Just a few years ago, mobile banking apps were a key differentiator for banks and credit unions. Nowadays, mobile banking apps are table stakes. Over 90% of the institutions listed on FindABetterBank have mobile banking apps, and 44% also offer mobile remote deposit capture.

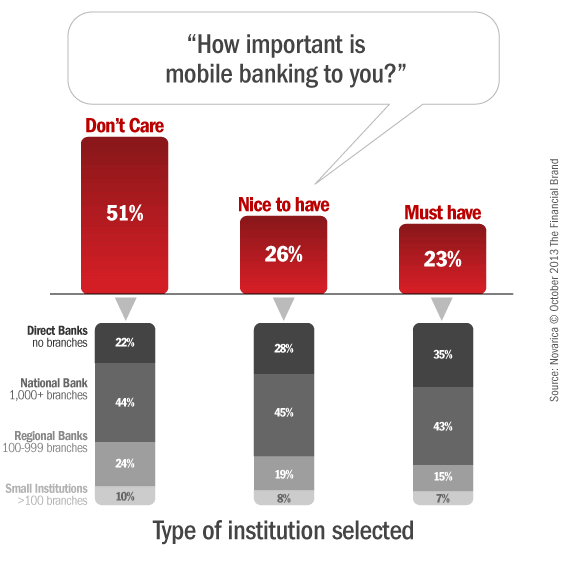

As more consumers adopt mobile banking, more will insist that any institution they switch to also provide this service. In Q1 2011, under 12% of shoppers on FindABetterBank indicated they “must have” mobile banking. Today, that number is 23%.

Direct banks like Ally Bank and Capital One 360 are winning the battle for these mobile-centric shoppers. In Q3 2013, direct banks were 38% more likely to be selected when a shopper indicated mobile banking was a must-have feature than when a shopper indicated they “don’t care” about mobile banking.

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

In fact, over 43% of “must-have” mobile shoppers cited low fees as the reason they chose a direct bank – the top reason among these shoppers. These mobile banking users aren’t as interested in paying for convenient branch locations. Shoppers who “don’t care” about mobile banking were 28% more likely to choose an institution based on convenient branch locations than “must-have” mobile banking shoppers.

Network banks and credit unions must address this disparity to maintain their market and deposit share over direct banks. Why? Direct banks’ lower costs and technology-oriented services will appeal to a larger share of consumers, as they begin adopting mobile apps for their everyday banking needs.

To date, direct banks own a small share of deposits overall. But technology adoption and a rising rate environment may soon change that: Fewer consumers will choose institutions based on the convenience of their branch locations; direct banks’ higher deposit rates will appeal to many consumers; more consumers will consider direct banks due to low fees. Suddenly, direct banks will own more than a blip of the overall deposit share. How will network banks and credit unions respond?