When the first challengers hit the market in the early 2010s, they instantly outclassed incumbents.

Where most incumbents’ digital portals were clunky and had limited capabilities, the likes of Chime and SoFi had slick, user-friendly apps that upended expectations. Suddenly, you could open an account in minutes and perform any banking task you could think of — without leaving your phone.

Since then, the digital gap has narrowed. But who is winning the war? Do challengers still have the advantage, or are there things incumbents do better?

To answer these questions, we dove into FinTech Insights’ data on the U.S. banking market as of March 2024.

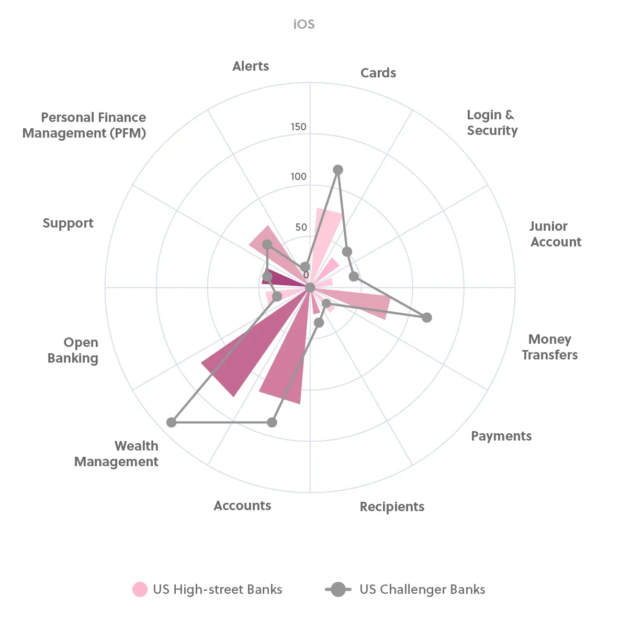

The State of iOS Banking

With 48% of Americans using banking apps compared to 23% who use web portals, mobile is, by far, the country’s preferred way to bank. And since 61% of cell phones in the U.S. market are iPhones, iOS is a key battleground.

Predictably, incumbents and challengers both invest significantly in iOS. This table shows the top categories the 19 incumbents and 22 challengers in our data set invest in.

| Incumbents | Challengers |

|---|---|

| Wealth management | Wealth management |

| Accounts | Accounts |

| Money transfers | Money transfers |

| Cards | Cards |

| Personal finance management |

At first glance, two things stand out.

First, with the exception of personal finance management, incumbents and challengers are both investing in the same categories. And they’re giving each category the same order of priority, with wealth management — a significant growth area — at the top of their respective lists.

Second, the fact challengers aren’t investing in personal finance management as much as incumbents are — incumbents offer 70 personal finance management functionalities compared to the challengers’ 55 — seems to suggest the latter are gaining ground. But a closer look at the data shows that, in every other category, challengers win hands down when it comes to breadth of functionality.

Challengers have a whopping 192 wealth management functionalities compared to incumbents’ 120. Similarly, they have:

- 138 accounts functionalities to incumbents’ 107

- 117 money transfer functionalities to incumbents’ 82

- 114 card functionalities to incumbents’ 70

Challengers also have a slight edge in security (49 functionalities to incumbents’ 41), recipients (39 to 22), and junior accounts ( 47 to 23) — a category which continues to be a largely untapped opportunity.

Incumbents, on the other hand, do better on support (47 functionalities to challengers’ 42), payments (28 to 18), alerts (20 to 16), and the emerging category of open banking (43 to 32).

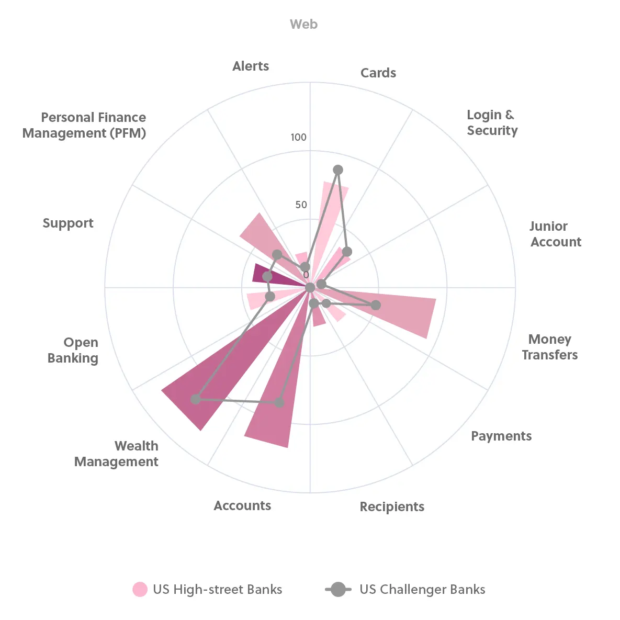

Who Does Desktop Banking Better?

Incumbents and challengers both prioritize the same categories on the web as they do on iOS. But, with the exception of cards, where challengers have 71 functionalities to incumbents’ 64, incumbents’ desktop portals offer more functionality in every category:

- 130 wealth management functionalities to challengers’ 114

- 121 accounts functionalities to challengers’ 89

- 85 money transfer functionalities to challengers’ 50

- 63 personal finance management functionalities to challengers’ 35

Incumbents also offer more functionalities in support (45 to challengers’ 34), payments (33 to 14), alerts (21 to 13), open banking (48 to 31), and recipients (30 to 9). And, they do better on junior accounts. Though, at 8 functionalities compared to challengers’ 6, this category is even less well-served than it is on iOS.

Challengers, meanwhile, have more security functionality. But the difference is very slight: 43 to incumbents’ 41.

In 2024, It’s All About the Fine Margins

A decade ago, challengers were winning the digital battle hands down. But while they continue to be more agile and adaptable, incumbents are making huge investments — an estimated $83.31 billion just in 2024 — and slow but steady progress.

The upshot is that digital banking supremacy is no longer about who has the slickest app. Increasingly, it depends on ensuring you have the breadth of functionality and the quality of implementation to meet consumers’ ever growing expectations.

So far, challengers and incumbents seemed to have carved their own niches. Challengers are winning on iOS, while incumbents are winning on desktop.

But if desktop is important today because it’s how older consumers prefer to bank, the future is mobile. Which means that, in the medium-to-long term, incumbents still have a lot of catching up to do.

Alexandros Argyriou is the CEO of FinTech Insights, fintech keynote speaker and influencer. FinTech Insights is the AI-powered competitive analysis platform for Banks and Fintechs. By analyzing the digital banking offerings from banks, CUs, and fintechs, FinTech Insights allows its users to innovate faster, speed up their product releases, and de-risk their product strategy.