Rather than send consumers to their institution’s homepage or generic product page, smart financial marketers utilize dedicated landing pages for each and every campaign. These landing pages are a more concentrated, directive and compelling destination for online marketing campaigns.

Persuading the target audience to take a specific desired action, a landing page often promotes a financial product, service, offer or event. Typical calls-to-action on these standalone web pages direct consumers to open an account, apply for a loan, enroll in a service, get a free quote, consult with a specialist, download an app or register for a seminar.

Successful landing pages should include strategic content, establish credibility and provide clarity to visitors.

CONTENT. As with all marketing, the messaging means as much — sometimes even more — than the offer or promotion itself, so the landing page must provide content that quickly nurtures and sells visitors. You must address a very specific need, getting into the mindset of the consumer. The copy should be concise and compelling, speaking directly to the problem the consumer wants to solve, offering them a unique solution. Imagery must be used judiciously, and can be used to represent the problem and/or target audience by reflecting the demographic profile and geographic footprint; but do so only without distracting from your main objective: generating conversions.

CREDIBILITY. Building trust with consumers is another important element of a compelling campaign landing page. Logos of industry certifications and vendor partnerships instill faith in your financial institution, while social proof — quotes and testimonials — can go a long way to providing credibility for your institution and its offer.

CLARITY. When crafting your content strategy, keep the landing page design streamlined and personalized. This increases the chances that the target audience will take the next step towards the desired result. Furthermore, be crystal clear with what your institution is offering; avoid the temptation to cross-sell other financial profucts. If you’re promoting a competitive rate, display it prominently so that users do not need to scroll to find it. Do you wish for the visitor to register for a webinar? Tell them how they will benefit and what they will gain by signing up, and place the “Register Now” button near the top of the page. Don’t tell your visitors to do something vague, like “plan and prepare” for a particular life stage, like saving for college tuition. Specifically demonstrate how your financial institution will help them achieve their goal and accomplish their immediate mission. Make your value proposition clear and obvious to the consumer, including only the most essential elements needed to build trust, frame the offer and encourage the next step.

Landing pages are a powerful tool for bank and credit union marketers looking to convert the leads they’ve cultivated from their integrated marketing campaigns. Here are 24 best practices that will help you maximize these individualized webpages and leverage them to their fullest potential.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

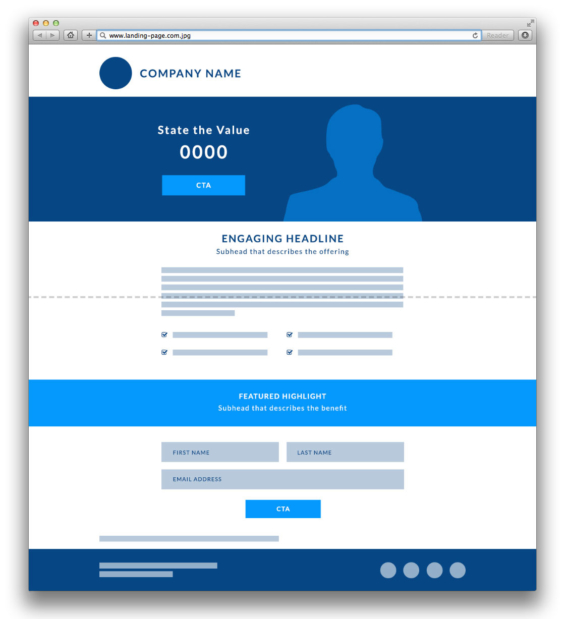

1. Remove (or severely limit) main site navigation to focus the visitor on the landing page’s main call to action, increasing the chances of conversion.

2. Identify the brand with prominent placement of your institution’s logo and/or tagline in a position of the webpage header that’s consistent with your other webpages.

3. Create visual interest with a captivating main header graphic, leveraging unique lines, colors, textures and photography in accordance with your financial institution’s digital style guide.

