During the month of October and running through the first week of November, exactly how many customers poured out of big banks and into credit unions? Hard to say.

Based on a nationwide survey of 5,000 credit unions, CUNA estimates at least 650,000 consumers joined credit unions in October, a 13-fold spike over the average month. Also during that time, CUNA estimates credit unions brought in $4.5 billion in new deposits.

To help put those numbers in perspective, credit unions added around 1.3 million new members total in 2010. That means credit unions have added half a year’s worth of new members in a single month.

As of Friday, November 4, one day prior to Bank Transfer Day, ABC News reported that the number of people switching to credit unions and community banks had already topped 1 million.

And on Bank Transfer Day on Saturday, November 5, CUNA put the number of new credit union members at around 40,000, bringing $80 million in deposits along with them.

CUNA said growth was particularly noticeable at larger credit unions — those with $100 million or more in assets, a pool which accounts for around 20% of all credit unions but represents 80% of the industry’s total membership. More than 70% of such credit unions reported growth in both members and deposits since September 29. (By inference, that also means 30% did not.)

Bankers dispute these credit union growth numbers, questioning the accuracy of CUNA’s survey methodology.

Alan Theriault, President/CU Financial Services and critic of the study, told American Banker that “clearly CUNA [has] skillful ways to spin stories to get the impact they want.”

What fueled this mass exodus? While there are plenty of aggravating factors — including Kristen Christian’s Bank Transfer Day and Molly Katchpole’s online petition — it’s impossible to attribute the impact of each. Indisputably, the root cause was clearly BofA’s now-aborted decision to charge debit card users a $5 fee. While it’s uncertain how big banks as a group fared through the month of October, what’s obvious is that BofA bore the brunt; they were their own arch-nemesis.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Money Floods From BofA

If you want to get a good, data-driven perspective of the money flooding from BofA, Bob Chatham, CMO of Andera, a provider of online account opening and switch kit technologies to more than 500 credit unions and banks, is a good person to ask.

“It looks like a few people actually put down the remote over [the Bank Transfer Day] weekend and did move some money,” Chatham said in an interview with the Credit Union Times. “Not on an oh-my-God-the-world-is-a-dramatically-different-place-afterwards scale, but kind of like a 4.5 magnitude earthquake in Virginia. You feel the shudder, and people are talking about it.”

Chatham said Andera’s client credit unions saw an average of 7.5 opened accounts over the Bank Transfer Day weekend, with $500 million to $1 billion credit unions averaging six new accounts, $1+ billion credit unions recording at least 19 new openings and $5+ billion credit unions averaging 55 new accounts.

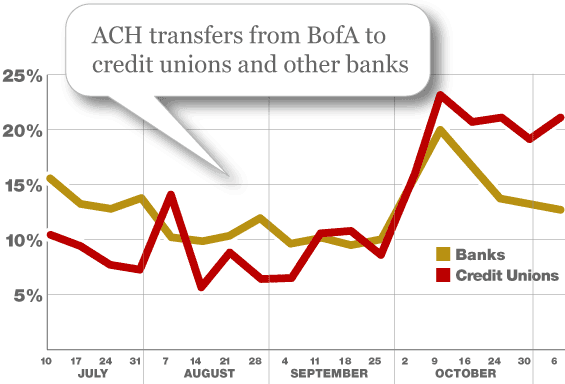

According to Andera’s data, credit unions and smaller banks saw the biggest influx of BofA money around October 10, two weeks after news of the megabank’s debit card fee broke but also before Bank Transfer Day achieved viral velocity. You’ll notice Andera’s ACH transfers out of BofA into credit unions started to skyrocket immediately after BofA’s fee became public on September 28. But switching volume had begun to ebb by the middle of the October.

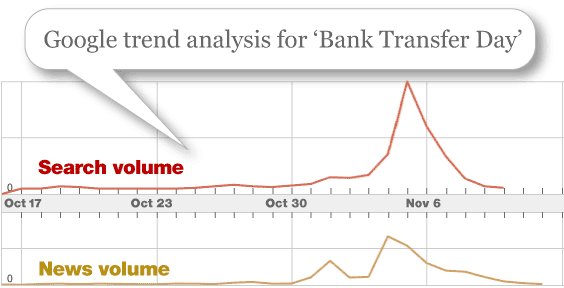

The Bank Transfer Day idea didn’t really take hold until mid October. One of the earliest references to Bank Transfer Day in the news can be found at the Credit Union Times on October 10.

Among 244 of Andera’s clients, the number of online applications completed during the Bank Transfer Day weekend totaled 2,772. That was 1,148 than the previous weekend.

