As financial institutions shift more money into digital advertising, and as digital advertising absorbs the TV market, the financial services industry has to come to terms with getting media value out of a much more complex ecosystem. Progressive organizations are finding new ways to deliver their message and measure their results.

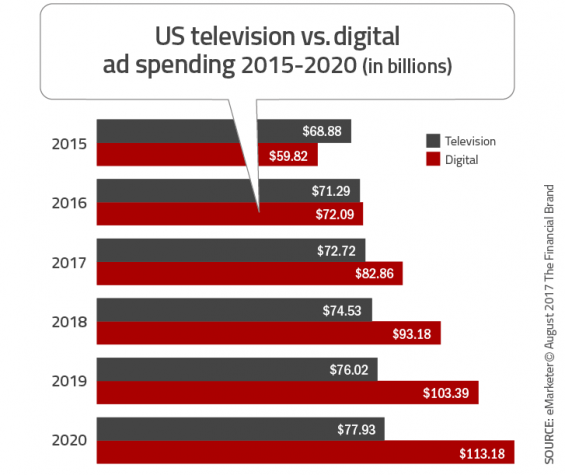

According to IPG Mediabrands’ Magna, 2016 marked the first year that digital ad spending overtook linear television ad spending in the U.S. market. The firm also forecasted that 2017 will be the first year that this will happen globally. Independent research by eMarketer further predicts the continued rise of digital ad spend versus TV.

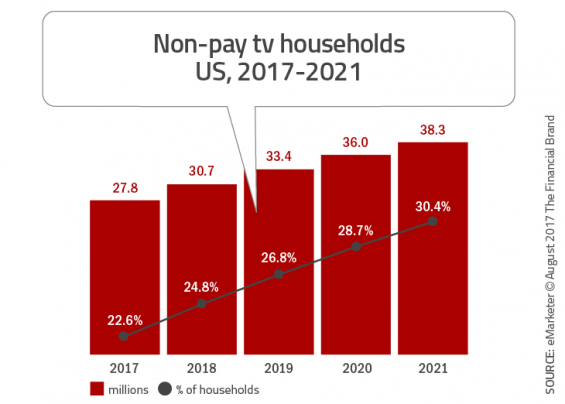

There also has been continued growth in non-pay TV households, which means more consumers are choosing to forego a traditional cable subscription for Internet-delivered TV content, using their telecom provider only for Internet access and connected devices like a smart TV, Roku or Apple TV to deliver the content they want to watch.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

The Impact of Changing Media Patterns

For marketers, these two trends equal a significant shift in how video marketing, including TV ads, will be delivered to consumers and measured by advertisers. As advertising shifts to digital delivery, the ability to present different messages and to collect more information on how and where viewers are watching and reacting in real-time (and after viewing) will allow marketers to shift from a one-to-many broadcast model to more of a conversational model.

A conversational model means a brand can leverage everything they know about a given consumer and the context of the advertising (device, placement, surrounding content, etc.) to “speak” to the consumer with a message tailored to their needs, while also being set up to “listen” to the consumer’s response to the video.

To date, the measurement of that consumer response has been extremely limited – the primary metrics used to judge a video’s success are click thrus and completions. As we move into a new era, where all video is shown on a screen that gives the viewer a chance to respond – be it desktop, mobile or connected TV – additional opportunities for the viewer to engage can be supported with interactivity.

How Banking Can Leverage Digital Media

So how are brands in the financial sector taking advantage of new opportunities in the digital video ecosystem?

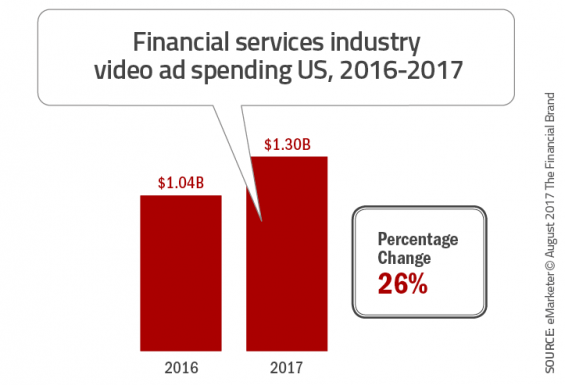

First, they are spending more. According to eMarketer, video ad spending in the financial industry is projected to increase 26% YOY in 2017, and Kantar identified 9 of the top 25 overall digital ad spenders as financial services companies.

Second, as is the case in many other industries, the financial services industry is adopting data management platforms (DMPs) that will allow them to centralize all the “listening” data from consumers’ various touchpoints with the brand. Organizations can then combine this with 3rd party data sets that can identify certain demographic or psychographic (interest-based) groups for consumers.

To give you an idea of the types of data that can be leveraged, here is a quick excerpt from a “Big Data in Financial Services and Banking” whitepaper from Oracle, one of the commonly used DMP providers.

Traditional enterprise data from operational systems related to customer touch points:

- ATMs

- Call Centers

- Web-based and mobile sources

- Branches / Brokerage units

- Mortgage units

- Credit cards

- Debt including student and auto loans

- Volatility measures that impact the clients’ portfolios

Financial business forecasts from various sources:

- News

- Industry data

- Trading data

- Regulatory data

- Analyst reports (internal and competing banks)

- Alerts about events (news, blogs, Twitter and other messaging feeds)

Other sources of data:

- Advertising response data

- Social media data

For financial companies, gathering and using this data is even more complicated than it is for other industries due to regulations relating to the privacy of consumer financial data.

Third, financial brands are looking to leverage this data for their digital ad buys, by investing more heavily in programmatic advertising. Through the use of technology, not unlike the financial exchanges, programmatic advertising allows desirable viewers to be selected to see a specific brand’s ads in real time.

In the past year, we have seen volatile support for this highly automated form of advertising by the financial sector, as well as other industries, but it still is responsible for a strong majority of all digital ad spend. Chief concerns with programmatic advertising focus on inventory quality issues – ad viewability, brand safety and so on.

Some industry players, including Allstate, have brought programmatic entirely in-house to maximize the value they get for their dollars, while others, like JPMorgan Chase, have aggressively culled the list of sites their advertising can appear on from about 400,000 to 5,000, as reported by The New York Times. The latter is seen as a step away from true programmatic, and raises questions about whether the general industry trend towards fully automated advertising will slow.

The final step that some forward-thinking brands are taking is to seek out video advertising technology specialists that can help them navigate the complexities of delivering and measuring video ads across the many devices and consumer touchpoints that now exist. These partners also typically help with the final piece of the puzzle, which is the video creative itself.

In the words of Lou Paskalis, SVP, Enterprise Media and Investment Planning, Bank of America, speaking at the Interactive Advertising Bureau’s annual mobile conference: “The biggest challenge is the sufficient number of messages that we have in inventory that are designed as solutions for those individual moments of receptivity” …” While the challenge of being able to present the right creative to match the viewer’s full context of profile, mindset, device, time and place is still in its relative infancy, creative and technological forces are in motion to address this issue alongside the others.

In the end, it boils down to making the investment in data, media and creative early enough, and with the right partners, to be ready for the changes to come. These changes are significant, but they hold the promise of enabling a new level of communication between financial brands and their customers.