4. Write an engaging headline that answers the problem set up in other campaign materials, paying off the corresponding visual and leads to the call to action.

5. Display callout boxes to promote special rates or draw attention to the offer towards the top of the page, reducing the need for the visitor to scroll.

6. Persuade with copy that sells the features and benefits of the banking promotion, product or service with a supporting subhead, actionable lead-in text, proof points and compelling close.

7. State the call to action clearly in the close of the body text with an actionable hyperlink, reemphasizing the promotion introduced at the top of the landing page.

8. Add real-life testimonials. You can use “pull quotes” or video interviews to foster legitimacy with your consumer via social proof.

9. Utilize clickable buttons to highlight primary and secondary actions, with user-centric language and purposeful color, making it easier for the consumer to take the next step.

10. Integrate a “smart form” into the page for fulfillment and future marketing automation, capturing only the most essential consumer information (e.g.. first name, last name, email) to encourage submissions, making sure that the user experience is consistent if linking to a third-party form.

11. Place the most important information “above the fold,” including the headline, brief description, supporting image, promo box, call-to-action button or embedded short form.

12. Embed video that shows an endorsement, reference or social proof to cultivate trust and increase conversions, as online consumers are more apt to watch, rather than read content.

13. Consolidate related content to tell a better story, minimize page scrolling and focus the visitor on conversion. Edit, edit, edit.

14. Keep it simple with liberal use of white space, focused imagery, concise text and minimal links to draw the consumer towards the call to action.

15. Place disclaimers in smaller type (no less than 11-point size) under all the main promotional information and just above the bottom footer.

16. Display trust symbols, such as Equal Housing Lender, FDIC and/or NCUA, in addition to award logos, satisfaction seals, and security marks in the bottom footer to build credibility with your consumer.

17. Include general information in the bottom footer, including full name of the financial institution, copyright, trust symbols as well as links out to the main site, privacy policy, and more.

18. Create templates using responsive design, so that the visitor can seamlessly engage the landing page from a desktop computer or mobile device.

19. Conform to ADA standards to maximize the user experience for all visitors, including those with visual disabilities.

20. Decrease page loading time as much as possible with streamlined design and efficient coding decisions, as visitors will abandon the landing page if there is too much of a load-time delay.

21. Optimize for search. Include a descriptive, branded page title, as well as key phrases in the meta data and organically throughout the page content – helping your landing page’s quality score for a search engine marketing (SEM) campaign.

22. Conduct A/B testing. Experiment with variations to the design and/or messaging of two landing pages for the same campaign, studying usability and conversion rates before settling on the final, optimal landing page.

23. Implement analytics. Track key conversion metrics,so you can measure, monitor and adjust the landing page to achieve maximize results.

24. Use a confirmation page that assures and thanks the consumer for taking the desired actions, including social sharing buttons post-conversion, so visitors can share the offering.

Part and parcel to lead generation, successful financial marketers should always drive consumers to landing pages for key promotions. Providing a seamless experience for the user along the sales funnel, the landing page offers continuous brand messaging from related content marketing, such as promotional emails, e-newsletters, blog articles, social media posts, video marketing, webinars, and more.

Additionally, as the main hub of an inbound marketing strategy, it should fuel subsequent marketing automation efforts by capturing valuable contact information. To incentivize consumers to submit their email address, offer something of value — like a free whitepaper or a special giveaway — on your landing page.

Delivering a customized experience along the customer journey, the landing page should be a centerpiece for how banks and credit unions convert leads. Whether creating in-house or with the assistance of a digital agency specializing in financial marketing, landing pages must be a primary conversion point for your institution’s integrated marketing campaigns.

Chris Rinaldi is a Digital Strategist at ZAG Interactive, a full-service digital agency in Glastonbury CT that has built hundreds of bank and credit union websites. To discuss your digital strategy needs with ZAG, call 860.633.4818 or send an email.