Of all the components fueling a strong brand, differentiation ranks more highly than ever. That’s especially so in financial services where most banks and credit unions offer commodity-like products and say their brand stands for “service” or “value” or “convenience.” If everyone else is saying the same thing, it doesn’t matter if you’re the best.

The search for that elusive attribute to set it apart led Citizens Bank to roll out a new “brand platform,” as the Rhode Island-based regional bank puts it. Others might call it a new brand promise. Either way it was a sharp change from the pedestrian message they had before.

“Most banks are kind of in the pack when it comes to brand distinctiveness.”

— Beth Johnson, Citizens Bank

“Most banks are kind of in the pack,” when it comes to brand distinctiveness, observes Beth Johnson, Citizens Bank’s CMO and Head of Virtual Channels. She says that while the large institution — with total assets of $163 billion and 1,100 branches in 11 states — had made progress on building distinctiveness, “it wasn’t where we wanted it to be.”

In the autumn 2018, the institution began a process, led by Johnson and her marketing team, that brought it to the launch of the new brand platform with the tagline: “Made Ready.” Johnson spoke with The Financial Brand about the strategic thinking behind this new brand promise, what sets it apart, and how it was executed.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

AI Helps Citizens to Be ‘Made Ready’

For about four years Citizens has been building data analytics capabilities to help it understand and meet customer needs. Over time the company formed an in-house analytics team that includes data scientists.

As a result the bank is now well along in using data analytics in various retail applications, including a digital “robo-adviser” for wealth management, as well as the ability to blend multiple internal and external sources to view consumers holistically.

Johnson came to Citizens after a 15-year stint as a consultant at Bain where she led the customer strategy and marketing practice. In addition to heading Marketing at the bank, Johnson is the head of corporate strategy. She notes that the sophisticated analytics tools are not only used to power the bank’s digital channel capabilities but feed into CRM and other tools to enable branch staff to have better-informed conversations with customers.

This enhanced capability wasn’t being conveyed in the bank’s previous tagline, “Ask a Citizen,” which had been in use for five years.

“We stepped back and said, ‘We’re building really good tools to drive personalization and impact with our customers and clients. Do we have the brand and the emotional connectivity with that?'” Johnson recounts. The new “Made Ready” theme was created to better reflect the bank’s upgraded abilities.

Millennials Go From Linear to Jungle Gym

Fans of Joanna Gaines, of “Fixer Upper” TV series fame, will be familiar with the phrase “made ready.” Gaines uses the term in her Magnolia Journal, where she writes: “This concept of being made ready is about acknowledging our capabilities but also knowing when we need help.”

That synchs nicely with Citizens’ new tagline. Johnson adds some color to the concept as used by the bank. The phrase emerged from brainstorming sessions with Ogilvy, the brand campaign’s agency of record. Based on ethnographic consumer research conducted within the bank’s footprint, Johnson states, the bank/agency team gravitated toward the idea of consumer journeys — not the “customer journey” of marketing parlance, but people’s actual life journeys — particularly Millennials on which the bank was particularly focused.

The team settled first upon a timeless truth: That the journey is always harder than it seems. “That concept resonates a lot in the ‘achievement’ and ‘bootstrap’ footprints that we tend to be in along the East Coast and in the Midwest,” Johnson explains. The “journey” may be about setting up a business, figuring out where to live or running a marathon, the CMO adds.

“Life has become much less linear, particularly for younger consumers.”

— Beth Johnson, Citizens Bank

The journey concept was then paired with a timely insight, which is that life, for many people, has really been transformed. “Life has become much less linear,” Johnson states, “particularly for younger consumers, but also for our middle market business and other clients. It’s more like a jungle gym than it’s ever been,” she says. “Today, people move out, but then they move back; maybe they’re in the gig economy and have a second job. Maybe they’re thinking about upsizing, then downsizing,” Johnson continues. “We see the same thing with our business clients. They are having to cope with a great deal of turmoil in the world today.”

The Citizens/Ogilvy team shaped these thoughts into a new brand promise. “We recognize that no matter who you are, you’re on your own unique journey and that Citizens is well-positioned to help you on that journey,” as Johnson puts it.

Read More:

- Truist Bank: Colossal Rebranding Misstep? Or Long-Term Winner?

- 9 of the Most Beautiful Brand Identities in Banking

How the New Brand Came Together

Johnson, who sits on the Citizens Bank Executive Committee, says that group was fully engaged in developing the brand strategy, including CEO Bruce Van Saun.

At the detail level, a cross-functional team was set up within the bank. It included executives from the consumer bank, employee development, and the head of capital markets representing the commercial side. These executives worked directly with the brand team in building the new brand platform.

Johnson says that early in the process the proposed messaging was tested among various age and wealth segments. The new brand promise had to represent the bank as a whole, but a bank-prepared fact sheet notes that the target audience is college graduates with $50k+ income.

The marketing team was conscious of not wanting to alienate older customers, Johnson notes. The message resonated well with Millennials. On the older end of the demographic range, it also resonated, according to Johnson, but for different reasons. Many of these people would have come of age in a more “linear” time, yet they liked the theme because, says Johnson, “they want to be associated with brands that are evolving, that recognize changes in society and have a certain hipness to them.”

