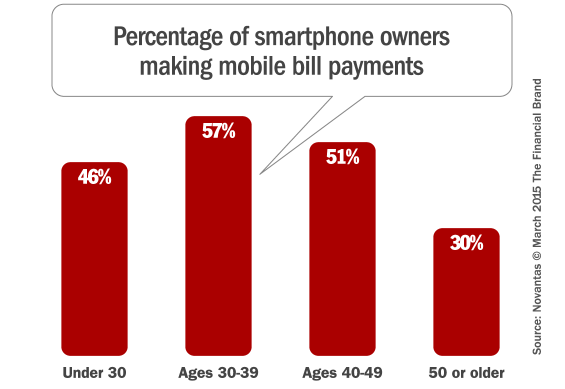

Active bank and checking account shoppers on FindABetterBank were asked how often they use their smartphone to pay bills and make other mobile transactions. Forty six percent of respondents indicated that they have paid a bill using their cell phone within the last 30 days — 10% growth compared to a year ago. Consumers 30 to 49 are more likely to use their phone to pay a bill than other age groups.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

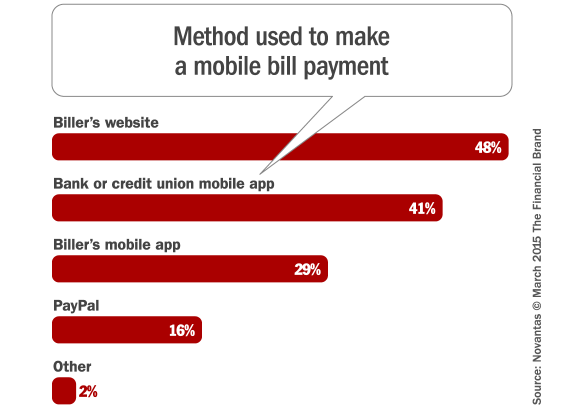

Most consumers pay bills directly on the biller’s website. Almost half of consumers who have paid a bill in the past 30 days with their smartphone did so directly on biller’s site to complete the payment. Lower income consumers are more likely to pay bills by visiting the biller’s website on their smartphone. This group of consumers is most likely to use their smartphone as their primary connection to the internet – they have less access to a desktop or laptop computer.

Consumers 40 or older prefer using their bank or credit union’s mobile application to pay bills. Last month 41% of smartphone owners said that they paid a bill using their bank or credit union’s downloadable mobile application in the last 30 days. We found that consumers 40 or older were more likely to use their financial institution’s mobile application to pay a bill compared to those under 40. FindABetterBank stats show that consumers 40 years or older are also more likely to request online bill pay as a “must have” feature with their new checking account. In general, older consumers rely more on their financial institution to pay bills than younger consumers.

Millennials are most likely to download a biller’s application. Almost 32% of consumers under 40 said that they paid a bill in the last 30 days using a biller’s downloadable application compared to 24% of consumers 40 or older. This discrepancy, along with other research, shows that younger consumers are more comfortable downloading mobile applications outside of their primary financial institutions for various financial transactions.