Today, most consumers prefer to do research online when they’re shopping for a new checking account or banking relationship. The internet enables people to cast a wide net and investigate all options available to them. FindABetterBank (a Novarica website) attracts consumers who use search engines precisely for this task. The comparison tool on FindABetterBank lets shoppers control how wide a net to cast by defining the radius of their search.

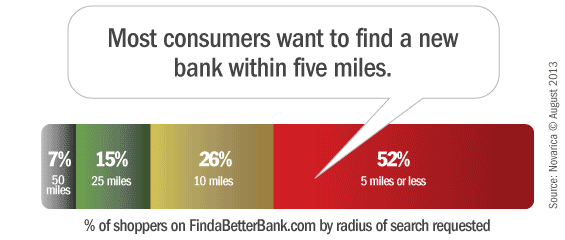

In Q2 2013, more than half of shoppers only want to compare institutions that fall within 5 miles of their location. Only 7% of FindABetterBank shoppers wanted to compare institutions within 50 miles of their location.

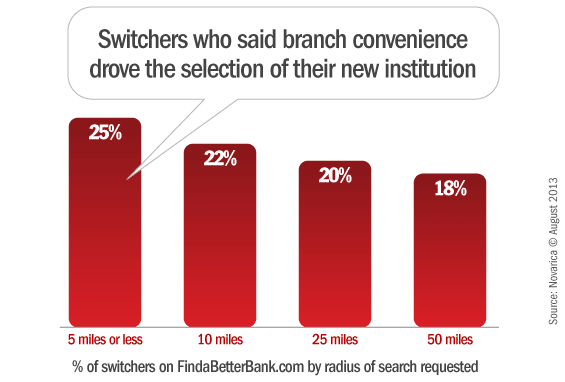

In a very densely populated part of the country, branch locations are likely the most important criteria when switching banks. But people who live in more rural communities are most likely to cast a wider net.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why is this? One hypothesis is that people who live in rural communities have less income and are more likely to choose an account based on fees. But data from FindaBetterBank shoppers doesn’t support this. People who search further afield indicate they maintain higher account balances than shoppers searching within 1-5 miles of their location.

Another hypothesis is that people who live far from branches are most interested in using technology (e.g., mobile banking) to bridge the gap. Yet, there’s little difference in the percent of shoppers who “must have” mobile banking when comparing responses by the radius of their search.

The explanation is most likely simpler: People who live “in the middle of nowhere” are accustomed to driving long distances for everything — from buying milk and going to the post office to banking — and therefore are less sensitive to branch proximity.

Does anyone have a different explanation?