Radius Bank is redefining what it means to be a “community bank.”

When Michael Butler joined what was then known as First Trade Union Bank in 2008 as CEO and president, he looked at the future of the industry and made a bold decision. Rather than continue gambling on the traditional growth model — built around brick-and-mortar branches — he decided to pour the bank’s resources into the mobile channel. With only six branches, he figured there’d never be a better opportunity for the bank to evolve; with every new location added to a branch network, it would only become harder and harder to make the switch to digital.

Today, Butler’s radical approach involves a combination of leading edge technologies and user-friendly products, driven by an unwavering focus on the customer experience. Now, with just one branch and a new more inclusive “Radius” brand name, the $900 million Boston-based community bank effectively serves clients in all 50 states through its virtual retail digital platform.

“We think of our virtual banking platform as our go-to-market retail banking strategy,” explains Virtual Banking EVP Chris Tremont.

Cultivating a Culture of ‘Yes’

So how did Radius make this work?

Butler says it starts with creating a cultural mindset and internal structure that supports the adaptation, analysis and execution of technology solutions. It boils down to building a team excited about chasing the future and improving the customer experience. In other words, it’s like turning a financial institution into a tech company.

To build a truly paperless virtual bank, Radius made a significant investment in time, technology and infrastructure. They also had to take some calculated risks. For instance, when Radius asked its online banking provider FIS to explore integration solutions that would support a partnership with mobile solutions provider LevelUp, FIS suggested waiting 18 months for the launch of its own mobile banking solution instead. Butler and Radius weren’t interested in waiting that long to get started.

“We knew we’d never be a leader if we didn’t have the audacity to make a move for a smaller, more nimble platform,” Butler recalls. “Sure, it would require some hard work, take a fair amount of time and cost us more money. But if we didn’t take that risk, we’d never be able to accomplish what we had wanted to do.”

So Radius dropped FIS and made the switch to Q2.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

An Amalgamation of Partnerships to Solve the Fintech/Product Puzzle

To challenge the traditional banking model, Radius had to look for innovative ways to bring the products and services that people want to market.

“We’re always looking for opportunities to partner with companies and get in on a beta project,” Tremont said. “Our strategic plan was not to build a physical branch on every corner, but to provide easier access and a better digital experience.”

According to Tremont, asking what consumers want — then figuring out how to build and deliver it — remains a cornerstone of the Radius strategy. For instance, people want to open checking accounts on their smartphone. No problem for a virtual bank like Radius. Through partnerships with firms like LevelUp and Bottomline Technologies, Radius says they can complete the entire application and approval process in just under six minutes, and customers never need to step foot in a branch or print out and mail an application. Customers simply snap a picture of the barcode on the back of their driver’s license and the data from the ID automatically populates into the form.

A screen shot of the online account opening system used by Radius Bank.

A screen shot of the online account opening system used by Radius Bank.

For those customers who need access to cash, a partnership with the NYCE shared deposit ATM network allows customers to make deposits and withdrawal at non-Radius banks across the country. Making it even easier for Radius customers, there are zero ATM fees. If charged, Radius simply reimburses customers.

Similarly, another fintech partnership simplified P2P payments. With the Pay-a-Friend service from Radius, the process of sending money to a friend is instantaneous.

Radius has also been able to offer a high-yield checking account (dubbed Hybrid) through a partnership with startup online investment firm Aspiration, and personal loans between $2,000 and $35,000 through the Prosper platform.

Radius forged an exclusive partnership with Gradifi to offer a MasterCard debit card with Apple Pay that helps people pay down their student loans. Cardholders earn 1% unlimited rewards on all debit card purchases, which can then be applied directly towards any student loan. As an added bonus, Radius staffers will also benefit from the latest partnership.

Tremont said these fintech partnerships are fundamentally an investment in product development and customer service — both pivotal components in the bank’s growth strategy.

It seems to be paying off. From June 2014 to June 2016, Radius went from opening an average of five accounts a week to over 500 accounts a week. Balances that were flat to negative back in 2014 are now growing $1 million a week on the bank’s virtual retail side.

Digital Marketing: Going ‘All In’

Retooling a traditional institution around digital channels requires wholesale change across the entire organization. Radius had to overhaul its technology, its name, and its brand, and the bank’s marketing strategy had to evolve too.

It can be tricky getting traditional branch users to embrace an all-digital banking model, so Radius had to ramp up digital advertising and reach a different target market.

“We’re not trying to change the traditional branch user’s perception or norm of how they want to bank,” explains Carie Kelly, AVP/Direct Channel Manager at Radius Bank. “We want to attract those who are excited about banking virtually — the technophiles, travel buffs, busy moms.”

With traditional marketing media, it is difficult to accurately measure account acquisition, so the bank made the shift to go 100% digital in late 2014, bringing all consumer/retail marketing in-house. Now, instead of airing a commercial on television, Radius uses YouTube in conjunction with the Google Display Network. Billboards have been replaced with banner ads across the internet.

“Tracking investments in traditional media channels can be the black hole with not much accountability,” Kelly says. “With digital, it’s instantaneous across every media source. We can test and measure the effectiveness of our SEO, SEM, display and native advertising and immediately see the impact.”

Using the network algorithms on platforms like Google and Yahoo has helped Radius gain a deeper understanding into the psychographics of its target market, which the bank then leverages to craft marketing messages with greater resonance.

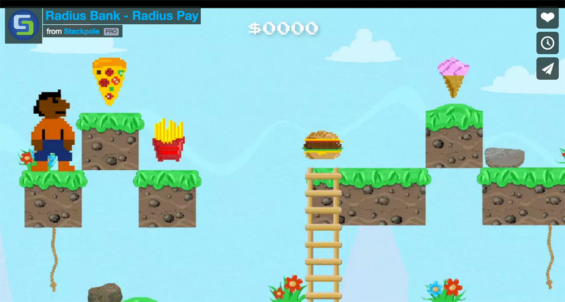

For example, to position Radius as a real player in the virtual banking space, Stackpole & Partners was tapped to create a campaign focused on core elements of the bank’s branchless, all-digital model: Apple Pay, premium rates, no ATM fees, Radius Pay and Radius Pay-A-Friend. The Boston-based full-service marketing communications firm developed short video spots reminiscent of 8-bit arcade hits like Super Mario Bros. Each of the five ads runs 15-18 seconds, presenting various Radius product/service offerings as different levels of a video game. Copy is minimal, explaining in simple terms what’s in it for the customer, wrapped with the catchphrase “Expand Your Radius. No Branch Required.”

One of five 8-bit online videos used by Radius Bank.

One of five 8-bit online videos used by Radius Bank.

Radius markets on a variety of news sites, blogs and niche sites across the internet that its target market frequents. Kelly says it’s removed the ambiguity of successfully tracking conversions from each media outlet.

“We optimize the cost-per-account instead of impressions and get really granular in our tracking,” Kelly says. “Week over week, we look at the full efficiency of the account opening process, how much it costs us in marketing dollars to increase our deposit balance per product type, retention and usage. Are people using the accounts they’ve opened?”

The bank’s all-digital delivery model and marketing mix has vastly improved tracking, attribution and ROI. “We’ve seen our biggest success tracking all these pieces under cost-to-acquire,” Kelly says. “And the growth has been outstanding.”