While the financial services industry has experienced rapid technological advancement and change over the past decade, the pandemic has only increased the pace of disruption. Consumers are visiting branches less, looking more to digital channels, and increasingly raising the bar for seamless, personalized service.

Banks and credit unions often look to technology upgrades to keep pace. In an ideal situation, a bank identifies its requirements, approves a budget, and issues an RFP to select the best solution. But in a fast-paced and complex environment, few can afford to go through a full procurement process for new solutions.

As unpredictable times call for flexibility and innovation, many banks and credit unions have learned that having a flexible tech stack offers tools and solutions to address new challenges creatively.

Adapting to the New Normal

Growing health concerns from COVID-19 and the closure of branches led to an overnight surge in digital channels, forcing many financial institutions to rethink their go to market strategy, according to Bain. Nearly a year into the pandemic, most analysts agree that consumers will continue to do more business online, visit branches less, and hold high expectations for a seamless digital experience.

As banks and credit unions remake their customer experience in response to the pandemic, they must help customers go digital, offer relief for distressed consumers, and improve experiences in ways that also address efficiency. While this requires new capabilities, many financial institutions struggle to keep pace. A survey of banking executives in the PwC Financial Services Technology 2020 and Beyond report found that more than 80% of banking executives say they are concerned about the speed of technological change.

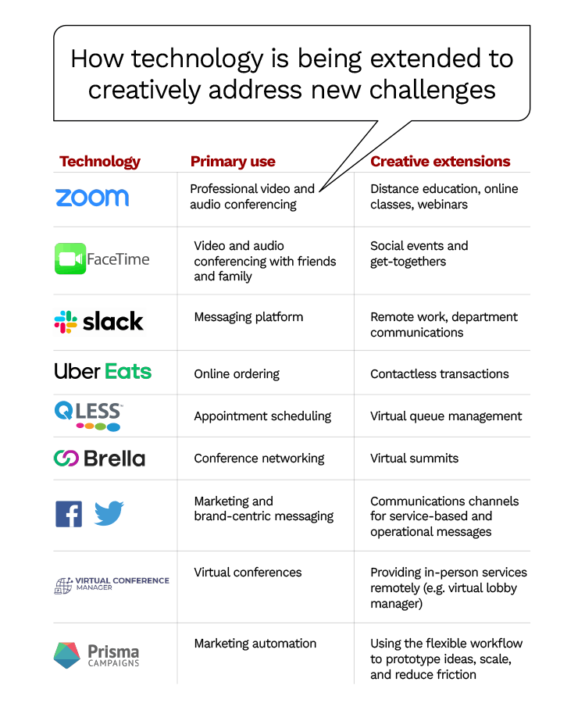

Sometimes, those who most quickly adapt don’t immediately jump to new technologies but learn to work with what they have. When schools began to close, teachers and students quickly moved to holding classes on Zoom calls. Businesses and their employees began using tools like Slack to communicate and collaborate. Restaurants adopted mobile solutions for online ordering and touchless payments, and associations used apps like Brella to hold virtual summits. Meanwhile, families and friends worldwide began using video conferencing and apps like Facetime to hold social events and get-togethers.

The pandemic didn’t necessarily push businesses and consumers to new tools. It led many of them to become more agile and think differently about the technology they already had. And in the financial services industry, many institutions learned to address challenges with flexible tools already are their fingertips. In Illinois, SIU Credit Union leveraged its existing email marketing tool and other social media marketing channels to support a mix of services and marketing messages about operations and relief packages.

In Washington, Numerica Credit Union used its Microsoft Teams Virtual Conference Manager account to enable remote greeters to interact with and guide customers visiting the physical bank lobby via teleconferencing. Other financial institutions used appointment-scheduling software like QLess to serve as virtual queue management to allow customers to wait outside and receive a text when they could come in.

Fast and Flexible Innovation

Those who learn to creatively make the most of flexible solutions are more likely to adapt in challenging times.