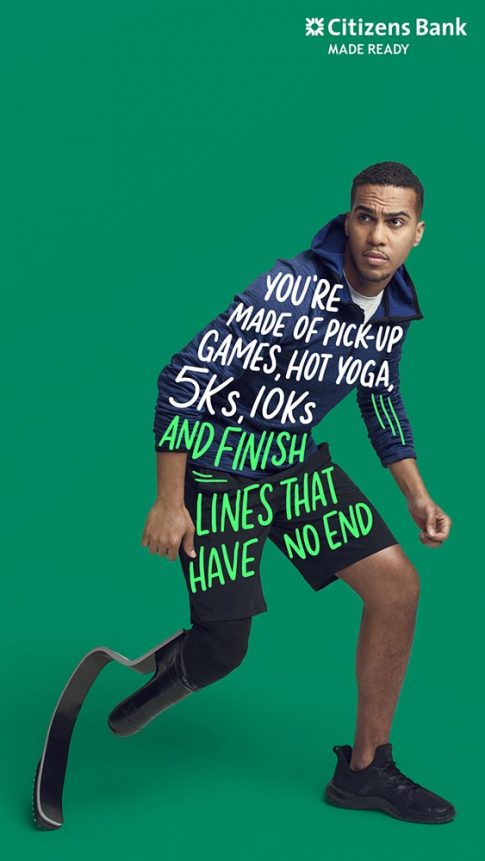

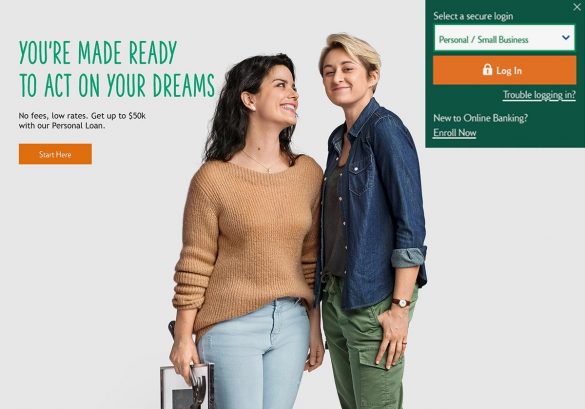

Inclusiveness is a clear theme of the new brand promise and speaks to Johnson’s point about societal change. The campaign’s creatives reflect this and picture, among other examples, an African American entrepreneur and a lesbian couple. As the bank’s brand fact sheet states: “We celebrate people’s unique journeys with respect and authenticity… we choose to see people as individuals, recognize them for who they are, and then help them on their path to reach their potential.”

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Details of the Marketing Plan and Launch

While she declines to specify the budget for the new brand platform, Johnson says the bank is “leveraging our marketing spend, but allocating the dollars differently across sponsorships, our media buy and direct marketing. There is an incremental spend there, but it’s really not a significant number.”

The campaign launched using a combination of earned outreach and paid advertising across mass media, including television, online, social media, radio, podcasts and streaming providers like Spotify. Johnson says they’re also doing some outdoor include “station domination” in Boston and Philadelphia, referring to commuter railroad stations in the two cities where Citizens has large customer bases.

In keeping with the desire for a distinctive brand promise, the bank partnered with Ahmir “Questlove” Thompson, whom the bank describes as “an eclectic artist who built a multidimensional career.”

Johnson says Citizens debated using a celebrity but when Ogilvy came up with the suggestion of using Questlove, the team decided he was a very good fit for the campaign. Johnson describes Questlove, who plays music, teaches at New York University, produces (including the upcoming Broadway musical version of Soul Train) and writes books, as “an authentic example of living a non-linear journey.”

The artist even created a “Made Ready” song for the brand’s launch, giving an exclusive performance of it at a Philadelphia high school. A music video of the event is another part of the brand kickoff.

Employee Engagement and KPIs

For a brand remake to be more than a surface refresh, customers must agree that the financial institution’s actions align with their words. A brand ultimately is what consumers think of a company, not what it says.

In addition to the years of investment in data analytics and AI tools for its employees to use to provide more personalized service — which is the foundation of the brand change — Johnson says employees have been directly involved in several campaign-related projects. One is an online quiz in which staff are asked a series of questions that overall answer “What are you made ready for?”

The CMO says they can upload their picture and post the results on their social media feed on the bank’s internal feed or even in their office. In addition, the bank ran a contest for staff in which they describe how they’re “made ready” as employees. The winners were invited to attend the Questlove event in Philadelphia.

Determining the success of the new brand platform will come from a combination of indicators, according to Johnson. These include the traditional metrics of brand awareness and consideration. But it also includes brand distinctiveness.

“There’s some good data now, particularly in banking,” Johnson notes, “that show how distinctiveness correlates directly to purchase behavior. On top of that, as we go live with these campaigns in specific markets, we’ll look at the lift we get in individual product sales.”