Everybody (almost everybody) agrees that digital is important in financial services. However, the views on what digital means for banking are diverse, and there is little consensus in the industry. When we ask banking executives what ‘digital’ means for them, we get a diverse, and sometimes inconsistent, set of answers. We have observed this first-hand when running roundtable discussions with financial services clients.

The following are just a few examples of how bankers define ‘digital.’ While none of these are wrong, none of them feels sufficiently robust to truly capture the essence of ‘digital’ in banking.

- “Engaging clients in a way that we have never been able to before, using data that we’ve not had up until now.”

- “Taking advantage of technology opportunities that directly affect the way the company interacts with its stakeholders mostly relating to web, mobile and ‘Big data’”

- “Staying ahead. Guarding against new direct start-ups.”

- “Delivering on the STP promise.”

- “Replacing paper by electronic documents.”

Concepts such as ‘customer experience’ and ‘mobile’ stood out as defining characteristics of digital in the executives’ minds. However, the range of attributes was broad and went from ‘omnichannel’ and ‘social’ to ‘transformation’ and ‘efficiency’. Some executives even connected terms like ‘innovation’, ‘contextual’ and ‘simplicity’ to the concept of digital in banking.

Digital Through the Ages

Of course, arguably, digital is not a new trend. If we take the strict definition of digital as simply “technologies that allow manual processing to be replaced by computer processing,” one could argue that digital banking has existed since the 1950s, when mainframes started processing banking transactions. Another milestone was the rollout of electronic banking in the 1990s. The common thread between these two transformations is that each was an example of technology taking over where previously live people had to perform a task, just as ATMs augmented the teller window.

And yet, we are now in the midst of a perfect storm where at least five different trends are coming together, radically reshaping banking and beyond. They are:

- Mobility and connectivity

- Social

- Cloud

- “Big data”

- Artificial intelligence and robotics

Collectively these trends represent to the established institutions both a threat and a unique opportunity to redesign their business model. The definition of digital in banking today needs to go beyond simply “replacing manual labor with technology.”

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Digital Banking Definition

We define digital banking as having the following elements:

- Delivering a customised but consistent FI brand experience to customers across all channels and points of interaction…

- underpinned by analytics and automation…

- requiring a change in the operating model, namely products and services, organization, culture, and skills and IT…

- in order to deliver demonstrable and sustainable economic value.

Delivering the Omnichannel Promise

Let’s focus on one element of the consistent brand experience: omnichannel (the other elements are addressed more deeply in the Celent report, Defining a Digital Financial Institution: What ‘Digital’ Means in Banking).

‘Omnichannel’ has become another industry buzzword, which everyone talks about but, when pressed, often struggles to articulate what exactly it means. For us, delivering on the omnichannel promise means the following:

- ‘Zero drop rate’ channel integration. The customer should be able to move seamlessly between different channels, such as picking up a previously saved application process or having an agent conversation without having to re-enter and repeat data.

- Optimizing a cross-channel experience by building on individual channel strengths. We recognize that each channel is different and the way the customer engages with, say, mobile is very different from interactions at the branch or even online. As a result, we don’t think that all channels must offer the same functionality or even access to the same information. Instead, we believe customer experience via an individual channel should be tailored to the strengths of that channel. For example, an investor may want a timely alert on his mobile and ability to act on that information (e.g., sell/buy shares), but is likely to prefer online and physical channels for in-depth research.

- Mutually reinforcing channels (for example, a live video chat from within a mobile banking app or an automated kiosk inside a branch). Barclays and Coutts in the UK have just announced they would be rolling out face-to-face video banking platforms to connect customers to banking experts from their mobile or desktop. Creative use of digital technologies in physical channels is an essential component of digital in banking. We also recognize that customers often use concurrent channels at the same time, such as looking at an online banking screen while talking to a customer service rep on the phone. This highlights the importance of real time information and consistency of data across channels.

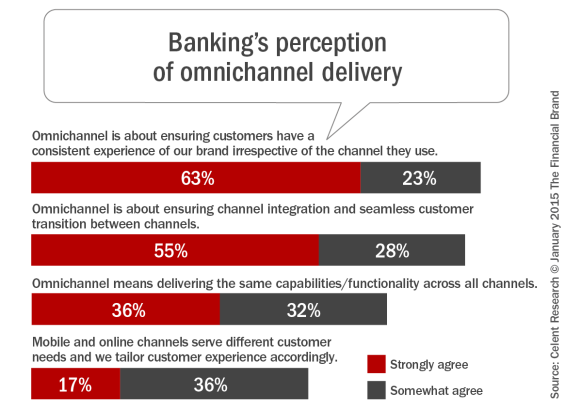

We recently conducted research among more than 150 North American financial institutions on a range of technology topics; detailed review of the survey findings will be published in a forthcoming report. One of the questions asked the participants about the degree to which they agree or disagree with a number of statements on ‘omnichannel.’

