When consumers who overdraw their checking accounts want to switch banks, it’s interesting to look at the overdraft fees charged by their new banking provider. Ironically, most of these consumers are unconcerned with the overdraft fees associated with their new account.

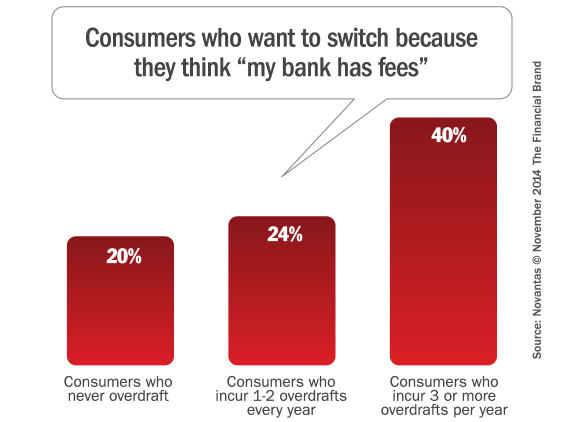

In December 2014, over 2,300 consumers actively shopping for checking accounts on FindABetterBank.com said what motivated them to open a new checking account. A quarter of these shoppers cited high fees at their current bank. Unsurprisingly, 40% of shoppers who indicated that they overdrew their accounts three or more times in the last year cited high fees as their primary motivation to switch.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

This is perfectly rational: If you feel you’re paying too much, find a less expensive option. Therefore, it would also be rational for heavy overdrafters to choose an account with low overdraft fees. But that’s not the case most of the time. In Q4 2014, only 20% of heavy overdrafters selected checking accounts that had no overdraft transfer fee — about the same as all shoppers. The average insufficient funds fee of checking accounts selected by heavy overdrafters was $31.72 — again, about the same as all shoppers. While overdrafters are concerned about fees in general, they don’t seem to be specifically worried about the overdraft fees they incur.

Interestingly, customers who regularly overdraft are more concerned with other fees. So even though some heavy overdrafters are motivated to switch because they don’t like the fees, they tend to focus on monthly service and ATM fees more than overdraft fees.