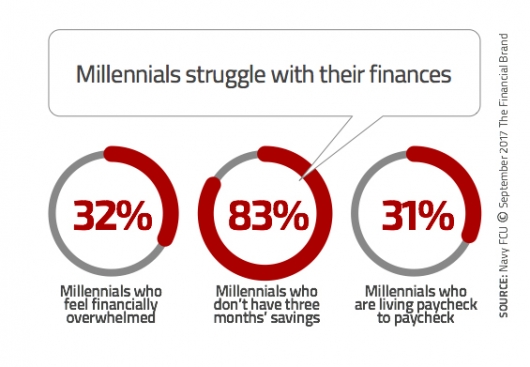

One-third of Millennials feel financially overwhelmed and are living paycheck to paycheck to make ends meet. Just over a quarter of Millennials have at least three months in savings.

As a result, Millennials have a short-term financial focus and are delaying many important financial life events. A quarter of Millennials have postponed buying a home, nearly a third have waited to buy a car, and only 22% have started saving for retirement. They know they need to save and plan, but they just don’t know where to start.

When it comes to managing their finances overall, Millennials aren’t doing very well. One in five say they don’t use any kind of budget, and two-thirds haven’t checked their credit score in the last year.

One in three Millennials still live with their parents, increasing the financial strain on their parents as well.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Read More:

- Millennials Are Ready For AI To Take Over Their Financial Lives

- Millennials Go Bananas For Super Cool, Very Pricey Metal Credit Card

- Credit Unions Lose ‘Primary’ Status with Half of Millennials as They Age

Despite their financial concerns, Millennials remain optimistic about their financial future. Seven out of ten say they are planning to save more in the next 12 months.

Financial institutions are in a unique position to help educate Millennials on the products and services that can enable them to reach the financial goals they feel are out of reach — buying a home, saving for retirement or paying down debt. One potential hurdle is that Millennials overall prefer a DIY approach, and often reach out to personal contacts for advice over financial providers and other professionals. The good news? They love digital apps and online savings tools, including those provided by their financial institution. There’s a big opportunity here for reaching Millennials where they prefer to manage their daily finances: online.

That said, the survey also shows that branches are still important to Millennials seeking financial advice. More than half of the Millennials in the study visit a branch to meet with service reps and financial experts in person.

The key takeaway in Navy FCU’s study is that Millennials know they need financial tools and advice to help improve their financial situation — both now and in the future — and financial institutions have the opportunity to fill this void.