The strongest agreement among the respondents is with the statement that “omnichannel is about ensuring customers have a consistent experience of our brand irrespective of the channel they use” — 86% of respondents agreed, with 62% agreeing strongly. This is closely followed by the statement that “omnichannel is about channel integration and seamless customer transition between channels” with 83% of respondents agreeing, 55% strongly.

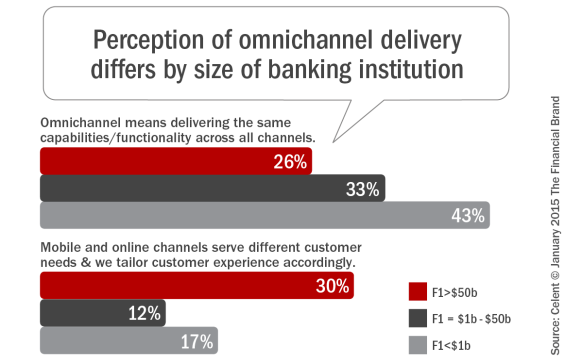

The following two statements: “omnichannel means delivering the same capabilities/functionality across all channels” and “mobile and online channels serve different customer needs & we tailor customer experience accordingly” also received strong support. 68% of respondents strongly or somewhat agreed with the former, and 53% with the latter statement. However, we suspect that different respondents agreed with different statements, as it would be difficult to agree with both. It appears that this issue — whether to make all channels the same or to play to each channel’s strength — continues to polarize the industry.

It is also possible that the participants were replying about their current ability rather than an aspirational vision. Tailoring customer experience to channel strengths requires a more sophisticated delivery capability. Another cut of the data hints at this possibility — percentage of respondents agreeing strongly with that statement among large financial institutions (with assets over $50 billion) rises to 30% compared to 17% for all FIs. Conversely, the percentage of large FIs agreeing strongly with the statement that omnichannel is about delivering the same capabilities across all channels is the lowest at 26% against the overall average of 36%.

Some would argue that a truly visionary definition should not even contemplate the debate over what capabilities and functionality should be delivered over what channels. Banks’ architecture should be so flexible as to allow customers to pick and choose what features and functionality they want to use through which channels. However, most banks have a long way to go to such a vision. Also, we would argue that too much choice may be detrimental to consumers; banks have an active role to play in creating superior customer experiences.

The third channel management imperative in the digital world is the need to recognize that customers engage with banking services in a broader ecosystem. This requires enabling access to banking products and services via third party channels, possibly through API integration, such as access to payment credentials, financial advice, or lending from within the merchant’s app. Digital is fragmenting and diversifying customer experiences as customers engage with more apps and websites and even use them in physical locations. In order to stay relevant, a digital financial institution needs to go where its customers are and be available when customers need it.

Some banks may also choose to selectively allow access to third party products and services through FI channels. For example, many banks in the US and in Europe are allowing their channels to be used to deliver card linked merchant offers. Some banks are even enabling customers to buy merchandise directly from their mobile banking apps. For example, Santander’s Polish subsidiary has linked its mobile banking app to a merchant marketplace where customers can buy flowers, transit fare, and other goods directly from the user’s bank account.

The Digital Challenge

As we think about the overall digital challenge, we recommend the following high-level actions for financial institutions embarking on a digital transformation journey:

- Focus on the customer’s experience of your brand

- Build flexibility into your operating model, both business and technology

- Keep an eye on the market

- Be clear how economic value will be derived

- Establish a portfolio of plays and create a roadmap

Bankers know that digital is important, but may have been perplexed about how best to approach it. Hopefully, this discussion provides a useful starting point.

About the Report

The new Celent report, Defining a Digital Financial Institution: What ‘Digital’ Means in Banking, presents Celent’s framework for digital in banking. The framework has been shaped and influenced by Celent’s own primary research, in addition to conversations with industry practitioners, attendance at conferences, and tracking the plethora of perspectives on the Internet and social media. Its intent is to frame the issues, raise questions, and provoke a debate rather than provide definitive answers. The 24-page report contains 16 figures. It concludes with recommendations for financial institutions embarking on a digital transformation journey.

Dan Latimore is the SVP of the banking practice at Celent. His research focuses on the expanding banking ecosystem, innovation, and digital technology, underpinned by a strong interest in behavioral economics and its implications for banks.

is the SVP of the banking practice at Celent. His research focuses on the expanding banking ecosystem, innovation, and digital technology, underpinned by a strong interest in behavioral economics and its implications for banks.

Zilvinas Bareisis is a Senior Analyst with Celent’s banking practice. His research focuses on retail payments, including cards and digital payments. He has a global perspective with a particular emphasis on market developments in North America, the UK, and Europe.

is a Senior Analyst with Celent’s banking practice. His research focuses on retail payments, including cards and digital payments. He has a global perspective with a particular emphasis on market developments in North America, the UK, and Europe.