One could bicker about whether BofA gave a rip about Bank Transfer Day, some online petition with 300,000 signatures, or the onslaught of nasty, derisive comments made in social media circles. But it’s almost certain BofA was able to monitor — and took serious note of — ACH transfers to credit unions.

A very interesting study by Compete, a web traffic analytics firm, graphed trends for unique visitors at credit union websites up through September 2011. While the data stops just short of BofA’s debit fee bombshell, it’s still worth a look for reference. Traffic clearly spikes at certain sites in the wake of BofA’s $5 fee.

As an anecdote, Arizona State Credit Union saw 75 online applications over the November 5th weekend, compared to the 21 they might normally see.

How Much Is At Stake?

Assuming that 1 million consumers did indeed switch to credit unions in the wake of BofA’s $5 fee, that would still only represent a fraction of the relationships held by big banks. BofA has as many as 50 million, with Chase, Citi and Wells Fargo not far behind. Even if all the fee-fleers came from BofA, it would only total about 3% of the bank’s checking customers. Nevertheless, something caught the attention of BofA — along with all its competitors, and all at once. If there’s any one thing that undoubtedly concerned big banks, it would have to be the number of relationships they hemorrhaged, not a bunch of social media noise. In a war of attrition, they felt like they were losing the battle of body counts.

As of June 30, credit unions held just 8% of federally insured deposits, compared with 70% for banks that have assets of more than $10 billion. In 2011, FDIC-insured deposits have brushed up on the $10 trillion dollar mark, while credit union deposits only amount to 8% of that, or $800 billion. So if CUNA is right and credit unions added around $5 billion in deposits, that would represent a 0.6% increase and only 0.05% of big banks’ holdings.

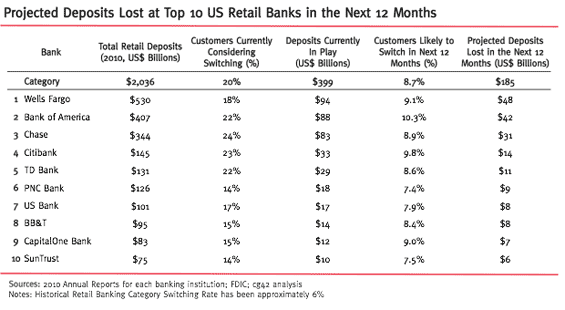

A study by cg42, a management consulting firm, estimated that $399 billion in deposits are currently in jeopardy at America’s ten largest banks — BofA, Citi, Wells, Capital One, Chase, TD, BB&T, US Bank, SunTrust and PNC. The study, which surveyed 5,600 primary checking customers, predicts that $185 billion in deposits will leave those banks in the next year. Do banks even care if they were to see 1.9% of their deposits walk out the door, especially in such a weak lending environment?

The cg42 report says 10.3% of BofA’s customers are expected to defect and move their deposits to another institution in the next year.

You Could Call It ‘Black October’

Either way you look at it, October 2011 can be regarded as “Black October.” For big banks, it was a hugely negative event like Black Monday in 1987, only a whole month of it. For community-based financial institutions — especially credit unions — it was a major boon to business, like 30 straight days of Black Friday.

So how did credit unions fare through Black October? Generally very well.

First Entertainment Credit Union saw the number of new accounts increase 40% in October. The credit union typically signs up an average of 550 new members each month, but that number hit 1,042 in October 2011.

Bethpage FCU said it saw an 85% increase for the month of October. In the final week before Bank Transfer Day, the credit union saw a record-breaking 1,471 new checking accounts compared to 383 opened the same week last year. 672 of those accounts were opened during the Saturday event alone. However, only around 25% of new members were in the 25-44 age range. The bulk were presumably older.

In September, Westerly Community Credit Union only had 111 new members. But in the month of October, that number ballooned to 375. That’s also compares with the mere 113 new members the credit union added in the same period last year.

Glendale Area Schools drew 118 new members in October, 40 more than it did in the same month a year prior. One depositor brought in $250,000.

The number of new members at Northwest Community Credit Union was triple the amount from last October, totaling over 1,500. Burbank City FCU saw the monthly number of its new members double in October to 180. Elevations’ new business jumped about 150% during October, gaining 953 new members vs. 620 for the same period the year prior.

Schools Financial, which has 11 branches in the Sacramento area, had 1,064 new member sign-ups in October, an 11% increase over the previous month. Greater Alliance FCU estimated a 20-30% increase in new accounts in October, above and beyond the 150 accounts they normally open. Highmark FCU gained 25% more members this October than in 2010, the difference amounting to 81 vs. 65 new members. Financial Benefits Credit Union gained 21 new accounts in October, compared to only 3 in the prior month.

