Millennials are lazy. Gen Z feels entitled. And young people today expect a expect a medal just for showing up.

These are just a couple of the common assumption perpetuated by the mainstream media. They are also among the many generational myths financial marketers believe that Jason Dorsey says simply aren’t true.

Dorsey knows what he’s talking about. As the president and CEO at The Center for Generational Kinetics, a research firm specializing in Millennials and Gen Z, Dorsey is widely respected as one of the world’s foremost authorities on generational marketing.

Dorsey says succumbing to common generational fallacies can be deadly for marketers, particularly those in the banking industry. According to Dorsey, the current retail environment is littered with brands that failed to adapt to the changing habits, preferences and behaviors of Millennials and Gen Z. Those that have struggled either saw their market share erode, or disappeared completely.

“Research separating generational myth from fact shows how quickly differences are driving a new normal, and how companies are failing to adapt.”

And it’s not just J.Crew or Abercrombie & Fitch that have suffered from failing to understand and/or respond to generational shifts. Banks and credit unions have also been slow to adjust their approach to Millennials or Gen Z, despite countless warnings from experts for nearly two decades.

These younger generations want to bank differently, says Dorsey, which has created an opening for new providers like Venmo and Wealthfront, who have enjoyed rapid growth.

“We expect the pace of change to only increase,” Dorsey explains. “Thinking that what worked even four years ago will work in the future is a set up for a generational miss.”

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Don’t Put Generations in a Box

One of the main messages Dorsey delivered to a packed auditorium at The Financial Brand Forum 2018 is that generations don’t fit neatly into boxes. Instead, explains Dorsey, a generation is a group of people born around the same time and raised around the same place that exhibit similar characteristics, preferences and values over their lifetimes.

“A generation is not a box, but a powerful set of clues suggesting where to begin when attempting to connect with- and influence people of different ages,” says Dorsey.

If you were born within five years of a generation’s beginning or ending birth year, you are what Dorsey calls a “cusper.” Cuspers have an advantage, explains Dorsey, because they tend to be more empathetic to the generations before and after. They can identify with elements of both.

And what impacts generational characteristics, preferences and values the most are parenting, technology and economics.

“The number one driver of generational behavior is parents,” says Dorsey. “Your parents influence everything — from your views on money, banking, spending and careers.”

Gen Z Are Not Younger Millennials

One quarter of Gen Z had a smart phone before the age of 10.

— Center for Generational Kinetics

One pervasive generational myth is that Gen Z, which The Center for Generational Kinetics defines as born after 1996, act the same as Millennials born between 1977 and 1995. Gen Z is very different from Millennials, and in fact exhibit characteristics more akin to Baby Boomers.

According to Dorsey, the biggest historical marker separating Gen Z from Millennials was the 9/11 terror attacks. If you were old enough to emotionally process the significance of 9/11 — maybe as young as 10 — then you are a Millennial.

“If 9/11 was something you’ve only read about and didn’t go through, then you are Gen Z and not a Millennial,” explains Dorsey.

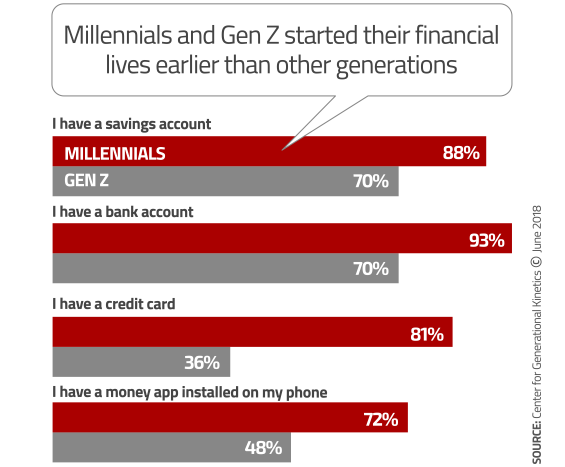

Heavily influenced by the Great Recession and its aftermath, members of Gen Z are fiscally pragmatic, with 12% already saving for retirement and an additional 35% planning to start sometime in their 20s. They are savers, rather the spenders of the previous generation. Unlike Millennials, who were influenced by their parents’ belief that they should attend the best school they can even if it means borrowing heavily, Gen Z looks at people like Mark Zuckerberg and think college might not be the best route.

As big an impact as Millennials will have on banking, Gen Z’s will be even greater. Based on sheer numbers alone, Gen Z’s presence will be increasingly felt at both the workplace and at the retail register, with more and more Gen Z employees and consumers pouring out of schools.

Geography Affect Psychographic Profiles

Geography also impacts how people perceive the world. People who grow up or live in urban areas tend to see trends sooner than those who live in rural areas. So, a Millennial in rural Iowa has different experiences and perspectives than a Millennial who lives in Brooklyn. And even those living within a Brooklyn block can differ based on where they were born: a native U.S. citizen will have different perspectives than someone who immigrated to the U.S.

Dorsey recommends that banks and credit unions tweak their marketing messages based on whether the target audience is rural or urban or from largely immigrant populations.

“It’s important to show that you are inclusive of all the audiences you serve and reflect their needs and priorities,” Dorsey recommends. “This includes the reality of being in a rural area or being a first-generation immigrant.”

It’s important not only to understand and adapt to your current customers and members but to understand and adapt to those who will drive your growth over the next ten and twenty years.

“The challenge for many financial institutions,” explains Dorsey, “is that their local market or the opportunity within their market may not be the one that got them to where they are now but will be the one they must attract and keep in order to grow now and in the future.”

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Delaying Major Life Events

Millennials are not anti-home ownership or anti-kids, says Dorsey. But they are delaying life events such as marriage, buying houses or having children. Some banks and credit unions do a good job marketing to these Millennials by creating entire advertising campaigns tied to these delayed life events. Other financial institutions are stuck in the past with marketing campaigns that badly need to be updated.

But, says Dorsey, marketing to Millennials is not as easy as just implementing a new campaign or swapping out a few images. Instead, it involves educating everyone from the board and senior leadership down to frontline tellers on understanding how generations are different — particularly Millennials with delayed adulthood — and knowing how to connect best and serve them, says Dorsey.

Trust in YouTube

Dorsey and his team have found that Gen Z trusts YouTube, but that it’s often an underutilized channel for financial institutions due to compliance concerns or an overall lack of comfort with social media.

YouTube offers a way for banks and credit unions to uniquely leverage their brand, story, and values to engage consumers. One effective way to engage consumers is to tell first-person consumer and employee stories on video. “We find that short videos incorporating humor, a strong local connection and a social mission connect well with Gen Z—particularly when introducing a new financial institution to them,” notes Dorsey.