When approached with agility and creativity, a tool like Prisma Campaigns enables financial institutions to innovate at a fintech-level pace. As a marketing automation platform designed for the financial industry, Prisma enables customers to easily leverage first-party data and the opportunity to transform service channels into selling channels.

As a vendor-agnostic go-between, Prisma connects with the financial institutions’ different data sources to understand and segment customers based on needs, interests, and behavior. The solution then uses that information to create personalized offers from one central dashboard and pushes them across multiple channels (online and mobile, website, email, SMS, chatbot, voice banking, and direct mail).

Prisma’s flexible workflow enables users to quickly put the right ad in front of the right customer at the right time without writing any code. This includes everything from simple scenarios like data capture forms to complex ones like digital account opening processes. The simplicity and fast response enabled several banks and credit unions to prototype, scale, and overcome challenges.

The Credit Union of Colorado initially used Prisma Campaigns to run segmented, data-driven marketing campaigns with personalized ads in their online banking and mobile app. Yet when faced with an urgent need to offer members financial relief (and having no runway for a typical one-year RFP cycle), the solution enabled it to quickly provide the right message, in the right place, at the right time. Because the speed and scope of decision-making changed with the pandemic, the credit union realized how important prototyping ideas would be to help the most members possible.

Credit Union of Colorado’s marketing team extended Prisma’s capabilities to pilot new offerings (such as skip-a-payment), test various messaging, and streamline the application process with small segments of their member base. Within two weeks, the credit union was up and running with automated workflows that pulled data and processed applications. Prisma proved to be a valuable tool to execute, adjust, and adapt.

In South America, Banco Agrario de Colombia leveraged Prisma’s flexibility to quickly open 230,000 new bank accounts for unbanked farmers to distribute pandemic-related aid. With no time to go through a formal procurement process, the bank reviewed its existing tech stack for an agile solution that could quickly deploy a simple, mobile-first account opening process for unbanked farmers who lacked computers and weren’t familiar with banking processes. Prisma offered a means to create a paperless mobile workflow that enabled farmers to easily open accounts with simple ID validation tools.

While the original scope was to leverage Prisma to open 500 accounts per month, the bank ultimately scaled to opening 8,000 per day. “Our internal platform and infrastructure weren’t prepared to handle such a load. Our partner, Prisma Campaigns remained agile, and made the necessary adjustments to our internal services to solve bottlenecks in a very short time,” said Luis Carlos Motta, Chief Innovation Manager at Banco Agrario.

In another example, a large credit union in California used Prisma to address a growing number of consumers seeking loan flexibility and skip-a-payment options. Without forcing customers to contact a call center or visit a branch, the credit union used the workflow to create a campaign for only those who had an outstanding loan and qualified to skip a payment. The workflow pulled member data from the credit union’s systems, reducing friction for the user and making the credit union’s approval process more straightforward. It ultimately decreased the load on call centers and branches to quickly process more than 200 applications over a few weeks.

A Solution to Support Flexibility

In today’s evolving environment, banks and credit unions must embrace agility, flexibility, and an innovative mindset. By looking to and leveraging the full capacity of all existing tools in their tech stack, they can often find creative ways to address new challenges.

Prisma Campaigns, an all-in-one marketing automation software for banks and credit unions, leverages data to support personalized omnichannel marketing campaigns to boost wallet share and loyalty. Prisma enables financial institution to engage customers with frictionless conversion flows of any type, from data capture to the recovery of abandoned processes. Combining channels and using hyper-personalization data offers a tool to help banks and credit unions adapt to challenges they don’t even know yet exist.

Because Prisma Campaigns is channel-agnostic and believes in the empowerment of business users, it is particularly well-positioned to serve as a versatile tool in challenging times. In addition to supporting the creation of an entire omnichannel campaign in only a matter of hours, it will also enable financial institutions to create branched, multi-step conversion workflows that don’t require any code.

The flexibility of Prisma Campaigns helped many banks and credit unions save time and money by negating the need for entirely new solutions. In a time of rapid change and an uncertain future, flexible solutions can offer assurance and options to overcome whatever challenges may arise.

Additional Resources