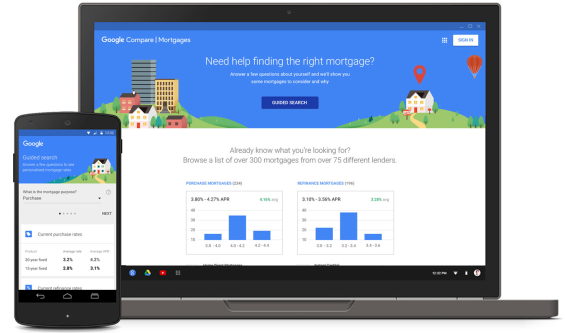

In early 2015, Google rolled out a mortgage comparison tool within its organic search engine. Now, the internet monolith is going a step further, with a full-blown, dedicated service that intends to directly connect home borrowers with lenders.

Google’s Compare service for mortgages aims to present consumers with an “apples-to-apples comparison” in less than a minute.

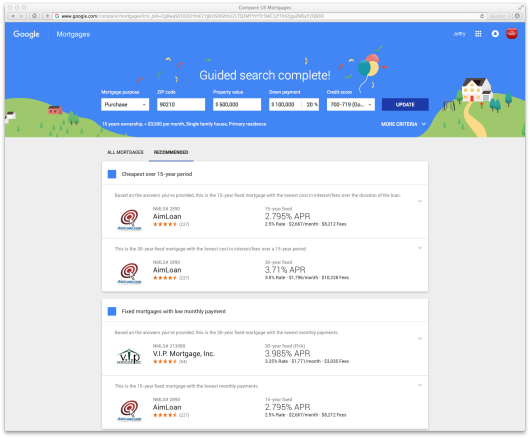

As you might expect from a company like Google, the experience using the Compare service is both quick and painless. After choosing “purchase” or “refinance,” users provide a few key pieces of information. Only the loan amount, purchase price and approximate credit score need to be specified in order to for Google to provide some initial recommendations. If the user also specifies their desired monthly payment and how long they intend to occupy the home, Google will refine its results.

Users can then review a customized list of suggested lenders, detailing variables like interest rate, terms of the loan and fees. The user can drill down to read ratings and reviews for specific lenders.

Once someone has selected a lender, they can either initiate the mortgage application process or ask to speak with a qualified advisor for more information. Within the Google tool, users can request a callback from the lender using an anonymous number provided by Google to keep the borrower’s contact information confidential.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Google wants to reassure more traditional mortgage lenders — not frighten them — so they are trying to put a positive spin on the release of Compare: “Whether you’re a national or local lender, people searching for mortgages on their smartphone or desktop computer can now find and contact you, along with a real-time comparison of rate quotes from other lenders — all in under 60 seconds.

According to Google, nearly one in every two borrowers don’t shop around for their mortgage, and often feel like they lack enough information to make an educated choice. “Buying a home is a major financial decision,” Google says. “When it comes to getting a mortgage, people want an easy way to understand and compare their options online.

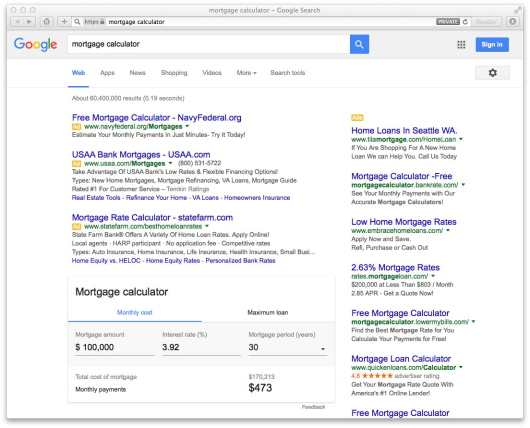

In this screenshot, you can see the paid Google AdWords results above the mortgage calculator built into the search engine.

Smart financial marketers are already buying search terms like “mortgage calculator,” and then geo-targeting their Google AdWords messages accordingly. Google continues to display paid AdWords messages from advertisers like Navy FCU and BECU for the search term “mortgage calculator,” right above the calculator they built into their search engine.

Just like AdWords, participation in Compare is based on a flexible cost-per-lead (CPL) model, however Google says the amount of money spent doesn’t affect which lenders are displayed nor how they are ranked.

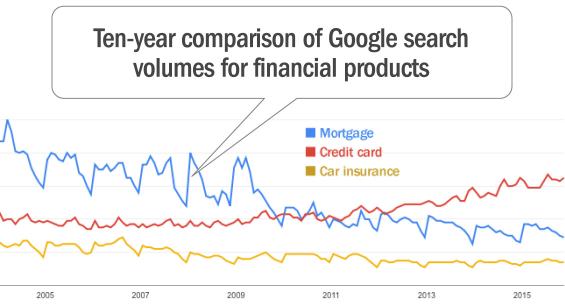

“Google has a very potent funnel,” notes Janko Roettgers, writing for tech pub Gigamon. “Google Trends shows that search interest in mortgage loans is almost as big as interest in credit cards, and a lot higher than in interest car insurance plans.”

Financial Marketers Must Plug Into Zillow and LendingTree

Google isn’t embarking on this venture alone. To power their mortgage comparison tool, they’ve partnered with both Zillow and LendingTree who will fuel Google with raw information including loan rates, ratings and reviews.

“Borrowers searching for mortgage quotes on Google Compare will have seamless access to Zillow’s real-time lender rates, reviews and ratings on both desktop and mobile devices,” Zillow said in a statement. “This mortgage shopping experience allows borrowers to shop anonymously, browse through more than 200,000 local and national lender reviews published on Zillow and choose to contact the lender best suited to their needs.”

So does this mean that banks and credit unions will have to work with Zillow and Lending Tree to leverage Google’s Compare service to its maximum potential? Most likely, yes. But this shouldn’t be viewed as a bad thing. Most retail financial institutions offering mortgages should already be looking at the marketing opportunities provided by online properties like Zillow and LendingTree. Bank and credit union marketers can use the arrival of Google Compare as the impetus (or excuse) to dig deeper and synch up with these mortgage shopping sites. To learn more about how mortgage lenders can tap Zillow, click here. To get started with LendingTree, click here.

What Is Google’s Next Play in the Banking Space?

Since late 2012, Google has been offering its Compare service for financial products in the U.K., including car insurance, credit cards, and mortgages. You can expect Google to follow the same blueprint in the U.S.

For now, the full Compare product is only available in California, where the company is a licensed mortgage broker, but the company has plans to expand into other states.

You may be wondering, “Wait a second… Why does Google have a mortgage broker’s license in California???” While that might initially sound super scary to conventional lenders like banks and credit unions, there is probably little cause for alarm. Does Google plan on every offering loans directly to consumers? Unlikely. As traditional financial institutions are painfully aware, there are a million regulatory and compliance headaches involved with consumer lending — a level of complexity that doesn’t fit neatly into Google’s business model, nor their streamlined user experience. What’s more likely is that Google is simply covering their butt. Lawyers probably reasoned that its safer and smarter for Google to have a mortgage broker’s license in states where it plans to offer the Compare service.

Don’t fret. The Compare mortgage shopping tool — just like Google itself — is all about paid advertising. Google will earn money every time consumers take action based on its recommendations, and there’s enough money at stake in the mortgage game to make this play particularly attractive.