Michigan Schools & Government Credit Union estimated its new membership increase was 25-50% at one of its nine branches. The credit union’s membership grew by only 4% last year, but had slowed to about 3.5% until BofA’s debit fee debacle. Now the credit union expects enrollment will be up 5% by the end of the year.

First Community Credit Union in Houston said it saw a 43% increase in new accounts. Boulder Valley Credit Union also reported a 40% increase in new member accounts for the five-week stretch leading up to Bank Transfer Day. Blu Current Credit Union said they observed a growth rate around 30%. While Community Credit Union in Brevard, Florida said new memberships spiked to 100 per month, a 25% increase. Same thing for iQ Credit Union. The Credit Union of New Jersey saw a more modest 20% rise in new accounts in the weeks following BofA’s debit card fee announcement.

McGraw-Hill Credit Union, however, reported a 173% increase in membership in the last two weeks of October. And MaPS Credit Union figured its new checking accounts were up 73% compared with October 2010.

For the month of October, APL Federal Credit Union issued 70% more debit cards than last year. Hits on APL’s debit card page spiked 323%, while the credit union’s switch kit page was up 50%.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Big Day Itself: Saturday, November 5th

On Bank Transfer Day itself, Saturday, November 5th, BECU in Seattle signed up a one-day record 699 new members. Compared with a typical Saturday, that’s an increase of nearly 40%, BECU said. The following Monday, the credit union welcomed an additional 799 new members.

BECU’s competitor, Seattle Metropolitan Credit Union, reported a 215% increase in new accounts on Bank Transfer Day.

In the week ending on November 5, Redwood Credit Union had gained 600 new members — six times normal activity — most switching from BofA. Redwood reported an overall increase of 83% increase over the same period last year.

Randolph-Brooks FCU opened 350 new accounts on November 5, up 67% from the same day a year ago. Firstmark Credit Union added 33 members Saturday, up as much as 50% over the typical Saturday.

Veridian Credit Union added 178 new members over the course of the Bank Transfer Day weekend. SF Fire Credit Union claimed over 200. First Entertainment opened 99 new accounts vs. the 16 they might normally open.

At Northwest Community Credit Union, 85 people became new members on Saturday. Some of them opened up multiple accounts, totaling 137 new accounts opened.

Elevations Credit Union signed up around 50 or 60 new members during the Saturday, November 5th event.

North Jersey Credit Union picked up 48 new accounts during the Saturday event, compared to the 4-5 they might typically see.

Oregon Community Credit Union said they opened 101 new accounts, with 40 new members. That’s triple the number of new members they get on most Saturdays.

Santa Cruz Credit Union added 35 new members during the Bank Transfer Day event — 5-10 times what they usually see.

First Financial FCU gained 23 new full banking relationships on Bank Transfer Day.

At Oregon Employees FCU main Salem branch, about 15 people opened new accounts, while nearby competitor Rivermark Community Credit Union say only five. Up at Rivermark’s Portland branch, the credit union added around 30 new members.

Fall River Municipal Employees Credit Union opened a dozen new accounts on November 5.

APL Federal Credit Union added nine new members on the 5th of November, up from the four or five they usually see.

Alameda Credit Union picked up eight new members on November 5. The credit union saw new membership growth double in the month prior to the Bank Transfer Day event.

From August through October, Northwest Georgia Credit Union with 12,500 members gained 316 more, compared with 231 in the previous three months, a 37% increase. However, they said new member signups slowed down noticeably in the last few days before Bank Transfer Day.

Some Didn’t See Diddly Squat

United SA Federal Credit Union said it did not see anyone coming in Saturday, November 5, because of Bank Transfer Day. They described the whole day as “pretty slow,” despite opening all eight of its branches specifically for the event.

When one of Vantage Credit Union’s vice presidents surveyed branch staff in October about the source of new accounts, some said people mentioned Bank of America by usually did not mention Bank Transfer Day.

According to a survey conducted by CUNA, one in five larger credit unions did not open a single account on Bank Transfer Day.

“Did we get more accounts than we normally would on that day? Yes we did,” said Nick Bavaro, President/Northwest Community Credit Union in Morton Grove. “We got a handful more, but people weren’t standing around the corner waiting to apply.”

Most banks on the other hand — even small community institutions — had much more lackluster Bank Transfer Day results than their credit union peers.

“Bank Transfer Day wasn’t an extraordinary event for us,” said Rolff Nelson, SVP Retail Banking/Exchange Bank, headquartered in Santa Rosa.

Broadway Bank, Frost Bank and Jefferson Bank and even Security Service Credit Union — all in San Antonio — agreed that Bank Transfer Day was “uneventful.”